- Home

- »

- Advanced Interior Materials

- »

-

Copper Foil Market Size & Share, Industry Report, 2030GVR Report cover

![Copper Foil Market Size, Share & Trends Report]()

Copper Foil Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Electrodeposited, Rolled), By Application (Circuit Boards, Batteries, Solar & Alternative Energy, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-909-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Copper Foil Market Summary

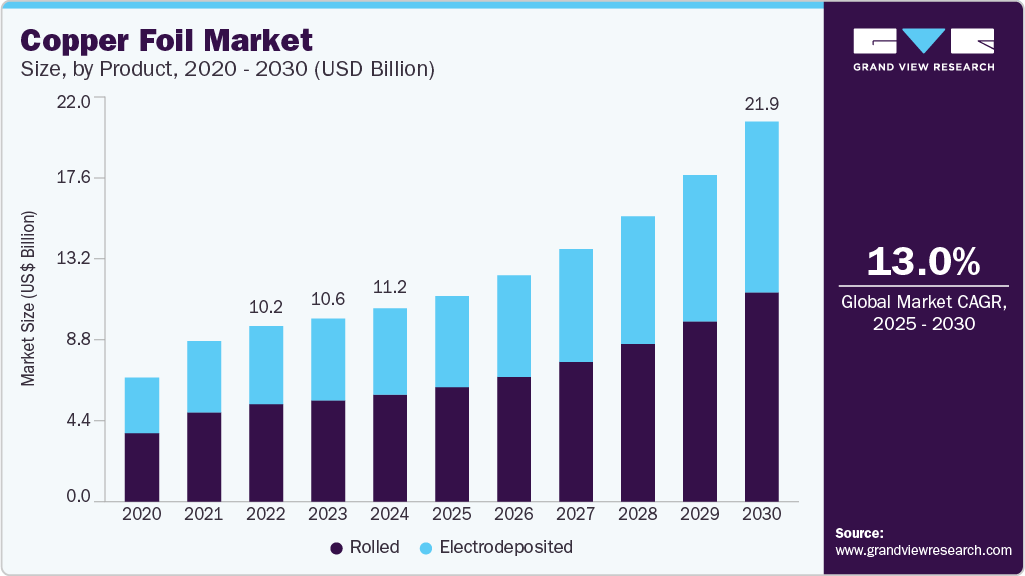

The global copper foil market size was estimated at USD 11.2 billion in 2024 and is projected to reach USD 21.99 billion by 2030, growing at a CAGR of 13.0% from 2025 to 2030. The market is expected to be driven by the expansion of electric vehicles, digitalization, and clean energy. Copper plays a vital role in infrastructure development.

