- Home

- »

- Homecare & Decor

- »

-

Cut Flowers Market Size And Share, Industry Report, 2030GVR Report cover

![Cut Flowers Market Size, Share & Trends Report]()

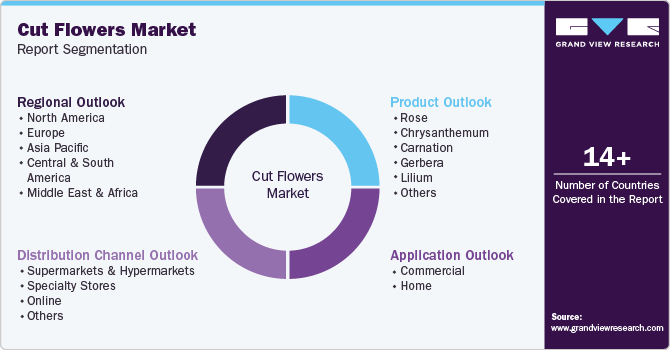

Cut Flowers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Rose, Chrysanthemum, Carnation, Gerbera, Lilium), By Application (Commercial, Home), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-232-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cut Flowers Market Summary

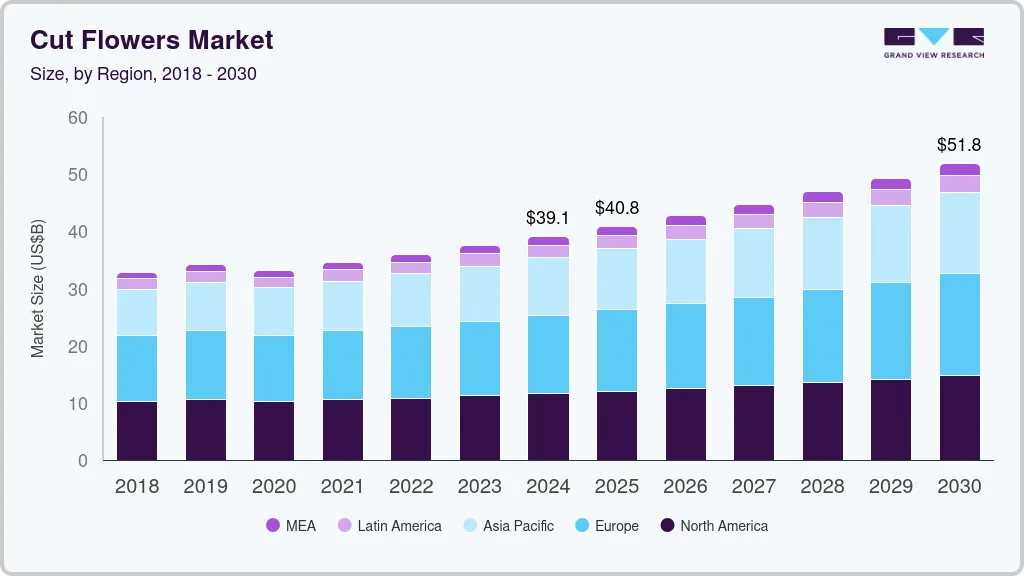

The global cut flowers market size was estimated at USD 39.08 billion in 2024 and is projected to reach USD 51.83 billion by 2030, growing at a CAGR of 4.9% from 2025 to 2030. The cut flower market is poised for sustained growth driven by increasing demand for fresh blooms across various occasions and events.

Key Market Trends & Insights

- The cut flowers market in North America held a share of 29.73% of the global revenue in 2024.

- The cut flowers market in the U.S. is projected to grow at a CAGR of 3.9% from 2025 to 2030.

- By Product, The rose cut flowers accounted for a revenue share of around 32.57% in 2024.

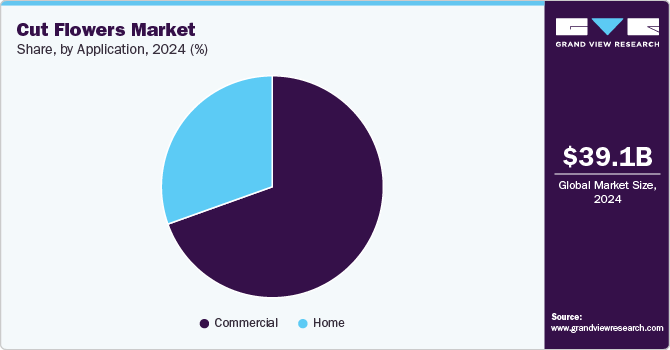

- By Application, Cut flowers for commercial applications accounted for a revenue share of around 69.54% in 2024.

