- Home

- »

- Medical Devices

- »

-

Corneal Topographers Market Size, Industry Report, 2030GVR Report cover

![Corneal Topographers Market Size, Share, & Trends Report]()

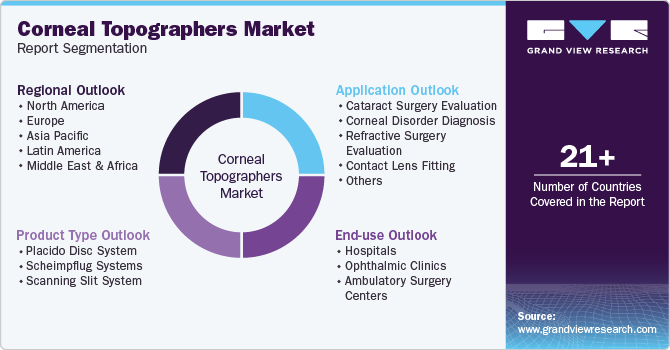

Corneal Topographers Market (2025 - 2030) Size, Share, & Trends Analysis Report by Product Type (Placido Disc System, Scheimpflug Systems, Scanning Slit System), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-192-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Corneal Topographers Market Size & Trends

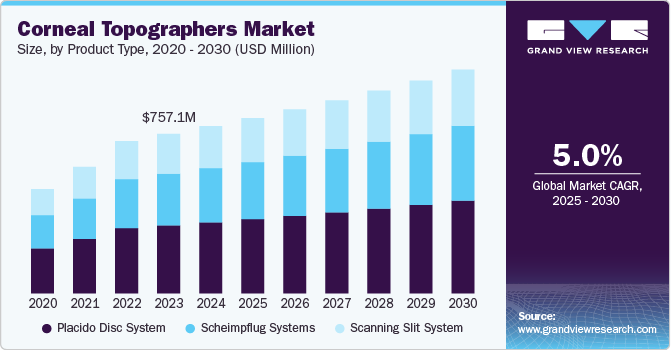

The global corneal topographers market size was valued at USD 793.4 million in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. Key factors driving market growth include the rising prevalence of age-associated ophthalmic conditions, rising number of awareness programs and increasing prevalence of cataract. For instance, a report published by the Centers for Disease Control and Prevention in 2022 indicates that approximately 20.5 million individuals (17.2%) in the U.S. aged over 40 are expected to have cataracts in one or both eyes, with around 6.1 million (5.1%) having undergone lens removal surgery. In addition, increasing government initiatives aimed at promoting early detection, treatment, and prevention of various conditions, along with a growing focus by market participants on research and development, are expected to drive the growth of the market.

The corneal topographers industry is driven by the rising prevalence of ophthalmic conditions such as cataracts, glaucoma, age-related macular degeneration, and diabetic retinopathy, which are leading causes of visual impairment and blindness globally. The increasing elderly population and lifestyle changes have contributed to a higher incidence of diseases like diabetes and hypertension, further escalating vision issues. For instance, according to the World Health Organization in August 2023, around 2.2 billion people globally experienced vision impairment due to refractive errors and cataracts, yet only a fraction received proper intervention, highlighting the urgent need for advanced diagnostic tools such as corneal topographers.

The increasing number of awareness programs focused on eye health and vision care serves as a significant growth driver, as these initiatives educate healthcare providers and patients on the advantages of utilizing advanced diagnostic technologies. Efforts led by organizations such as the World Health Organization, various eye health non-governmental organizations, and professional ophthalmology societies are instrumental in emphasizing the importance of early diagnosis and preventive strategies for corneal conditions. For instance, in May 2024, the World Health Organization introduced the SPECS 2030 initiative aimed at addressing uncorrected refractive errors, a leading cause of vision impairment. This initiative seeks to enhance access to appropriate eyewear by 40%. Thus, drives the demand for the corneal topographers.

