- Home

- »

- Automotive & Transportation

- »

-

Crane Market Size, Share And Growth Analysis Report, 2030GVR Report cover

![Crane Market Size, Share & Trends Report]()

Crane Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mobile, Fixed), By Application (Construction, Mining, Industrial, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-168-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crane Market Summary

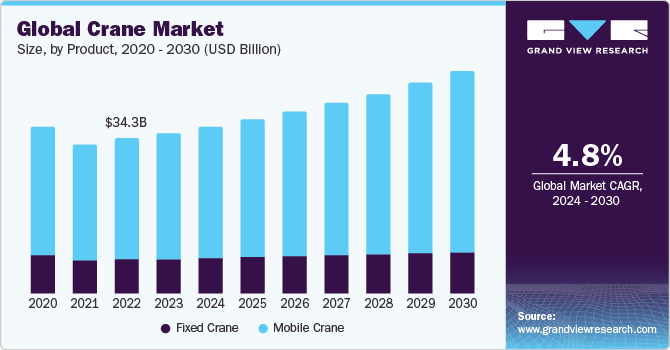

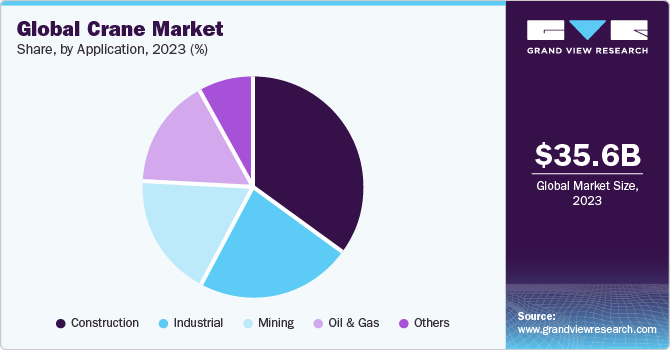

The global crane market size was estimated at USD 35.58 billion in 2023 and is projected to reach USD 49.14 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. Growing demand for cranes is high in construction projects, where they are essential for lifting heavy materials and equipment.

Key Market Trends & Insights

- Crane market in North America accounted for a market share of 35.2% in 2023.

- The U.S. crane market has seen steady growth due to increasing construction activities across various sectors.

- By product, mobile cranes segment held the largest revenue market share of over 78.2% in 2023.

- By application, construction segment held the largest revenue market share of over 35.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 35.58 Billion

- 2030 Projected Market Size: USD 49.14 Billion

- CAGR (2024-2030): 4.8%

- North America: Largest market in 2023

Besides, the growing trend of urbanization has led to an uptick in the construction of residential and commercial buildings, further fueling the demand for cranes. Technological advancements have led to developing more efficient and versatile crane models, enhancing their appeal to a wider range of industries. In addition, adopting advanced technologies such as IoT and automation enhances the efficiency and safety of crane operations, further propelling the market growth.The increased emphasis on renewable energy sources has increased demand for cranes to install wind turbines and other renewable energy infrastructure. The global energy sector, including renewable energy sources such as wind and solar, requires cranes to install, maintain, and repair power plants and associated infrastructure. In April 2024, China continued expanding its solar energy infrastructure, building upon significant growth witnessed in 2023. According to the National Energy Administration of China, new solar installations soared to 216.88 GW in 2023, marking an increase of 148.12% compared to 2022. Moreover, in the first quarter of 2024, China augmented its solar PV capacity by 45.74 GW, a rise from the 33.66 GW added in the same quarter of the previous year. The surging popularity of wind and solar power as viable alternatives to traditional energy sources has spurred the development and deployment of renewable energy projects on a global scale. However, the successful implementation of these projects heavily relies on efficiently using cranes that can handle the unique challenges associated with installing and maintaining the renewable energy infrastructure.

