- Home

- »

- Pharmaceuticals

- »

-

COVID-19 Vaccine Development Tools Market Report, 2028GVR Report cover

![COVID-19 Vaccine Development Tools Market Size, Share & Trends Report]()

COVID-19 Vaccine Development Tools Market (2021 - 2028) Size, Share & Trends Analysis Report By Technology, By Application (Vaccine Process Development, Vaccine Research), By End Use (CROs, Pharma & Biopharma Companies), And Segment Forecasts

- Report ID: GVR-4-68038-286-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2020

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global COVID-19 vaccine development tools market size was valued at USD 16.0 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2021 to 2028. The market is expected to maintain its momentum in the coming future, attributive to the heavy influx of vaccine developers and manufacturers across the globe. Despite the speedy development and rollout of vaccines, the SARS-CoV-2 infection curve has just begun to plateau, particularly in the developed countries.

Additionally, variants of SARS-COV-2 have emerged in 2020 that demand re-testing of the immunization efficacy of first-generation vaccines, while current efforts are still being targeted towards finding the best manner of vaccine rollout that addresses the unprecedented vaccination programs implemented globally. Life sciences industries are focusing on developing long-term recovery for the SARS-COV-2 infection, which has propelled manufacturers such as, Thermo Fisher Scientific, Inc., Sartorius AG, Agilent Technologies, Hamilton Company, and Bio-Rad Laboratories, Inc. to expand their tools portfolio that is exclusively employed in COVID-19 vaccine development.

Several factors are contributing to the growth of this industry, including, the integral role of artificial intelligence in the COVID-19 vaccine race, expanding pool of collaborations to fast-track vaccine research and clinical trials, and robust funding initiatives by government and private organizations. The present scenario of fast-track vaccine research and clinical trials has encouraged collaborations amongst vaccine developers and industry participants.

For instance, in February 2021 BioNTech extended its partnership with Merck KGaA targeted towards addressing the required supply of tools and technologies for vaccine creation. This strategic move of extending the collaboration agreement with Merck is aimed at accelerating the development of the mRNA-based COVID-19 vaccine. Merck’s life science business division is supporting with its tools to approximately 50 vaccine development programs worldwide.

Artificial intelligence (AI) has immense potential to facilitate and revolutionize the development of novel COVID-19 vaccines. AI is anticipated to become integral to the development of shots for emerging coronavirus variants, entities operating in this market space are partnering with vaccine developers, further flourishing the market. One such company, namely, Nanotronics stated in April 2021, that it has partnered with different key COVID-19 vaccine developers to assist in the effective management of data associated with COVID-19 vaccine development projects with its AI-based online tools.

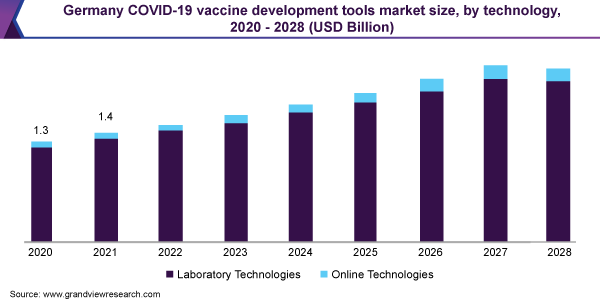

Technology Insights

The laboratory technologies segment dominated the market and accounted for the largest revenue share of 95.3% in 2020. Widening usage of laboratory technologies, such as PCR, cell culture, flow cytometry, and spectrometry in the vaccine research and process is expected to contribute to the segment’s dominance through 2021-2028. PCR and qPCR display the highest revenue contribution to the laboratory technologies segment in 2020. Routine use of PCR tools in vaccine surveillance programs and efficacy testing is attributive to segment growth.

Online technologies are set to grow at a rapid pace during the forecast period with a CAGR of 13.2%. Apart from the rise in demand for vaccine management and tracker tools, established companies are also working towards adopting interactive online platforms that assist in R&D activities. In November 2020, a webtool namely, COVID-19 Vaccine Predictor was launched. This webtool enables users to assess the recently updated vaccine portfolio and also allows them to generate timeline estimates for R&D activities.

Application Insights

The vaccine research segment dominated the market and accounted for the largest revenue share of 43.9% in 2020. The growth of the segment is driven by several factors such as rising government funding, extensive research by universities and healthcare organizations, and increasing business development strategies by prominent pharmaceutical companies, among others. Moreover, the growth in the segment can be further attributed to continuous research activities for improving the vaccine development process.