Favorable government policies significantly drive the corneal topographer market by expanding eye care access and enabling a greater number of patients to undergo diagnostic and corrective procedures. For instance, in May 2023, the National Health Service (NHS) in the United Kingdom introduced updated clinical guidelines to optimize eye care services, aiming to cut waiting times by enhancing diagnostic imaging prior to specialist referrals. These guidelines are expected to reduce unnecessary referrals by approximately 30%, while also lowering patient anxiety and optimizing the use of ophthalmology resources. Such initiatives enhance patient satisfaction and convenience, which is expected to drive the demand for advanced diagnostic solutions, thereby supporting market growth.

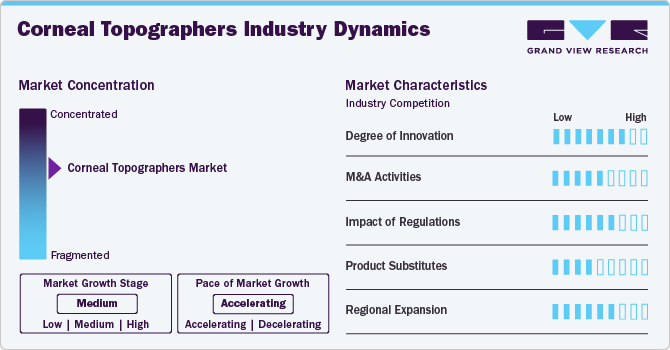

Market Concentration & Characteristics

The corneal topographers market exhibits a moderate level of industry concentration, with a combination of established multinational corporations and emerging enterprises competing for market share. Key players leverage advanced technological solutions, extensive distribution networks, and significant investments in research and development to maintain their dominance. Prominent companies such as Carl Zeiss Meditec AG, OCULUS, INC., Cassini Technologies, NIDEK CO., LTD., TOMEY CORPORATION, EyeSys Vision, Tracey Technologies, and TOPCON CORPORATION lead in innovation, driving the development of advanced corneal topographers. These market leaders benefit from strong brand recognition, comprehensive product portfolios, and a global presence, providing them with a competitive advantage. Concurrently, emerging firms are introducing innovative technologies and focusing on specialized solutions to address unmet patient needs, thereby contributing to the market's dynamic growth.

The corneal topographers market is characterized by a high degree of innovation, driven by continuous advancements in imaging technologies and diagnostic capabilities. Leading players are integrating artificial intelligence (AI) and machine learning algorithms to enhance the accuracy and speed of corneal mapping. For instance, AI-based topography systems can detect subtle changes in corneal curvature with up to 95% accuracy, compared to 75% accuracy with traditional systems. This level of precision is crucial in identifying early-stage conditions such as keratoconus, which affects approximately 1 in 375 people globally. In addition, the market is witnessing the adoption of higher-resolution imaging systems and non-invasive techniques. For instance, the development of Fourier-domain optical coherence tomography (OCT) in corneal topographers has significantly improved imaging resolution, allowing for the detailed visualization of corneal layers. This technology has resulted in a 20% improvement in diagnostic accuracy for conditions such as corneal ectasia, leading to faster diagnosis and better patient outcomes.

The impact of regulation on the corneal topographers industry is significant, as regulatory bodies govern the approval and commercialization of new diagnostic technologies to ensure safety, efficacy, and quality. In highly regulated regions such as North America and Europe, these regulations can influence both the speed of market entry and the cost of innovation. For instance, in the United States, the U.S. Food and Drug Administration (FDA) requires rigorous testing and clinical trials before approving corneal topography devices. The average time for a new ophthalmic device to receive FDA clearance is approximately 12 to 18 months, depending on the complexity of the product. In 2023, only 65% of ophthalmic devices cleared by the FDA were approved through the 510(k) pathway, which is typically faster and less costly than the premarket approval (PMA) process.

