- Home

- »

- Network Security

- »

-

Cyber Security Services Market Size, Industry Report, 2030GVR Report cover

![Cyber Security Services Market Size, Share & Trends Report]()

Cyber Security Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Professional Services, Managed Services), By Industry Vertical (BFSI, Healthcare, Defense/Government, IT & Telecom), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-406-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cyber Security Services Market Summary

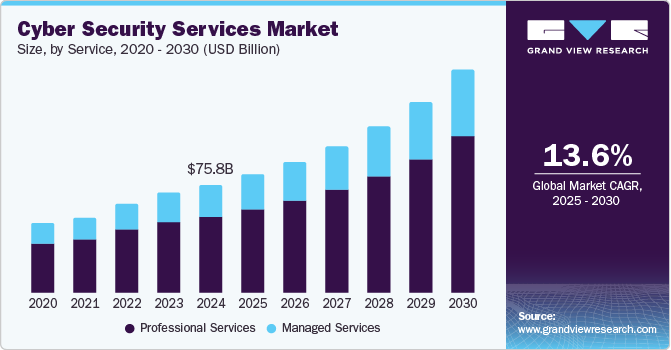

The global cyber security services market size was valued at USD 75.82 billion in 2024 and is projected to reach USD 156.76 billion by 2030, growing at a CAGR of 13.6% from 2025 to 2030. Advances in Artificial Intelligence (AI), Internet of Things (IoT), and Machine Learning (ML) have led to increased adoption of web applications and mobile apps, subsequently creating more complex IT infrastructure that can be vulnerable to cyberattacks.

Key Market Trends & Insights

- The North America accounted for 38.3% of the global cyber security services market in 2024.

- U.S. dominated the regional market in 2024.

- Asia Pacific cyber security services market is anticipated to experience the fastest CAGR over the forecast period.

- Based on service, the professional services segment held the largest revenue share of 70.8% in 2024.

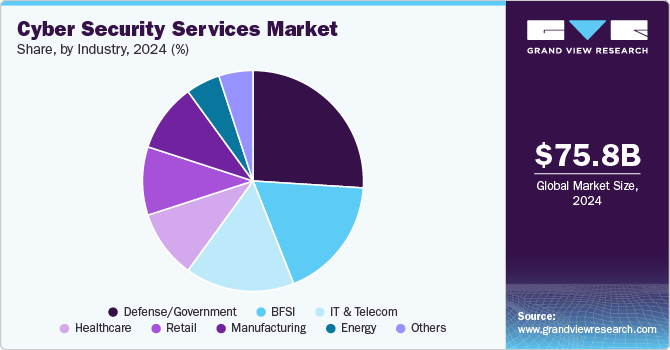

- Based on industry verticals, the defense and government segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 75.82 Billion

- 2030 Projected Market Size: USD 156.76 Billion

- CAGR (2025-2030): 13.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

To address potential security challenges, organizations are outsourcing security services to detect bugs and analyze the security landscape while efficiently responding to cyberattacks. The need to fix bugs in web applications and mobile apps and mitigate data loss risks associated with cybercrimes is expected to fuel the adoption of cyber security services over the forecast period.

Rising awareness among Small- and Medium-sized Enterprises (SMEs) and advancements in Artificial Intelligence (AI)-powered threat detection are helping address the shortage of skilled cyber security professionals and reducing the high costs of comprehensive solutions. The adoption of managed security services, which provide scalable and cost-effective solutions, has increased significantly, particularly among organizations with limited resources. The surge in Internet of Things (IoT) devices and the expansion of 5G networks are creating more vulnerabilities, driving the need for advanced, adaptable security solutions. Companies are increasingly adopting zero-trust security models, which continuously verify access to systems and data. At the same time, AI and Machine Learning (ML) are transforming the field by enabling faster threat detection, predictive analytics, and real-time responses to cyberattacks.