- By Distribution Channel, Supermarkets and hyper market driven sales accounted for around 43.54% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 39.08 Billion

- 2030 Projected Market Size: USD 51.83 Billion

- CAGR (2025-2030): 4.9%

- North America: Largest market in 2024

Factors such as evolving consumer preferences, growing popularity of floral gifts, and rising disposable incomes fuel market expansion. Moreover, adopting sustainable practices and the emergence of online flower delivery services are expected to positively impact market dynamics. The key players in the cut flower market include the European countries and the U.S. as major buyers, while the Netherlands, Ecuador, Colombia, Kenya, and Ethiopia stand out as leading growers and exporters. Among the most sought-after blooms are roses, carnations, and chrysanthemums.

In the UK cut flower market, approximately 80% of cut flowers are sourced from the Netherlands, with Kenya emerging as a notable supplier. Kenyan flowers, particularly roses, hold a significant share in the European market, highlighting the country's pivotal role in global flower trade. The cut flower industry in Kenya contributes substantially to the country's GDP and employment, underscoring its economic significance.

Innovations in breeding, logistics, and cultivation methods are expected to drive market growth. Adopting automation, artificial intelligence, and biotechnology to enhance productivity and sustainability is particularly noteworthy. These advancements have facilitated the production of high-quality flowers, even in urban areas, bringing fresh blooms closer to consumers and revolutionizing the floriculture industry.

To thrive in this evolving landscape, cut flower players remain agile and have started to embrace technological advancements to ensure a robust and sustainable future. By leveraging technology and adapting to changing trends, manufacturers capitalize on emerging opportunities and meet evolving consumer demands while contributing to environmental conservation and resource efficiency.

Consumer Survey & Insights

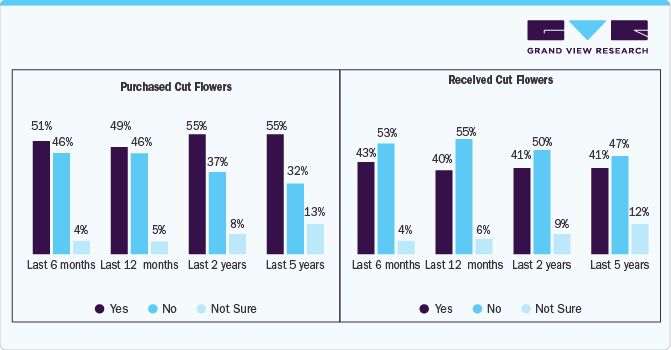

Toluna, Inc., conducted a survey of 8502 consumers, during which participants were asked various cut flower usage and purchasing questions. The percentage of participants who received cut flowers was smaller across each of the periods. 43% of participants received cut flowers during the last 6 months, and 40% to 41% received cut flowers between 12 months and 5 years. Surprisingly, 20% of survey participants did not purchase flowers at any point within the last 5 years, and 32% had not received flowers.

According to American Floral Endowment & the Floral Marketing Research FundYue the high prices of cut flowers were a major barrier for many consumers, especially Millennials, who were associated with not purchasing cut flowers. The main reasons for which participants purchased cut flowers were Mother’s Day (51%), Valentine’s Day (44%), birthday (44%), and for your home (43%).

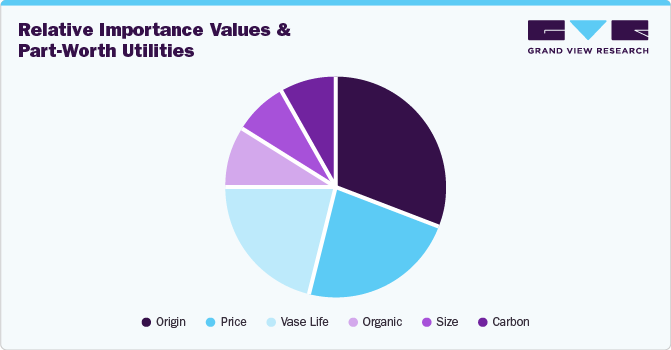

Panelists from the online panel database of Toluna Inc. (Dallas, TX, USA) were sent a link to the survey. Toluna Inc. has a panel database of millions of consumers. A total of 2776 respondents completed the study, and it was observed that rose origin had the highest relative importance value (31%), followed by price (23%) and vase life (21%).

