- Home

- »

- Consumer F&B

- »

-

Surimi Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Surimi Market Size, Share & Trends Report]()

Surimi Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Tropical, Cold Water), By Form (Frozen, Fresh), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-057-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surimi Market Summary

The global surimi market size was valued at USD 4.0 billion in 2023 and is projected to reach USD 6.07 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The increasing popularity of surimi as a cost-effective alternative to seafood in various regions across the globe is a key factor driving the market growth in the forecast period.

Key Market Trends & Insights

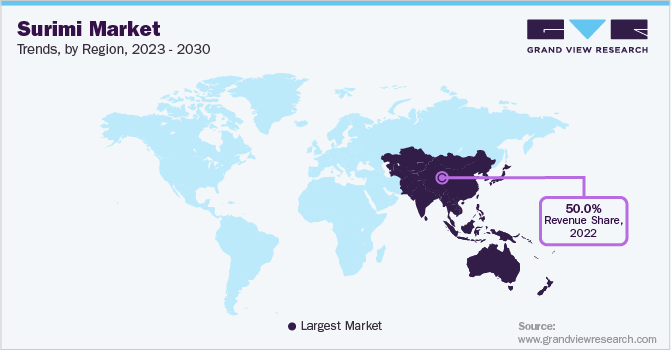

- Asia Pacific held the highest share of over 50% of the global market in 2022.

- Europe held a significant share of the market and is expected to grow with a significant CAGR of 6.0% over the forecast period.

- By source, the tropical segment dominated the market with a share of approximately 70% in 2022.

- By form, the frozen segment dominated the market and held a share of over 70% in 2022 and is expected to register a faster CAGR of 6.4% in the forecast period from 2023 to 2030.

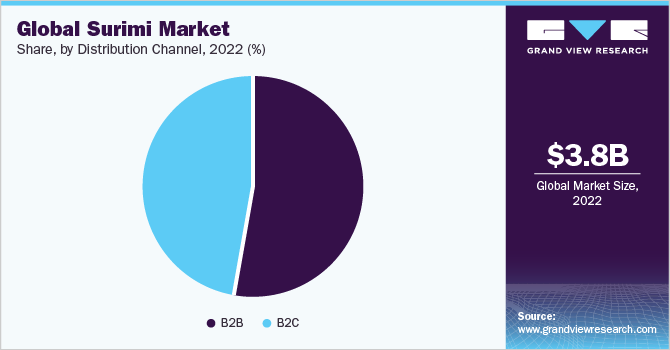

- By distribution channel, the B2C segment is expected to expand with a faster CAGR of 6.5% over the forecast period from 2023 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 4.0 Billion

- 2030 Projected Market Size: USD 6.07 Billion

- CAGR (2024-2030): 6.1%

- Asia Pacific: Largest market in 2022

The demand for seafood-based products is rapidly increasing resulting in increased demand for surimi as it is used as a significant ingredient in several dishes significantly in Asian cuisine. In addition, various factors such as high nutritional value, the long shelf life of frozen surimi, and low-cost surimi are gaining high popularity among consumers further fueling the market growth.Moreover, rising awareness among consumers regarding the health benefits of surimi such as high protein, low fat, and others are also driving the growth of the surimi market. The global market experienced both positive and negative impacts owing to the COVID-19 pandemic. A surge in demand for surimi has been observed during the initial phase of the pandemic as consumers stocked up on products that have a longer shelf life. However, Various challenges were experienced by the market owing to disrupted supply chains, economic fallout, declining purchasing power of consumers, and reduced exports.

Additionally, the production and processing of surimi were also affected by the pandemic due to labor shortages and the temporary shutdown of manufacturing facilities. Moreover, the closure of the food service industry such as restaurants further resulted in a decline in the consumption of surimi. However, the increasing demand for healthy food products is contributing to market growth. Surimi is highly used in various processed foods and with the rising popularity of processed food usage of surimi is also growing which is another factor contributing to the growth of the surimi market.

Consumers across the globe are actively looking for easy-to-prepare and convenient food options. Processed foods, including surimi-based products, are gaining popularity as they require less effort and time and are easy to prepare and store. Owing to such factors, consumers are willing to spend on surimi-based products as they are cost-effective and an affordable alternative to seafood options. Thus, the increasing demand for convenient food options is fueling the growth of the market. In addition, increasing awareness regarding the health benefits of consuming surimi is one of the major factors contributing to the market growth.

Surimi-based products consist of high nutritional value such as omega-3 fatty acids and a high source of protein making them an ideal choice for consumers who are health conscious. Surimi and surimi-based products are an excellent source of omega-3 and consumption of omega-3 fatty acids reduces the risk of heart disease. Moreover, surimi is an ideal choice for consumers who are weight conscious as it has low calorie and fat content. Thus, the rising awareness regarding health benefits associated with surimi and surimi-based products is expected to propel the market.

