- Home

- »

- Agrochemicals & Fertilizers

- »

-

Crop Protection Chemicals Market Size, Industry Report 2030GVR Report cover

![Crop Protection Chemicals Market Size, Share & Trends Report]()

Crop Protection Chemicals Market Size, Share & Trends Analysis Report By Product (Insecticides, Biopesticides), By Application (Cereals & Grains), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-567-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Crop Protection Chemicals Market Trends

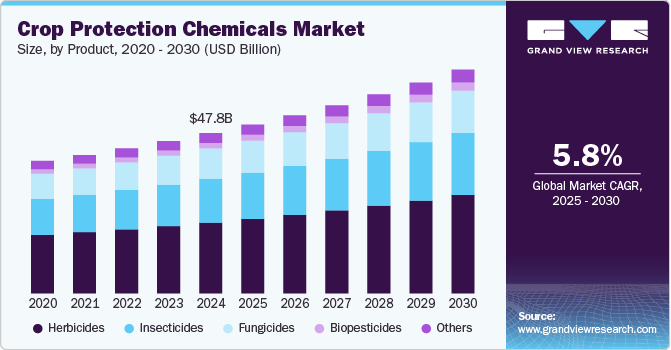

The global crop protection chemicals market size was estimated at USD 47.78 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. Technological advancements play a pivotal role in the growth of the market, particularly through innovations in chemistry and the adoption of precision agriculture. The development of new and more effective active ingredients, including biopesticides and environmentally friendly alternatives, enhances the efficacy of crop protection solutions while minimizing environmental impact.

The impacts of climate change and extreme weather conditions, such as droughts, floods, and unseasonal temperature fluctuations, pose substantial risks to market. In response, farmers are increasingly adopting crop protection chemicals that can help mitigate these risks. These products enable crops to withstand stress factors and reduce losses, ensuring better harvests despite unpredictable weather patterns.

Global trade dynamics are another crucial driver of the crop protection chemicals market. Emerging economies are increasingly recognizing the importance of agricultural productivity for economic growth. As a result, there is a rising demand for product in regions such as Asia-Pacific, Latin America, and Africa. Investment in agricultural infrastructure and initiatives to improve farming practices in these regions’ further drive market expansion.

Growing consumer awareness regarding food safety and sustainability is reshaping the agricultural landscape. There is a heightened demand for sustainably produced food, leading farmers to seek out environmentally friendly crop protection solutions. This trend is encouraging manufacturers to focus on developing sustainable market that meet consumer expectations, driving innovation and growth in the market.

Product Insights

The herbicides segment held the highest revenue share of 44.2% in 2024. The adoption of modern farming practices, including precision agriculture and integrated pest management (IPM), drives the herbicides market. Precision farming technologies enable farmers to apply herbicides more efficiently and effectively, optimizing usage and minimizing environmental impact. As farmers increasingly adopt these technologies, the demand for herbicides that can integrate with these advanced practices grows, driving innovations in product formulations and application methods.

Biopesticides segment is expected to grow at fastest CAGR of 6.8% over the forecast period. Investment in research and development for biopesticides is on the rise, as both private companies and governments recognize the need for sustainable agricultural practices. This investment is leading to the discovery of new biopesticide products and enhancing existing ones, thereby expanding the market. As the portfolio of biopesticides continues to grow, farmers gain access to a wider range of tools for effective pest management.

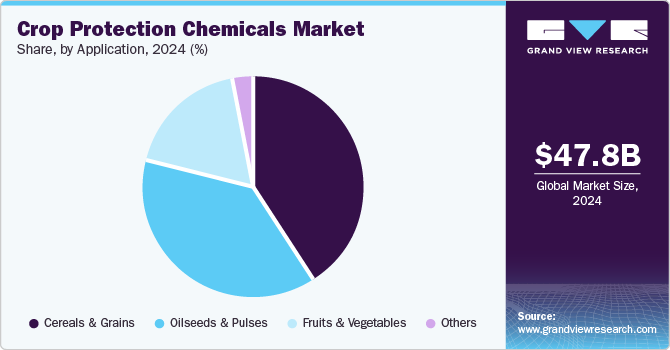

Application Insights

The cereals and grains segment dominated the market with a revenue share of 41.7% in 2024. Emerging economies, particularly in Asia-Pacific and Africa, represent a rapidly expanding market for cereals and grains. As these regions focus on improving agricultural productivity to support their growing populations, the demand for market tailored for cereals and grains is increasing. Investments in agricultural infrastructure, coupled with government initiatives aimed at enhancing food security, are further fueling the growth of this segment.

