- Home

- »

- Automotive & Transportation

- »

-

Cylinder Deactivation System Market Size, Share Report 2030GVR Report cover

![Cylinder Deactivation System Market Size, Share & Trends Report]()

Cylinder Deactivation System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Valve Solenoid, Engine Control Unit), By Actuation Method, By Fuel Type, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-574-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cylinder Deactivation System Market Summary

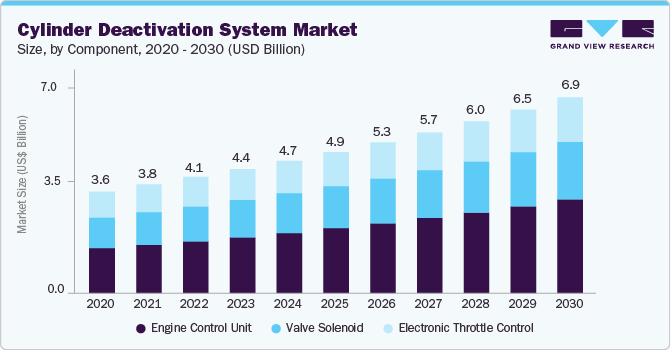

The global cylinder deactivation system market size was estimated at USD 4.68 billion in 2024 and is projected to reach USD 6.93 billion by 2030, growing at a CAGR of 6.8% from 2025 to 2030. Governments worldwide enforce stricter fuel economy standards and emission norms, prompting automakers to adopt technologies that improve efficiency without compromising performance.

Key Market Trends & Insights

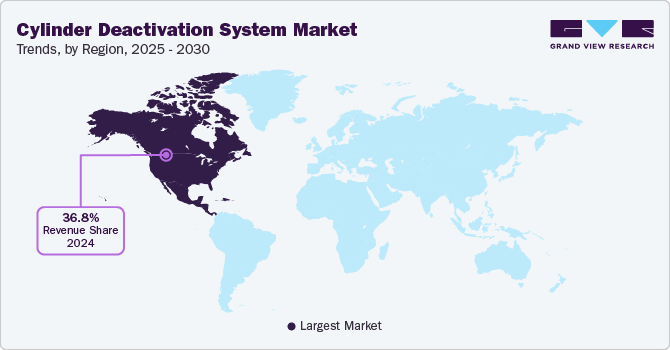

- The North America market accounted for 36.8% share of the overall market in 2024.

- Based on component, the engine control unit segment accounted for the largest share of 45.48% in 2024.

- Based on actuation method, the overhead camshaft design segment accounted for the largest share in 2024.

- Based on fuel type, the gasoline segment held the largest market share in 2024.

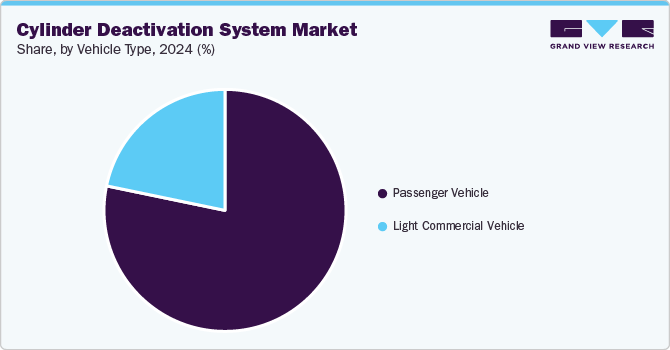

- Based on vehicle type, the passenger vehicles segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.68 Billion

- 2030 Projected Market Size: USD 6.93 Billion

- CAGR (2025-2030): 6.8%

- North America: Largest market in 2024

Cylinder deactivation has emerged as a practical solution, allowing internal combustion engines to temporarily disable some cylinders during low-load driving conditions. This reduces fuel consumption and emissions, especially in city driving.

As corporate average fuel economy (CAFE) targets and Euro emission standards tighten, manufacturers increasingly integrate cylinder deactivation systems into mid- to high-displacement gasoline engines to meet compliance benchmarks. In emerging regions such as Asia Pacific and Latin America, the continued dominance of gasoline-powered vehicles contributes to the growing adoption of cylinder deactivation systems. While electric vehicle (EV) penetration remains limited in price-sensitive markets, there is strong demand for conventional vehicles with improved fuel efficiency. OEMs are localizing powertrain technologies, and cylinder deactivation is being considered a cost-effective way to enhance fuel economy without a full hybrid or EV transition. This trend is expected to support the market, especially in mid-range SUVs and sedans.

