- Home

- »

- Agrochemicals & Fertilizers

- »

-

Biopesticides Market Size & Share, Industry Report, 2033GVR Report cover

![Biopesticides Market Size, Share & Trends Report]()

Biopesticides Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Biofungicide, Bioinsecticide, Bionematicide, Bioherbicide), By Crop Type, By Source, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-842-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biopesticides Market Summary

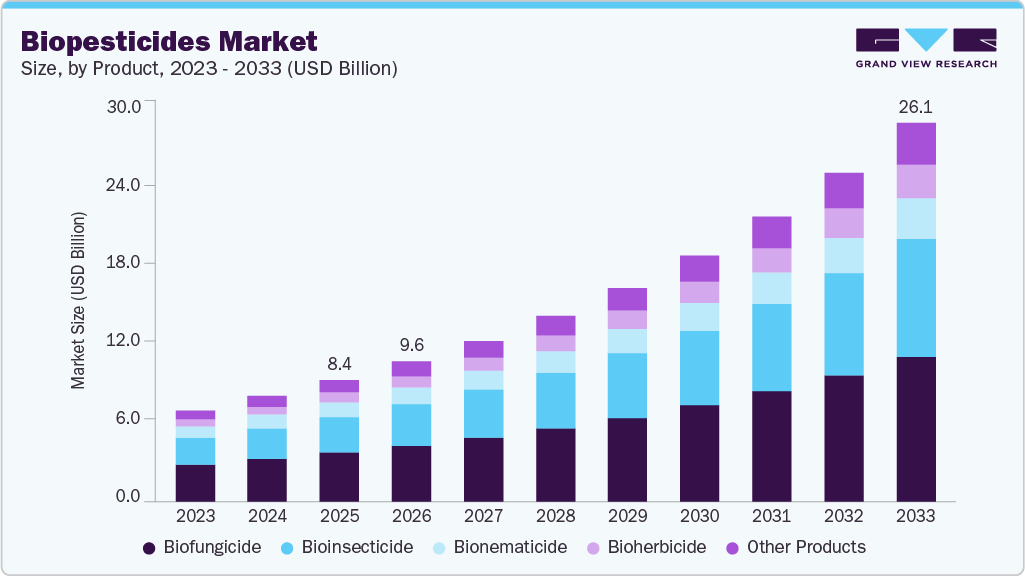

The global biopesticides market size was estimated at USD 8,366.6 million in 2025 and is projected to reach USD 26,082.1 million by 2033, growing at a CAGR of 15.3% from 2026 to 2033. The increasing adoption of biopesticides in sustainable agriculture, organic farming, and integrated pest management practices is driving market growth.

Key Market Trends & Insights

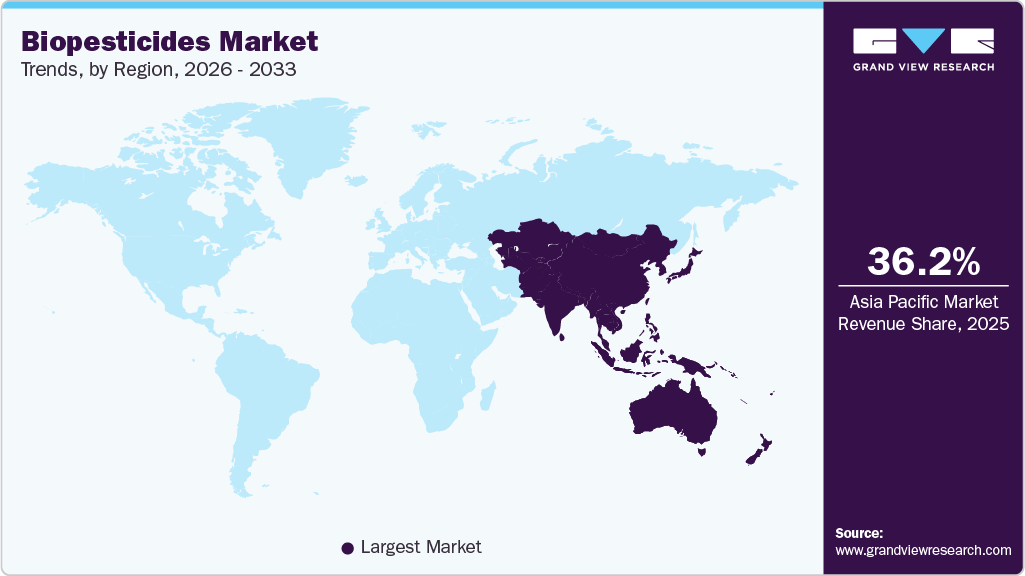

- Asia Pacific dominated the biopesticides market with the largest revenue share of 36.2% in 2025.