The crane industry is experiencing a surge in the adoption of cutting-edge technologies like remote monitoring, telematics, and lifting capacity advancements, presenting promising prospects for the foreseeable future. Manufacturers increasingly recognize the advantages of integrating automation, remote control systems, and telematics into crane designs to meet the growing demand for equipment capable of efficiently handling complex tasks, reducing labor-intensive activities, and enhancing overall project productivity. This trend has captured the attention of infrastructure developers striving to enhance their construction processes. By incorporating advanced crane technologies, infrastructure developers can streamline construction timelines, mitigate risks, and achieve cost savings. For instance, in May 2023, ANDRITZ unveiled an autonomous log yard crane for the wood industry at the LIGNA 2023 exhibition in Hanover, Germany, featuring artificial intelligence (AI) capabilities like real-time tracking and wood classification through Metris ANDI.

Furthermore, increased preference for electric and hybrid cranes, integration of smart technologies for enhanced operational efficiency, and a growing emphasis on sustainability are among the prominent trends shaping market dynamics. For instance, in October 2023, Mammoet, a crane service provider, purchased LTC 1050-3.1E, an electric mobile crane from Liebherr. It is a compact 50-ton crane that helps reduce CO2 and meets the requirements for zero-emission operation on construction sites.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of market growth is accelerating. This growth is primarily attributed to the increasing demand for construction and infrastructure development across various sectors globally. As populations grow and urbanization continues, there is a corresponding need for erecting buildings, bridges, and other structures. Cranes are pivotal in facilitating these construction activities, thus driving the market forward.

Advancements in technology have also contributed significantly to the market's growth. Innovations such as automation, remote operation, and enhanced safety features have made cranes more efficient and safer to operate. These technological advancements improve productivity and attract customers looking for modern solutions that align with industry standards and regulations.

In the dynamic landscape of the market, mergers and acquisition activities play a pivotal role in shaping its trajectory. Companies engaged in the Oil & Gas, distribution, and servicing of cranes often seek strategic acquisitions to enhance their market position, expand their product portfolio, or access new geographic regions.

Governments worldwide are increasingly focusing on adopting greener crane technologies. Across numerous nations, governments are offering incentives, encouraging businesses to invest in sustainable crane solutions. Consequently, the collective efforts of governments and crane manufacturers propel the adoption of eco-friendly crane technologies, fostering a greener future for the construction industry and beyond.

The threat of substitutes for cranes within the construction industry is low due to the specialized nature of their functionality and the need for viable alternatives. Cranes play an indispensable role in lifting heavy materials and equipment to considerable heights, a task that is challenging to replicate with alternative methods. While there are some alternatives, such as forklifts or aerial lifts, they need more versatility and lifting capacity than cranes, particularly in large-scale construction projects. Furthermore, the safety and efficiency provided by cranes make them the preferred choice for handling heavy loads in construction sites worldwide. In addition, the significant upfront investment required for purchasing and maintaining cranes is a deterrent for considering substitutes. The formidable lifting capacity, enhanced performance, and efficiency of cranes render them indispensable in the construction sector, effectively countering substitute threats and solidifying their enduring significance within the industry.

Product Insights

Amongst the products, mobile cranes held the largest revenue market share of over 78.2% in 2023 and is expected to register the highest CAGR over the forecast period. Infrastructure development stands out as a key catalyst for the global proliferation of mobile cranes. As economies expand and urbanization accelerates, the call for fresh infrastructure projects intensifies. In addition, the shift towards adaptable and versatile infrastructure models enables mobile cranes to cater to various construction needs.

Besides, the rapid pace of urbanization and increased infrastructure projects worldwide are anticipated to drive the segment demand during the forecast period. Mobile cranes play a vital role in equipment installation and maintenance in the oil and gas sector. With increasing exploration activities in regions such as the Middle East and North America, the demand for mobile cranes is gaining traction during the forecast period.