The level of mergers and acquisitions (M&A) activities in the corneal topographers industry has been steadily increasing as companies aim to expand their technological capabilities, enhance their product portfolios, and enter into new geographic markets. M&A activities are crucial for staying competitive in a market that is rapidly evolving due to technological innovations, regulatory changes, and growing demand for advanced diagnostic tools in ophthalmology. In 2023, the ophthalmic device sector saw a 20% increase in M&A activity compared to the previous year, driven by strategic acquisitions aimed at broadening product offerings and gaining access to emerging technologies. For instance, in 2022, TOPCON CORPORATION, a global leader in diagnostic ophthalmic equipment, acquired VISIA Imaging S.r.l., a company specializing in corneal imaging technologies. This acquisition allowed Topcon to expand its product portfolio in corneal diagnostics, offering more advanced and accurate solutions for conditions such as keratoconus and refractive errors. As a result of this acquisition, Topcon’s market share in Europe increased by 12%, highlighting the significant impact of strategic M&As in boosting market position.

The market faces competition from substitutes such as manual keratometers, slit-lamp biomicroscopy, and optical coherence tomography (OCT), but these alternatives generally fall short in terms of diagnostic precision and overall capability. For instance, Manual keratometers measure only the central curvature of the cornea and are estimated to have an accuracy rate of around 60%. In contrast, corneal topographers can detect conditions such as keratoconus with up to 92% accuracy, providing a more comprehensive view of the cornea’s shape and curvature. Similarly, slit-lamp biomicroscopy, though useful for examining visible corneal abnormalities, lacks the ability to generate detailed, high-resolution maps of the cornea, which are crucial for diagnosing early-stage corneal diseases. OCT, while valuable for retinal imaging, is less optimized for corneal topography, focusing instead on deeper layers of the eye.

Regional expansion plays a crucial role in the growth of the corneal topographers market, with companies targeting emerging markets to meet the increasing demand for eye care solutions. Carl Zeiss Meditec AG has strengthened its global footprint by increasing its presence in both developed and emerging markets. In 2023, the company expanded its operations in Asia, particularly in China and India, where the demand for advanced ophthalmic diagnostic devices is rapidly growing. In 2022, OCULUS established a new office in India to strengthen its market presence and cater to the growing demand for corneal topographers and other ophthalmic diagnostic devices in the country. In addition, OCULUS has expanded its distribution network in Latin America to capitalize on the rising awareness of eye health and improve access to its products in countries such as Brazil and Mexico.

Product Type Insights

The placido disc system segment dominated the market, accounting for over 42.5% of the revenue share in 2024 due to the product’s widespread adoption and accuracy in measuring the shape and curvature of the cornea. This system uses a series of concentric rings projected onto the cornea's surface to assess its shape and detect irregularities. It is highly favored for its non-invasive nature, ease of use, and ability to provide precise, reliable measurements, making it ideal for refractive surgery planning, contact lens fitting, and diagnosis of corneal diseases. The Placido Disc System is considered a standard method for routine corneal mapping in both clinical and research settings.

The scheimpflug systems segment is expected to exhibit the fastest CAGR during the forecast period. The advantages of scheimpflug imaging include high cornea resolution, measuring corneas with severe irregularities, such as keratoconus, ability to calculate pachymetry. The devices also offer corneal wavefront analysis for the detection of higher-order aberrations. Scheimpflug systems allow high-resolution imaging of the cornea, anterior chamber, iris, and lens in the anterior portion of the eye. The shape, thickness, and topography of these structures are all captured in three dimensions by these devices, which provides useful information.

Application Insights

The refractive surgery evaluation segment dominated with a market share of around 33.0% in 2024 due to its critical role in assessing the cornea's shape and structure before procedures like LASIK or PRK. Accurate mapping of the cornea is essential for personalized treatment planning, ensuring optimal outcomes in laser eye surgeries. Corneal topographers provide valuable data on corneal thickness, curvature, and asymmetry, helping surgeons assess visual acuity, predict healing, and minimize complications. The dominance is mainly attributed to factors such as the higher prevalence of patients diagnosed with refractive errors such as myopia (near-sightedness), hyperopia (farsightedness), astigmatism (distorted vision at all distances), and presbyopia. Refractive surgery aims to improve vision by altering the cornea's shape or by inserting intraocular lenses.