The fruit and vegetables segment is expected to witness the fastest growth over the forecast period. One of the primary drivers for the fruits and vegetables segment is the increasing health consciousness among consumers. As awareness of the nutritional benefits of fruits and vegetables grows, so does the demand for fresh, high-quality produce. This shift in consumer behavior encourages farmers to invest in market to enhance the quality and yield of their harvests. Farmers rely on these chemicals to protect against pests, diseases, and weeds, ensuring that the fruits and vegetables they produce meet the high standards expected by consumers and retailers.

Regional Insights

The North America crop protection chemicals market is expected to grow significantly over the forecast period. The regulatory environment in North America plays a critical role in shaping the crop protection chemicals market. Stricter regulations regarding food safety and environmental protection are driving the development of safer and more sustainable crop protection solutions. Manufacturers are focusing on creating environmentally friendly products that comply with regulatory standards while effectively controlling pests and diseases. This shift towards sustainable practices aligns with consumer preferences for safe and responsibly produced food.

U.S. Crop Protection Chemicals Market Trends

Evolving consumer preferences towards sustainable and organic food options further influence the U.S. crop protection chemicals market. As consumers become more aware of food safety and environmental issues, there is a growing demand for sustainably produced agricultural products. This shift is prompting farmers to adopt integrated pest management (IPM) practices and explore organic crop protection solutions, driving innovation and market growth in environmentally friendly alternatives.

Central and South America Crop Protection Chemicals Market Trends

Central and South America held the highest revenue share of over 32.2% in 2024. Investment in modern farming practices is another critical driver of the crop protection chemicals market in Central and South America. Farmers are increasingly adopting advanced agricultural technologies, such as precision farming and integrated pest management (IPM), which rely on effective crop protection solutions. These innovations enable more efficient use of chemicals, reduce environmental impact, and improve crop quality. As farmers seek to maximize their productivity and sustainability, the demand for high-quality crop protection chemicals grows correspondingly.

Middle East & Africa Crop Protection Chemicals Market Trends

A primary driver of the crop protection chemicals market in the MEA region is the growing emphasis on agricultural development to ensure food security. As the population continues to rise, particularly in urban areas, there is a pressing need to enhance agricultural productivity. Farmers are increasingly adopting crop protection chemicals to combat pests, diseases, and weeds, ensuring that their crops can meet the increasing demand for food. This need for higher yields and quality produce has made effective pest management solutions essential for local agricultural practices.

Asia Pacific Crop Protection Chemicals Market Trends

The Asia Pacific crop protection chemicals market is expected to grow significantly over the forecast period. The Asia Pacific region is a major agricultural producer, and there is an increasing focus on boosting agricultural exports to global markets, particularly in staple crops, fruits, and vegetables. International demand for high-quality, pest-free produce requires effective pest and disease management, driving demand for crop protection chemicals. As countries look to enhance the quality and competitiveness of their agricultural exports, farmers are turning to advanced crop protection solutions to meet international standards, particularly those for minimal pesticide residues.

China crop protection chemicals market is witnessing demand due toChina's agricultural sector is undergoing significant modernization to increase productivity and efficiency in response to the demands of its large and growing population. As urbanization accelerates, there is heightened pressure on limited arable land to produce more food. This need has driven farmers to adopt crop protection chemicals that can effectively manage pests, weeds, and diseases, maximizing yields while protecting crop quality. With government support for mechanized and technologically advanced farming, crop protection chemicals have become an essential component in China’s agricultural productivity strategy.