The proliferation of smartphones and the continued rollout of high-speed internet networks have triggered the adoption of mobile banking apps and apps for health monitoring, shopping, and socializing. Mobile banking induces flexibility in banking practices by allowing users to transact irrespective of their location. Customers can also shop using e-commerce apps and make payments using their smartphones. As the number of smartphone users continues to increase, the preference for banking, shopping, making payments, and socializing via mobile apps is also growing. However, all these applications have also emerged as potential targets for hackers; thereby prompting companies to opt for cyber security services to identify loopholes in the applications, plug the loopholes, and subsequently save users from potential losses.

The number of cyberattacks worldwide shows no signs of abating. At the same time, cyberattacks are getting more sophisticated and the losses stemming from cyberattacks are also increasing. While new networks are being rolled out and existing networks are being expanded, these networks are increasingly becoming vulnerable to cyber threats. This is driving the need for monitoring the networks, critical infrastructures, and digital assets of both small and large enterprises and hunting for potential threats continuously.

Moreover, the instances of cybercrimes are rising in line with the proliferation of digital assets and connected devices. Internet-connected devices are particularly vulnerable to cyber threats. Social media interactions are equally vulnerable to cyber threats and can potentially expose individuals to privacy invasion risks. Privacy threats are particularly increasing as intruders remain keen on acquiring the personal information of individuals through unauthorized access. Penetration testing and bug bounty services help in ensuring that applications are free from bugs and IT infrastructure is in line with the existing enterprise cyber landscape.

Service Insights

The cyber security services market is segmented into professional and managed services. In 2024, the professional services segment held the largest revenue share of 70.8%, which can be attributed to the increasing demand for specialized expertise in areas such as risk assessments, penetration testing, and vulnerability management. The rapid adoption of new technologies such as cloud computing and IoT is driving the need for customized security solutions, prompting businesses to seek expert guidance. The need for regulatory compliance and stricter data protection laws in the cyber security services industry also increases demand for services such as audits and privacy assessments. In addition, the shortage of skilled cybersecurity professionals is leading organizations to rely on external providers for ongoing security monitoring, incident response, and managed services. These services help businesses maintain strong security while focusing on their core operations.

The managed services segment is expected to grow at the fastest CAGR during the forecast period from 2025 to 2030. This growth can be attributed to the increasing complexity of cyber threats, the shortage of skilled cyber security professionals, and the growing adoption of cloud computing and remote work. In addition, businesses seek to enhance their security posture without the burden of managing everything in-house, driving the demand for Managed Security Service Providers (MSSPs). Furthermore, MSSPs offer access to expert teams, advanced security tools, and scalable solutions that can adapt to evolving threats and compliance requirements, further fueling the growth of managed services in the coming years.

Industry Verticals Insights

The defense and government segment led the market in 2024. This segment’s vulnerability stems from its management of sensitive data, such as national security information and military strategies, which are frequent targets for cyber criminals. With governments confronting escalating threats to their data stored both on-premises and in the cloud, the demand for sophisticated security systems capable of countering these attacks is also surging.

The persistent shortage of skilled cyber security professionals and limitations in sharing internal vulnerability information has hindered cyber security initiatives within government agencies. As a result, many agencies are prioritizing training their internal IT teams rather than outsourcing to external ethical hackers, reflecting concerns regarding confidentiality and the time-sensitive nature of the information. Crowdsourced bug bounty programs remain a popular strategy for addressing vulnerabilities.

The healthcare segment is expected to witness the fastest CAGR over the forecast period. The rapid adoption of digital technologies in healthcare, such as electronic health records, connected medical devices, and patient management systems, has significantly increased the risk of cyberattacks. In order to mitigate these risks, regulations such as the NIST cyber security framework and ISO/IEC 80001 have been implemented to enforce security standards across healthcare IT systems. Furthermore, forums such as the Healthcare Security Forum (Healthcare Information and Management Systems Society [HIMSS]) are playing a critical role in raising awareness about the security risks of medical devices and the advantages of using bug bounty programs and AI-driven solutions to enhance cyber security. The HIPAA standard 164.308(a)(8) also emphasizes the importance of conducting regular penetration tests to identify vulnerabilities, contributing to the growth of the cyber security services industry in the healthcare sector in 2024.