The cataract surgery evaluation segment is expected to grow at a lucrative CAGR during the forecast period. The demand for cataract surgery is anticipated to increase due to an aging population and an increase in the prevalence of cataracts. For instance, according to the report published by OCHA, in January 2023, with its cataract surgery project, the IHH Humanitarian Relief Foundation performed 16,693 surgeries across 8 different nations in 2022. So far, 173,693 surgeries have been performed. It is one of the most frequently performed surgical procedures worldwide.

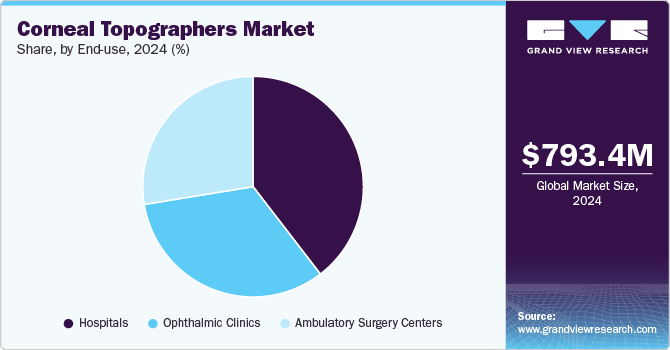

End Use Insights

The hospitals segment held the largest revenue share in 2024, accounting for more than 39.6% of the market share. Hospitals provide comprehensive eye care services, including treatment, surgery, and diagnosis. Corneal topography can be used to assess several eye disorders, including keratoconus, corneal dystrophies, and anomalies in the cornea. Hospitals may see a growing need for corneal topography equipment as they treat a wide variety of patients with various eye health requirements.

The ambulatory surgical centers (ASC) segment is expected to be the fastest-growing segment during the forecast period. This can be attributable to increasing surgical interventions carried out in the ASCs as compared to hospital settings owing to low-cost surgeries, easy access, and convenience for the elder and the disabled population is expected to accelerate the growth rate of ASCs over the forecast period.

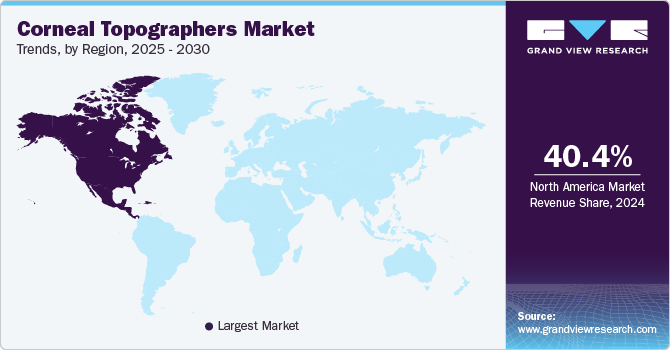

Regional Insights

North America corneal topographers market dominated and accounted for 40.4% of revenue share in 2024, driven by the high prevalence of eye diseases and advanced healthcare infrastructure. The region's strong market position is attributed to the increasing incidence of conditions such as cataracts, glaucoma, and age-related macular degeneration. For instance, the American Academy of Ophthalmology reports that over 24 million people in the U.S. are affected by cataracts, a number expected to grow as the population ages. Similarly, the Centers for Disease Control and Prevention (CDC) estimates that more than 3 million people in the U.S. have glaucoma, and this number is expected to rise in the coming decades. The presence of leading market players, such as Alcon, Inc., Bausch + Lomb, and Johnson & Johnson Services, Inc. further strengthens the region's market dominance.

