- Home

- »

- Distribution & Utilities

- »

-

Current Transformer Market Size, Industry Report, 2030GVR Report cover

![Current Transformer Market Size, Share & Trends Report]()

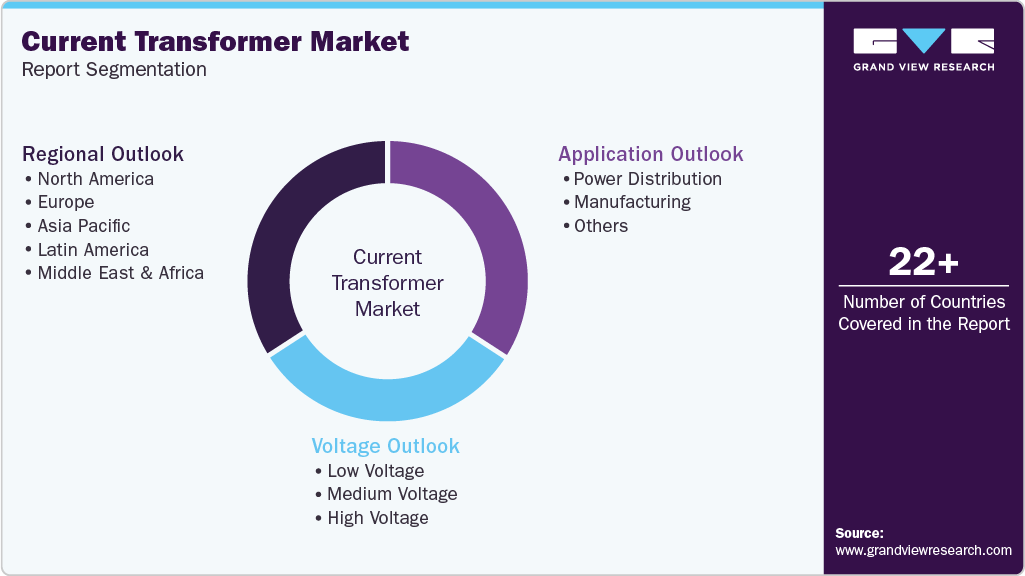

Current Transformer Market (2025 - 2030) Size, Share & Trends Analysis Report By Voltage (Low Voltage, Medium Voltage, High Voltage), By Application (Power Distribution, Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-611-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Current Transformer Market Summary

The global current transformer market size was estimated at USD 2.63 billion in 2024 and is projected reach USD 3.90 billion by 2030, growing at a CAGR of 6.82% from 2025 to 2030. The industry is witnessing steady growth due to rising demand for efficient energy monitoring and control across the utility, industrial, and commercial sectors.

Key Market Trends & Insights

- The current transformer market in Asia Pacific dominated the global industry with a share of 38.89% in 2024.

- The current transformer market in the U.S. is benefiting from a surge in substation automation, electric vehicle (EV) infrastructure development.

- By voltage, medium voltage held the largest market share of over 50.0% in 2024.

