- Home

- »

- Nutraceuticals & Functional Foods

- »

-

CSA Nutraceuticals Market Size, Share, Industry Report 2033GVR Report cover

![Central And South America Nutraceuticals Market Size, Share & Trends Report]()

Central And South America Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-836-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Central & South America Nutraceuticals Market Summary

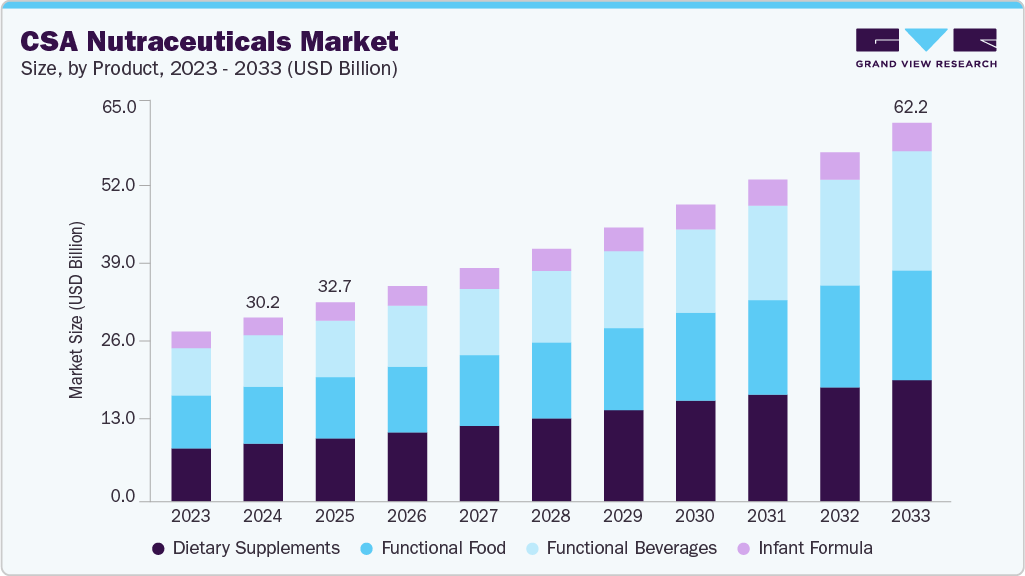

The Central and South America nutraceuticals market size was estimated at USD 30.18 billion in 2024 and is projected to reach USD 62.17 billion by 2033, growing at a CAGR of 8.4% from 2025 to 2033. This market is primarily driven by the growing demand for natural and plant-based products, supportive government initiatives and regulatory frameworks, the rise in fitness culture and sports participation, and a growing middle-class population with increased purchasing power in the region.