Produced organically, carbon footprint and bloom size were less important, with less than 10% relative importance each. It does not mean that organic, carbon footprint, and bloom size are unimportant. They could play an important role in several Vase from origins with similar part-worth utilities, the same price, and/or identical vase life.

Trump Tariff Impact On The Market

The Trump administration's tariff policy has significantly affected the global cut flower market, particularly affecting major exporters like Colombia and Ecuador. Under the new policy, a current 10% tariff is applied across all flower-producing countries. However, Ecuador faces a compounded effective rate of 16.8%, due to an existing 6.8% tariff, making it less competitive compared to countries like Colombia, which enjoys a duty-free relationship with the U.S. This tariff hike has raised concerns among Ecuador's flower producers, but Eduardo Letort, president of Expoflores, remains optimistic, noting that talks with the U.S. administration are ongoing to address these challenges.

Colombia supplies 65-70% of the flowers in the U.S. and 80% of supermarket bouquets, so the tariff could disrupt the floral sector. Augusto Solano of Asocolflores has highlighted the potential for increased retail prices or reduced revenue for the industry. The seasonal nature of the flower business, particularly around high-demand periods like Mother's Day, could exacerbate cash flow difficulties, as companies may need to pay millions in tariffs upfront while waiting for customer payments.

Globally, the imposition of these tariffs could lead to higher flower prices, potentially reducing consumer demand in the U.S. Additionally, the disruption in the supply chain could cause delays and complications in fulfilling floral orders during peak seasons. Colombia and Ecuador's flower industries face considerable hurdles in maintaining market stability under the new tariff structure, with financial pressures growing as businesses navigate these tariffs.

Product Insights

The rose cut flowers accounted for a revenue share of around 32.57% in 2024. The rose has established itself as an enduring symbol of romance and passion with roots in ancient times. Its association with love, passion, and longing transcends cultural and religious boundaries, making it a universally cherished flower.

Lilium cut flower sales are projected to grow at a CAGR of 6.4% over the forecast period of 2025 - 2030. Lilies, renowned for their versatility and popularity, are among the most sought-after flowers globally. They are available in a range of colors and celebrated for their captivating fragrance.

In 2021, Japan demonstrated prominence in the cut flower market with a significant production area dedicated to lilies, spanning 659 hectares and yielding 114.8 million stems. Japanese and Chinese consumers embrace cut lilies for home decoration and gifting purposes, while recognizing the culinary value of certain lily species, such as Lilium leichtlinii, lancifolium, auratum, and speciosum.

Application Insights

Cut flowers for commercial applications accounted for a revenue share of around 69.54% in 2024. A study at Rutgers University revealed that flowers play a significant role in fostering emotional connections among individuals, whether friends or family. This is attributed to the mood-enhancing properties inherent in flowers, which subconsciously evoke feelings of sharing and camaraderie, particularly in social settings such as dining in restaurants.

Cut flowers for home applications are projected to grow at a CAGR of 5.4% over the forecast period of 2025 - 2030. The presence of freshly cut flowers in residential spaces has positively impacted mood and comfort levels. Beyond aesthetics, displaying newly cut flowers contributes to air purification and generating positive ions, enhancing one's emotional state and cognitive function. These flowers' vibrant colors and fragrant aromas further contribute to uplifting moods and creating pleasant atmospheres.

Distribution Channel Insights

Supermarkets and hyper market driven sales accounted for around 43.54% in 2024. According to the National Agricultural Statistics Service (NASS) report of 2022, Americans collectively purchase approximately 10 million cut flowers daily, contributing to a robust floriculture market valued at USD 6.43 billion across all retail channels, including supermarkets & hypermarkets, where it is convenient to purchase all types of flowers under one roof.

Online sales are projected to grow at a CAGR of 6.7% over the forecast period. The rise of online flower shopping reflects shifting consumer preferences towards convenient digital transactions. The primary advantage of purchasing flowers online is its convenience, enabling customers to browse a diverse selection of floral offerings from the comfort of their homes. This eliminates the need for physical store visits and facilitates easy comparing prices and styles across multiple vendors.