- By product, the bioherbicide segment is expected to grow at the fastest CAGR of 17.4% from 2026 to 2033.

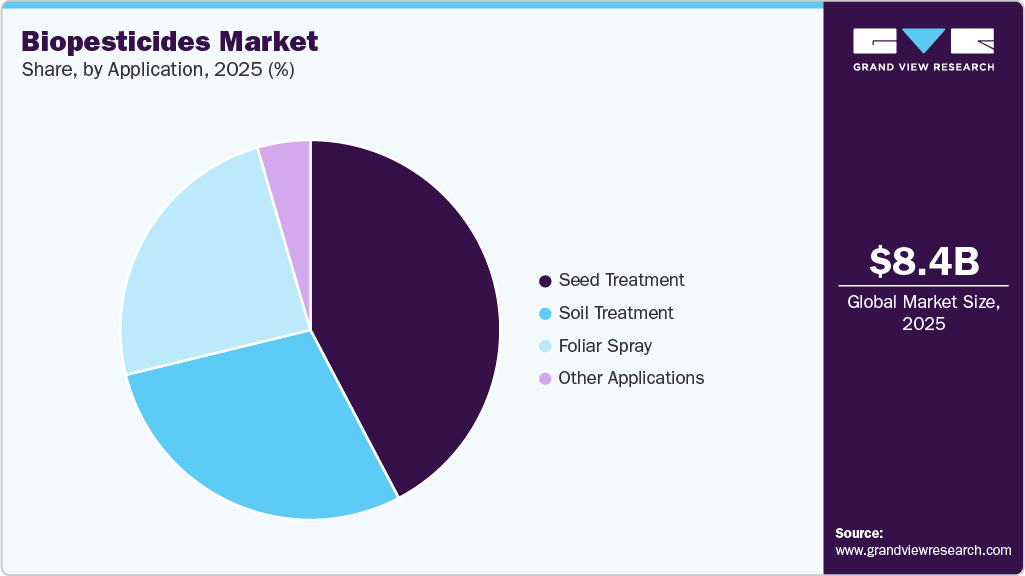

- By application, the seed treatment segment led the market with the largest revenue share of 42.3% in 2025.

- By application, the foliar spray segment led the market with the largest revenue share of 24.3% in 2025.

- By crop type, the cereals & grains segment led the market with the largest revenue share of 42.4 in 2025.

Market Size & Forecast

- 2025 Market Size: USD 8,366.6 Million

- 2033 Projected Market Size: USD 26,082.1 Million

- CAGR (2026-2033): 15.3%

- Asia Pacific: Largest market in 2025

Rising regulatory support for eco-friendly crop protection solutions, growing demand for residue-free food products, increasing focus on soil health, and continuous innovation in microbial and biochemical formulations are contributing to the market’s steady expansion.

Biopesticides are naturally derived crop protection solutions formulated from microorganisms, biochemicals, and plant-incorporated protectants, valued for their targeted action, environmental safety, and reduced impact on non-target organisms. Biopesticides are applied across various stages of crop production and are increasingly recognized as a critical component of sustainable agriculture, with applications spanning cereals and grains, fruits and vegetables, oilseeds and pulses, and specialty crops. The rising demand for biopesticides is largely driven by growing adoption of organic farming practices, increasing emphasis on integrated pest management, and the need for residue-free agricultural produce, along with advancements in formulation technologies that enhance efficacy and field performance.

The increasing awareness of environmental sustainability and food safety is supporting the adoption of biopesticides globally. Rising concerns related to soil degradation, pest resistance to chemical pesticides, and regulatory restrictions on synthetic crop protection products continue to encourage the shift toward biologically based solutions, further strengthening demand for biopesticides across global agricultural markets.