Key Market Trends & Insights

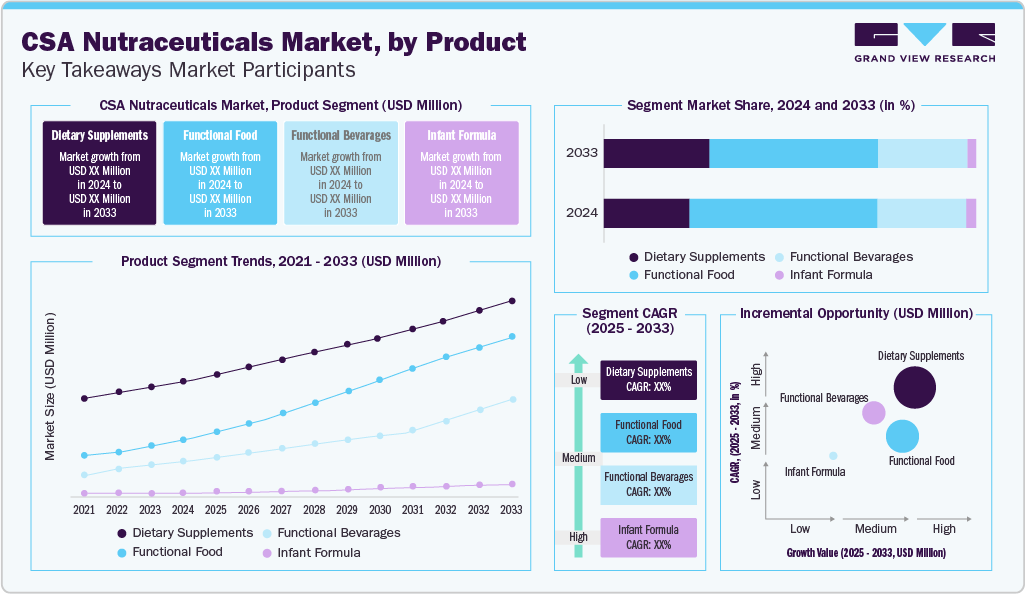

- By product, the dietary supplements segment held the highest market share of 31.4% in 2024.

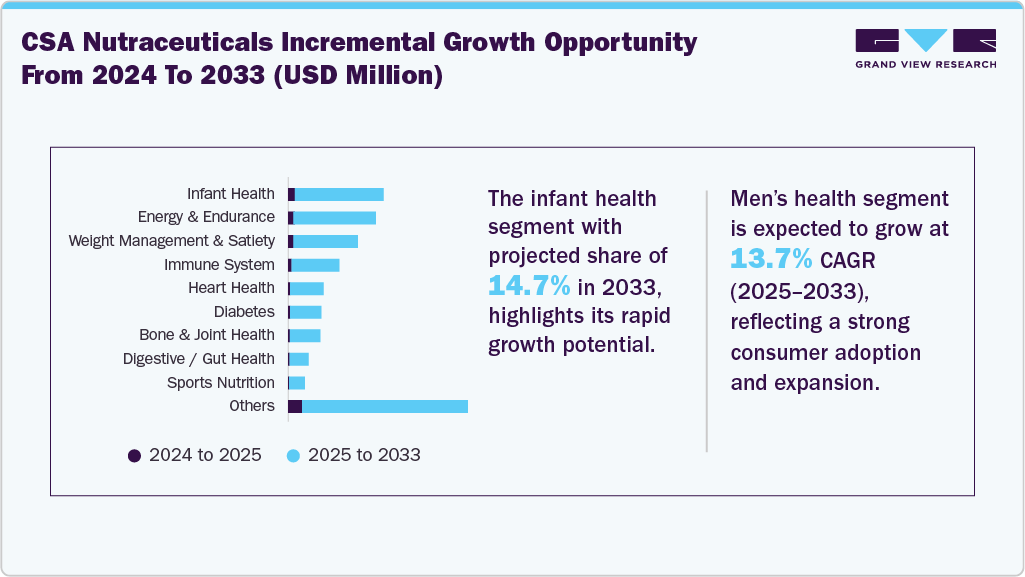

- Based on application, the weight management & satiety segment held the highest market share in 2024.