U.S. Corneal Topographers Market Trends

The U.S. corneal topographer market held a significant share of North America in 2024. The growth is driven by the country's aging population and the availability of cutting-edge medical technologies. With a large portion of the population aged 65 and older, the demand for treatments related to conditions like cataracts and age-related macular degeneration continues to rise. For instance, the American Academy of Ophthalmology reports that 24 million people in the U.S. are affected by cataracts, a number expected to grow as the elderly population increases. The U.S. also benefits from its strong healthcare system, offering access to the latest corneal topographers and surgical options. In addition, the presence of top market players such as Alcon, Inc., Bausch + Lomb, and Johnson & Johnson Services, Inc., which are at the forefront of innovation, further drives the U.S. corneal topographers market, ensuring the availability of advanced treatments and therapies for eye diseases.

Europe Corneal Topographers Market Trends

The corneal topographers market in Europe is experiencing significant growth, driven by factors such as an aging population, increasing awareness of eye health, and advancements in healthcare infrastructure. The region is facing a rising prevalence of conditions such as cataracts, glaucoma, and age-related macular degeneration, which are contributing to the demand for corneal topographers. For instance, the European Eye Epidemiology (E3) Consortium reported that more than 50 million people in Europe are living with uncorrected vision impairment. The increasing focus on specialized eye care centers and the availability of cutting-edge medical technologies are also fueling market growth. In addition, European countries benefit from strong healthcare systems and public health initiatives that promote early detection and treatment of eye diseases.

The UK corneal topographers market is experiencing steady growth, driven by an aging population and increasing prevalence of eye conditions, such as cataracts and diabetic retinopathy. For instance, according to The Royal National Institute of Blind People, nearly 2 million people in the UK are living with sight loss, and this number is expected to rise. In addition, the UK’s strong healthcare infrastructure and the National Health Service (NHS) programs that support eye care contribute to the widespread availability of corneal topographers.

The corneal topographers market in France is expanding due to rising eye disease incidence, such as cataracts and glaucoma, among the elderly population. The French Ministry of Health reports that approximately 1.5 million people in France are affected by cataracts, with this number expected to grow as the population ages. In addition, the French healthcare system supports access to advanced eye care, with a strong emphasis on specialized eye centers and ophthalmology services.

The German corneal topographers market is primarily driven by the increasing demand for advanced eye care technologies. Germany’s aging demographic has led to a higher incidence of age-related macular degeneration and other ophthalmic disorders. For instance, according to the German Ophthalmological Society, approximately 5 million people in Germany suffer from age-related macular degeneration. The country's strong healthcare infrastructure, in addition to its continuous investment in medical technology, enables the widespread adoption of cutting-edge eye care treatments.

Asia Pacific Corneal Topographers Market Trends

The Asia Pacific corneal topographers industry is experiencing significant growth, driven by increasing awareness of eye health and rising demand for refractive surgeries like LASIK. Countries like China, India, and Japan are seeing a surge in the adoption of advanced diagnostic technologies due to growing healthcare infrastructure and rising disposable incomes. The region's expanding population, along with a growing prevalence of myopia and other refractive disorders, further fuels the market. Additionally, technological advancements in Placido Disc Systems and Scheimpflug imaging are enhancing accuracy and efficiency in corneal mapping, boosting the demand for topography systems across Asia Pacific.

The corneal topographers market in Japan is benefiting from technological advancements and an aging population. With one of the oldest populations globally, Japan has a growing number of people suffering from cataracts and age-related macular degeneration. For instance, according to the Japan Ophthalmological Society, about 6 million people in Japan suffer from cataracts. The country’s healthcare system provides access to advanced medical technologies and high-quality ophthalmic care, supporting the market growth.

The China corneal topographers market is expected to grow rapidly, driven by rising healthcare expenditures. With increasing government investment in healthcare infrastructure and access to advanced treatments, the demand for corneal topographers is expanding. For instance, over 30 million people in China are affected by cataracts, as reported by the World Health Organization, contributing to the growing need for corneal topographers. In addition, improvements in healthcare accessibility, particularly in rural areas, are expected to boost the adoption of advanced eye care technologies. The increasing affordability and availability of eye surgeries, fueled by government initiatives and rising healthcare spending, support market growth in China.