One of the significant factors contributing to the market growth is the expanding aquaculture industry. The aquaculture industry is one of the fastest-growing industries across the globe. The rapidly increasing demand for seafood is contributing to the growth of the aquatic industry. According to an article published by the Food and Aquaculture Organization, approximately 214 million tons of aquaculture and fisheries were produced in 2020 and this number is further expected to increase by 15% by the year 2030. Thus, with the increasing demand for seafood, the production of surimi is also expected to increase thus surging the market growth.

Moreover, the rapidly rising popularity of Asian culture is resulting in the rising popularity of Asian cuisine across the globe. Surimi is used as a key ingredient in various Asian dishes such as dumplings, spring rolls, and others and is also used to manufacture a wide range of seafood products including fish cakes, fish balls, crab sticks, and others. The extensive use of surimi in these products along with a rising willingness to consume non-meat alternatives of protein owing to health concerns regarding the consumption of red meat is further expected to expand the market growth in the coming years.

Source Insights

The tropical segment dominated the market with a share of approximately 70% in 2022 and is expected to remain the leading segment in the forecast period. Various tropical fish included in the tropical segment include big eye snapper, lizardfish, threadfin bream, goatfish, and others. Big eye snapper, lizardfish, threadfin bream, and goatfish hold more than 90% of the tropical segment. Tropical surimi is a more affordable alternative to other types of seafood, making it an attractive option for consumers who are looking for a cost-effective way to enjoy seafood. In addition, tropical surimi is a more sustainable option compared to traditional seafood because it utilizes underutilized fish source that are abundant in tropical regions. This reduces the pressure on the overfished sources and supports the conservation of marine biodiversity.

The cold water segment is expected to grow with a CAGR of 6.7% over the forecast period from 2023 to 2030. The cold water segment is further sub-segmented into Alaska Pollock, Pacific Whiting, and others. The rapid growth of the segment can be attributed to advancements in technology and fishing practices that have made it easier to access and catch these fish sources. Improved fishing gear and methods, such as longline fishing and bottom trawling, have made it possible to target these fish in deeper waters. Moreover, the increasing interest in sustainable seafood production has led to a focus on cold-water fisheries as they are often more resilient to overfishing compared to the tropical source. This has resulted in increased investment in the development of sustainable aquaculture practices for a cold water source.

Form Insights

The frozen segment dominated the market and held a share of over 70% in 2022 and is expected to register a faster CAGR of 6.4% in the forecast period from 2023 to 2030. The growth of the segment can be attributed to the fact that frozen surimi offers a longer shelf life than fresh seafood, making it a convenient option for consumers who do not have access to fresh seafood or who prefer to stock up on frozen products for future use. In addition, frozen surimi is more widely available than fresh seafood in many regions, making it a more accessible option for consumers. Moreover, advances in freezing and packaging technology have helped to maintain the quality and taste of frozen surimi products thus contributing to the segment growth in the coming years.

The fresh segment is expected to expand at a considerable CAGR of 5.5% in the forecast period. The growth of the segment is attributed to the higher quality products compared to frozen surimi due to its shorter shelf life and less processing. This has led to increased demand among consumers who prioritize freshness and quality in their food choices. Moreover, the increasing interest in healthy and sustainable diets has led to a growing demand for fresh surimi, which is a low-fat and low-calorie source of protein that can be used in a variety of dishes. Furthermore, advancements in transportation and logistics have made it easier to transport fresh surimi over longer distances, expanding its availability in more regions.

Distribution Channel Insights

The B2B segment held a higher share of over 50% of the global market in 2020 and is expected to register a considerable CAGR during the forecast period. The higher share of the segment is attributed to the wide usage of surimi in various industries including food services, animal feed, food processing, and others. Surimi is a popular ingredient used in restaurants and food services due to its versatility and cost-effectiveness. It can be used in a wide range of seafood dishes, such as sushi, seafood salads, and soups, and it is typically less expensive than fresh seafood options, making it an attractive choice for budget-conscious establishments. Additionally, surimi byproducts, such as fish meal, are commonly used as a source of protein in animal feed for pets, livestock, and aquaculture in the animal feed industry. Surimi byproducts are a cost-effective alternative to other protein sources, and they also offer several nutritional benefits.

The B2C segment is expected to expand with a faster CAGR of 6.5% over the forecast period from 2023 to 2030. The B2C segment is further fragmented into hypermarkets & supermarkets, convenience stores, online, and others. The hypermarkets & supermarkets segment held a significant share of around 30% in 2022. This is attributed to a larger selection of products compared to other retail outlets, and frozen surimi is often included in their frozen seafood section. Moreover, the online segment is expected to grow with the fastest CAGR of 8.1% over the forecast period.

