- Home

- »

- Alcohol & Tobacco

- »

-

Dark Spirits Market Size, Share And Growth Report, 2030GVR Report cover

![Dark Spirits Market Size, Share & Trend Report]()

Dark Spirits Market (2025 - 2030) Size, Share & Trend Analysis Report By Type (Whiskey, Rum, Brandy), By Distribution Channel (Offline Trading, Online Trading), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-932-9

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dark Spirits Market Size & Trends

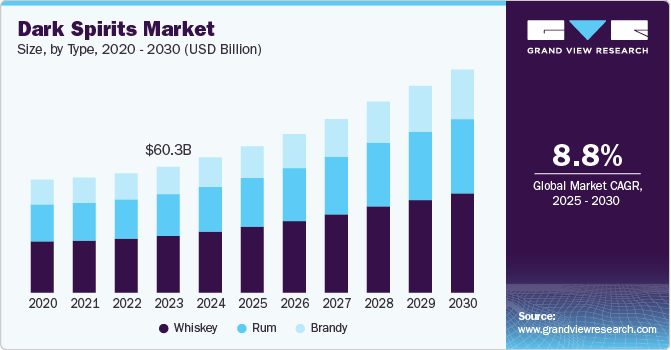

The global dark spirits market size was estimated at USD 64.82 billion in 2024 and is expected to grow at a CAGR of 8.8% from 2025 to 2030. The market has witnessed steady growth driven by evolving consumer preferences and increased demand for premium alcoholic beverages. One of the key market trends is the growing preference for aged dark spirits, such as whiskey, rum, and brandy, as consumers increasingly seek out high-quality, sophisticated drinks. The rising popularity of craft spirits and small-batch distilleries has further fueled this demand, with connoisseurs and younger demographics willing to pay premium prices for unique, artisanal dark spirits.

The growing acceptance of new exotic flavors of artisanal spirits is one of the major factors driving market growth. The increasing demand for premium spirit products in countries such as the U.S. and the UK is expected to boost market growth. The rising demand to procure high-quality spirits at an affordable cost is an upcoming market opportunity. However, the increasing trend to consume low-alcoholic beverages is hindering market growth. At present, key players are focusing on launching e-commerce platforms to gain traction with the spirits consumers. Hence, the spirits market is expected to showcase significant growth during the forecast period.

Mass-manufactured dark spirits are extremely prevalent in emerging countries such as India. However, the premium segment has observed an increase in demand in the past few years. Furthermore, aspiring customers are developing a taste for premium products that provide a unique and genuine experience. In addition, growing disposable income, urbanization, and increasing middle-class population positively impact the market for premium products. With the rising number of pubs, bars, and breweries offering alcoholic beverages, superior spirits are pouring into the market development in advanced and emerging economies. High taxation puts negative pressure on the customers and deeply impacts their buying decisions. With large taxation on whiskey, the market struggles across different regions.

Growing investment from U.S.-based key players to procure high-quality rum products is estimated to boost the market growth. The major market players are procuring value-added spirits with bizarre tastes. Rapidly growing demand for innovative spirit-based beverages from European consumers is driving industry growth. Adequate intake of dark spirits can relieve pain, swelling bone mineral density, stop the common cold, and keep the body warm.

Type Insights

Whiskey accounted for a market share of 45.2% of global revenues in 2024. The high disposable income of developing economies such as China and India, plus the growing whiskey consumption in Japan, is projected to continue its significant growth in the market during the forthcoming years. The delicious taste and lower fat content will enhance whiskey sales throughout the forecast period.

The brandy market is projected to grow at a CAGR of 9.3% from 2025 to 2030. This robust expansion can be attributed to a combination of factors, including increasing consumer demand for premium and craft spirits, particularly in regions such as Europe, North America, and Asia Pacific. Consumers are showing a greater preference for high-quality, aged brandy products as they become more knowledgeable about the nuances of flavor, aging processes, and the overall craftsmanship involved in production.