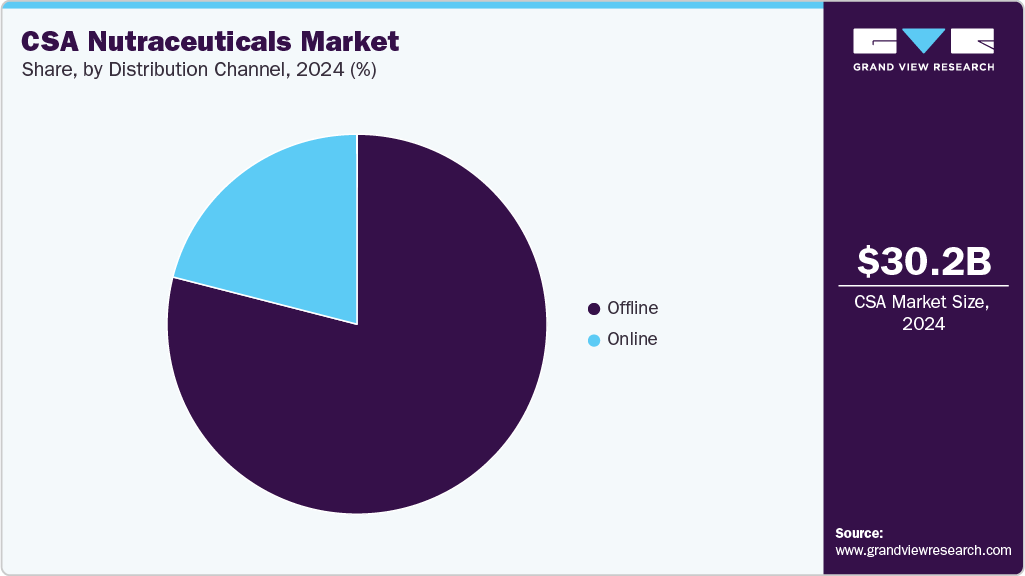

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 30.18 Billion

- 2033 Projected Market Size: USD 62.17 Billion

- CAGR (2025-2033): 8.4%

Consumers are increasingly looking for natural, organic, and plant-based nutraceutical options, driven by growing environmental awareness and concerns over synthetic ingredients. The rich biodiversity of Central and South America (CSA) supports the use of traditional botanical ingredients, which companies incorporate into innovative supplements.The increased fitness culture and sports engagement across the region drives demand for sports nutrition supplements, such as protein powders, amino acids, and energy boosters. Younger age groups, particularly millennials and Gen Z, are embracing active lifestyles and demand products that improve performance and recovery. Fitness influencers and gym clubs are key channels for advertising these products, increasing adoption and awareness. This trend splits the nutraceutical market from broad wellness into specialized segments. Companies operating in the market are launching sports nutritional products enriched with vitamins and minerals, aligning with broader health and wellness trends.

Consumer Insights

The nutraceuticals market in CSA shows a clear divide between urban and rural consumers, shaped by differences in access, awareness, affordability, and product preferences. Urban areas in Brazil, Argentina, Colombia, and Chile are hubs for nutraceutical consumption, with consumers having better access to modern pharmacies, supermarkets, and e-commerce platforms. These urban buyers often prefer specialized products such as collagen powders, plant-based protein, and sleep aids, and are more receptive to international or premium brands.

Gender is a key factor in influencing nutraceutical consumption trends across CSA, with women being the main consumers and decision-makers. At the same time, men increasingly develop an interest in targeted applications such as sports nutrition and vitality supplements. Women comprise a larger proportion of the consumer base for nutraceuticals, especially in beauty-from-within, hormonal balance, weight management, and family well-being. They are more likely to investigate product benefits and are affected by peer opinions, influencer endorsements, and clean-label statements.

Product Insights

The dietary supplements segment dominated the market with a revenue share of 31.4% in 2024. The growing health consciousness has significantly heightened the demand for vitamins, minerals, and herbal supplements that promote immune function. Patients in CSA are actively taking supplements to avoid illness instead of seeking treatment after the fact. This change of attitude is also driven by wider exposure to health information through the internet. Government-led wellness campaigns and rising healthcare costs encourage consumers to invest in self-care.

The functional beverages segment is expected to witness a CAGR of 9.8% from 2025 to 2033. Consumers in the region are increasingly drawn to functional beverages that offer appealing taste profiles and health benefits. Manufacturers in the region are innovating with tropical and exotic flavors such as passion fruit, guava, and acai blended with functional ingredients such as vitamin C, magnesium, and probiotics.

Application Insights

The weight management & satiety segment held the largest revenue share in 2024, driven by the rising obesity and overweight rates across the region. Obesity is a growing public health issue in the region, with lifestyle-related weight gain affecting both adults and adolescents. According to the Pan American Health Organization, in Argentina in 2022, the prevalence of overweight and obesity among people aged 15 and older was 68.4%. Governments are pushing educational campaigns on nutrition, and consumers are actively seeking non-pharmaceutical ways to manage weight.

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033. Men in the region are increasingly becoming aware of age-related hormonal decline, such as testosterone, and its impact on energy, mood, and sexual health. This has spurred demand for nutraceuticals that support testosterone balance, libido, and stamina. Men are now more willing to invest in supplements that address stress, sleep, energy, and aging proactively. This shift is driven by digital health content and growing acceptance of self-care among men, expanding the market for general and targeted men’s health nutraceuticals.