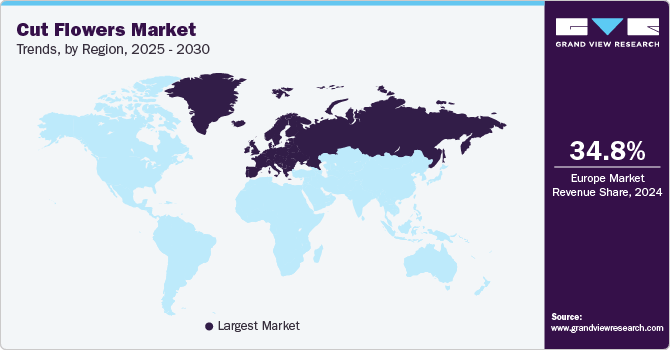

Regional Insights

The cut flowers market in North America held a share of 29.73% of the global revenue in 2024. The growing appreciation for floral arrangements and cut flowers as decorative elements in homes, events, and workplaces. As consumers seek to enhance their surroundings and express emotions through floral displays, the demand for cut flowers increases.

U.S. Cut Flowers Market Trends

The cut flowers market in the U.S. is projected to grow at a CAGR of 3.9% from 2025 to 2030. According to a consumer study conducted by researchers from the University of Georgia in February 2022, which surveyed over 8,000 consumers across the U.S., boomers have identified the rose as their flower of choice, particularly for occasions like Valentine's Day.

Europe Cut Flowers Market Trends

The Europe cut flowers market had a revenue share of around 34.82% in 2024. According to the Centre for the Promotion of Imports from Developing Countries, the European Union is the largest consumer of cut flowers globally, accounting for more than half of the world's consumption. This market comprises nations with notably high per capita utilization of cut flowers. Leading the export market is the Netherlands, boasting a well-established industry and robust infrastructure for flower cultivation, distribution, and sales.

Asia Pacific Cut Flowers Market Trends

The Asia Pacific cut flowers market is projected to grow at a CAGR of 5.9% from 2025 to 2030. The significant scale and success of China's cut flower industry play a pivotal role in driving market growth. This highlights the market’s substantial contribution to the country's economy, with over 1.8 million hectares of land dedicated to flower production, resulting in an impressive revenue of USD 8.48 billion. These statistics depict the critical importance of the cut flower industry in China and its considerable potential for further expansion and development across Asia Pacific.

Key Cut Flowers Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. These major players leverage extensive global distribution networks to reach diverse customer bases and tap into emerging markets.

Key Cut Flowers Companies:

The following are the leading companies in the cut flowers market. These companies collectively hold the largest market share and dictate industry trends.

- The Queen’s Flowers Corp

- Selecta Cut Flowers SAU

- Sher Holland BV

- Multiflora Corp

- Rosebud Ltd

- Karen Roses Ltd

- Washington Bulb Co Inc

- Dummen Orange Holding BV

- Esmeralda Farms LLC

- Marginpar BV

Recent Developments

-

In October 2024, Chrysal a Netherland based flower care company has developed the Chrysal Transport Stickers designed to preserve the quality of cut flowers during transit.

-

In February 2023, Floriday introduced 'trade settings,' a feature designed to streamline the trading process between growers and buyers. This innovation simplifies trading operations for both parties, enhancing efficiency and convenience.

Cut Flowers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.83 billion

Revenue forecast in 2030

USD 51.83 billion

Growth Rate

CAGR of 4.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

The Queen’s Flowers Corp; Selecta Cut Flowers SAU; Sher Holland BV; Multiflora Corp; Rosebud Ltd; Karen Roses Ltd; Washington Bulb Co Inc; Dummen Orange Holding BV; Esmeralda Farms LLC; Marginpar BV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cut Flowers Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the cut flowers market on the basis of product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Rose

-

Chrysanthemum

-

Carnation

-

Gerbera

-

Lilium

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Commercial

-

Home

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cut flowers market was estimated at USD 39.08 billion in 2024 and is expected to reach USD 40.84 billion in 2025.

b. The global cut flowers market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 51.83 billion by 2030.

b. Europe dominated the cut flowers market with a share of around 34.82% in 2024. The market in the region is dominating owing to the presence of nations with notably high per capita utilization of cut flowers.

b. Some of the key players operating in the cut flowers market include The Queen’s Flowers Corp; Selecta Cut Flowers SAU; Sher Holland BV; Multiflora Corp; Rosebud Ltd; Karen Roses Ltd; Washington Bulb Co Inc; Dummen Orange Holding BV; Esmeralda Farms LLC; Marginpar BV

b. Key factors that are driving the cut flowers market growth include increasing demand for fresh blooms across various occasions and events, growing popularity of floral gifts, and rising disposable incomes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.