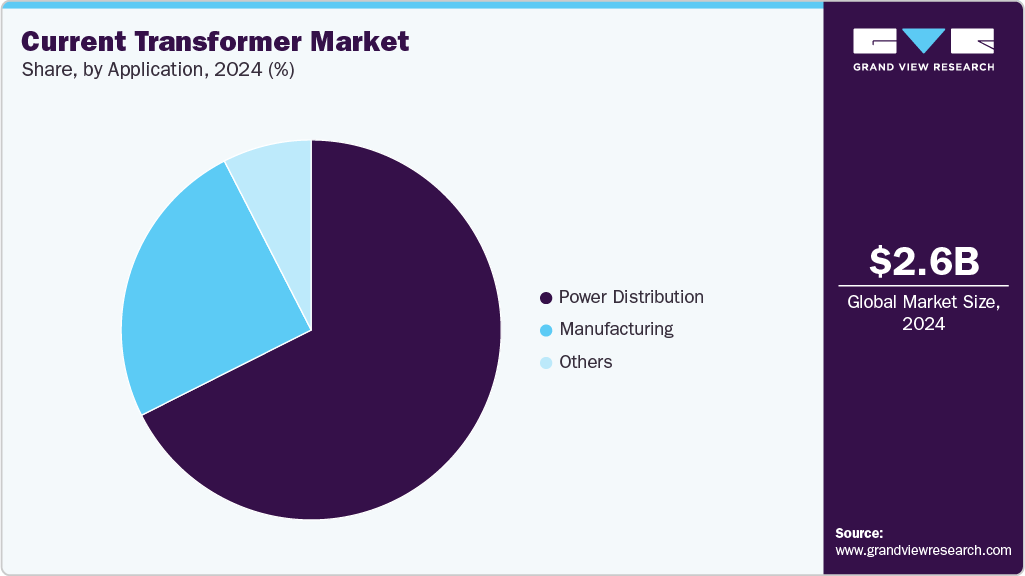

- By application, power distribution segment held the largest market share of 67.59% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.63 Billion

- 2030 Projected Market Size: USD 3.90 Billion

- CAGR (2025-2030): 6.82%

- Asia Pacific: Largest market in 2024

- Latin America: Fastest growing market

With the ongoing modernization of electrical grids and the growing focus on grid stability, current transformers are becoming critical components in energy distribution and protection systems. Moreover, increasing investment in power infrastructure, especially in emerging economies, along with advancements in smart metering and substation automation, accelerates market adoption globally.Technological advancements in materials science, digital monitoring, and smart grid integration reshape the market. Innovations such as incorporating IoT-enabled sensors and digital signal processing enable real-time current measurement, fault detection, and predictive maintenance. These features significantly improve the accuracy and reliability of power systems, especially in high-voltage environments. Additionally, the growing emphasis on energy efficiency and grid automation aligns with the broader push toward digital substations and smarter energy infrastructure, increasing the relevance of current transformers in the evolving grid ecosystem.

The utility and industrial sectors are driving demand for advanced current transformer solutions to support load management, system protection, and compliance with stringent safety standards. Adoption is particularly strong in regions like North America, Europe, and Asia Pacific, where expanding grid networks and substation upgrades are underway to meet rising electricity demand. Compact design, improved insulation, and low maintenance requirements enhance their appeal in space-constrained or harsh operating conditions. However, the market still faces challenges, including pricing pressures, the need for skilled installation, and performance limitations in extreme environments. Nevertheless, continuous R&D and growing investment in grid modernization projects are expected to strengthen the market outlook and support long-term growth.

Drivers, Opportunities & Restraints

The demand for improved power system monitoring and protection is a primary driver of the industry. With the global grid infrastructure under strain from rising energy demand, integration of renewables, and climate-induced disruptions, current transformers have become essential in ensuring accurate current measurement, relay coordination, and fault detection. Additionally, regulatory mandates around energy efficiency and safety compliance in industrial and utility sectors are boosting the deployment of high-precision current transformers, particularly in medium- and high-voltage applications.

Opportunities are expanding as digital transformation accelerates in the power sector. Integrating IoT, digital relays, and substation automation technologies creates new avenues for intelligent current transformers that enable real-time diagnostics and predictive maintenance. There is also strong potential in emerging markets and rural electrification initiatives, where expanding transmission and distribution networks require reliable and scalable current measurement solutions. Furthermore, retrofitting aging grid infrastructure with smart current transformers presents a cost-effective alternative to full system overhauls, offering utilities and industries a pathway to modernize without extensive downtime.

However, the market faces several restraints. High manufacturing costs, particularly for precision and high-capacity transformers, challenge broader adoption, especially in cost-sensitive markets. Technical limitations in extreme operating environments-such as temperature sensitivity and magnetic saturation-can impact measurement accuracy and longevity. Additionally, variations in regional standards and a lack of interoperability across different grid systems can complicate deployment and increase system integration costs. Overcoming these hurdles through innovation, standardization, and robust quality assurance will ensure sustained market growth.

Voltage Insights

The medium voltage segment dominated the current transformer industry, accounting for the largest share due to its extensive use across utility substations, industrial facilities, and commercial distribution networks. Medium voltage current transformers, typically rated between 1kV and 72.5kV, are essential for metering, protection, and control in power distribution systems. Their ability to deliver accurate, current readings while ensuring insulation and safety in mid-range applications makes them indispensable in modern power grids. As countries invest in upgrading their electrical infrastructure and integrating distributed energy resources, medium voltage CTs are increasingly deployed to support grid reliability and monitoring functions.

