- Home

- »

- Medical Devices

- »

-

COVID-19 Drug Delivery Devices Market Share Report, 2021-2027GVR Report cover

![COVID-19 Drug Delivery Devices Market Size, Share & Trends Report]()

COVID-19 Drug Delivery Devices Market Size, Share & Trends Analysis Report By Product (Prefilled Syringe, Patches), By Route of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2021 - 2027

- Report ID: GVR-4-68038-785-8

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2020

- Forecast Period: 2021 - 2027

- Industry: Healthcare

Report Overview

The global COVID-19 drug delivery devices market size is valued at USD 1.87 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2022 to 2027. The drastic surge in drug development due to the COVID-19 outbreak and competitive race among the healthcare companies owing to the lack of effective treatments or vaccines are anticipated to create a lucrative environment for market growth. The unavailability of adequate medications and the absence of effective alternatives for COVID-19 management are anticipated to accelerate the U.S. FDA approval pathway, thus creating a surge for COVID-19 drug delivery devices by 2020 end. Drugmakers are in a rush to develop vaccines and therapies for the highly contagious coronavirus that has killed over 500,000 people worldwide, infected more than 10.5 million by the start of July 2020, and severely impacted the economies globally.

The unprecedented outbreak has compelled various researchers and a group of experts with diverse backgrounds to collectively work on the development of vaccines against COVID-19. Constant efforts are implemented to make suitable vaccines available for meeting the emergency needs caused by a pandemic. In April 2020, a Research and Development (R&D) Blueprint was set up by the WHO in response to the COVID-19 outbreak. The R&D was mainly activated to speed up the development of diagnostics, vaccines, and therapeutics for the condition.

In early June 2020, France, Germany, Italy, and the Netherlands partnered to form the Inclusive Vaccine Alliance. On 13th June 2020, these countries inked an agreement with AstraZeneca for the supply of the coronavirus vaccine. The company will supply 300 to 400 million doses of vaccine in Europe post-approval. To accelerate the global supply, the company has signed agreements with the Coalition for Epidemic Preparedness Innovations (CEPI) and vaccines organization GAVI to help provide 700 million doses. AstraZeneca has also partnered with the Serum Institute of India to help provide 1 billion doses.

In May 2020, the allocation of a USD 13 million grant from PM-CARES (Prime Minister’s Citizen Assistance and Relief in Emergency Situations) funds to support vaccine development was among the trends observed in India. Moreover, the DBT-BIRAC (Biotechnology Industry Research Assistance Council) consortium is providing regulatory and monetary support for about 10 vaccine projects in India. DBT, under its National Biopharma Mission, aids in the fast-track vaccine development programs. Additionally, on 4th June 2020, the Union Health Ministry relaxed the stringent regulations of the Drugs and Cosmetics Act, 1940 to speed up the development of a COVID-19 vaccine.

Product Insights

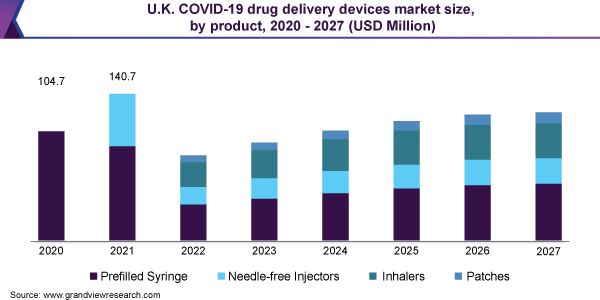

The prefilled syringe segment is expected to account for the largest revenue share of 64.6% in 2021 as several efforts are put up by the government organizations to ramp up prefilled syringe production. In May 2020, the U.S. Department of Health and Human Services (HHS) and the Department of Defense (DOD) provided a US$ 138 million grant to ApiJect Systems America to ensure the sufficient production of about 100 million prefilled syringes by 2020 end. These organizations together launched Project Jumpstart and RAPID USA to expand the production capability for medical-grade and domestically manufactured injection devices.

The developers are focused on developing novel drug delivery platforms for use in resource-constrained settings, thus accelerating the growth of nasal drug delivery devices. The devices can potentially reduce drug administration costs, including transport and storage. For instance, in April 2020, Bharat Biotech initiated the clinical trials for the COVID-19 nasal drop vaccine. The company has collaborated with the University of Wisconsin-Madison and FluGen, a vaccine developer for conducting human trials in the U.S.

Distribution Channel Insights

The hospital pharmacies segment is expected to account for the largest market share of 57.3% in 2021 as these drug delivery devices require medical assistance for vaccine administration. The online pharmacies segment is expected to expand at the highest CAGR of 14.4% from 2022 to 2027 and is anticipated to maintain its lead over the forecast period. These pharmacies play an important role in providing vaccines, therapeutics, and critical health services to the public.

Moreover, vaccine administration at healthcare institutions and medical settings enhances the market share as these settings adopt vaccines from hospital pharmacies, thereby reducing storage and transport costs. On 2nd June 2019, the National Association of Chain Drug Stores (NACDS) requested the U.S. government rely on pharmacies and pharmacists for the rapid deployment of COVID-19 vaccines. The major aim is to vaccinate the American population safely and efficiently.