Modern engine control units (ECUs) and electronic throttle systems have become increasingly sophisticated, enabling seamless cylinder activation and deactivation without noticeable performance lag. This advancement enhances the driving experience and encourages broader adoption across different engine configurations, including turbocharged engines. Innovations in solenoid actuation and valve control systems are reducing mechanical complexity and costs, making it feasible to deploy cylinder deactivation in smaller displacement engines as well.

Automakers are shifting toward modular engine platforms that can be adapted across multiple vehicle models and segments. Cylinder deactivation fits well within this strategy, offering an efficiency-boosting feature that can be scaled without major architectural changes. As global OEMs look to balance the transition toward electrification with the reality of ICE vehicle demand in many regions, cylinder deactivation is being prioritized as a transitional efficiency technology. This approach aligns with automaker goals to offer fuel-saving features without incurring the higher costs associated with full hybridization.

The increasing maturity of engine control units and valve solenoid mechanisms has enabled a smoother transition between active and deactivated cylinder states. For both passenger vehicles and LCVs, this results in a virtually unnoticeable change in power delivery, ensuring that the driving experience remains unaffected. As consumer awareness grows, and driver complaints related to rough transitions decline, adoption is expected to accelerate in personal and commercial-use vehicles.

Component Insights

Engine control unit accounted for the largest share of 45.48% in 2024. The engine control unit (ECU) continues to dominate the cylinder deactivation systems market due to its central role in optimizing engine performance and fuel economy. With stricter emission regulations and rising fuel efficiency demands in passenger and light commercial vehicles, ECUs have evolved to process real-time data from multiple sensors to execute seamless cylinder deactivation. The growing integration of advanced software, AI-based calibration, and real-time diagnostics within ECUs allows automakers to achieve precision control over combustion events, thereby enhancing performance without sacrificing drivability.

The electronic throttle control segment is expected to grow at a significant CAGR during the forecast period. Electronic Throttle Control is rapidly emerging as a vital enabler of next-generation cylinder deactivation systems, particularly as automakers move toward more refined drive-by-wire architectures. Electronic Throttle Control facilitates smoother transitions between full- and partial-cylinder operations by adjusting airflow and engine load dynamically, enhancing vehicle responsiveness and driver comfort. As OEMs seek to reduce mechanical complexity and improve engine adaptability, Electronic Throttle Control systems are being upgraded with more accurate sensors and faster actuation capabilities.

Actuation Method Insights

The overhead camshaft design segment accounted for the largest share in 2024. Overhead Camshaft Design continues dominating the market, especially in passenger and light commercial vehicles, due to its widespread use in modern engine platforms. Automakers favor this layout for its superior valve control precision, essential for seamless activation and deactivation of engine cylinders under varying load conditions. The design allows for easier integration of solenoids and actuators, core to cylinder deactivation functionality. As global emission norms tighten and efficiency standards rise, overhead camshaft configurations are further optimized with variable valve timing and turbocharging, reinforcing their dominance across a broad spectrum of fuel-efficient ICE models.

The pushrod segment is expected to grow significantly during the forecast period. While traditionally considered a mature design, the Pushrod segment is experiencing renewed attention in select markets, particularly North America. Automakers leveraging large-displacement V6 and V8 engines, such as those used in pickup trucks and performance vehicles, are adopting cylinder deactivation to meet fuel economy regulations without sacrificing power output. Recent advancements in lifter design and valvetrain control have made it feasible to implement cylinder deactivation in pushrod architectures more efficiently.

Fuel Type Insights

The gasoline segment held the largest market share in 2024. The gasoline segment remains the primary market driver due to its widespread adoption in passenger vehicles and regulatory pressure to improve fuel efficiency. As OEMs strive to balance performance with compliance to tightening global emission norms, cylinder deactivation technology has become a cost-effective solution to reduce fuel consumption and CO₂ emissions in gasoline-powered engines. The architecture of gasoline engines is inherently more compatible with deactivation systems, enabling smoother transitions and minimal impact on ride quality. Furthermore, the increasing production of turbocharged, downsized gasoline engines in conventional and mild hybrid models reinforces the segment's growth, making it the most dominant fuel type in the market.

