- Home

- »

- Biotechnology

- »

-

Custom Antibody Market Size & Share Analysis Report, 2030GVR Report cover

![Custom Antibody Market Size, Share & Trends Report]()

Custom Antibody Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Monoclonal), By Service (Antibody Development), By Source (Mice), By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-030-3

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Custom Antibody Market Summary

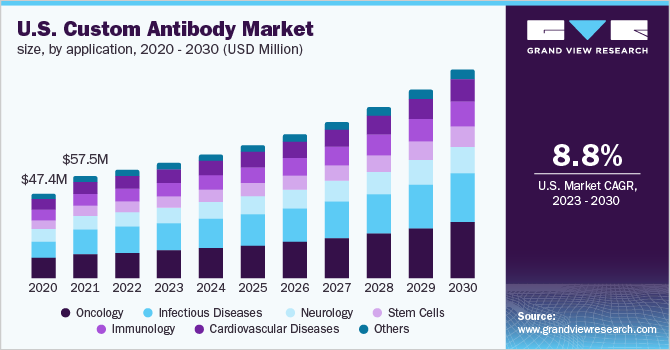

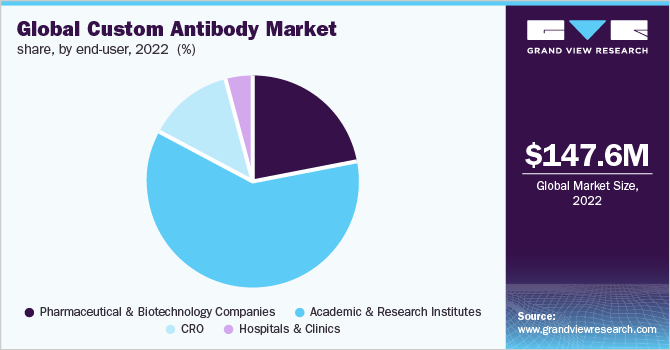

The global custom antibody market size was valued at USD 147.6 million in 2022 and is projected to reach USD 301.7 million by 2030, growing at a compound annual growth rate (CAGR) of 9.7% from 2023 to 2030. Increasing demand for customized diagnostic and therapeutic treatments has encouraged players to invest in product development and expansion strategies.

Key Market Trends & Insights

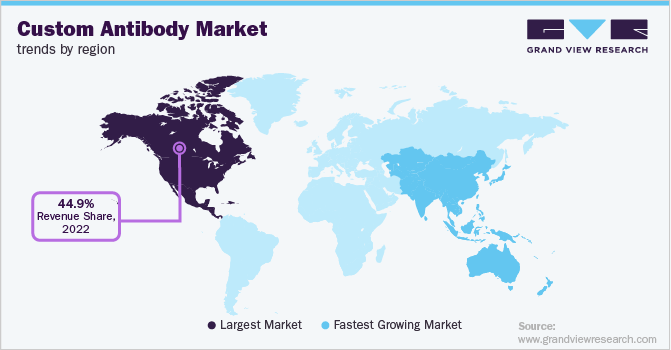

- North America accounted for the largest share of the custom antibodies market in 2022 with 44.9%.

- The market in the Asia Pacific is estimated to grow at the fastest rate during the forecast period.

- Based on type, the monoclonal antibodies segment held the major share of the custom antibodies market in 2022 with 50.6%.

- Based on service, the antibody development segment accounted for the largest market share of 54.2% in 2022.

- Based on application, the infectious disease segment captured the majority of the custom antibodies market share of 27.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 147.6 Million

- 2030 Projected Market Size: USD 301.7 Million

- CAGR (2023-2030): 9.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

For instance, in January 2023, Creative Biolabs introduced a series of services, including therapeutic antibodies, to complement its therapeutic segment. The company is expected to offer comprehensive services of therapeutic antibody development. The market is expected to witness lucrative growth during the forecast period. Technological advancements in the workflow by market players are likely to support end-users with the process of development. For instance, in November 2022, Bio-Rad Laboratories, Inc. launched the antibody discovery service, Pioneer Antibody Discovery Platform, to develop biologic candidates. The platform features a phage display library engineered that can include over 200 billion exclusive sequences and is capable of detecting antibody candidates through the recently developed technology, SpyDisplay. The platform offers therapeutic antibodies candidate according to the tailored client’s requirements. The final antibodies are expected to be delivered functionally characterized with comprehensive sequences and data packages.