Key Market Trends & Insights

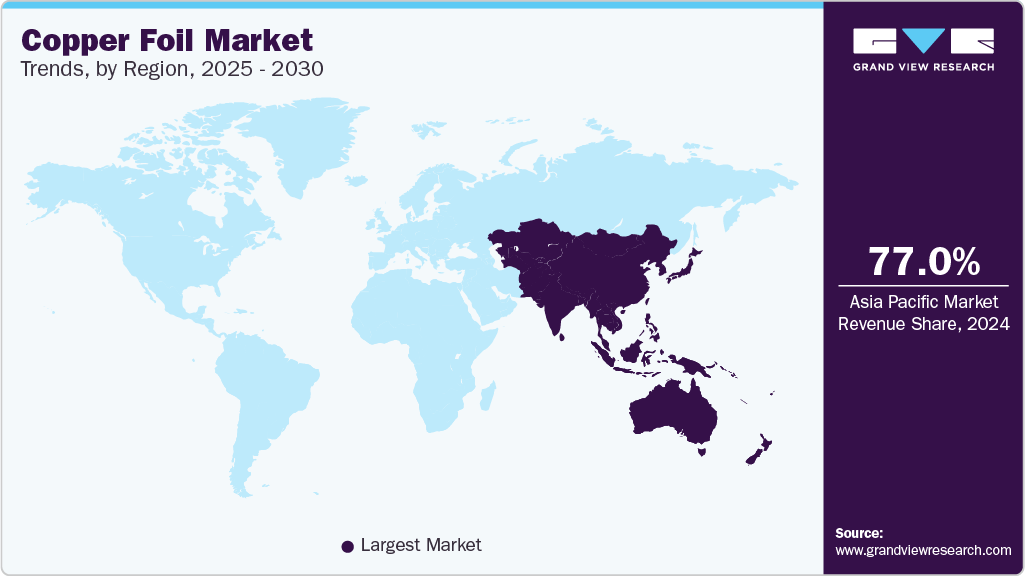

- The Asia Pacific copper foil market held the largest share of 77.0% in 2024.

- Based on product, the rolled segment accounted for the largest share of 55.5 % in 2024.

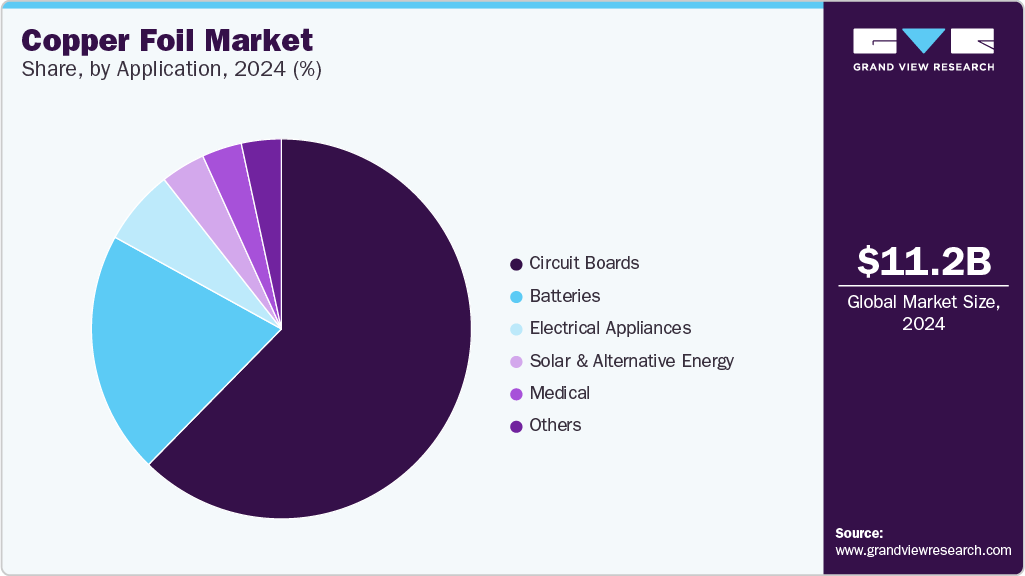

- Based on application, the circuit boards segment held the largest market share of 62.4 % in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.2 Billion

- 2030 Projected Market Size: USD 21.99 Billion

- CAGR (2025-2030): 13.0%

- Asia Pacific: Largest market in 2024

Presently, industry output and electricity generation are responsible for 40% of the world’s greenhouse gas emissions. Decarbonization involves the use of renewable resources for electrification. Copper is the key element used extensively for transmission infrastructure, and foil is essential for the manufacturing of components, including batteries used in renewable energy systems, such as solar and wind power storage.

Growing need for sustainable and eco-friendly energy production is boosting demand for solar energy worldwide. This is expected to have a positive impact on the copper foil industry. According to the Solar Energy Industries Association, more than 162.8 gigawatts (GW) of solar power is installed in the U.S., capable of powering 29.6 million homes. Over the last decade, the solar market in the country has grown at an average rate of 24% each year.This has encouraged manufacturers to ramp up their production and incorporate different technologies in their manufacturing processes. For instance, in December 2024, the Australian startup named Sun Drive Solar achieved copper plate production rates exceeding 99% through its cell metallization technology, which helped the company to lower production costs, improve efficiency and boost solar energy adoption.