The corneal topographers market in India is experiencing significant growth, driven by technological advancements. With a large population affected by conditions such as cataracts, the introduction of corneal topographers is transforming treatment options in the country. For instance, 12 million people in India suffer from cataracts, creating a high demand for advanced topographers. The ongoing development of cutting-edge technologies, including more precise surgical tools, is expected to drive the adoption of corneal topographers across India.

Latin America Corneal Topographers Market Trends

The Latin American corneal topographers industryis experiencing significant growth, driven by growing awareness of corrective eye surgeries. With an increasing focus on eye health education and greater availability of information, more people in countries such as Brazil and Mexico are seeking treatments for conditions such as cataracts and glaucoma. For instance, Brazil has approximately 3.5 million people affected by cataracts, leading to a higher demand for intraocular lenses. In addition, improved public and private healthcare initiatives are making corrective eye surgeries more accessible to the population, further driving the market’s expansion in the region.

The corneal topographers market in Saudi Arabia is growing rapidly due to the aging population and increasing healthcare investments aimed at enhancing eye care services. For instance, according to the Saudi Ophthalmological Society, cataracts are one of the leading causes of vision impairment in the country.

Key Corneal Topographers Company Insights

The competitive scenario in the corneal topographers market is highly competitive, with key players such as Alcon, Inc., Bausch + Lomb. and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Corneal Topographers Companies:

The following are the leading companies in the corneal topographers market. These companies collectively hold the largest market share and dictate industry trends.

- Carl Zeiss AG

- OCULUS Optikgeräte GmbH

- Cassini Technologies

- Nidek Co., Ltd

- Tomey Corporation

- EyeSys Vision

- Tracey Technologies

- Topcon Corporation

Recent Developments

-

In March 2023, Haag-Streit launched a new corneal ectasia display for its Eyestar 900 OCT analyzer, featuring advanced topography for both corneal surfaces, pachymetry maps, Belin ABCD grading, and additional parameters. This tool aids corneal specialists in detecting early signs of keratoconus and ectatic changes, offering high-quality anterior chamber imaging for comprehensive evaluation.

-

In August 2023, KeraLink International (KLI) unveiled three key initiatives aimed at eliminating corneal blindness in low- and middle-income countries (LMICs). These include advancing corneal regeneration, enhancing global prevention and treatment strategies, and combating infectious keratitis. KLI, once the world’s largest provider of ocular tissue, is now solely focused on eradicating corneal blindness in LMICs.

Corneal Topographers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 831.8 million

Revenue forecast in 2030

USD 1.06 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Carl Zeiss AG; OCULUS Optikgeräte GmbH; Cassini Technologies; Nidek Co., Ltd; Tomey Corporation; EyeSys Vision; Tracey Technologies; Topcon Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corneal Topographers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the corneal topographers market report based on product type, application, end use and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Placido Disc System

-

Scheimpflug Systems

-

Scanning Slit System

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cataract Surgery Evaluation

-

Corneal Disorder Diagnosis

-

Refractive Surgery Evaluation

-

Contact Lens Fitting

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Clinics

-

Ambulatory Surgery Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global corneal topographers market size was estimated at USD 793.4 million in 2024 and is expected to reach USD 831.8 million in 2025.

b. The global corneal topographers market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 1.06 billion by 2030.

b. North America dominated the corneal topographers market with a share of 40.4% in 2024. This is attributable to favorable reimbursement and government and non-government initiatives to boost research and innovation.

b. Some key players operating in the corneal topographers market include Carl Zeiss AG, OCULUS Optikgeräte GmbH, Cassini Technologies, Nidek Co., Ltd., Tomey Corporation, EyeSys Vision, Tracey Technologies, and Topcon Corporation.

b. Key factors that are driving the market growth include increasing volume of surgical procedures, the surge in medical tourism, increasing prevalence of ophthalmic conditions and high engagement in strategic collaborations to develop innovative ophthalmic diagnostic modalities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.