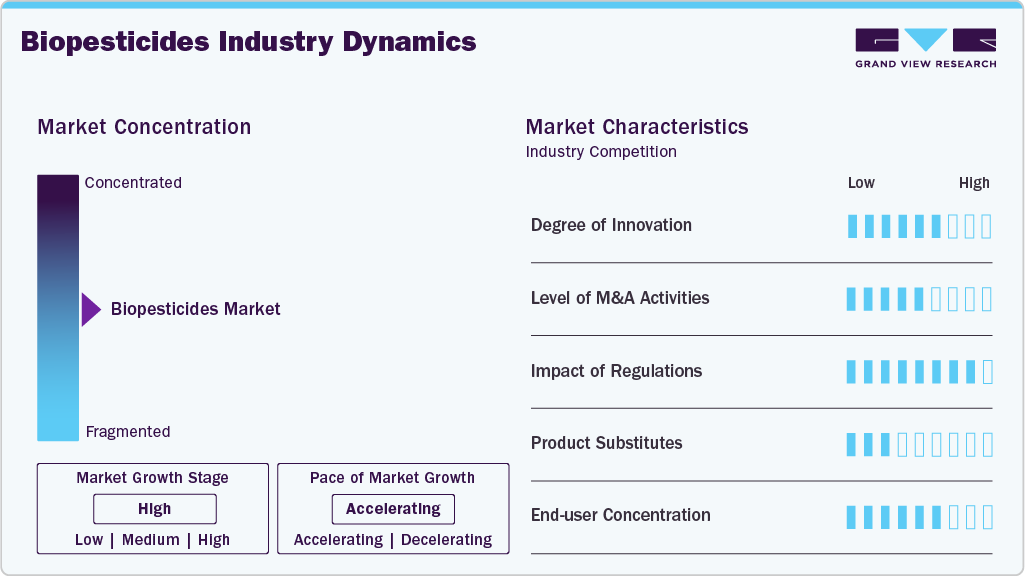

Market Concentration & Characteristics

The biopesticides industry is moderately fragmented, with the presence of a mix of multinational players and regional manufacturers shaping the competitive landscape. These companies benefit from established distribution networks, strong R&D capabilities, and diversified biological product portfolios. Key participants are increasingly focusing on expanding their biological pipelines, investing in formulation optimization and product standardization, and strengthening regulatory compliance and field validation efforts to enhance their competitive positioning in the global biopesticides industry.

Leading players in the global biopesticides industry are adopting a mix of capacity expansion, product innovation, strategic collaborations, and sustainability-focused initiatives to strengthen their market presence. Companies operating across biological development, formulation, and commercialization are investing in microbial strain enhancement, formulation technologies, and next-generation biopesticide products to improve efficacy, stability, and crop specificity. To address rising demand across Asia Pacific and Latin America, several market participants are expanding their manufacturing capabilities, strengthening regional distribution networks, and supporting farmer education and field demonstration programs to accelerate product adoption.

Product Insights

The biofungicides segment led the market with the largest revenue share of 40.4% in 2025. The demand for biofungicides is driven by their widespread use in managing fungal diseases across various crops, including fruits and vegetables, cereals and grains, and high-value crops, supported by the increasing adoption of sustainable and residue-free crop protection solutions. Biofungicides are widely applied through foliar sprays, seed treatments, and soil applications, supporting their strong penetration across both conventional and organic farming systems. Rising awareness of integrated pest management practices, tightening regulations on chemical fungicides, and an increasing focus on soil health are further boosting the adoption of biofungicides globally. Biopesticides are also widely used across various segments, including bioinsecticides, bionematicides, bioherbicides, and other product categories, to address diverse pest and disease challenges.

Biofungicides are valued for their targeted mode of action, reduced environmental impact, and compatibility with biological and chemical crop protection programs, making them suitable for a wide range of agricultural applications. Continuous advancements in microbial strain development, formulation technologies, and application methods, along with expanding use in high-value and specialty crops, are expected to drive sustained growth of the biofungicides segment over the forecast period.