Application Insights

Construction industry held the largest revenue market share of over 35.3% in 2023 and is expected to register the fastest growth rate over the forecast period. Cranes are indispensable in various construction projects due to their efficiency and ability to handle heavy loads. As construction activities flourish, so does the demand for cranes, creating a symbiotic relationship between the two industries. Moreover, the evolution of construction techniques and the need for greater efficiency have further fueled the demand for advanced crane technology. Contractors and construction companies increasingly opt for innovative crane solutions that offer enhanced safety features, increased load capacity, and improved maneuverability. This drive towards technological advancement within the market is also propelled by the necessity to meet stringent safety and regulatory standards. Manufacturers are investing in R&D to introduce cutting-edge crane models that cater to the evolving needs of the construction industry.

The industrial segment is anticipated to register considerable growth over the forecast period. The industrial sector relies on cranes for material handling, assembly line operations, and equipment installation. Material handling is one of the primary uses of cranes in the industrial sector. Cranes are employed to lift, move, and position raw materials, components, and finished products throughout production. Whether it's loading and unloading materials from trucks, transferring items between different stages of the assembly line, or storing products in warehouses, cranes provide the necessary lifting capacity and maneuverability to ensure efficient and safe material handling operations.

Regional Insights

Crane market in North America accounted for a market share of 35.2% in 2023. Infrastructure development is rising in North America, marked by significant investments in transportation, energy, and construction. This surge has created a need for cranes, especially more extensive and specialized models, which is expected to propel the market growth. The renewable energy sector is also booming, with wind turbines and solar farms becoming increasingly prevalent. As a result, there is a growing demand for cranes capable of lifting heavy components to great heights. For instance, in April 2024, Apple Inc. revealed further advancements in their efforts to enhance clean energy initiatives, aligning with their vision for Apple 2030. The company is funding solar energy projects in both the U.S. and Europe to offset the electricity consumption associated with charging and operating Apple devices.

U.S. Crane Market Trends

The U.S. crane market has seen steady growth due to increasing construction activities across various sectors such as infrastructure, residential, and commercial. This growth can be attributed to rising urbanization and government investments in infrastructure projects.

Additionally, the demand for cranes has been fueled by the need for efficient material handling and lifting solutions in industries like manufacturing, energy, and logistics. Besides, technological advancements, such as the integration of telematics and IoT in crane systems have further contributed to market growth by enhancing operational efficiency and safety standards.Europe Crane Market Trends

Cranes market in Europe holds a market share of about 23.5% in 2023. Europe crane industry has witnessed significant increase in demand, largely driven by the region's robust infrastructure projects. Besides, government initiatives to improve transportation networks and expand urban areas have fuelled the need for cranes across various construction sites.

Crane market in the UK has a growing emphasis on renewable energy sources like wind and solar power. This has spurred construction activities related to renewable energy infrastructure, creating additional opportunities for crane manufacturers and suppliers, which is driving the market in the UK

Germany crane market is driven by its expanding oil & gas sector, a cornerstone of Germany's economy, which drives demand for cranes in industrial applications such as material handling and production processes. The country's diverse oil & gas base, spanning automotive, aerospace, and machinery industries, relies on cranes for efficient logistics and assembly operations. As oil & gas activities continue to evolve and expand, so does the need for advanced crane solutions tailored to specific industry requirements.

Crane market in France is projected to grow at a CAGR of 3.9% from 2024 to 2030. Stringent safety regulations and standards in France ensure that crane operators prioritize safety. Compliance with safety norms not only safeguards workers and equipment but also fosters trust among buyers regarding the reliability and durability of cranes. Manufacturers and suppliers that adhere to these regulations gain a competitive edge by demonstrating their commitment to quality and safety.

Asia Pacific Crane Market Trends

The crane market in Asia Pacific witnesses the rapid pace of infrastructure development across the region. Countries such as China, India, and Japan are making substantial investments in transportation infrastructure like highways, railways, and airports, leading to a notable demand for cranes to facilitate construction endeavors. Specifically, China has initiated a program to revamp and advance its crane sector, focusing on fostering innovation, enhancing safety standards, and bolstering the industry's competitiveness.

