- Home

- »

- Network Security

- »

-

Cyber Insurance Market Size & Share, Industry Report, 2025GVR Report cover

![Cyber Insurance Market Size, Share & Trends Report]()

Cyber Insurance Market (2019 - 2025 ) Size, Share & Trends Analysis Report By Organization (SMB, Large Enterprise), By Application (BFS, Healthcare, IT & Telecom), And Segment Forecasts

- Report ID: GVR-2-68038-952-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industry Insights

The global cyber insurance market size was valued at USD 4.3 billion in 2018 and is expected to register a CAGR of 25.6% over the forecast period. Growing digitalization within businesses and economies has created several challenges related to management of digital security and privacy. Management of internet and online risks has become one of the topmost priorities for businesses owing to rapidly increasing incidences of cybercrimes, digital frauds, threats, and data breaches. Despite implementing robust cybersecurity solutions for curbing and mitigating cyberattacks, losses incurred due to security breaches continue to be significant, thereby impacting the profit margins of organizations.

As per the European Network and Information Security Agency (ENISA) Threat Landscape Report 2018, the average total cost of a data breach amounted to USD 3.86 million, an increase of 6.4% from 2017. With rising threats such as information leakage, identity theft, and ransomware, monetary losses are anticipated to grow at a steady rate. Thus, eliminating cyber risk and its potential impacts continues to be a necessity for businesses. Risk transfer has emerged as a suitable alternative to a robust cyber security stance in the current threat landscape.

Insurance plays a pivotal role in assisting businesses and consumers to manage cyber risks. It also offers financial protection to policyholders against attacks that cannot be completely mitigated. Cyber insurance solutions protect a company from internet-based risks and provide policies that include first-party coverage from losses incurred due to extortion, data destruction, hacking, theft, and denial-of-service attacks. Moreover, they offer liability coverage, enabling organizations to cover losses incurred due to omission and errors, defamation, and failure to safeguard data, in addition to security audits and post-incident investigating expenses.

For instance, as of 2016, Target Corporation incurred USD 291 million in breach-related costs, which included forensics costs, crisis communication, and legal fees. However, the company received a sum of USD 100 million through cyber insurance from multiple underwriters. Similarly, Home Depot Inc. received a sum of USD 105 million as cyber protection coverage from American International Group Inc.

Cyber insurance has proved to be significantly useful in the event of a large-scale security breach. Insurers in the market require an adequate level of cybersecurity as a precondition for coverage. This is compelling organizations to adopt the necessary online protection and security practices to receive lower premium rates. Insurance providers offer a flexible funding mechanism to recover from significant losses, thus, reducing the need for government assistance.

With an increasing number of cyberattacks, it has become essential to prioritize the threats using a robust risk mitigation strategy. Cyber insurance is expected to help organizations hedge against the potentially devastating effects of cybercrimes. Moreover, companies are adopting cyber insurance to become more resilient to online threats However, cyber as well as general liabilities policies exclude coverage for losses incurred due to cyber warfare. This is expected to hinder the market growth.

Organization Insights

Organizations of all sizes are vulnerable to cyberattacks owing to the proliferation of technology and trends such as Internet of Things (IoT), cloud technologies, machine learning, artificial intelligence, and big data. Advanced technologies have helped businesses to grow and achieve business goals with utmost efficiency. However, due to digitalization and ease of access to broadband Internet, these technologies have also created new vectors of attack.

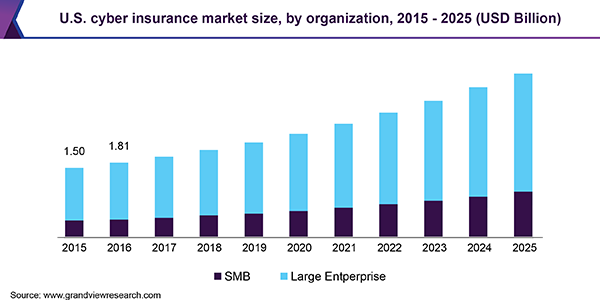

The large enterprise segment dominated the market in 2018 and is projected to continue to dominate over the forecast period. These organizations have a higher spending capacity for implementing robust cybersecurity solutions. Moreover, large organizations are rapidly investing in cyber insurance policies to minimize risks associated with a cyberattack. Furthermore, cyber insurance can potentially contribute to improving computer security risk management in an organization. This is expected to further strengthen the segment’s growth over the forecast period.