Distribution Channel Insights

The offline distribution segment dominated the CSA nutraceuticals market in 2024. Pharmacies remain a dominant retail channel in CSA, with trusted national chains such as Drogasil offering a wide range of supplements. These outlets provide easy physical access, medical guidance, and immediate product availability appealing to older adults and conservative buyers. Retail chains are devoting increasing shelf space to functional foods and nutraceuticals. This growth is addressed to healthy consumers who want to browse through a product in store and enjoy instant satisfaction. Additionally, the growing integration of pharmacy spaces within supermarkets is expected to contribute to the growth of segment owing to greater accessibility and regulatory compliance for OTC medications and nutraceutical products across CSA's expanding health and wellness market.

The online segment is anticipated to experience the fastest CAGR of 10.1% from 2025 to 2033. Increased use of smartphones and better access to the internet, particularly in Brazil, Argentina, and Colombia, have increased online buying of health products. This improved internet access allows shoppers to easily compare brands, check reviews, and buy nutraceuticals via web pages and mobile applications. This ease has seen an increasing trend in sales via the internet, particularly among younger and technologically oriented consumers.

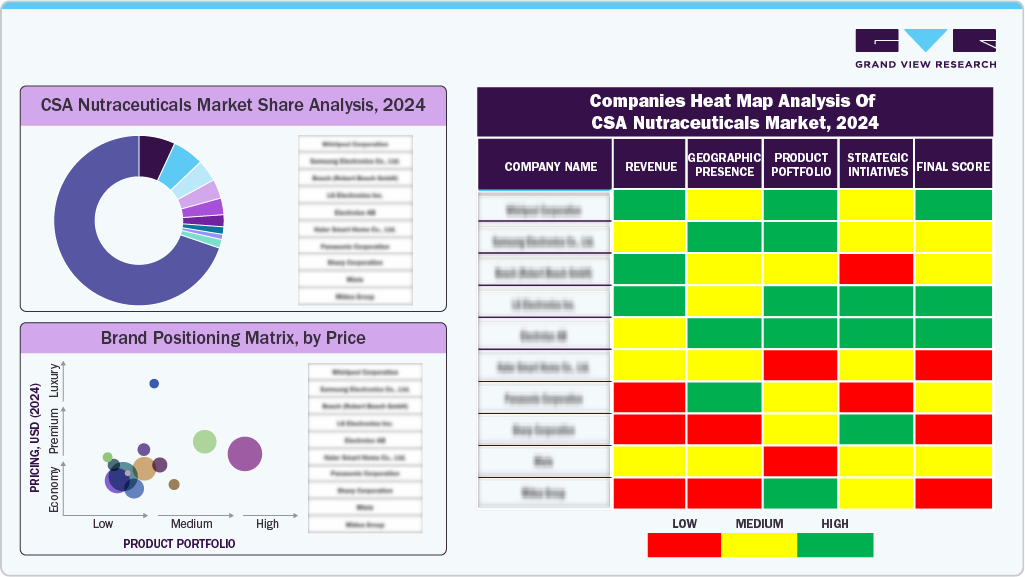

Key Companies & Market Share Insights

Some of the key players in the CSA nutraceuticals market include Amway Corp., Herbalife Nutrition Ltd., Abbott Laboratories, Nestle S.A., and others.

Key CSA Nutraceuticals Companies:

- Amway Corp.

- BASF SE

- Bayer AG

- Glanbia Public Limited Company

- GSK plc

- Herbalife International of America, Inc.

- Nestle Health Science S.A.

Recent Developments

- In January 2024, Sabinsa’s Curcumin C3 Reduct was approved by Brazil’s health agency, ANVISA, for inclusion on its IN28 list. This regulatory approval enabled the ingredient’s commercialization in foods and supplements across Brazil following the submission of safety and efficacy data.

CSA Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.69 billion

Revenue forecast in 2033

USD 62.17 billion

Growth rate

CAGR of 8.4% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Countries covered

Brazil, Argentina

Key companies profiled

Amway Corp., BASF SE, Bayer AG, Glanbia Public Limited Company, GSK plc, Herbalife International of America, Inc., Nestlé Health Science S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

CSA Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the CSA nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino AcidsFibers & Specialty Carbohydrates

- Collagen

- Others

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy-based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.