China crane market is projected to grow at a CAGR of 6.5% from 2024 to 2030. China’s strong export-oriented economy drives demand for cranes in international markets. China Crane offers manufacturers the benefit of a reputation for reliability, precision engineering, and technological innovation, making their products different and technologically advanced. Export opportunities enable companies to expand their market reach and mitigate risks associated with domestic market fluctuations.

Crane market in India is growing due to rising demand for construction projects in metropolitan areas. Cranes are indispensable in high-rise construction, urban redevelopment, and infrastructure upgrades, supporting the expansion and modernization of cities. The influx of people into urban centers creates a need for efficient construction methods, where cranes play a pivotal role in accelerating project timelines and optimizing resource utilization.

Japan crane market is driven by manufacturers' innovation to offer solutions to the aging workforce. The manufacturers are focusing on developing ergonomic and user-friendly crane designs. As older workers retire, there is a growing need for intuitive crane systems that are easy to operate and maintain.

Middle East and Africa Crane Market Trends

The Crane Market in the Middle East and Africa (MEA) region is anticipated to reach USD 4.45 billion by 2030. Advancements in automation and digitalization are reshaping the Middle East and Africa crane industry. Integrating technologies such as IoT sensors, telematics, and automation systems enhances the efficiency and productivity of crane operations. Businesses increasingly seek smart crane solutions that offer real-time monitoring, predictive maintenance, and data-driven insights to optimize performance and minimize downtime.

Saudi Arabia crane market is influenced by the country's ongoing construction projects, particularly in sectors like infrastructure, oil and gas, and industrial development. The Saudi Vision 2030 initiative, aimed at diversifying the economy and reducing dependency on oil revenues, presents additional opportunities for the market. Initiatives such as developing entertainment cities, tourism projects, and renewable energy installations require extensive construction work, thereby driving the demand for cranes across various sectors. The emphasis on expanding non-oil industries aligns with the long-term growth prospects in Saudi Arabia.

Key Crane Company Insights

The market participants are entering into strategic collaborations, mergers & acquisitions, new product developments, and partnerships to expand business and customer base. For instance, in April 2024, Liebherr launched the third generation LTM 1300-6.4, 300-tonne crane at the Intermat 2024 in Paris. The cranes operate through a LICCON3 control system, which will improve operation efficiency by making it easy to operate and prepared for telemetry and fleet management systems.

Key Crane Companies:

The following are the leading companies in the crane market. These companies collectively hold the largest market share and dictate industry trends.

- BUCKNER HEAVYLIFT CRANES, LLC

- CARGOTEC CORPORATION

- Caterpillar

- CERTEX USA

- Demag Cranes & Components GmbH

- GORBEL INC.

- Hitachi Construction Machinery Europe NV

- KITO CORPORATION

- Komatsu Ltd

- Konecranes

- LIEBHERR

- PALFINGER AG

- Pelloby Premier Cranes

- SANY Group

- Street Crane Company Limited

- Tadano Ltd

- Terex Corporation

- The Manitowoc Company, Inc.

- XCMG

- Zoomlion Heavy Industry Science&Technology Co., Ltd.

Recent Development

-

In April 2024, LOCATELLI CRANE S.R.L, an Italian crane manufacturer, launched a rough terrain crane of 100-tonne capacity Gril 110.100 in the Intermat 2024 trade show held in Paris, France. The cranes weigh 55 tonnes and have a 47-meter boom in the five sections. This product launch signifies a strategic initiative by the company to enhance its brand visibility and engage with customers.

-

In March 2024, Konecranes launched the X-series industrial crane, a compact, safe, and comfortable crane integrated with a compact and efficient motor to improve the crane's overall performance. Furthermore, the crane’s design is based on the Design for Environment (DfE) approach to reduce the environmental impact.