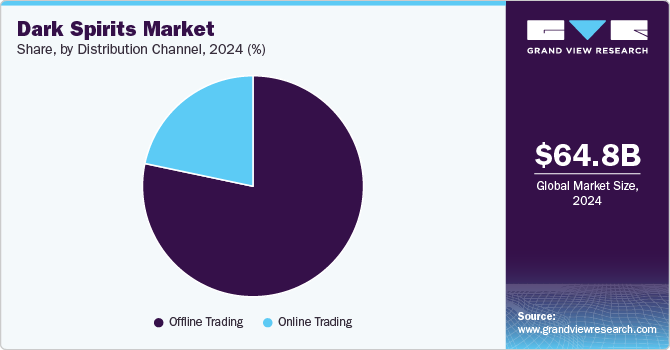

Distribution Channel Insights

Offline trading accounted for a market share of 78.3% of global revenues in 2024. The offline trading includes suppliers such as liquor shops, restaurants, bars, pubs, supermarkets, and specialty stores. Dark spirits are largely served in most restaurants, bars, and pubs. In addition, these are mixed with interesting, flavored juices and sparkling water to offer pleasing customer experiences. Domestic suppliers provide a variety of spirits at a lower cost, boosting segment growth. The increased inclination toward Western culture and rising adoption of drinking practices will propel market growth.

The online trading market is projected to grow at a CAGR of 10.1% from 2025 to 2030. This growth can be credited to the distributors' better focus on implementing modern trade technology for doorstep delivery. Moreover, brands and retailers are conducting online promotional campaigns via various social media platforms to increase customer brand awareness. Increasing demand for the super-premium spirit product over an e-commerce portal, coupled with the supportive government measures to fulfill the demand for alcoholic beverages by means of an online platform, are the factors fueling market growth.

Regional Insights

The North America dark spirits market accounted for 22.7% of the global revenue in 2024. This market is driven by increasing consumer interest in premium and craft spirits, particularly whiskey and bourbon, which have seen significant demand across the U.S. and Canada. Cocktail culture has gained momentum, with whiskey-based drinks enjoying widespread popularity. Millennials and younger consumers gravitate towards craft and small-batch distilleries, driving innovation and market growth.

U.S. Dark Spirits Market Trends

The U.S. dark spirits market is projected to grow at a CAGR of 9.2% from 2025 to 2030. In the U.S., whiskey remains the dominant dark spirit, with bourbon and rye whiskey leading the market. The rise in home consumption and the cocktail culture has driven demand for premium whiskey brands. The craft distilling movement has also gained traction, with consumers increasingly seeking unique, local products. This growth is supported by favorable trade agreements and expanding distribution channels, particularly online platforms, making dark spirits more accessible across the country.

Europe Dark Spirits Market Trends

The Europe dark spirits market is projected to grow at a CAGR of 8.9% from 2025 to 2030. The European market is characterized by strong demand for whiskey, rum, and brandy, with established markets such as the UK, Germany, and France leading consumption. The region's rich heritage in whiskey production, particularly in Scotland and Ireland, continues to dominate. Craft and premium brands are in high demand, while sustainable production and organic sourcing trends are gaining traction among environmentally conscious consumers. Europe also remains a key exporter of dark spirits globally, particularly Scotch whiskey.

The UK dark spirits market accounted for a share of 25.68% of Europe's revenue in 2024. The UK market for dark spirits is dominated by Scotch whisky, which continues to enjoy strong domestic and international demand. The rise of premium, single-malt variants, and innovative craft distilleries has driven growth in the category. Consumer interest in whisky-based cocktails and home bartending has also surged, increasing consumption. In addition, a growing interest in rum, especially premium and spiced varieties, is adding diversity to the dark spirits landscape in the UK.

The dark spirits market in Germany is projected to grow at a CAGR of 9.0% from 2025 to 2030. Germany’s market is led by a growing preference for whiskey, particularly Scotch and bourbon, as well as rum and brandy. The market is experiencing a shift toward premium and craft options as German consumers become more interested in the craftsmanship and aging process behind dark spirits. E-commerce platforms have also enhanced accessibility, making it easier for consumers to explore a wide range of products. The country’s sophisticated palate for spirits and a growing cocktail culture continue to support market growth.

Asia Pacific Dark Spirits Market Trends

The Asia Pacific dark spirits market accounted for a share of 31.3% of the global revenue in 2024. The Asia Pacific market is witnessing rapid growth, fueled by rising disposable incomes, urbanization, and the growing popularity of Western-style alcoholic beverages. Whiskey is the leading category, especially in countries like Japan and India, where local production contributes to strong demand. The region’s affluent middle class is driving the market for premium dark spirits, particularly in metropolitan areas. Increasing e-commerce penetration and expanded distribution networks also facilitate market growth.

China dark spirits market accounted for a share of 41.30% of the Asia Pacific market in 2024. China’s market is expanding, with whiskey and brandy leading the category due to rising demand among affluent consumers. Premiumization is a key trend, as Chinese consumers increasingly favor high-end international brands and locally-produced craft spirits. The growing cocktail culture in urban areas contributes to the rise in consumption, and the expansion of e-commerce platforms has made it easier for consumers to access a wide range of dark spirits. The market is expected to continue growing as disposable incomes rise.