Regional Insights

The cyber security services market in North America is driven by increasing cyber threats, stringent regulatory requirements, and the widespread adoption of advanced technologies such as cloud computing and IoT. Organizations are rapidly embracing zero-trust security models to mitigate risks associated with expanding attack surfaces. The region's strong IT infrastructure and the presence of major cyber security vendors foster innovation, while AI and ML are being increasingly integrated into security solutions for real-time threat detection.

U.S. Cyber Security Services Market Trends

The U.S. dominated the regional market in 2024, which can be attributed to rising cyber threats, rapid technology adoption, and stringent regulations such as the California Consumer Privacy Act (CCPA). High-profile attacks on critical infrastructure and enterprises have pushed organizations to adopt advanced security solutions, including AI-powered threat detection and zero-trust architecture. The expansion of cloud computing, IoT, and remote work has further increased the need for robust cyber security measures. Government initiatives, such as the Biden Administration’s Executive Order on Improving the Nation’s Cyber security, have boosted investments in infrastructure modernization and enhancing public-private collaborations. The shortage of skilled cyber security professionals has led businesses to rely on MSSPs for expertise and scalable solutions. These factors collectively position the U.S. as a key leader in the global cyber security services industry.

Europe Cyber Security Services Market Trends

The European cyber security services market is expected to experience robust growth in the coming years due to rising awareness of cyber threats, stringent data protection regulations, and rapid digital transformation across industries. The GDPR compliance has been a significant driver, pushing organizations to adopt stricter security measures to avoid penalties. The region is also seeing an increase in the adoption of managed security services while businesses address the shortage of cyber security professionals. In addition, the energy and manufacturing sectors are prioritizing cyber security to safeguard critical infrastructure from cyberattacks. The UK, Germany, and France are leading country-specific growth in Europe. The UK has emerged as a leader due to its strong focus on cyber security innovation and public-private collaborations, such as the National Cyber Security Centre (NCSC). Germany’s industrial base is driving the demand for cyber security services, especially to protect Industrial Control Systems (ICS), while France is focusing on securing public sector networks and critical infrastructure, supported by government investments in cyber security technologies.

Asia Pacific Cyber Security Services Market Trends

Asia Pacific cyber security services market is anticipated to experience the fastest CAGR over the forecast period. This growth is driven by the increasing digitalization of businesses, rising cyberattacks, and government initiatives to strengthen cybersecurity frameworks. The region’s growing reliance on cloud services and IoT has created an urgent need for advanced security solutions. Key industries such as BFSI, healthcare, and manufacturing are driving market demand as they adopt digital technologies while addressing regulatory requirements. The region’s diverse economies and varying levels of cybersecurity maturity present both challenges and opportunities for service providers.

China cyber security services market accounted for the largest revenue share in the region in 2024, which can be attributed to the rapid digitalization and stringent domestic regulations such as the Cybersecurity Law of People’s Republic of China and Data Security Law. These laws enforce strict guidelines for protecting critical infrastructure, industrial systems, and personal data, compelling businesses to invest in advanced cybersecurity measures. The rise in cyberattacks targeting key sectors such as manufacturing, finance, and government services has heightened the urgency for both managed and professional security services tailored to China’s specific needs. The government’s push for technological self-reliance has led to significant investments in homegrown AI-driven cybersecurity tools and secure cloud platforms. Initiatives under the 14th Five-Year Plan and policies spearheaded by the Cyberspace Administration of China (CAC) focus on bolstering digital resilience and safeguarding critical assets. With large-scale projects in IoT, 5G, and smart cities, alongside a growing emphasis on securing state-run enterprises, China is rapidly evolving into a global leader in cybersecurity innovation and adoption.