Route of Administration Insights

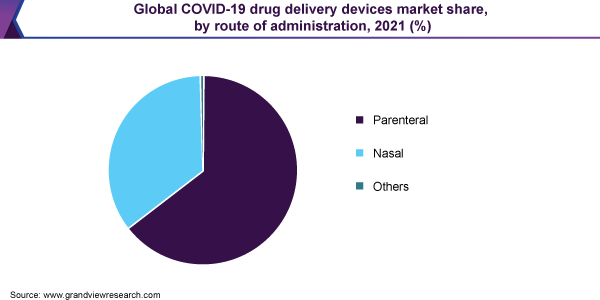

The parenteral segment is expected to capture more than 60.0% share of the overall revenue in 2021 and is anticipated to maintain its lead over the forecast period. Novel biologics such as RNA and DNA-based vaccines, recombinant nanoparticles, and monoclonal antibodies are currently being explored in clinical trials. Such biologics can only be administered intravenously as they are degraded when given orally. Currently, about 10 potential COVID-19 vaccine candidates have entered the clinical trials, most of which are to be administered via a parenteral route of administration. On 1st June 2020, Moderna initiated a Phase II clinical trial for mRNA-1273, a COVID-19 vaccine candidate. The company partnered with the Vaccine Research Center (VRC) at the National Institute of Allergy and Infectious Diseases (NIAID) for vaccine development.

The nasal segment is anticipated to witness significant growth over the forecast period as the drug and vaccine manufacturers are focused on developing vaccines, which would reduce storage and administration costs. Thus, the innovative approach helps in eliminating disease transmission and needle stick injuries, thus saving medical costs in the already burdened healthcare settings.

Regional Insights

North America is expected to capture the largest share of 52.4% in 2021 and is expected to maintain its lead over the forecast period. North America has a well-established healthcare infrastructure and a large number of key pharmaceutical companies. It is a developed economy with high disposable income, which enables people to choose from various advanced treatment options. The majority of the population in this region has health insurance and access to healthcare services. The region is expected to maintain its lead during the forecast period owing to continuous innovations. In the U.S., a collaborative framework was established by an initiative named Accelerating COVID-19 Therapeutic Interventions and Vaccines (ACTIV). The initiative aims to bring together biopharmaceutical companies, the Centers for Disease Control and Prevention, the U.S. Food and Drug Administration, and the European Medicines Agency.

Asia Pacific is likely to register a significant CAGR over the forecast period as the region consists of emerging economies like Japan, China, and India. A large population base, growth in research funding, and exponential registered cases of COVID-19 are expected to boost the regional market growth. In April 2020, the Government of Japan and UNICEF inked a grant agreement to provide support, strengthen COVID-19 response, and protect children from pandemic impacts in the Asia Pacific region.

Key Companies & Market Share Insights

Market players are adopting several strategies such as acquisitions to intensify the product portfolio and for geographical expansion, significant investment in research and development, and product launch and innovation to gain a significant share in the global market. For instance, in May 2020, PharmaJet, the developer of needle-free injection technology, partnered with Abnova Corporation, a Taiwan-based antibody manufacturer. The deal was aimed to develop a needle-free injection system technology for delivering a messenger RNA (mRNA) vaccine against coronavirus. Moreover, in February 2020, Johnson & Johnson collaborated with the U.S. Biomedical Advanced Research and Development Authority (BARDA) to provide the resources required to accelerate the development of a vaccine against the novel SARS-CoV-2 coronavirus. Together, the organizations have funded US$ 1 billion for R&D. Some of the prominent players in the COVID-19 drug delivery devices market include:

-

AstraZeneca

-

Johnson & Johnson

-

Serum Institute of India

-

GlaxoSmithKline plc

-

Moderna

-

Bharat Biotech

-

Pfizer

-

PharmaJet

-

Novawax, Inc.

COVID-19 Drug Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2,512.5 million

Revenue forecast in 2027

USD 2,155.6 million

Growth Rate

CAGR of 8.1% from 2022 to 2027

Base year for estimation

2020

Historical data

2020

Forecast period

2021 - 2027

Quantitative units

Revenue in USD million and CAGR from 2022 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; Columbia; South Africa; Saudi Arabia; UAE

Key companies profiled

AstraZeneca; Johnson & Johnson; Serum Institute of India; GlaxoSmithKline plc; Moderna; Bharat Biotech; Pfizer; PharmaJet; Novawax, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels as well as provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2020 to 2027. For the purpose of this study, Grand View Research has segmented the global COVID-19 drug delivery devices market report based on the product, route of administration, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2020 - 2027)

-

Prefilled Syringe

-

Needle-free Injectors

-

Inhalers

-

Patch

-

-

Route of Administration Outlook (Revenue, USD Million, 2020 - 2027)

-

Parenteral

-

Nasal

-

Dermal

-

-

Distribution Channel Outlook (Revenue, USD Million, 2020 - 2027)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global COVID-19 drug delivery devices market size is estimated to be USD 1,875.0 million in 2020 and is expected to reach USD 2,512.5 million in 2021.

b. The global COVID-19 drug delivery devices market is expected to grow at a compound annual growth rate of 8.1% from 2022 to 2027 to reach USD 2,155.6 million by 2027.

b. North America is estimated to dominated the COVID-19 drug delivery devices market with a share of 52.4% in 2021. This is attributable to the well-established healthcare infrastructure, rising number of COVID cases, and a large number of key pharmaceutical companies undertaking R&D.

b. Some key players operating in the COVID-19 drug delivery devices market include AstraZeneca, Johnson & Johnson, Serum Institute of India, GlaxoSmithKline plc, Moderna, Bharat Biotech, PharmaJet, Pfizer, and Novavax, Inc.

b. Key factors that are driving the COVID-19 drug delivery devices market growth include a drastic surge in drug development due to the COVID-19 outbreak and competitive race among the healthcare companies owing to the lack of effective treatments or vaccines.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."