- Home

- »

- Consumer F&B

- »

-

Crab Market Size, Share, Trends And Growth Report, 2030GVR Report cover

![Crab Market Size, Share & Trends Report]()

Crab Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Frozen, Fresh), By Application (Whole Cooks, Meat), By Distribution Channel (Foodservice, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-459-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crab Market Summary

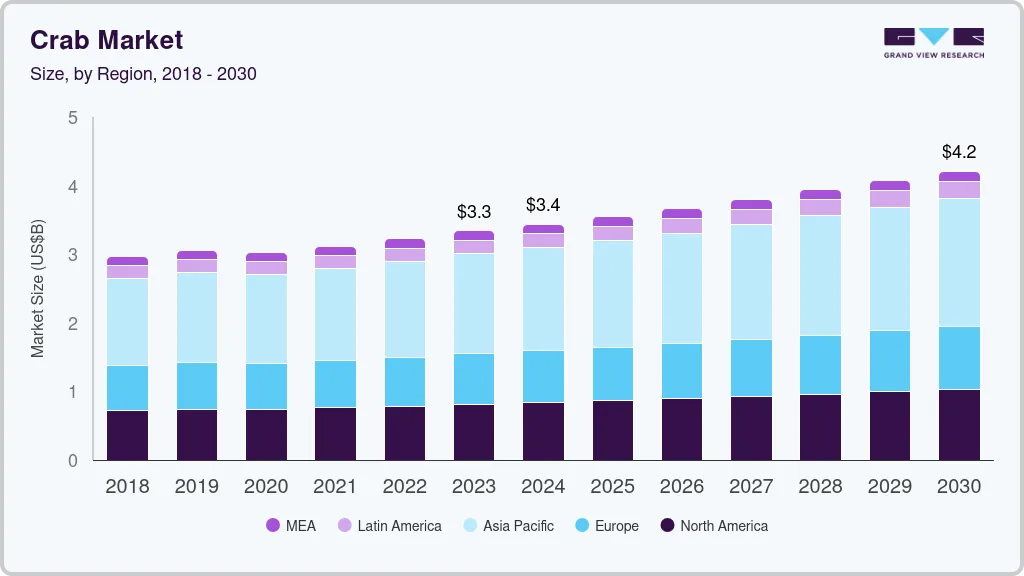

The global crab market size was estimated at USD 3.34 billion in 2023 and is projected to reach USD 4.21 billion by 2030, growing at a CAGR of 3.4% from 2024 to 2030. Crab is considered a premium seafood product, with its tender meat and delicate flavor making it a popular choice in luxury dining.

Key Market Trends & Insights

- Asia Pacific accounted for a revenue share of 43.5% in 2023.

- By type, the frozen crabs segment held a revenue share of 46.7% in 2023.

- By application, crab meat segment accounted for a revenue share of 59.8% in 2023.

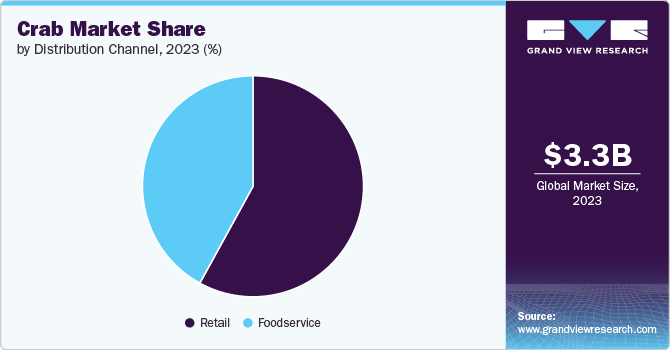

- By distribution channel, retail channels segment held market share of 58.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.34 Billion

- 2030 Projected Market Size: USD 4.21 Billion

- CAGR (2024-2030): 3.4%

- Asia Pacific: Largest market in 2023

The growing middle-class population in emerging markets and the increased disposable income in developed countries have led to a surge in demand for premium seafood options like crab. In regions such as North America, Europe, and parts of Asia Pacific, crab is often seen as a delicacy, featured in high-end restaurants and gourmet cuisine.

Consumers are becoming more willing to pay for high-quality seafood as they perceive it to be healthier and more nutritious than red meat or poultry. This preference has contributed to the growing popularity of crab dishes such as crab cakes, crab legs, and soft-shell crab. Moreover, processed crab meat has gained popularity, particularly in the ready-to-eat and convenience food segments. The shift toward convenience and ready-made meals has accelerated the demand for processed crab meat products, such as canned crab, frozen crab meat, and crab sticks. These products appeal to busy consumers who are looking for quick, easy, and nutritious meal options.