Key Cyber Security Services Company Insights

Some key companies in the cybersecurity services market are Accenture, AT&T INC., Atos SE, Capgemini, and Cisco Systems, Inc. The market for cyber security services can be described as a fragmented market characterized by the presence of multiple vendors offering various services, such as testing, threat detection, threat hunting, and regulatory monitoring, in the enterprise cyber security landscape. Vendors are aggressively pursuing various strategies, such as strategic partnerships, as part of the efforts to contribute toward safer cyberspace, improve their service capabilities, and extend their user base. For instance, in January 2020, HackerOne partnered with OPPO, a mobile manufacturer. The partnership was aimed at further supporting the “Security Research Community” and reducing cyber risks. In October 2019, By Light Professional IT Services LLC., partnered with FireEye, Inc. to expand its EmberSec portfolio, which comprises managed services, such as Managed Detection and Response (MDR) security incident event management (SIEM), utilizing endpoint detection and response, email threat protection, and network security monitoring.

Competition in the market is intensifying continuously as increasing funding is allowing startups to make a foray into it. New entrants in the market include various smaller technology vendors offering various services. For instance, in August 2020, Cobalt raised USD 29 million in a Series B funding round to make its “penetration testing-as-a-service” platform available to more software vendors.

-

Accenture is a global professional services company specializing in strategy, consulting, technology, and operations. It offers comprehensive cybersecurity solutions, including risk management, threat intelligence, and managed security services. Accenture leverages advanced technologies, such as AI and cloud-native tools, to protect clients across industries from emerging cyber threats. Its extensive global network and collaboration with leading technology providers ensure innovative and scalable cybersecurity solutions tailored to client needs.

-

AT&T INC is a leading telecommunications and technology company offering robust cybersecurity services through its AT&T Cybersecurity division. It provides managed security services, threat detection, and response solutions designed to protect businesses of all sizes. AT&T INC leverages its expertise in networking and connectivity to deliver integrated security solutions, including Secure Access Service Edge (SASE) and cloud-based threat intelligence platforms, ensuring comprehensive protection across hybrid environments.

Key Cyber Security Services Companies:

The following are the leading companies in the cyber security services market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- AT&T INC.

- Atos SE

- Capgemini

- Cisco Systems, Inc

- CrowdStrike Holdings, Inc

- Deloitte Global

- DXC Technology Company

- IBM

- Rapid7

Recent Developments

-

In November 2024, CrowdStrike announced its partnership with Ignition Technology to launch the Falcon cybersecurity platform in Ireland. By integrating Ignition’s market expertise with CrowdStrike’s advanced AI-driven tools, this partnership aims to improve breach prevention and promote a more secure and streamlined cybersecurity framework across Europe.

-

In November 2024, Cisco expanded its partnership with LTIMindtree to enhance cybersecurity for hybrid workforces on a global scale. This collaboration involved the integration of Cisco Secure Access with LTIMindtree’s industry-specific expertise to deliver customized SASE solutions that provide seamless, identity-based protection. The partnership aims to simplify IT operations, improve user experience, and strengthen zero-trust security frameworks for modern workplaces.

-

In August 2024, Rapid7 introduced its Command Platform to enhance threat detection and risk management for organizations. The platform offers a unified view of vulnerabilities and exposures by consolidating critical security data from endpoints, cloud environments, and attack surfaces. With the launch of Exposure Command and Surface Command, businesses can prioritize and address risks more effectively, gaining greater visibility and control. This platform simplifies security operations, improves risk management, and provides organizations with more efficient and comprehensive cybersecurity solutions.

Cyber Security Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 82.79 billion

Revenue forecast in 2030

USD 156.76 billion

Growth rate

CAGR of 13.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, industry verticals, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Accenture; AT&T INC; Atos SE; Capgemini; Cisco Systems, Inc; CrowdStrike Holdings, Inc; Deloitte Global; DXC Technology Company; IBM; Rapid7.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cyber Security Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cybersecurity services market report based on services, industry verticals, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional Services

-

Integration

-

Support and Maintenance

-

Training, Consulting, and Advisory

-

Penetration Testing

-

Bug Bounty

-

Others

-

-

Managed Services

-

Managed Detection Response (MDR)

-

Managed Security Incident and Event Management (SIEM)

-

Compliance and Vulnerability Management

-

Others

-

-

-

Industry Verticals Outlook (Revenue, USD Million; 2018 - 2030)

-

IT & Telecom

-

Retail

-

BFSI

-

Healthcare

-

Defense/Government

-

Energy

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.