Considering the potential of the market, key foil producers have been investing in the U.S. copper foil market. For instance, in February 2024, Addionics, a provider of next-generation battery technologies, announced its plan to invest USD 400 million in building 3D copper foil manufacturing facilities across the U.S. to support domestic EV battery production. As a result of rising demand for renewable energy, the usage of copper foil has increased in various applications, and key industry players are adopting strategic initiatives to stay ahead in a copper foil industry.

Market Concentration & Characteristics

The market growth stage is high, and the pace of market growth is accelerating. The demand for copper foil is rising due to the growing adoption of clean, renewable energy in power generation and the electrification of applications. The industry experiences a moderate level of merger and acquisition activities by key industry companies owing to market concentration. Partnerships and collaborations among emerging players to enhance their positioning are witnessing a consistent rise. Emerging players have a shared commitment to work towards common objectives, using each other's expertise and strengths for mutual benefit. This is due to several factors, including a desire to maintain market share and a need for a highly competitive, and growing market.

For instance, in September 2023, SK Nexilis Co. entered into a contract worth approximately USD 1.5 billion (WON 2 trillion) with Envision Automotive Energy Supply Corp., a leading Chinese secondary battery manufacturer. Under the terms of the contract, SK Nexilis agreed to provide copper foil, a critical material used in the production of electric vehicle battery cells.

The copper foil industry is moderately impacted by regulations & standards pertaining to copper foil production. For instance, the Occupational Safety and Health Administration (OSHA) provides standards for processing various materials, including copper, zinc, aluminum, and others. Unlike aluminum foils, copper is used extensively for electrical and electronic applications. There are no plausible substitutes for copper foils across different end-use applications, and owing to this, the threat of substitutes is low. End-user concentration is high in industry owing to its limited applications, such as electrical appliances, circuit boards, medical, batteries, and solar and alternative energy.

Product Insights

The rolled segment accounted for the largest share of 55.5 % in 2024. It is anticipated to grow at a lucrative pace owing to high demand from applications such as lithium-ion batteries, IoT-enabled services, and solar photovoltaic panels. Further, increasing emphasis on technology upgrades is expected to be a key driver during the forecast period. Copper foil is extensively used in the printed circuit board industry owing to its granular structure and smooth surface that is optimal for flexible and dynamic circuitry applications. In addition, it is a preferred choice in the production of high-frequency printed circuit boards due to its smooth surface. This has encouraged the manufacturers to boost their rolled copper foil offerings. For instance, in 2024, Hindalco Industries announced its new copper foil manufacturing facility in India to support the EV battery sector and reduce import dependence. Hindalco is also partnering with global tech firms to localize production.

The electrodeposited segment is expected to register the fastest CAGR during the forecast period. The key drivers for this are attributed to advancements in 5G and IoT technologies, and strategic partnerships. Electrodeposited copper foils are obtained when high-grade copper is dissolved in acid to produce an electrolyte, which is pumped into partially immersed rotating drums that are charged electrically. A thin film of copper is electrodeposited on these drums. These are used in circuit boards for conduction as they easily bond with an insulating layer, can be printed with a protective coating, and form a circuit pattern after etching. Companies are sourcing funding and technological proficiency for manufacturing electrodeposited copper foils. For instance, in January 2024, Taiwan's LCY Group successfully secured a financing agreement totaling USD 9.5 million with Nippon Denkai. This investment will support DENKAI America Inc., their subsidiary specializing in electrolytic copper foil production. This collaboration signifies a strategic partnership between the two companies.

