- Home

- »

- Automotive & Transportation

- »

-

Dashboard Camera Market Size, Share, Growth Report 2030GVR Report cover

![Dashboard Camera Market Size, Share & Trends Report]()

Dashboard Camera Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Basic, Advanced, Smart), By Product, By Video Quality, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-771-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dashboard Camera Market Summary

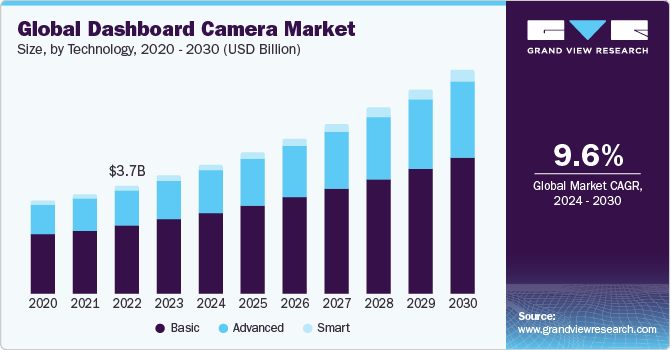

The global dashboard camera market size was estimated at USD 4.03 billion in 2023 and is anticipated to reach USD 7.64 billion by 2030, growing at a CAGR of 9.6% from 2024 to 2030. The industry growth is attributed to the rising awareness about vehicular safety, quicker insurance claims, and protection against rising vehicle thefts.

Key Market Trends & Insights

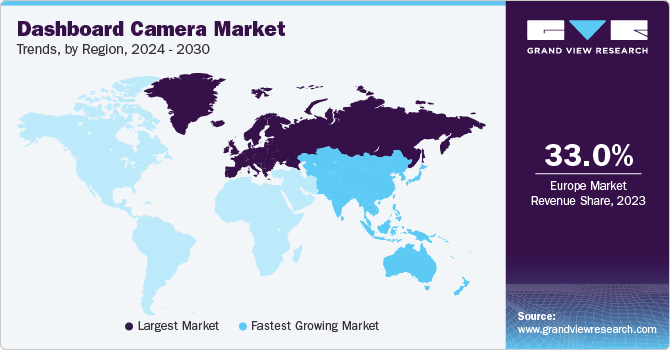

- Europe accounted for the largest revenue share of 33% of the dashboard camera market in 2023.

- The U.S. dashboard camera market is expected to grow at a CAGR of over 7.3% from 2024 to 2030.

- By distribution channel, online distribution channels accounted for the highest compound annual growth rate (CAGR) of around 11.0% from 2024 to 2030.

- By technology, basic technology segment accounted for a dominant revenue share of the market in 2022.

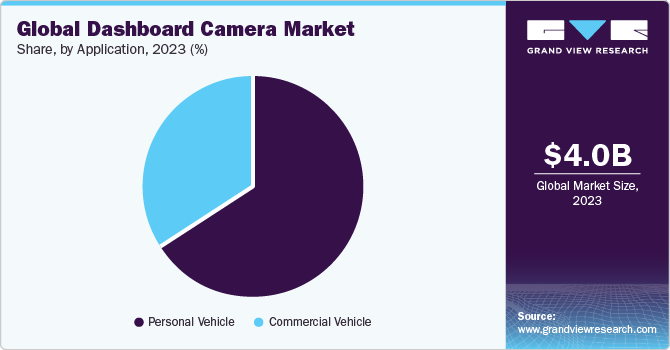

- By application, the personal vehicle application segment dominated the global market and accounted for a dominant revenue share in 2022.

Market Size & Forecast

- 2023 Market Size: USD 4.03 Billion

- 2030 Projected Market Size: USD 7.64 Billion

- CAGR (2024-2030): 9.6%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

A crucial factor driving product demand is a rise in the number of fraudulent insurance claims and medical compensation by means of fake car accidents. Insurance companies are encouraging the use of vehicles to resolve insurance claims more accurately and quickly. Prominent automotive dashboard camera manufacturers have started developing innovative car DVRs that feature advanced safety measures such as lane departure warning systems, blind spot detection, and collision avoidance systems. Automotive companies, commercial fleet operators, and individual vehicle owners are adopting these systems to increase vehicle safety. Key companies are producing sophisticated dashcams that are fitted with forward collision warning systems. These systems can warn vehicle drivers in case of any potential collision, providing greater protection against potential accidents. The market has gained immense momentum owing to the growth of the automotive sector. Recorded footage from dash cams is being extensively used in the event of accidents and road mishaps as evidence against claims for 'cash for crash' frauds.

The U.S. House of Representatives established the "Dashboard Camera Act of 2017," which gave vehicle manufacturers six months to equip all their models with dashcams once they were commercialized. As per the law, The Land Transportation Office rejects the registration of vehicles that are not equipped with these cameras. Also, as per the rule, the Public Utility Vehicle (PUV) operators will not be granted a franchise if they do not comply with the regulation. The Land Transportation Franchising and Regulatory Board (LTFRB) oversees maintaining an archive of all the video recordings from vehicles that are involved in traffic accidents. The law imposes a heavy penalty for PUV operators who do not comply with the regulations. Such stringent norms have forced the OEMs to install cameras in their vehicles, accelerating their sales over the coming years.