Moreover, the growth of smart grid projects and the expansion of renewable energy installations drive demand for medium voltage transformers with advanced features such as digital output, compact design, and remote monitoring capabilities. These transformers are particularly favored for their cost-effectiveness and ease of installation in new and retrofit projects. As medium voltage networks serve as the backbone for urban power distribution, this segment is expected to maintain its lead, fueled by ongoing electrification efforts and the transition toward more intelligent, automated grid systems.

Application Insights

The power distribution segment led the current transformer industry, driven by CTs' essential role in monitoring and controlling current flow within utility distribution networks. These transformers ensure accurate current measurement, protection relays, and fault detection across low- and medium-voltage distribution systems. As utilities worldwide modernize their grid infrastructure and expand capacity to accommodate rising electricity demand and renewable energy inputs, the need for reliable, current transformers in power distribution continues to grow. Their widespread deployment in substations, feeder lines, and switchgear panels highlights their foundational role in maintaining grid stability and safety.

Meanwhile, the Manufacturing segment is also showing robust growth as industries increasingly rely on current transformers to manage electrical loads, optimize energy usage, and safeguard equipment from overloads or faults. In high-energy-consuming facilities-such as metal processing, chemical, and automotive plants-accurate, current measurement is crucial for maintaining operational efficiency and meeting compliance standards. Adopting smart current transformers with digital communication capabilities further enhances industrial automation and energy management. While Power Distribution remains the dominant application, rising industrial electrification and smart factory initiatives are also steadily boosting demand from the manufacturing sector.

Regional Insights

Asia Pacific Current Transformer Market Trends

The current transformer market in Asia Pacific dominated globally in 2024, and is driven by rapid industrialization, urban expansion, and government-led electrification initiatives. Countries such as China, India, Japan, and South Korea invest heavily in upgrading aging grid systems and deploying renewable energy at scale. This is fueling demand for current transformers in both high-voltage transmission and medium-voltage distribution networks. Smart grid projects and regional rural electrification schemes further contribute to market expansion. Additionally, the rising adoption of advanced metering infrastructure (AMI) and automated substations is boosting demand for high-accuracy CTs across utilities and heavy industries.

North America Current Transformer Market Trends

The current transformer market in North America is witnessing stable growth, driven by ongoing grid modernization efforts, the integration of renewable energy, and the demand for advanced monitoring and protection solutions. Utility companies across the U.S. and Canada are increasingly investing in smart grid infrastructure, which necessitates precise current measurement devices to enhance reliability and safety. The growing focus on decarbonization and distributed energy resources has also spurred demand for current transformers in renewable power projects. Additionally, government initiatives to replace aging infrastructure and enforce compliance with updated grid codes are expected to contribute to sustained demand across transmission and distribution networks.

U.S. Current Transformer Market Trends

The current transformer market in the U.S. is benefiting from a surge in substation automation, electric vehicle (EV) infrastructure development, and the digitization of power systems. Technological advancements enable the adoption of digital current transformers with enhanced accuracy, communication capabilities, and compact designs. These features are particularly valuable for real-time monitoring and predictive maintenance applications in utility, industrial, and commercial settings. With an increasing emphasis on grid resilience and energy efficiency, the U.S. market is poised for continued innovation and growth.

Europe Current Transformer Market Trends

The current transformer market in Europe is growing steadily as the region transitions toward sustainable and decentralized energy systems. Initiatives under the EU's Clean Energy for All Europeans Package and various national decarbonization strategies are pushing utilities and industrial players to modernize grid assets. Current transformers are widely adopted in renewable energy installations, energy storage systems, and electric mobility infrastructure. Markets in Germany, the UK, France, and Nordic countries are particularly active, with a strong focus on digitalization, grid stability, and cybersecurity integration-driving demand for next-generation CTs equipped with smart monitoring features.