The COVID-19 pandemic is estimated to have a positive impact on the demand for custom antibody services by pharmaceutical and biotech companies. Various players incorporated specific services for developing customized COVID-19 antibodies. For instance, ProSci is a service provider of custom COVID-19 antibodies for monoclonal, single-domain, and polyclonal antibody development. The company assists or collaborates with end-users to develop COVID-19 antibodies for vaccine R&D, recombinant single domain, diagnostic assay and detection screening kits, and commercial and research purposes.

However, the cost of producing custom antibodies is relatively high. The initial stages of production are expensive, including synthesizing peptides, genes, antigens, and other components, although the cost of production decreases over time. The average price for providing custom antibody services is approximately USD 899. Monoclonal production can be relatively complicated and expensive, costing around USD 6,000 to USD 15,000. While polyclonal antibodies have a low production cost, ranging around USD 1,000. Hence, increasing the cost of production has resulted in a handful of service providers in the market.

Type Insights

Monoclonal antibodies held the major share of the custom antibodies market in 2022 with 50.6%. This dominant market share is attributed to high R&D investments by prominent market players. In addition, the increasing risk of lifestyle-related chronic diseases is anticipated to drive clinical urgency to incorporate these systems, thus propelling the custom antibodies market over the forecast period. However, custom monoclonal antibodies are relatively expensive, resulting in a higher cost of production for the end-users. Thus, the high production cost is likely to hamper segment growth in the long run.

The recombinant antibodies segment is the fastest-growing sub-segment in the custom antibodies market. It is expected to expand at a CAGR of 11.9% between 2023 and 2030. Players are entering the market through strategic initiatives such as acquisitions and mergers. For instance, in December 2020, LSBio announced the acquisition of Absolute Antibody, Ltd. to expand its product portfolio is recombinant antibodies. Absolute Antibody specializes in recombinant antibody technology and offers custom services for recombinant production, antibody sequencing, and engineering.

Service Insights

Antibody development is the most common form of service and thus accounted for the largest market share of 54.2% in 2022. The service providers include academic and research institutions, in-house research verticals of pharma and biotech companies, and CROs. For instance, an article published in December 2022 stated the research initiated by professionals from the University of Texas Health Science Center on developing antibodies to treat brain injuries and bone cancer. As of December 2022, both antibody therapeutics are under clinical trials. The university also entered into a license agreement with AlaMab Therapeutics Inc., which is worth multimillion dollars. The agreement includes custom antibodies developed by researchers from the university. Hence, increasing collaboration between companies and universities for developing antibodies is expected to boost the market growth.

Similarly, in October 2022, Kemp Proteins announced receiving a contract from the U.S. FDA to develop monoclonal antibodies to influenza and COVID-19 molecules. The U.S. FDA lab is expected to use antibodies in the development of in-vitro assays for the potency release of influenza and COVID-19 vaccines.

Source Insights

The rabbit source gained the largest market share of custom antibodies with 48.5% in 2022. Rabbit is a common source of a host in the production of antibodies, and is ideal for protein and peptide antigens research. Companies are advancing technology to support the growth of rabbit-based antibody discoveries. For instance, GenScript’s MonoRab is one of the technologies in the market for developing custom monoclonal antibodies and can produce them in considerable quantities.

Mice are projected to witness the fastest growth during the forecast period. This growth is attributed to rising innovations by the suppliers to ease the process of R&D for end-users. For instance, in October 2022, Taconic Biosciences announced the launch of an immunodeficient mouse model, the FcResolv NOG portfolio, which lacks murine Fc gamma receptors. According to the company, this model is expected to support antibody-based therapies during the preclinical stage, since the product allows researchers to assess candidates without the interference of residual murine Fc gamma receptor activity.

Application Insights

The infectious disease segment captured the majority of the custom antibodies market share of 27.3% in 2022 and is expected to maintain its dominance throughout the forecast period. For instance, The Native Antigen Company is a developer and manufacturer of antibodies and antigens along with a service provider to the biopharma and diagnostic sectors. In December 2022, the company announced to expand its antibodies and antigen portfolio in the infectious diseases segment and design the product to support vaccines and immunoassay development. Increasing expansion of product portfolios by companies is anticipated to surge the market growth.