Small and medium businesses (SMB) are more vulnerable to cyberattacks as they lack the necessary security infrastructure. They are striving to identify, assess, and respond to emerging threats. Cyber insurance has the potential to economize such businesses by offering first-party and third-party protection coverage. These coverages include loss or damage to digital assets, business interruption, online extortion, and theft of money as well as customer notification costs, computer forensics investigation, multi-media liability, loss of third-party data, and third-party contractual indemnification.

Application Insights

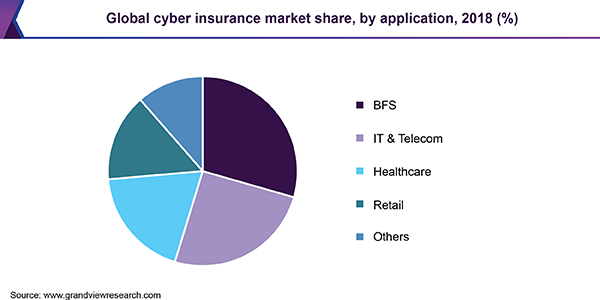

The banking and financial services (BFS) application segment accounted for the dominant share in the cyber insurance market in 2018. It has emerged as a key industry owing to the increasing monetary operations. It is subject to a higher number of cybersecurity incidents such as large-scale breaches, frauds, and heists. The security of banking and financial services is a matter of concern since these services are considered to be the backbone of economies. In response to growing threats and breaches, financial institutions and government agencies are rapidly adopting cyber insurance solutions to economize mounting losses and as a better risk-mitigating strategy for any organization.

The healthcare application segment is anticipated to grow at the highest CAGR over the forecast period. The widespread digitalization in the healthcare sector for facilitating easy access to customers’ data has created vulnerabilities online. The sensitive data is exposed to external and internal threats. The healthcare sector has become a prime target for hackers over the last few years. In awake to the cyberattacks, healthcare organizations are anticipated to opt for cyber insurance as a convenient option to offset some of the losses.

Regional Insights

The North America market accounted for the largest revenue share in 2018. The growth of the region can be attributed to the presence of prominent players such as The Chubb Corporation; American International Group, Inc.; and Lockton Companies, Inc. Furthermore, growing awareness of cyber insurance among SMBs is expected to drive demand over the forecast period.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. Cybercrimes in emerging countries such as India, Australia, and China are increasing. The increasing importance of Asian countries in the global economy has drawn the attention of the government and compelled these emerging economies to enhance their cybersecurity. This has encouraged cyber insurance providers to potentially capitalize on the opportunity by offering policies for risks and underwriting cyber products to strengthen the security strategies of industries.

Cyber Insurance Market Share Insights

The global market is at a nascent stage and is a growing segment of the insurance sector that offers necessary protection to an organization against digital threats. The presence of limited established insurance providers increases the competitiveness of the market. Moreover, the rising need for cybersecurity is anticipated to create a substantial opportunity for insurers to increase cyber insurance uptake and build customer trust.

The players in the market are capitalizing on the evolving online threat landscape and offering necessary solutions to minimize the negative impact of cyberattacks. The key player's cyber insurance industry include AON Plc; American International Group, Inc.; Allianz Group; Berkshire Hathaway; Lockton Companies, Inc.; The Chubb Corporation; Munich Re Group; XL Group Ltd.; and Zurich Insurance Co. Ltd. The prominent market players are developing innovative ways to assess the client’s cyber risk as it would enable them in delivering customized terms and conditions in insurance offerings.

Recent Development

-

In June 2023, Aon plc launched a software, Insurer Pricing Platform. This software enhanced the company's performance by providing better risk solutions and meaningful analytics to insurers.

-

In June 2023, Aon collaborated with Praedicat, a liability emerging risk analytics and modeling company. The collaboration provided a new tool for Aon to advise its clients on the reduction of complex and evolving liability risks.

-

In June 2023, Chubb launched Cyber Central, an innovative quoting platform designed for people specialized in cyber risks. This platform enhances and simplifies the process of quoting and issuing cyber risk by providing leading solutions to the distribution partners in the cyber insurance market.

-

In June 2022, Allianz collaborated with Coalition, a leading cyber insurance and security provider. This collaboration strengthened and expanded Allianz’s cyber business with an innovative approach to cyber risks.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Representation

Revenue in USD Billion and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, U.K., Germany, China, India, Japan, and Brazil

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis on latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global cyber insurance market report on the basis of organization, application, and region.

-

Organization Outlook (Revenue, USD Billion, 2015 - 2025)

-

SMB

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Billion, 2015 - 2025)

-

BFS

-

Healthcare

-

IT & Telecom

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

MEA

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.