Processed crab meat has gained popularity, particularly in the ready-to-eat and convenience food segments. The shift toward convenience and ready-made meals has accelerated the demand for processed crab meat products, such as canned crab, frozen crab meat, and crab sticks. These products appeal to busy consumers who are looking for quick, easy, and nutritious meal options. Crab meat is a versatile ingredient used in various dishes such as salads, soups, pasta, and sushi. The expansion of quick-service restaurants (QSRs) and fast-casual dining chains, which increasingly offer crab-based dishes, has further boosted demand for processed crab meat.

In addition, the rise of meal-kit services and home delivery platforms, which allow consumers to prepare gourmet meals at home, has led to a surge in demand for processed crab meat. The crab market has benefited significantly from advancements in processing technologies, which have improved the efficiency and quality of crab meat extraction. Furthermore, automated processing equipment has reduced the time and labor required to process crabs, allowing manufacturers to scale production and meet increasing global demand. Innovations such as high-pressure processing (HPP) and mechanical de-shelling have improved the consistency of processed crab meat and reduced waste.

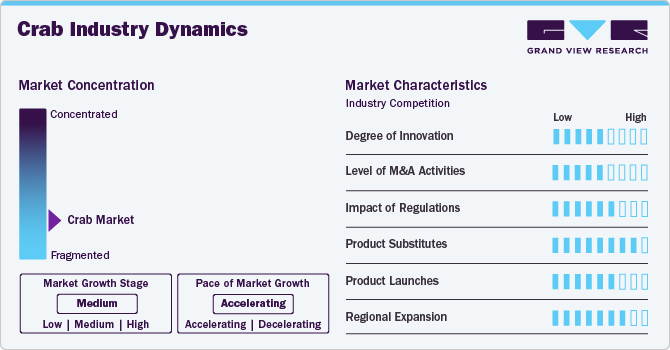

Market Concentration & Characteristics

The market has seen innovation in processing and packaging technologies, such as flash freezing and vacuum-sealed packaging, to extend shelf life and maintain product freshness. Sustainable aquaculture practices and traceability technologies have also emerged to address concerns about overfishing and seafood fraud. Additionally, product diversification, including ready-to-eat and pre-cooked crab meals, caters to convenience-focused consumers.

The market has witnessed significant mergers and acquisitions as companies aim to expand their market share, improve supply chain efficiency, and increase access to premium seafood. For example, acquisitions of smaller crab fisheries and processors by larger seafood corporations have strengthened their global distribution networks, especially in key regions like Asia Pacific and North America.

The market is heavily regulated to prevent overfishing and ensure sustainable seafood practices. Various international and regional fishing quotas, traceability laws, and food safety standards are enforced, particularly in North America and Europe. These regulations help protect crab populations while ensuring the quality and safety of crab products in domestic and export markets.

Substitutes for crab include other shellfish like shrimp, lobster, and imitation crab (surimi), which offer similar flavors but at varying price points. Imitation crab is particularly popular in processed foods due to its affordability, but it lacks the taste and texture of real crab. The availability of these substitutes can affect the demand for crab, especially during price fluctuations.

Manufacturers are increasingly launching innovative crab products, such as frozen pre-cooked crab legs, crab meat-based snacks, and ready-to-cook crab meals, to cater to the growing demand for convenience. Premium crab products, including organic and sustainably sourced options, are also gaining traction in the market, as consumers seek higher-quality and eco-friendly seafood options.

The market is expanding into emerging regions, driven by rising seafood consumption, economic growth, and urbanization. Companies are increasingly targeting these regions by establishing new processing facilities and distribution networks. The growing middle class in countries like China, India, and Vietnam offers substantial growth potential for premium and fresh crab products.

Type Insights

The frozen crabs segment held a revenue share of 46.7% in 2023 due to its longer shelf life, ease of transportation, and wide availability in retail outlets. Frozen crab products are popular in regions that have limited access to fresh crabs due to geographic or logistical constraints. The ability to freeze crab immediately after harvesting preserves its quality, flavor, and texture, making it appealing for export to distant markets. This is particularly important for consumers and foodservice providers who want high-quality seafood year-round, regardless of seasonality or location.

Frozen crab also caters to the growing demand for convenience, as it can be stored for extended periods without the risk of spoilage, making it a practical option for both households and restaurants. Moreover, advancements in freezing technology, such as flash freezing, have allowed manufacturers to offer frozen crab that retains much of the same freshness and nutritional value as fresh crab. The frozen crab segment has been further bolstered by the expansion of online grocery platforms, which provide consumers with easy access to a variety of frozen seafood products.

