- Home

- »

- Pharmaceuticals

- »

-

Cough Remedies Market Size, Share & Growth Report, 2030GVR Report cover

![Cough Remedies Market Size, Share & Trends Report]()

Cough Remedies Market Size, Share & Trends Analysis Report By Type (Expectorants, Bronchodilators, Antibiotics), By Dosage Form, By Age, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-194-4

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Cough Remedies Market Size & Trends

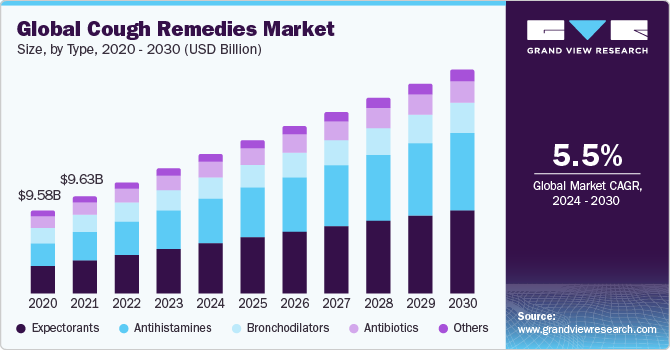

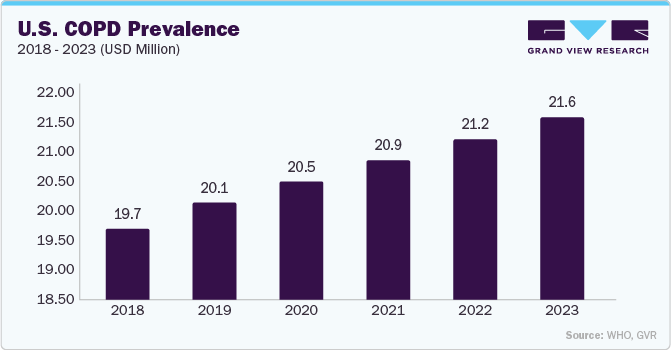

The global cough remedies market size was valued at USD 9.90 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.51% from 2024 to 2030. Asthma, chronic pulmonary obstructive disease (COPD), cold, flu, bronchitis, pertussis, and allergies are some of the medical conditions that can cause cough. According to an article published by The Economic Times in 2023, around 339 million people are affected by asthma globally. Increasing cases of medical conditions leading to cough are expected to positively impact the cough remedies market.

In addition, humid climates, rising tobacco consumption, and unhealthy lifestyles are major contributors to the rise in cough cases globally. Furthermore, it is a common complaint among people who smoke. According to the WHO, every year, more than 8 million people die prematurely from tobacco consumption. Among these, 7 million people are direct smokers, and 1.7 million are second-hand smokers. Moreover, several government and non-government organizations organize various campaigns and programs for awareness among the population. For instance, in July 2023, the Lung Foundation of Australia launched a chronic cough awareness campaign to raise awareness and support diagnosis in pediatrics and adults. This is expected to increase the consumer base for remedy products worldwide, thereby driving market growth.

Furthermore, acid reflux, tobacco, asthma, and postnasal drip are common causes of cough in the elderly population. According to WHO, the world’s population of people aged 60 and above was 1 billion in 2020 and is expected to reach 2.1 billion by 2050. Moreover, the global elderly population (above 60 years) will double from 12% to 22%. Thus, an increase in the geriatric population is expected to boost the adoption of cough remedies, as this population group is more susceptible to chronic conditions.

Type Insights

The cough remedies market is segmented into expectorants, antihistamines, bronchodilators, antibiotics, and others based on the type. The expectorants segment held the largest market share in 2023. This can be attributed to the launch of new expectorants for early relief. In November 2022, Genexa Inc. launched its first artificial inactive ingredient-free new cough & chest congestion for adults to relieve chest congestion, temporarily control, and loosen mucus. It is a liquid suspension with oral administration.

Dosage Form Insights

On the basis of dosage form, the market is segmented into oral syrup, tablets/pills, lozenges, and others. The oral syrup segment held the largest market share in 2023. This can be attributed to the wide availability of oral syrup brands and easy administration. Furthermore, factors such as new product development, high efficacy, and rapid delivery of drugs are driving the utilization of products globally.

Age Insights

The cough remedies market is segmented based on age into pediatric and adult. The adult segment held the largest market share in 2023. The adult population commonly suffers from acute and chronic cough due to unhealthy lifestyles and high exposure to tobacco. Chronic cough is common among adults and is highly prevalent in the older population. As per the study published by the European Respiratory Society in 2020, approximately 10% of the adult population suffers from chronic cough due to impaired quality of life. Thus, the growing adult population is anticipated to drive the adoption of cough remedies in the coming years.

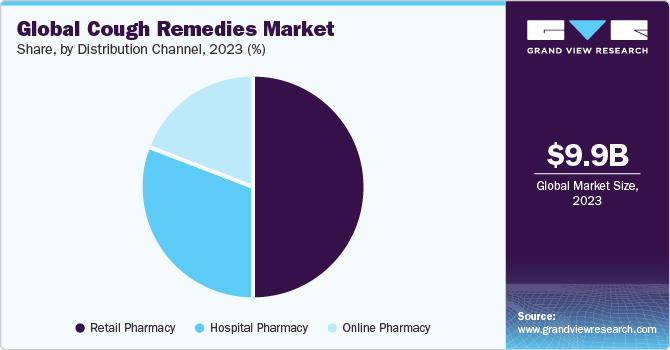

Distribution Channel Insights

Based on the distribution channel, the cough remedies market is segmented into retail and online pharmacies. The retail pharmacy segment held the largest market share in 2023. According to the Federal Union of German Associations of Pharmacists (ABDA), in 2023, around 18,068 community pharmacies in Germany cater to medical needs. The availability of branded and generic remedy products in retail pharmacy chains, such as Walgreens and Walmart Stores, Inc., supports segment growth. In addition, tie-ups of hospitals with these chains further contribute to market growth.

Regional Insights

North America held the largest market share in 2023. A large patient pool and the presence of established manufacturers are anticipated to strengthen market growth in this region further. The adoption of remedies is increasing rapidly in the region as a larger number of people are concerned about the health risks arising from a long-term cough. Asia-Pacific is expected to witness the fastest CAGR over the forecast period. Rapidly developing healthcare expenditure, improving healthcare infrastructure, rising geriatric population, and increasing prevalence of respiratory diseases are among the key factors driving the Asia Pacific region.

Key Cough Remedies Company Insights

Key players operating in the market are Dr. Reddy’s Laboratories Ltd, Johnson & Johnson Services Inc., AstraZeneca, Bayer AG, Sun Pharmaceutical Industries Ltd, Procter & Gamble, Novartis AG, Pfizer Inc, and GSK plc. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In 2023, GSK plc. signed an acquisition deal with a Canadian Biotech firm, Bellus Health, for USD 2 billion. This deal is expected to strengthen GSK’s clinical pipeline portfolio and market position worldwide. The portfolio also includes syrups and other formulations.

-

In 2023, the U.S. FDA issued a complete response letter (CRL) about Merck’s new drug application (NDA) for gefapixant, an investigation drug to treat patients with refractory chronic cough (RCC) in adults.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."