-

In April 2023, Liebherr launched a narrow track crawler crane named LR 1700-1.0W for the assembly of wind turbines. The crane has a lifting capacity from 73 to 120 tons and an option of luffing jib. Liebherr’s product launches are strategically planned to showcase its product offering globally and maintain company’s market share globally.

-

In February 2023, Action Construction Equipment Ltd. announced the launch of an electric crane with a lifting capacity of 180 tons. The electric crane is built to give optimum power and productivity and keep the equipment adaptable to Indian circumstances as part of the company's commitment to promoting sustainable technologies.

Crane Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.00 billion

Revenue forecast in 2030

USD 49.14 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Units, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

BUCKNER HEAVYLIFT CRANES, LLC; CARGOTEC CORPORATION; Caterpillar; CERTEX USA; Demag Cranes & Components GmbH; GORBEL INC.; Hitachi Construction Machinery Europe NV; KITO CORPORATION; Komatsu Ltd; Konecranes; LIEBHERR; PALFINGER AG; Pelloby Premier Cranes; SANY Group; Street Crane Company Limited; Tadano Ltd; Terex Corporation; The Manitowoc Company, Inc.; XCMG; Zoomlion Heavy Industry Science&Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

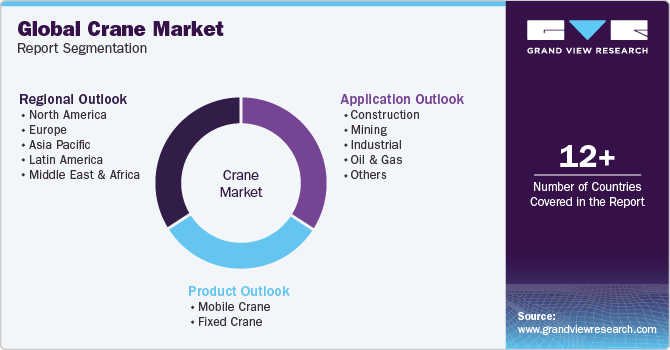

Global Crane Market Report Segmentation

The report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the crane market report based on product, application, and region:

-

Product Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Mobile Crane

-

Type

-

All Terrain Crane

-

Crawler Crane

-

Rough Terrain Crane

-

Truck Loader Crane

-

-

Load Capacity

-

Below 20 ton

-

20 To 50 Ton

-

50 To 200 ton

-

Above 200 ton

-

-

-

Fixed Crane

-

Type

-

Monorail Crane

-

Stiff Leg Crane

-

Tower Crane

-

Gantry Crane

-

-

Load Capacity

-

Below 25 ton

-

26-50 Ton

-

51-80 Ton

-

Above 80 Ton

-

-

-

-

Application Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Mining

-

Industrial

-

Oil & Gas

-

Others

-

-

Region Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the expansion of cities and increasing population necessitate the construction of new residential and commercial buildings, bridges, roads, airports, and other infrastructure developments

b. The global crane market size was estimated at USD 35.58 billion in 2023 and is expected to reach USD 37.00 billion in 2024.

b. The global crane market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 49.14 billion by 2030.

b. North America dominated the market with a market share of over 35.0% in 2023. North America is witnessing a surge in infrastructure development, with major investments being made in the transportation, energy, and construction sectors. This has led to a high demand for cranes in the region, particularly emphasizing larger, more specialized equipment.

b. Some key players operating in the crane market include BUCKNER HEAVYLIFT CRANES, LLC; CARGOTEC CORPORATION; Caterpillar; CERTEX USA; Demag Cranes & Components GmbH; GORBEL INC.; Hitachi Construction Machinery Europe NV; KITO CORPORATION; Komatsu Ltd; Konecranes; LIEBHERR; PALFINGER AG; Pelloby Premier Cranes; SANY Group; Street Crane Company Limited; Tadano Ltd; Terex Corporation; The Manitowoc Company, Inc.; XCMG; and Zoomlion Heavy Industry Science&Technology Co., Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.