Crop Type Insights

The cereals & grains segment led the market with the largest revenue share of 42.4 in 2025. The demand for biopesticides in cereals and grains is driven by the need for effective control of fungal, insect, and nematode threats across key staple crops, including wheat, rice, maize, and barley. Biopesticides provide targeted, environmentally safe protection during critical growth stages, supporting their widespread adoption in commercial grain production. Rising awareness of sustainable farming practices, increasing adoption of integrated pest management, and efforts to reduce chemical pesticide use are further boosting biopesticide application in cereals and grains globally. Meanwhile, other crop types, such as fruits & vegetables, oilseeds & pulses, also benefit from biopesticide interventions.

Biopesticides used in cereals and grains are valued for their ability to enhance crop health, improve yield quality, and manage early- and late-stage pest pressure with minimal environmental impact. Continuous innovations in microbial formulations, application methods, and compatibility with seed and soil systems, along with expanding adoption in large-scale grain cultivation, are expected to drive sustained growth of the cereals & grains segment over the forecast period.

Source Insights

The microbial segment led the market with the largest revenue share of 52.3% in 2025. Microbial biopesticides, including bacteria, fungi, viruses, and nematode-based formulations, are widely used for their targeted pest control, minimal environmental impact, and compatibility with sustainable agricultural practices. These products are extensively applied across cereals & grains, fruits & vegetables, oilseeds & pulses, and other crops to manage a broad spectrum of fungal, insect, and nematode threats. The increasing adoption of integrated pest management, growing demand for residue-free produce, and regulatory incentives supporting eco-friendly crop protection solutions are further driving the global microbial biopesticides industry, while biochemical and plant-incorporated protectants also contribute to crop protection strategies.

Microbial biopesticides are valued for their efficacy in enhancing plant growth, improving soil health, and providing long-term pest suppression with reduced chemical input. Ongoing advancements in strain development, formulation technologies, and field application techniques, coupled with expanding adoption in both conventional and organic farming systems, are expected to sustain growth of the microbial segment over the forecast period.

Application Insights

The seed treatment segment led the market with the largest revenue share of 42.3% in 2025. Demand for biopesticides in seed treatment is driven by the need for early-stage crop protection, improved seed vigor, and effective control of soilborne pathogens and pests. Seed-applied biopesticides offer targeted protection during germination and early plant development, contributing to their strong adoption across cereals and grains, oilseeds and pulses, as well as high-value horticultural crops. The rising emphasis on sustainable farming practices, increasing adoption of integrated pest management, and the growing need to reduce chemical pesticide usage are further driving the global use of biopesticides in seed treatment applications. At the same time, biopesticides are also extensively applied through soil treatment, foliar spray, and other application methods to manage a wide range of crop protection challenges.

Biopesticides used in seed treatment are valued for their ability to enhance crop establishment, reduce early-season pest pressure, and support long-term plant health with minimal environmental impact. Continuous advancements in formulation technologies, seed coating techniques, and microbial compatibility with seeds, along with expanding adoption in commercial seed production, are expected to drive sustained growth of the seed treatment segment over the forecast period.

The foliar spray segment is expected to grow at the fastest CAGR of 16.5% from 2026 to 2033. Growth is driven by the increasing use of biopesticides for rapid and targeted control of insect pests, fungal diseases, and foliar pathogens across a wide range of crops. Foliar-applied biopesticides are increasingly preferred due to their ease of application, quick action, and compatibility with existing spraying equipment, making them suitable for both conventional and organic farming systems.

Rising adoption of integrated pest management practices, growing demand for residue-free crop protection solutions, and increasing focus on sustainable agriculture are further accelerating the use of biopesticides in foliar spray applications, particularly in high-value fruits and vegetables and intensive cropping systems. Continuous advancements in formulation technologies, including improved adhesion, rainfastness, and stability, along with expanded field validation across diverse agro-climatic conditions, are expected to support strong growth of the foliar spray segment over the forecast period.

Regional Insights

The biopesticides market in North America is experiencing steady growth, driven by the increasing adoption of sustainable and environmentally safe crop protection solutions. Biopesticides are increasingly applied across cereals and grains, fruits and vegetables, and specialty crops to manage pests and diseases while reducing the use of chemical pesticides. Growing awareness of integrated pest management practices, soil health, and residue-free agricultural production, coupled with supportive regulations, is driving product innovation and supporting market expansion across the United States, Canada, and Mexico.