Application Insights

Circuit boards held the largest market share of 62.4 % in 2024. The advent of automation, 5G, and electronic gadget upgrades has been increasingly resulting in higher PCB production, and this trend is expected to continue over the forecast period. It is used as an anode in lithium-ion batteries, a source of power in electric vehicles. It is used as a current collector due to its excellent electrical conductivity and workability. A lithium-ion battery structure consists of anode, cathode, separator, and electrolyte. Electrodes are fabricated by applying coating slurry onto metallic foils.

Its application in batteries helps reduce the amount of wrinkling, folding, fracturing, and deformation at high pressure during cell manufacturing. Additionally, ultra-thin copper foil is beneficial due to the requirement for lightweight and compact battery designs.

The growth in the electric vehicle industry has resulted in a flurry of activity amongst copper foil producers, who have been increasing their production capacities and setting up new plants. For instance, in September 2024, Lotte Energy Materials Corporation (LEMC) has signed an exclusive supply agreement with StarPlus Energy LLC’s to provide copper foil for inaugural EV battery manufacturing facility, currently under construction in Indiana, USA.

Batteries segment is expected to register the fastest CAGR during the forecast period. The key factors attributed to growth are surging EV demand, advancements in battery technology spurred by global efforts to reduce carbon emissions and transition to clean energy transportation, and continuous advancements in battery technology that enhance energy density, charging speed, and lifecycle performance.

Regional Insights

The North America copper foil market was identified as a lucrative market in 2024. In recent years, the increasing urbanization, along with the shift towards renewable energy, has led to a significant rise in copper demand. The U.S. has intensified its efforts to develop critical minerals. In light of these supportive policies, 25 U.S. copper mining projects are currently receiving attention. Some of the projects that are being constructed include the Black Butte Project in Montana, the Florence Project in Arizona, and the Idaho Cobalt Operation in Idaho.

U.S. Copper Foil Market Trends

The U.S. copper foil market was identified as the largest market in North America in 2024. According to the U.S. Energy Information Administration (EIA), the percentage of U.S. solar electricity capacity additions grew from 45% in 2022 to 56% in 2023 and reached 62% in 2024. Implementation of the U.S. Inflation Reduction Act (IRA), solar panel manufacturing has been given a boost in the country. Through 2023, solar panel manufacturers, such as Trina Solar, Canadian Solar, and Longi, announced the construction of a total of 5 GW of solar module manufacturing facilities, which would add 15 GW to the solar capacity.

Asia Pacific Copper Foil Market Trends

The Asia Pacific copper foil market held the largest share of 77.0% in 2024. It is witnessing rapid development in the manufacturing sector, which is attributable to rising demand from various applications under study, cheap labor, government initiatives, and FDI inflow. Investments concerning battery production and energy projects are key growth drivers for the market, which are expected to boost copper foil consumption in the region over coming years. For instance, in March 2025, Hindalco planned to invest in India’s metal business and establish a copper foil manufacturing facility for EVs.

China dominated the regional Copper foil industry. In December 2024, an IEA report stated that China contributed to the growth of electric vehicle (EV) sales by more than 4 million units in fiscal year 2024, representing 80% of global EV sales. This surge in sales has significantly impacted the copper foil market in 2024. Growth in EV production in China is anticipated to increase the consumption of copper foil over the forecast period.

Europe Copper Foil Market Trends

The Europe copper foil market was identified as a lucrative region in 2024. This is attributed to factors like sustainability initiatives, and technological advancements. For instance, in December 2024, Researchers at the Fraunhofer Institute for Solar Energy Systems (Fraunhofer ISE) in Germany are developing advanced copper metallization technologies as a sustainable alternative to silver in perovskite-silicon tandem solar cells.

Germany has one of the largest manufacturing sectors and ranks third globally in terms of goods and services exports. Improving industrial outlook, presence of renowned automotive players restructuring the market, and significant demand for electronic products are expected to fuel demand for copper foil. Moreover, increasing emphasis on solar energy is anticipated to boost consumption as Germany is among leading photovoltaic installers in global solar energy market.