For instance, in January 2021, the researchers at Stanford University are working on the development of a single-dose vaccine for coronavirus that could potentially be stored at room temperature. This could possibly help in reducing the cost of storage and transportation associated with vaccines. Moreover, companies are increasingly engaged in business development strategies such as agreements, partnerships, and collaborations for COVID-19 target discoveries.

For instance, in April 2020, Merck & Co., Inc. entered in collaboration with the Institute for Systems Biology (ISB) for the investigation and identification of targets for COVID-19 vaccine development. Through this collaboration, scientists examined blood samples using different techniques such as proteomics, transcriptomics, metabolomics, and genetic techniques for evaluating the impact of infection and identification of potential biomarkers, predicting the risk of severe disease. These insights were crucial for vaccine designing against COVID-19.

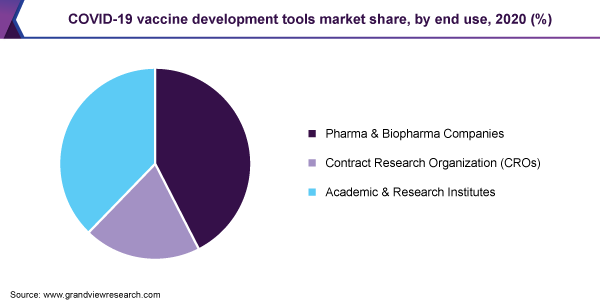

End-use Insights

The pharma and biopharma companies dominated the market and accounted for the largest revenue share of over 42.0% in 2020. These companies were amongst the initial key players in conducting studies on SARS-CoV-2 in the early stages of the pandemic owing to their existing vaccine development infrastructure. For instance, in January 2020, the researchers at Merck Research Labs gathered a previously available understanding of coronavirus and proceeded with the identification of possible approaches for vaccines and therapeutics development with potential activity against SARS-CoV-2. The company examined around 1,000 compounds from its vast libraries for evaluating their activity against SARS-CoV-2.

The large share of the segment can be attributed to the robust investment capabilities of pharmaceutical companies for facilitating the rapid development of the COVID-19 vaccine. Large-scale pharmaceutical companies are collaborating with biotech companies for assisting them in scaling up the manufacturing process of the COVID-19 vaccine.

Research institutes are mainly focused on conducting research studies for finding novel solutions that can be implemented in vaccine development. They are developing several online tools and analyzing the data based on them for rapid vaccine development. For instance, in September 2020, researchers from the University of Melbourne developed COVID-3D an online tool for monitoring the rate of mutation in SARS-CoV-2.

Regional Insights

Asia Pacific dominated the COVID-19 vaccine development tools market and accounted for the largest revenue share of 39.6% in 2020. A major factor that contributed to the accelerated vaccine development for the SARS-CoV-2 was the early identification of the novel coronavirus’ genome by using advanced sequencing techniques in the region. The researchers in China conducted several studies directed at early genome sequencing, viral structure analysis, and immune response profiling with the application of next-generation sequencing, electron microscopy, and flow cytometry, respectively.

North America accounted for a revenue share of 28.0% in 2020. The growth in this region can be attributed to several factors such as increasing research and development activities, funding initiatives, the presence of key players, rising COVID-19 cases, and a large population base receiving COVID-19 vaccine, among others. In addition, the promoting government initiatives for developing COVID-19 vaccine can be further attributed to the market growth. For instance, the U.S. government launched Operation Warp Speed, a public-private partnership for the development, manufacturing, and distribution of COVID-19 vaccines.

Monitoring the rate of mutation is an important consideration for the development of an efficient vaccine against SARS-CoV-2. Companies in the U.S. are developing surveillance infrastructure for monitoring of mutation of SARS-CoV-2. For instance, in January 2021, Illumina, Inc. and Helix entered into a collaboration for building a national surveillance infrastructure in the U.S. for tracking the emergence and prevalence rate of novel strains of SARS-CoV-2. This combines Helix’s national COVID-19 testing footprint and Illumina’s sequencing technology for expanding the country’s existing surveillance efforts for the detection and characterization of emerging variants of SARS-CoV-2.

Key Companies & Market Share Insights

Market players are focused on the expansion of their offerings through extensive R&D and the formation of alliances and partnerships with other major players to sustain their market position. In October 2020, Sartorius AG expanded its presence in North America by opening a 40,000-square-foot Customer Interaction Center. The new site in Marlborough will provide optimized factory acceptance testing and is equipped with new bioprocess equipment. Additionally, it will support the development of COVID-19 vaccines. Some of the prominent players in the COVID-19 vaccine development tools market include:

-

Thermo Fisher Scientific, Inc.