The growth of the segment is due to the increasing preference of consumers buying online owing to the convenience of ordering groceries and other goods online. Frozen surimi is a product that can be easily shipped and stored in a frozen state, making it a good fit for online retailers. Furthermore, online retailers often have a wider selection of products compared to physical stores and can source frozen surimi from a variety of suppliers. This has led to an increase in the availability of frozen surimi through online channels.

Regional Insights

Asia Pacific held the highest share of over 50% of the global market in 2022 and is anticipated to remain the leading region in the forecast period. The region is also anticipated to expand at the fastest CAGR of 6.6% over the forecast period. Surimi is highly consumed in the Asia Pacific region due to its affordability, versatility, and flavor. In many parts of Asia, seafood is a staple food and a major part of the local cuisine. In addition, surimi has been promoted and marketed extensively in the Asia Pacific region by the seafood industry, leading to its widespread popularity. Surimi-based products like fish balls, crab sticks, and kamaboko are commonly consumed as snacks or added to dishes as a protein source.

Europe held a significant share of the market and is expected to grow with a significant CAGR of 6.0% over the forecast period. The growing demand for healthy and sustainable protein sources has been observed in the region and surimi is seen as a healthy and low-fat alternative to other types of meat and seafood. Moreover, the seafood industry in Europe has also been promoting surimi-based products as a convenient and affordable alternative to fresh seafood. Furthermore, the popularity of Asian cuisine in Europe has led to greater awareness and appreciation of surimi-based products, such as crab sticks and fish balls thus driving the market.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others. In January 2023, Santa Bremor, a Belarusian seafood processor, announced to move the manufacturing of surimi sticks to its Russian Sea facility in Noginsk, close to Moscow. Some of the prominent players in the surimi market include:

-

HAI THANH CO., LTD

-

MEENA Brand Surimi

-

APITOON GROUP

-

Starfish Co., Ltd.

-

Java Seafood

-

PT. INDO SEAFOOD

-

Southern Marine

-

SEAPRIMEXCO

-

Zhejiang Longsheng Aquatic Products Co.,Ltd.

-

PT.Indonesia Bahari Lestari

Surimi Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.24 billion

Revenue forecast in 2030

USD 6.07 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; Thailand; South Korea; Brazil; UAE; Saudi Arabia

Key companies profiled

HAI THANH CO., LTD; MEENA Brand Surimi; APITOON GROUP; Starfish Co., Ltd.; Java Seafood; PT. INDO SEAFOOD; Southern Marine; SEAPRIMEXCO; Zhejiang Longsheng Aquatic Products Co.,Ltd.; and PT.Indonesia Bahari Lestari

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surimi Market Report Segmentation

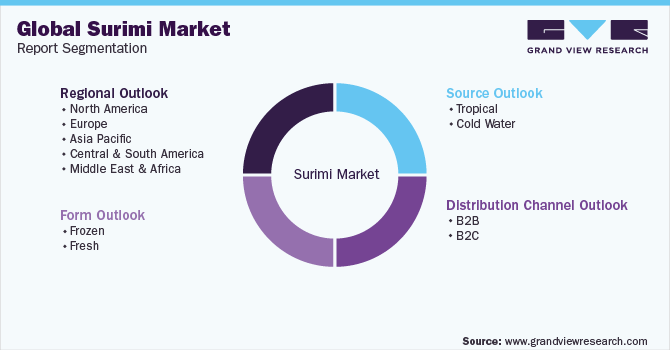

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global surimi market on the basis of source, form, distribution channel, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Tropical

-

Cold Water

-

Alaska Pollock

-

Pacific Whiting

-

Others

-

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen

-

Fresh

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

Thailand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global surimi market size was estimated at USD 3.78 billion in 2022 and is expected to reach USD 4.00 billion in 2023.

b. The global surimi market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 6.07 billion by 2030.

b. Asia Pacific dominated the surimi market with a share of 51.9% in 2022. This is attributed to the high consumption of surimi in the region owing to various factors such as affordability, versatility, and flavor.

b. Some key players operating in the surimi market include HAI THANH CO., LTD; MEENA Brand Surimi; APITOON GROUP; Starfish Co., Ltd.; Java Seafood; PT. INDO SEAFOOD; Southern Marine; SEAPRIMEXCO; Zhejiang Longsheng Aquatic Products Co.,Ltd.; and PT.Indonesia Bahari Lestari.

b. The increasing popularity of surimi as a cost-effective alternative to seafood in various regions across the globe is a key factor driving the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.