U.S. Biopesticides Market Trends

The biopesticides market in the U.S. is growing steadily, driven by increasing adoption of sustainable and environmentally safe crop protection solutions. Biopesticides are widely applied to fruits and vegetables, cereals and grains, and high-value crops to manage pests and diseases while reducing the use of chemical pesticides. The rising demand for integrated pest management practices, residue-free produce, and sustainable farming solutions is driving innovation. Expansion of production facilities, distribution networks, and product availability across commercial and retail channels is further supporting market growth.

Asia Pacific Biopesticides Market Trends

Asia Pacific dominated the biopesticides market with the largest revenue share of 36.2% in 2025, driven by increasing adoption of sustainable agricultural practices and rising awareness of eco-friendly crop protection solutions. Growing pressure to reduce chemical pesticide usage, coupled with the expansion of organic farming acreage, is encouraging the use of biopesticides across cereals and grains, fruits and vegetables, and plantation crops. Strong agricultural activity, supportive government initiatives, and improving access to biological crop protection products across India, China, Japan, and Southeast Asia are expected to sustain regional growth.

The biopesticides market in China accounted for the largest market revenue share in the Asia Pacific in 2025, driven by increasing adoption of sustainable agricultural practices and rising awareness of environmentally safe crop protection solutions. As growers focus on improving crop yields while reducing reliance on chemical pesticides, demand for biopesticides is increasing across cereals and grains, fruits and vegetables, and high-value horticultural crops. The expansion of domestic manufacturing capabilities, improved distribution networks, and continued product innovation in microbial and biochemical biopesticides are further supporting market growth, positioning China as a key contributor to the Asia-Pacific region.

Europe Biopesticides Market Trends

The biopesticides market in Europe is anticipated to grow at a significant CAGR during the forecast period, driven by strong regulatory support for sustainable agriculture and increasing demand for environmentally safe crop protection solutions. Farmers across Germany, France, the UK, and other European countries are increasingly adopting biopesticides to comply with strict regulations on chemical pesticide use and to support organic and integrated pest management practices. The market is further supported by rising awareness of soil health, biodiversity conservation, and residue-free food production, as well as government initiatives promoting sustainable farming systems.

Growing emphasis on clean-label and sustainably produced agricultural output is encouraging manufacturers to innovate with advanced microbial and biochemical biopesticide formulations. In addition, the expansion of organic farming acreage, improvements in distribution infrastructure, and the rising adoption of biopesticides across fruits and vegetables, cereals and grains, and specialty crops are strengthening Europe’s position as a key regional market, contributing significantly to overall global growth.

The Germany biopesticides market is growing steadily, driven by increasing adoption of sustainable and eco-friendly crop protection solutions. Biopesticides are widely used across fruits and vegetables, cereals and grains, and high-value crops to manage pests and diseases while reducing reliance on chemical pesticides. Rising awareness of integrated pest management practices, soil health, and environmentally safe agriculture is encouraging manufacturers to innovate with microbial and biochemical formulations. Expansion of production facilities, distribution networks, and application technologies is further supporting market growth.

Latin America Biopesticides Market Trends

The biopesticides market in Latin America is anticipated to witness at a steady CAGR during the forecast period, driven by increasing adoption of sustainable and eco-friendly crop protection solutions. Biopesticides are gaining popularity across various crops, including cereals and grains, fruits and vegetables, and high-value crops, to manage pests and diseases while reducing the use of chemical pesticides. Rising awareness of integrated pest management practices, soil health, and environmentally safe agriculture, along with growing demand for organic and residue-free produce, is encouraging manufacturers to innovate and expand production capabilities across Brazil and other key markets.

Middle East & Africa Biopesticides Market Trends

The biopesticides market in the Middle East & Africa is growing at a rapid pace, supported by increasing adoption of sustainable and environmentally safe crop protection solutions. Biopesticides are increasingly applied to cereals and grains, fruits and vegetables, and high-value crops to manage pests and diseases while reducing the use of chemical pesticides. Growing interest in integrated pest management practices, soil health, and residue-free agricultural production is driving innovation in products. Expansion of production facilities and distribution networks across key markets, including the UAE, Saudi Arabia, and South Africa, further supports growth.