The diesel segment is expected to register the fastest CAGR during the forecast period. Though traditionally less common, diesel engines gradually incorporate cylinder deactivation technologies, particularly in light commercial vehicles where fuel economy and long-haul efficiency are critical. Diesel engines operate under higher compression and torque, making implementing cylinder deactivation more complex. However, advancements in electronic control units and valve actuation mechanisms enable better compatibility. In markets like Europe, where diesel engines still hold a significant share of the LCV market, OEMs are exploring this technology as part of their broader emissions-reduction strategies.

Vehicle Type Insights

The passenger vehicles segment held the largest market share in 2024. The growing consumer preference for advanced technology, sustainability, and convenience is strongly driving the passenger vehicle market. As consumers become more environmentally conscious, the increasing demand for electric vehicles (EVs) and hybrid vehicles is one of the primary drivers. Furthermore, advancements in in-car technology, such as autonomous driving features, connectivity, and infotainment systems, are reshaping the industry. The rise of shared mobility services, such as ride-hailing, also influences buying patterns, with consumers opting for more affordable, fuel-efficient, and compact models.

The light commercial vehicles segment is expected to register the fastest CAGR during the forecast period. The light commercial vehicle (LCV) market is driven by the expansion of e-commerce, urbanization, and the need for more efficient transportation solutions for small businesses. As online shopping continues to rise, there is a growing demand for LCVs to fulfill last-mile delivery requirements. The need for more fuel-efficient, eco-friendly, and cost-effective vehicles also pushes the adoption of electric and hybrid LCVs. Regulatory measures around emissions and urban freight further encourage businesses to upgrade to cleaner, greener vehicles. In addition, the focus on improving fleet management and logistics efficiency is driving the demand for LCVs equipped with advanced telematics and tracking systems.

Regional Insights

The North America market accounted for 36.8% share of the overall market in 2024. The North American market held a significant share in 2024, driven primarily by the U.S. market. The growing demand for fuel-efficient and environmentally friendly vehicles and stringent emissions regulations are key factors propelling the market. Consumers' increasing preference for vehicles that offer improved fuel economy, coupled with the adoption of advanced automotive technologies, further boosts the market. The presence of leading automotive manufacturers and the push for sustainability are key regional drivers.

U.S. Cylinder Deactivation System Industry Trends

The cylinder deactivation system industry in U.S. held a dominant position in 2024, with the market heavily influenced by the push to reduce fuel consumption and emissions. Automakers are increasingly integrating cylinder deactivation technologies in their vehicles to meet stringent fuel economy standards and cater to the rising demand for hybrid and fuel-efficient vehicles.

Europe Cylinder Deactivation System Industry Trends

The cylinder deactivation system industry in Europe was identified as a lucrative region in 2024. Regulatory pressure for reduced CO2 emissions and improved fuel efficiency is a driving force in the region. The adoption of cylinder deactivation technology is accelerating due to the region's focus on environmental sustainability and compliance with emissions standards like Euro 6. As European automakers strive to meet these regulations, the market for cylinder deactivation systems is expanding.

The UK cylinder deactivation system market is experiencing growth, driven by increasing consumer demand for fuel-efficient vehicles, stringent emissions regulations, and the need to reduce carbon footprints. The country’s automotive industry is focused on developing innovative technologies to meet both environmental goals and the rising demand for improved fuel economy. With a strong presence of leading automotive manufacturers and suppliers, UK automakers heavily invest in cylinder deactivation systems to enhance vehicle performance and efficiency.

Asia Pacific Cylinder Deactivation System Industry Trends

The cylinder deactivation system industry in Asia Pacific held a significant share in 2024. The Asia Pacific market held a significant share in 2024, fueled by the region's rapidly growing automotive industry and the expansion of fuel-efficient vehicle technologies. Countries like China, India, Japan, and South Korea are leading the adoption of cylinder deactivation systems as they face increasing demand for vehicles with improved fuel economy and lower emissions. The Chinese market is witnessing strong growth, driven by the country’s large-scale automotive manufacturing sector and technological advancements in engine performance optimization.

China cylinder deactivation system market held a substantial share in 2024. The market is experiencing significant expansion, supported by China’s commitment to reducing vehicle emissions and promoting eco-friendly technologies. As one of the largest global automotive markets, China’s automotive industry increasingly incorporates cylinder deactivation systems to meet stringent fuel efficiency standards and environmental goals.