Oncology is expected to be the fastest-growing application in the market. The increasing incidence rate of cancer and innovation in personalized treatment are expected to be key growth determinants for the oncology application in the custom antibodies market.

End-user Insights

The academic & research institutes segment held the largest market share in 2022 and is likely to maintain its dominance with the fastest CAGR at 10.8%. The increasing grant programs by companies and regulatory bodies to encourage research in custom antibodies is anticipated to a be significant growth factor for the market. The key sponsors for the research and development of custom antibodies include regional governments, venture capitalists, and companies.

For instance, in May 2021, a UK-based startup in biotech, Antiverse, announced to raise a USD 1.72 million (GBP 1.4 million) fund through venture capitalists. The fund is expected to be used in developing an AI-based antibody discovery technology to enhance antibody-based drug development by accurately projecting antigen-antibody binding. The development of supplement technologies and increased funding is expected to boost the overall market.

Regional Insights

North America accounted for the largest share of the custom antibodies market in 2022 with 44.9%, owing to the presence of major companies, extensive government funding, and an increase in research activities in the region. In addition, large-scale cancer & genomics research programs are conducted by universities in the U.S. and Canada. These have accelerated the progress in the biotechnology sector, thereby increasing the demand for high-throughput technology solutions in laboratory workflows. North America is expected to maintain its market dominance over the forecast period owing to the rapid adoption of advanced technological solutions, high investments in R&D, and rising wages of skilled personnel.

The markets in the Asia Pacific are estimated to grow at the fastest rate during the forecast period, which can be attributed to the increasing interest of key global players in capturing regional revenue share by expanding into emerging markets. Global investors are increasingly investing in China and India due to economic developments. Similarly, regional players are strengthening their presence in the global custom antibodies market.

Key Companies & Market Share Insights

The continuous demand for custom antibodies by multiple end-users has created numerous market opportunities for major players to capitalize on. Companies are indulging in strategic initiatives such as collaborations and acquisitions to maximize their market share. For instance, in January 2023, Adimab, a company involved in the discovery and optimization of monoclonal and bispecific antibodies, announced entering into partnerships with around 11 companies in 2022. As of January 2023, the company has collaborated with more than 105 companies for discovering therapeutics. Some of the key players in the global custom antibody market include:

-

Thermo Fisher Scientific Inc.

-

Creative Diagnostics

-

Abcam plc

-

Bio-Rad Laboratories, Inc

-

Kaneka Eurogentec S.A.

-

YenZym Antibodies, LLC.

-

Abmart

-

Labcorp Drug Development

-

LifeSpan BioSciences, Inc

-

GenScript

Custom Antibody Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 158.0 million

Revenue forecast in 2030

USD 301.7 million

Growth rate

CAGR of 9.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, source, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Creative Diagnostics; Abcam plc; Bio-Rad Laboratories, Inc; Kaneka Eurogentec S.A.; YenZym Antibodies, LLC.; Abmart; Labcorp Drug Development; LifeSpan BioSciences, Inc; GenScript

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Custom Antibody Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global custom antibody market report based on type, service, source, application, end-user, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies

-

Polyclonal Antibodies

-

Recombinant Antibodies

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibody Development

-

Antibody Production & Purification

-

Antibody Fragmentation & Labeling

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Mice

-

Rabbit

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Infectious Diseases

-

Neurology

-

Stem cells

-

Immunology

-

Cardiovascular Diseases

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

CRO

-

Hospitals And Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global custom antibody market size was estimated at USD 147.6 million in 2022 and is expected to reach USD 158.0 million in 2023.

b. The global custom antibody market is expected to grow at a compound annual growth rate of 9.7% from 2023 to 2030 to reach USD 301.7 million by 2030.

b. North America dominated the custom antibody market with a share of 44.91% in 2022. This is attributable to large number of manufacturing base within the region

b. Some key players operating in the custom antibody market include Thermo Fisher Scientific Inc.; Creative Diagnostics; Abcam plc; Bio-Rad Laboratories, Inc; Kaneka Eurogentec S.A.; YenZym Antibodies, LLC.; Abmart; Labcorp Drug Development; LifeSpan BioSciences, Inc; and GenScript

b. Key factors that are driving the custom antibody market growth include increasing demand for personalized medicine along with an increasing number of collaborations and partnerships for the development of custom antibodies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.