Latin America Current Transformer Market Trends

The current transformer market in Latin America is gaining traction, supported by efforts to strengthen grid infrastructure, reduce transmission losses, and integrate renewable energy sources. Countries like Brazil, Mexico, and Chile are witnessing infrastructure upgrades in their energy sectors, where current transformers play a pivotal role in metering, fault detection, and load balancing. Government programs to expand electricity access in underserved and rural areas also contribute to market growth. Furthermore, growing investment in solar and wind energy is boosting the need for protection-grade and metering-grade current transformers in new grid-connected installations.

Middle East & Africa Current Transformer Market

The current transformer market in the Middle East and Africa is developing steadily as countries aim to diversify energy portfolios and enhance grid reliability. Investments in renewable energy projects, particularly solar and wind, are expanding the role of current transformers in regional power systems. Nations like Saudi Arabia and the United Arab Emirates are leading energy infrastructure projects aligned with their Vision 2030 and Energy Strategy 2050 programs. Meanwhile, in Africa, efforts to improve electrification rates in rural and remote areas are prompting the deployment of compact and cost-effective current transformers. These developments, alongside rising demand for industrial automation, are expected to spur continued growth across the region.

Key Current Transformer Companies Insights

Key players operating in the current transformer market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Current Transformer Companies:

The following are the leading companies in the current transformer market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Amran Inc

- ARTECHE

- CG Power & Industrial Solutions Ltd.

- Circutor

- Eaton Corporation

- General Electric

- Hammond Manufacturing Ltd.

- Hitachi Energy Ltd.

- Instrument Transformers LTD.

- Littelfuse, Inc.

- NISSIN ELECTRIC Co., Ltd.

- RECO Transformers Pvt. Ltd.

- Schneider Electric

- Siemens Energy

Recent Developments

-

In February 2024, Siemens Energy announced the launch of a next-generation current transformer designed for enhanced accuracy and durability in high-voltage applications, aiming to improve grid monitoring and reliability across North America and Europe.

-

In March 2024, Hitachi Energy Ltd. secured a major contract to supply advanced current transformers for a large-scale smart grid project in Asia Pacific, supporting the region’s growing demand for reliable energy measurement and grid safety solutions.

Current Transformer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.80 billion

Revenue forecast in 2030

USD 3.90 billion

Growth rate

CAGR of 6.82% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Voltage, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; China; India; Japan; South Korea; Brazil; Argentina.

Key companies profiled

ABB; Amran Inc; ARTECHE; CG Power & Industrial Solutions Ltd.; Circutor; Eaton Corporation; General Electric; Hammond Manufacturing Ltd.; Hitachi Energy Ltd.; Instrument Transformers LTD.; Littelfuse, Inc.; NISSIN ELECTRIC Co., Ltd.; RECO Transformers Pvt. Ltd.; Schneider Electric; Siemens Energy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Current Transformer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global current transformer market report on the basis of voltage, application, and region.

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Distribution

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global current transformer market size was estimated at USD 2.63 billion in 2024 and is expected to reach USD 2.80 billion in 2025.

b. The global current transformer market is expected to grow at a compound annual growth rate of 6.82% from 2025 to 2030 to reach USD 3.90 billion by 2030.

b. The Medium Voltage segment dominated the market with a revenue share of over 50% in 2024. This segment's prominence is attributed to its widespread application in power distribution systems and industrial operations, where it provides accurate current measurement and ensures system safety. Its balance of performance, reliability, and affordability makes it the preferred choice for medium-scale electrical infrastructure.

b. Some of the key vendors of the global current transformer market are ABB; Amran Inc; ARTECHE; CG Power & Industrial Solutions Ltd.; Circutor; Eaton Corporation; General Electric; Hammond Manufacturing Ltd.; Hitachi Energy Ltd.; Instrument Transformers LTD.; Littelfuse, Inc.; NISSIN ELECTRIC Co., Ltd.; RECO Transformers Pvt. Ltd.; Schneider Electric; and Siemens Energy.

b. The key factors driving the growth of the global current transformer market include the rising frequency of grid disruptions caused by natural disasters, cyberattacks, and aging electrical infrastructure. These challenges are prompting utilities, industries, and critical facilities to adopt more reliable and secure power solutions. Current transformers play a vital role in monitoring and protecting electrical systems within these setups, ensuring accuracy in metering and system protection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.