The cylinder deactivation system market in Japanalso held a significant share in 2024. Japan’s highly advanced automotive infrastructure and rapid adoption of energy-efficient technologies drive the demand for cylinder deactivation systems. With a strong focus on sustainability and emissions reduction, Japan’s automotive manufacturers are integrating advanced engine technologies, such as cylinder deactivation, to enhance fuel efficiency and meet the country’s environmental regulations.

Key Cylinder Deactivation System Company Insights

Some of the key companies in the market include Eaton, Delphi Technologies, Schaeffler Technologies and Robert Bosch GmbH, among others. To gain a competitive edge and increase their market share, these players actively pursue strategic initiatives such as technology partnerships, product innovations, and collaborations with leading automotive OEMs and engine manufacturers. These efforts aim to develop more refined, fuel-efficient, and emission-compliant deactivation systems, tailored for both conventional and hybrid powertrains.

-

Eaton is a global leader in advanced valvetrain technologies. It offers cylinder deactivation solutions widely adopted by top-tier automakers to improve fuel economy and meet emission regulations. The company emphasizes scalable platforms compatible with multiple engine architectures.

-

Robert Bosch GmbH, a key innovator in engine management systems, integrates cylinder deactivation into its broader portfolio of electronic throttle control units, solenoid valves, and ECUs. Leveraging its deep expertise in automotive electronics, Bosch provides OEMs with precision control systems that support seamless transition between active and deactivated cylinder modes.

Key Cylinder Deactivation System Companies:

The following are the leading companies in the cylinder deactivation system market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton

- Delphi Technologies

- Schaeffler Technologies

- Robert Bosch GmbH

- Continental

- BorgWarner

- Magna International

- Daimler

- Toyota Motor Corporation

- Ford Motor Company

Recent Developments

-

In April 2025, the SAE WCX Congress featured extensive technical discussions on sustainability, emissions, and advanced powertrain technologies. As part of advanced powertrain strategies, Cylinder deactivation systems were likely covered in the 495 technical papers and panel discussions, although detailed specific sessions on cylinder deactivation require subscription access. The event also included an exhibition showcasing the latest automotive innovations.

-

In August 2024, Cummins demonstrated positive results from its Jacobs Cylinder Deactivation (CDA) system, which has shown a fuel savings of 2.76% in on-road testing using SAE J1321 standards. The CDA system uses a hydraulically actuated mechanism to deactivate selected cylinders in low engine load conditions, optimize fuel efficiency and reduce emissions, especially by enhancing thermal management of the exhaust after-treatment system. In lab tests, the system achieved a 77% reduction in NOx emissions during low-load cycles. The system was tested on a 2018 International LT625 truck and showed comparable NVH (Noise, Vibration, Harshness) performance to non-CDA engines.

Cylinder Deactivation System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.99 billion

Revenue forecast in 2030

USD 6.93 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, actuation method, fuel type, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Eaton; Delphi Technologies; Schaeffler Technologies; Robert Bosch GmbH; Continental; BorgWarner; Magna International; Daimler; Toyota Motor Corporation; Ford Motor Company.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cylinder Deactivation System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cylinder deactivation system market report based on component, actuation method, fuel type, vehicle type, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Valve Solenoid

-

Engine Control Unit

-

Electronic Throttle Control

-

-

Actuation Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Overhead Camshaft Design

-

Pushrod

-

-

Fuel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Diesel

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Light Commercial Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cylinder deactivation system market size was estimated at USD 4.68 billion in 2024 and is expected to reach USD 4.99 billion in 2025.

b. The global cylinder deactivation system market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030, reaching USD 6.93 billion by 2030.

b. North America dominated the cylinder deactivation system market in 2024 and accounted for a 36.8% share of the global revenue. The growing demand for fuel-efficient and environmentally friendly vehicles, along with stringent emissions regulations, is a key factor propelling the regional growth of the market.

b. Some of the key companies in the cylinder deactivation system market include Eaton, Delphi Technologies, Schaeffler Technologies, Robert Bosch GmbH, Continental, BorgWarner, Magna International, Daimler, Toyota Motor Corporation, and Ford Motor Company.

b. The cylinder deactivation system market is undergoing significant transformation, propelled by several critical trends. One of the primary drivers is the increasing demand for fuel-efficient and environmentally sustainable vehicles. With stringent emissions regulations and fuel economy standards worldwide, automakers are adopting cylinder deactivation technology to optimize engine performance and reduce fuel consumption without compromising power. This technology allows engines to deactivate select cylinders under light-load conditions, improving overall efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.