The Japan dark spirits market is projected to grow at a CAGR of 8.5% from 2025 to 2030. Japan’s market is driven by its renowned whiskey industry, with Japanese whiskey gaining international acclaim for its high quality and craftsmanship. Domestic demand for whiskey remains strong, supported by a culture of whiskey bars and home consumption. The export market for Japanese whiskey is also booming, further enhancing the country’s position in the global dark spirits industry. Premiumization and the rising cocktail culture among younger consumers fuel continued growth in the sector.

Central & South America Dark Spirits Market Trends

The dark spirits market in Central and South America is projected to grow at a CAGR of 8.1% from 2025 to 2030.The market in Central & South America is heavily dominated by rum, particularly in Caribbean nations and countries like Brazil. Local production of rum plays a key role in both domestic consumption and exports. Whiskey is also gaining popularity, especially in urban centers where consumers explore premium and international brands. The rise of cocktail culture and increased disposable income in key markets like Brazil, Colombia, and Mexico drive demand for dark spirits across the region.

Middle East & Africa Dark Spirits Market Trends

The dark spirits market in the Middle East & Africa is projected to grow at a CAGR of 8.9% from 2025 to 2030.The market in the Middle East & Africa is relatively niche due to cultural and religious factors that limit alcohol consumption in several countries. However, in regions with a more liberal approach, such as the UAE and South Africa, the market is growing, driven by expatriates and affluent consumers who favor premium whiskey and rum. The hospitality sector, particularly in tourist-heavy areas, is crucial in driving dark spirits sales. Expanding distribution networks and rising disposable incomes in parts of Africa also support market growth.

Key Dark Spirits Company Insights

The major focus of the companies is to launch rum-based products to meet the increasing demand for alcoholic beverages. The main key players are adopting digital online platforms to fulfill the demand for alcoholic spirits. However, implementing sustainability has its unique challenges and limitations. Multiple companies are targeting the expansion and launch of premium brand products in the market.

Key Dark Spirits Companies:

The following are the leading companies in the dark spirits market. These companies collectively hold the largest market share and dictate industry trends.

- Diageo

- Anheuser-Busch InBev

- Suntory Holdings

- Pernod Ricard

- Asahi Group Holdings

- Kirin Holdings

- Bacardi Limited

- LT Group, INC

- The Brown-Forman Corporation

- Rémy Cointreau

Recent Developments

-

In June 2024, Casa Lumbre, a Mexican-based global spirits company, unveiled a second wave of their highly sought-after Contraluz 11:11 Mezcal Reposado expression. The limited-edition product, made from 100% Maguey Espadín, has been matured for 11 months and 11 days in American Oak bourbon barrels and Sakura casks.

-

In May 2024, Pernod Ricard and ecoSPIRITS entered a new stage in their relationship with a five-year global licensing agreement to enable the distribution of Pernod Ricard's spirits brands in ecoSPIRITS' circular packaging technology to on-trade venues worldwide.

Dark Spirits Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 70.16 billion

Revenue forecast in 2030

USD 106.89 billion

Growth rate

CAGR of 8.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Russia; China; India; Japan; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Diageo; Anheuser-Busch InBev; Suntory Holdings; Pernod Ricard; Asahi Group Holdings; Kirin Holdings; Bacardi Limited; LT Group, INC; The Brown-Forman Corporation; Rémy Cointreau

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dark Spirits Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dark spirits market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Whiskey

-

Rum

-

Brandy

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline Trading

-

Online Trading

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global dark spirits market size was estimated at USD 64.82 billion in 2024 and is expected to reach USD 70.16 billion in 2025.

b. The global dark spirits market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030 to reach USD 106.89 billion by 2030.

b. Asia Pacific dominated the dark spirits market, with a share of 31.3% in 2024. This is due to the increasing demand for fruity, clean, and polished malt scotch whiskey in China and Japan. The growing adoption of bourbon and sherry cask spirits by Indian consumers will help to boost the market growth.

b. Some key players in the dark spirits market include Diageo, Anheuser-Busch InBev, Suntory Holdings, Pernod Ricard, Asahi Group Holdings, Kirin Holdings, Bacardi Limited, LT Group, INC, The Brown–Forman Corporation, and Rémy Cointreau.

b. Key factors driving the dark spirits market growth include growing consumption of dark spirits from emerging economies such as China and India, rising popularity of scotch whisky, and growing demand for rum-based spirits across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.