Fresh crab is expected to grow at a CAGR of 4.0% from 2024 to 2030 driven by increasing consumer preference for fresh, locally sourced, and high-quality seafood. Fresh crab is considered a premium product, offering superior taste and texture compared to frozen or canned varieties. This preference for fresh seafood is particularly strong in regions with a well-established seafood culture, such as coastal areas in Asia Pacific and North America, where consumers can access fresh crab from nearby fisheries. The rise of farm-to-table dining and the demand for fresh, unprocessed ingredients in restaurants and at home have contributed to the growth of the fresh crab segment. Consumers are increasingly willing to pay a premium for fresh seafood, viewing it as a healthier and more natural option. Moreover, as global transportation and logistics improve, the ability to deliver fresh crab to consumers in distant markets has become more feasible, further driving demand.

Application Insights

Crab meat accounted for a revenue share of 59.8% in 2023 due to its versatility, convenience, and wide range of culinary applications. Processed crab meat is used in a variety of ready-to-eat and easy-to-prepare products, such as crab cakes, crab salads, sushi rolls, and soups. It is particularly popular in the food service industry, where convenience and consistent quality are crucial for preparing large volumes of food efficiently. Crab meat is preferred by consumers who want the flavor of crab without the effort of cooking and shelling whole crabs. Processed crab meat, whether fresh, frozen, or canned, provides a time-saving alternative for both home cooks and professional chefs. It is also widely used in processed foods like surimi, crab-flavored snacks, and seafood spreads.

Whole-cooks crabs are expected to grow at a CAGR of 3.5% from 2024 to 2030 due to increasing demand in both the food service and retail sectors. Whole-cooked crab is popular in luxury dining and seafood restaurants, where the presentation and visual appeal of the dish are important. Dishes like steamed whole crab, crab boils, and crab feasts are particularly popular in regions like North America, where seafood festivals and gatherings featuring whole crabs are common. The appeal of whole-cooked crab lies in its authenticity and the dining experience it offers, especially in upscale restaurants that highlight premium seafood. Consumers who enjoy the process of cracking open whole crabs and savoring the fresh meat are drawn to this product, contributing to its growing popularity.

Distribution Channel Insights

Sales through retail channels held a market share of 58.0% of the crab market in 2023, driven by the increasing availability of crab products in supermarkets, hypermarkets, and online platforms. Retail consumers, including those who prefer to cook at home, make up a significant portion of the demand for crab. The convenience of purchasing crab through retail channels, particularly frozen and canned varieties, appeals to a broad range of consumers who value ease of access and extended shelf life. In recent years, the expansion of online grocery and e-commerce platforms has made it easier for consumers to purchase crab products from the comfort of their homes. Companies like Amazon Fresh and Instacart have capitalized on this trend, offering a wide variety of frozen, fresh, and canned crab products that can be delivered directly to consumers. This shift towards online shopping has further boosted the retail distribution channel's dominance.

Sales through food service are expected to grow at a CAGR of 3.2% from 2024 to 2030. The rising popularity of seafood dishes in restaurants, hotels, and catering services is fueling the demand for crab products in the food service sector. Crab is a versatile ingredient used in a wide range of cuisines, including Asian, Mediterranean, and American, making it a staple in many restaurant menus. The food service sector is also driven by the increasing number of fine-dining establishments and seafood-focused chains that specialize in crab dishes. Restaurants offering crab in various forms, such as crab cakes, crab bisque, and soft-shell crab, contribute to the growing demand in this sector. Additionally, seafood buffets and all-you-can-eat seafood restaurants, which are popular in regions like North America and Asia, further drive demand for crab in the foodservice industry.

Regional Insights

The North America crab market is expected to grow with a CAGR of 3.5% from 2024 to 2030driven by the increasing popularity of seafood and the rising demand for premium crab products. The U.S., in particular, is a major market for crab, with products such as Alaskan king crab, Dungeness crab, and snow crab being highly popular in both retail and food service sectors. The trend towards healthier eating habits has also contributed to the growth of the crab market in North America, as consumers seek out lean protein sources like seafood. Crab is viewed as a nutritious option that is high in protein and low in fat, making it appealing to health-conscious consumers.

Asia Pacific Crab Market Trends

The crab market in Asia Pacific accounted for a revenue share of 43.5% in 2023 due to the region’s long-standing tradition of seafood consumption, the cultural significance of crab, and its proximity to abundant crab fishing grounds. Countries like China, Japan, and South Korea are major consumers of crab, and they have a strong preference for fresh and live crab, which is often featured in traditional dishes. The region is also home to some of the world’s largest crab fisheries, such as in Vietnam and Indonesia, where blue swimming crab is harvested for both domestic consumption and export. This local supply of crab, combined with strong demand, makes Asia Pacific the leading market for crab products.

Key Crab Company Insights

The market key players are constantly working towards new product launches, partnerships, M&A activities, and other strategic alliances to gain new market avenues.