Key Biopesticide Company Insights

Key players, such as BASF SE., Castrol India Ltd., Bayer AG., and Sumitomo Chemical Co Ltd., are dominating the global market.

- BASF SE is emerging as a key player in the global biopesticides industry, focusing on the development, formulation, and commercialization of high-quality microbial and biochemical crop protection solutions. The company leverages its extensive R&D capabilities, technological expertise, and global production infrastructure to deliver innovative and effective biopesticide products across fruits and vegetables, cereals and grains, and high-value crops. BASF SE’s commitment to sustainable agriculture, regulatory compliance, and product innovation supports its growing presence in both domestic and international biopesticides industry.

Key Biopesticides Companies:

The following are the leading companies in the biopesticides market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Bayer AG

- Syngenta Group

- UPL Ltd.

- Corteva Agriscience

- FMC Corporation

- Sumitomo Chemical Co Ltd

- Marrone Bio Innovations (MBI)

- Koppert B.V.

- Valent Biosciences LLC

Key Industry Developments

-

In January 2026, Indovinya, the specialty chemicals and surfactants division of Indorama Ventures, launched SURFOM ETHOS, a new product line designed to meet the formulation needs of biologically based agricultural inputs. The portfolio addresses technical and application challenges that have historically limited biopesticide adoption, optimizing performance from laboratory formulation to field application. Such innovations enhance product efficacy, ease of use, and reliability, encouraging wider adoption among farmers. By improving the practical applicability of biopesticides, developments like these are expected to drive growth in the global biopesticides industry.

Biopesticides Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9,629.0 million

Revenue forecast in 2033

USD 26,082.1 million

Growth rate

CAGR of 15.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, crop type, source, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

BASF SE; Bayer AG; Syngenta Group; UPL Ltd.; Corteva Agriscience; FMC Corporation; Sumitomo Chemical Co Ltd; Marrone Bio Innovations (MBI); Koppert B.V.; Valent Biosciences LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biopesticides Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global biopesticides market report based on product, source, crop type, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Biofungicide

-

Bioinsecticide

-

Bionematicide

-

Bioherbicide

-

Other Products

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Cereals & Grains

-

Fruits & Vegetables

-

Oilseeds & Pulses

-

Other Crop Types

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Microbial

-

Biochemical

-

Plant-Incorporated-Protectants

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Seed treatment

-

Soil treatment

-

Foliar Spray

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global biopesticides market size was estimated at USD 8,366.6 million in 2025 and is expected to reach USD 9,629.0 million in 2026.

b. The global biopesticides market is expected to grow at a compound annual growth rate of 15.3% from 2026 to 2033 to reach USD 26,082.1 million by 2033.

b. The biofungicide segment dominated the global biopesticides market by product in 2025, accounting for a significant share of 40.4% of overall consumption, driven by its proven efficacy, broad spectrum of activity, and compatibility with sustainable agriculture practices. Biofungicides are widely used across cereals, fruits, vegetables, and oilseeds to control fungal diseases while reducing reliance on chemical pesticides. Key advantages such as environmental safety, target specificity, and alignment with organic and integrated pest management (IPM) practices continue to strengthen the market position of biofungicides globally.

b. Some of the key players operating in the market include BASF SE, Bayer AG, Syngenta Group, UPL Ltd., Corteva Agriscience, FMC Corporation, Sumitomo Chemical Co Ltd, Marrone Bio Innovations (MBI), Koppert B.V., Valent Biosciences LLC.

b. The global biopesticides market is primarily driven by rising demand from the cereals, fruits & vegetables, oilseeds, and specialty crops sectors, supported by increasing adoption of sustainable and eco-friendly crop protection solutions. Growing awareness of environmentally safe farming practices, continuous product innovation, and expanding use of biofungicides, bioinsecticides, and other biopesticides are accelerating market growth. The application of biopesticides across seed treatment, soil treatment, and foliar spray, driven by demand for residue-free, target-specific, and eco-friendly crop protection solutions, continues to support steady global market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.