Increasing demand for copper foil in Brazil is mainly due to growth of renewable energy industry. In 2023, according to the National Electric Energy Agency (Aneel), approximately 93% of country's electricity was generated from clean energy source., Solar energy sector has been main source of renewable power growth, contributing to over a 75.0% increase in electricity output in 2023 compared to same period in 2022. Total photovoltaic solar capacity in Brazil was 30.0 GW during same period, with an addition of 4.4 GW since January 2023.

Taiwan is an important hub for producing printed circuit boards in Asia Pacific. As such of several semiconductor and printed circuit board manufacturers have announced production expansion plans in Taiwan. In March 2023, JX Nippon Mining & Metals Group announced plans to expand its semiconductor production capacity in the country. This is expected to directly and positively impact demand for copper foils used in electronics and printed circuit boards in Taiwan in the coming future.

Key Copper Foil Company Insights

Some of the key players operating in the market include Furukawa Electric Co., Ltd. and Nippon Denkai, Ltd.

-

Furukawa Electric Co., Ltd is a manufacturer of electrical & electronics equipment. Key end-use industries of the company are telecommunications, electronics, construction, and automobiles. The company offers its products in Japan, China, North America, and the rest of the Asia Pacific. It focuses on maintaining its leadership position in the copper foil industry through continuous investment in R&D.

-

Nippon Denkai, Ltd. develops, manufactures, and sells electrodeposited copper foils. It offers high-strength foils, ultrathin copper foils with microcircuit substrates, carriers, and general-purpose foils. The company also offers materials for use in circuit boards mounted on electronic devices, including 5G communication devices such as mobile phones.

Lingbao and Circuit Foils are some of the emerging market participants.

-

Lingbao offers high-precision and alloy-rolled copper foils. It invested in advanced manufacturing technologies and process optimization to enhance productivity and reduce production costs. With leading production equipment and technology, it can produce different types of foils with a thickness of 4-100 μm and a maximum width of 660mm.

-

Circuit Foils is a European manufacturer of copper foil. Although the company was acquired by The Doosan Group in 2014, Circuit Foils continues to operate independently. It sells copper foil products for use in Internet of Things (IoT) applications, high-speed digitals, 5G devices, smart cards, smartphones, autonomous vehicles, and IC substrates. It also promotes innovations through its R&D centers. It has recently been certified with ISO 9001:2015 standards.

Key Copper Foil Companies:

The following are the leading companies in the copper foil market. These companies collectively hold the largest market share and dictate industry trends.

- Chang Chun Group

- Circuit Foils

- Doosan Corporation Electro-Materials

- Furukawa Electric Co., Ltd.

- Lingbao

- Lotte Energy Materials

- LS Mtron Ltd.

- Nippon Denkai, Ltd.

- SKC

- UACJ Foil Corporation

Recent Developments

-

In February 2024, Volta Energy Solution expanded its product offering by starting to manufacture a new battery copper foil plant in Quebec, Canada, to fill North America's battery copper foil vacuum supply chain. The plant is expected to have an annual production capacity of 25,000 tons, with operations in 2025.

-

In March 2025, Scientists have developed ultralight, ultrathin copper current collectors that could transform lithium battery technology. Compared to conventional copper foils, these advanced collectors are much lighter, significantly boosting energy density at the cell level.

Copper Foil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.92 billion

Revenue forecast in 2030

USD 21.99 billion

Growth Rate

CAGR of 13.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Russia, China, Japan, India, South Korea, Taiwan, Brazil.

Key companies profiled

Chang Chun Group; Circuit Foils; Doosan Corporation Electro-Materials; Furukawa Electric Co., Ltd.; Lingbao; Lotte Energy Materials; LS Mtron; Nippon Denkai, Ltd.; SKC; UACJ Foil Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Copper Foil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global copper foil market report based on product, application, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electrodeposited

-

Rolled

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Circuit Boards

-

Batteries

-

Electrical Appliances

-

Solar & Alternative Energy

-

Medical

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.