-

Celerion

-

Cole-Parmer Instrument Company, LLC.

-

Pfizer Inc.

-

Sartorius AG

-

STEMCELL Technologies Inc.

-

AB Sciex Pte. Ltd.

-

Illumina, Inc.

-

Agilent Technologies

-

Bio-Rad Laboratories, Inc.

-

Danaher

-

Merck KGaA

-

Qiagen N.V.

-

Shimadzu Corporation

-

Eurofins Scientific

-

Charles River Laboratories

-

Takara Bio Inc.

-

PerkinElmer Inc.

-

Fluidigm

-

OLYMPUS CORPORATION

-

Avantor, Inc.

-

Polyplus Transfection

-

Hamilton Company

-

Aurora Biomed Inc.

COVID-19 Vaccine Development Tools Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 17.5 billion

Revenue forecast in 2028

USD 30.9 billion

Growth rate

CAGR of 8.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2020

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; Italy; France; Spain; Russia; China; India; South Korea; Australia; Japan; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Thermo Fisher Scientific, Inc.; Celerion; Cole-Parmer Instrument Company, LLC.; Pfizer Inc.; Sartorius AGSTEMCELL Technologies Inc.; AB Sciex Pte. Ltd.; Illumina, Inc.; AgilentTechnologies; Bio-Rad Laboratories, Inc.; Danaher; Merck KGaA; Qiagen N.V.Shimadzu Corporation; Eurofins Scientific; Charles River Laboratories; Takara Bio Inc.; PerkinElmer Inc.

Fluidigm; OLYMPUS CORPORATION; Avantor, Inc. Polyplus Transfection; Hamilton Company; Aurora Biomed Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2028. For the purpose of this study, Grand View Research has segmented the global COVID-19 vaccine development tools market report on the basis of technology, application, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2020 - 2028)

-

Laboratory Technologies

-

Next Generation Sequencing

-

PCR & qPCR

-

Flow Cytometry

-

Spectrometry

-

Microscopy & Electron Microscopy

-

Preparative & Process Chromatography

-

Nucleic Acid Isolation & Purification

-

Transfection Electroporation

-

Cell Culture

-

Automated Liquid Handling

-

-

Online Technologies

-

Interactive Web Technologies

-

Vaccine Management & Tracker Technologies

-

-

-

Application Outlook (Revenue, USD Million, 2020 - 2028)

-

Vaccine Research

-

Vaccine Process Development

-

Vaccine Quality Assurance/Quality Control

-

-

End-use Outlook (Revenue, USD Million, 2020 - 2028)

-

Pharma & Biopharma Companies

-

Contract Research Organization (CROs)

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Australia

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global COVID-19 vaccine development tools market size was estimated at USD 16.0 billion in 2020 in 2020 and is expected to reach USD 17.5 billion in 2021.

b. The global COVID-19 vaccine development tools market is expected to grow at a compound annual growth rate of 8.6% from 2021 to 2028 to reach USD 30.9 billion by 2028.

b. The laboratory technologies segment dominated the COVID-19 vaccine development tools market and accounted for the largest revenue share of 95.3% in 2020.

b. Some of the key players operating in the COVID-19 vaccine development tools market are Thermo Fisher Scientific, Inc.; Celerion; Cole-Parmer Instrument Company, LLC.; Pfizer Inc.; Sartorius AG; STEMCELL Technologies Inc.; AB Sciex Pte. Ltd.; Illumina, Inc.; Agilent Technologies; Bio-Rad Laboratories, Inc.; Danaher; Merck KGaA; Qiagen N.V.; Shimadzu Corporation; Eurofins Scientific; Charles River Laboratories; Takara Bio Inc.

b. Key factors driving the COVID-19 vaccine development tools market growth include the integral role of AI in the COVID-19 vaccine race, expanding pool of collaborations to fast-track vaccine research & clinical trials, and robust funding initiatives by government & private organizations.

b. The vaccine research segment dominated the COVID-19 vaccine development tools market and accounted for the largest revenue share of 43.9% in 2020.

b. The pharma and biopharma companies dominated the COVID-19 vaccine development tools market and accounted for the largest revenue share of over 42.0% in 2020.

b. Asia Pacific dominated the COVID-19 vaccine development tools market and accounted for the largest revenue share of 39.6% in 2020.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.