Europe Crop Protection Chemicals Market Trends

Europe’s Green Deal has intensified the push towards sustainable agriculture, aiming for a significant reduction in pesticide use and a shift to organic farming. The Farm to Fork strategy, a core element of the Green Deal, sets ambitious targets, including a 50% reduction in pesticide use by 2030. This commitment to environmental sustainability is driving demand for organic and natural pest control solutions, such as biopesticides, and Integrated Pest Management (IPM) practices. As farmers look to adopt more sustainable farming methods, the market is seeing increased investment in sustainable crop protection solutions that align with these long-term environmental goals.

Key Crop Protection Chemicals Company Insights

Some of the key players operating in the market include American Vanguard Corp; Dow; Arysta LifeSciences Corporation;

-

American Vanguard Corporation, based in Newport Beach, California, is a leading provider of agricultural and specialty chemicals, focusing on products that support effective pest control and crop enhancement. Operating primarily through its subsidiary, AMVAC Chemical Corporation, American Vanguard offers a diverse range of products, including herbicides, insecticides, fungicides, and soil fumigants tailored to support row crops, specialty crops, and various non-crop applications. The company places emphasis on sustainable and innovative solutions, incorporating eco-friendly technologies and precision application tools to help optimize pest management while reducing environmental impact.

-

Dow Chemical Company, a prominent player in the global crop protection chemicals market, is recognized for its extensive portfolio and innovation-driven approach in agricultural solutions. The company, now a division within Dow Inc., leverages advanced science to address critical agricultural challenges, focusing on crop protection products that promote sustainable and efficient farming practices.

Key Crop Protection Chemicals Companies:

The following are the leading companies in the crop protection chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- American Vanguard Corp

- Dow Chemical Company

- Arysta LifeSciences Corporation

- Bayer AG

- BASF SE

- FMC Corporation

- Corteva

- Chr. Hansen Holding A/S

- Bioworks

- Syngenta Group

View a comprehensive list of companies in the Crop Protection Chemicals Market

Recent Developments

-

In June 2024, BASF launched its new rice fungicide, Cevya, in China, marking a significant advancement in crop protection for one of the country’s staple crops. Cevya is formulated with BASF’s innovative Revysol technology, designed to provide long-lasting and effective disease control against various fungal pathogens commonly affecting rice. This product introduction aligns with BASF’s commitment to sustainable agriculture by reducing crop losses, improving yields, and minimizing environmental impact. By introducing Cevya in China, BASF aims to support Chinese farmers with reliable protection against challenging rice diseases, enhancing both productivity and resilience in rice cultivation.

Crop Protection Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 50.34 billion

Revenue forecast in 2030

USD 66.74 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Spain; UK; China; Japan; South Korea; Brazil; Argentina; South Africa

Segments covered

Product, application, region

Key companies profiled

American Vanguard Corp; Dow Chemical Company; Arysta LifeSciences Corporation; Bayer AG; BASF SE; FMC Corporation; Corteva; Chr. Hansen Holding A/S; Bioworks; Syngenta Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crop Protection Chemicals Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global crop protection chemicals market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Herbicides

-

By Product

-

Selective

-

Non-selective

-

-

By Active Ingredients

-

Glyphosate

-

Atrazine

-

2,4-D

-

Others

-

-

-

Fungicides

-

By Active Ingredients

-

Chlorathalonil

-

Sulfur

-

PCNB

-

Maneb

-

Others

-

-

-

Insecticides

-

By Active Ingredients

-

Malathion

-

Carbaryl

-

Chlorpyrifos

-

Others

-

-

-

Biopesticides

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The crop protection chemicals market size was estimated at USD 47.78 billion in 2024 and is expected to register a growth of 5.8% in terms of revenue over the forecast period.

b. The global crop protection chemicals market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030, reaching USD 66.7 million by 2030.

b. Central and South America held the highest revenue share, over 32.2%, in 2024. Investment in modern farming practices is another critical driver of the crop protection chemicals market in these regions.

b. Some of the key players operating in the market include American Vanguard Corp, Dow, Arysta LifeSciences Corporation

b. Key factors that are driving the development of new and more effective active ingredients, including biopesticides and environmentally friendly alternatives, enhance the efficacy of crop protection solutions while minimizing environmental impact.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."