Key Crab Companies:

The following are the leading companies in the crab market. These companies collectively hold the largest market share and dictate industry trends.

- The J.M. Clayton Company

- Phillips Foods, Inc.

- Blue Star Foods Corp.

- Nippon Suisan Kaisha (Nissui)

- High Liner Foods Inc.

- Trans-Ocean Products

- Graham & Rollins, Inc.

- Handy Seafood Incorporated

- King Crab Legs Company

- Harbor Seafood

Recent Developments

-

In September 2023, Handy Seafood launched mini crab cakes. These mini crab cakes have exceptional taste, are microwavable, and have consistent taste in each bite. By introducing these mini crab cakes, Handy Seafood addresses the growing demand for culinary convenience at home. Consumers seek gourmet experiences with minimal cooking skills or time-consuming preparation in today's fast-paced world. Handy Seafood's mini crab cakes cater to this need, providing a hassle-free solution for individuals and families looking to enjoy restaurant-quality seafood without leaving the comfort of their homes.

-

In February 2023, Handy Seafood has made its packaging more vibrant and sustainable. This packaging indicates its ingredients with colorful food illustrations. It is recyclable, compostable and easy to dispose of. Handy Seafood demonstrated its commitment to sustainability by making these new packages both recyclable and compostable. This move aligns with the growing global emphasis on reducing plastic waste and promoting environmentally friendly practices. The recyclable nature of the packaging ensures that it can be efficiently processed through existing recycling systems, minimizing its environmental impact.

-

In January 2022, Handy Seafood partnered with Old Bay and launched new flavors of crab cakes. This is expected to improve sales through brand recognition and iconic flavors from Old Bay. Introducing these new crab cake flavors marked a significant expansion in Handy Seafood's product line. By incorporating the distinctive and time-tested taste of Old Bay's seasoning, the crab cakes gained an instant appeal among consumers familiar with the brand. Old Bay's signature blend of spices, herbs, and flavors added a new dimension to Handy Seafood's offerings, catering to seafood enthusiasts' evolving tastes and preferences. This partnership brought together two well-known brands and capitalized on the rich culinary heritage associated with Old Bay.

Crab Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.44 billion

Revenue forecast in 2030

USD 4.21 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

The J.M. Clayton Company; Phillips Foods, Inc.; Blue Star Foods Corp.; Nippon Suisan Kaisha (Nissui); High Liner Foods Inc.; Trans-Ocean Products; Graham & Rollins, Inc.; Handy Seafood Incorporated; King Crab Legs Company; Harbor Seafood

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

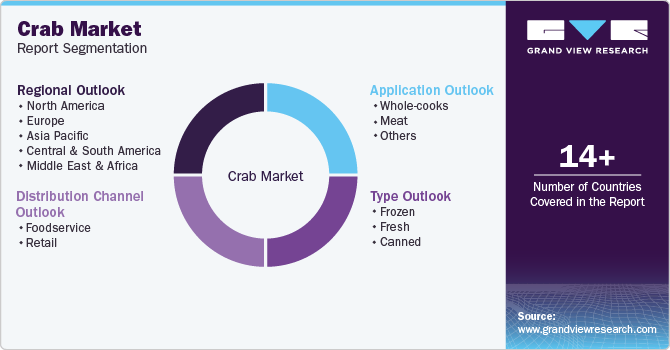

Global Crab Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global crab market report based on type, application, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen

-

Fresh

-

Canned

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole-cooks

-

Meat

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Retail

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crab market size was estimated at USD 3.34 billion in 2023 and is expected to reach USD 3.44 billion in 2024.

b. The global crab market is expected to grow at a compounded growth rate of 3.4% from 2024 to 2030 to reach USD 4.21 billion by 2030.

b. Frozen crab dominated the crab market with a share of 46.7% in 2023 2023 due to its longer shelf life, ease of transportation, and wide availability in retail outlets. Frozen crab products are popular in regions that have limited access to fresh crabs due to geographic or logistical constraints. The ability to freeze crab immediately after harvesting preserves its quality, flavor, and texture, making it appealing for export to distant markets.

b. Some key players operating in the crab market include The J.M. Clayton Company, Phillips Foods, Inc., Blue Star Foods Corp., Nippon Suisan Kaisha (Nissui), High Liner Foods Inc., Trans-Ocean Products, Graham & Rollins, Inc., Handy Seafood Incorporated, King Crab Legs Company, Harbor Seafood.

b. Crab is considered a premium seafood product, with its tender meat and delicate flavor making it a popular choice in luxury dining. The growing middle-class population in emerging markets and the increased disposable income in developed countries have led to a surge in demand for premium seafood options like crab.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.