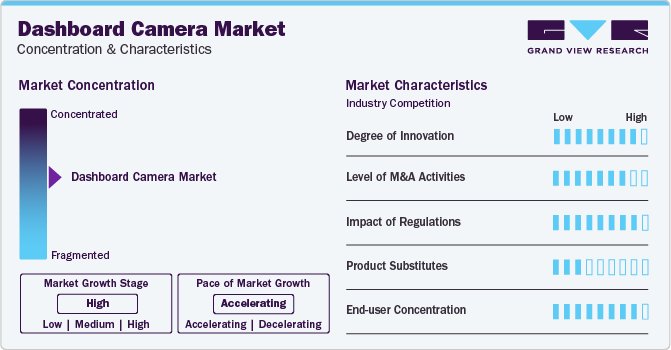

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. This can be attributed to several factors, including the increasing awareness of the advantages of dashboard cameras or dashcams, such as providing evidence in case of accidents or theft and enhancing vehicle safety. Additionally, the rise in demand for advanced driver assistance systems (ADAS) has also contributed to the growth of the dashboard camera market. With the increasing adoption of connected cars and the emergence of autonomous vehicles, the demand for dashboard cameras is expected to continue growing in the coming years.

The dashboard camera market is seeing a moderate number of merger and acquisition (M&A) activities by the leading companies underlying a dynamic industry landscape. The leading companies engage in merger and acquisition activities to expand their market share, acquire innovative technologies, and gain a competitive edge over their rivals. With the market growth stage being high and the pace of growth accelerating, such M&A activities can help companies stay ahead of the curve and capitalize on the rising demand for dashboard cameras.

The dashboard camera market is also subject to increasing regulatory scrutiny. The regulators are likely looking at various aspects of the dashboard camera market, such as data privacy, cybersecurity, and compliance with safety standards. With the increasing adoption of connected cars and the rise in incidents of cyber-attacks, dashboard camera manufacturers need to ensure that their products comply with the relevant regulations. Failure to do so could result in legal and financial implications for the companies.

End-user concentration is a significant factor in the dashboard camera market. The user-friendliness and convenience of dashboard cameras by incorporating additional features such as expandable storage capacity, high-endurance battery life, and inclusion of night vision cameras in their product offerings. Commercial users of dash cams, such as taxi operators and trucking companies, increasingly prefer 2-channel (dual channel) variants as single-channel ones cannot be upgraded by adding a secondary unit to capture footage inside the vehicle.

Application Insights

The personal vehicle application segment dominated the global market and accounted for a dominant revenue share in 2022. This growth of dashboard cameras for cars can be attributed to several factors, such as an increase in the number of road accidents, rising concerns over safety and security, and the availability of affordable and advanced cameras. One of the main reasons for the growth of personal vehicle applications in the market is the increasing number of road accidents. According to the National Highway Traffic Safety Administration (NHTSA), in 2022, there were 42,795 fatalities in motor vehicle crashes in the United States. The availability of dash cams has made it easier for drivers to provide evidence in case of accidents and can help in reducing insurance costs.

By application, the commercial vehicle segment is likely to grow at a steady growth rate of nearly 9.0% during the forecast period from 2023 to 2030. The rise in the need for vehicle fleet monitoring and management is one of the prominent factors increasing the adoption of dashcams among owners fleet of commercial vehicles. Dash cams can provide real-time monitoring of the vehicles, allowing fleet managers to track the location and behavior of their drivers. This can help in improving efficiency, reducing fuel costs, and increasing productivity. Furthermore, dashcams can help in reducing insurance costs for commercial vehicles. Insurance companies are increasingly offering discounts to companies that install dash cams in their vehicles as they provide evidence in case of accidents or other incidents on the road. This can help in reducing the overall cost of insurance for commercial vehicles.

Technology Insights

Basic technology segment, based on technology, accounted for a dominant revenue share of the market in 2022. The entry level has been significantly lowered by manufacturers offering dash cams, which come with basic features and technology. These dashcams are inexpensive and can be installed within minutes. Most customers are satisfied with the basic features. Basic technology dashcams are more popular in developing regions due to their effortless process and low cost of production.

The smart technology segment is projected to grow at a compound annual growth rate (CAGR) of nearly 15.4% from 2024 to 2030. There has been an increasing awareness regarding the benefits of cameras among customers due to frequent news videotapes of crashes and road accidents captured by cameras. Leading companies are now offering Wi-Fi-enabled models, allowing customers to transfer videos to their smartphones using mobile applications along with this the companies are also focusing on enabling dashboard cameras with GPS. The incorporation of such advanced features, along with several other driver assistance features, is expected to drive the demand for smart cameras over the forecast period.

Product Insights

The 1-Channel product segment is gaining market traction and dominated the market by revenue in 2022. 1-channel products are an ideal option for drivers who want a basic dash cam that can record footage of their journey. Drivers can capture any incidents that occur on the road, ensuring that they have visual evidence in case of an accident or other incident. Additionally, 1-channel dash cams are often more affordable than multi-channel cameras, making them accessible to a wider range of consumers. As an increase in drivers recognize the importance of having a dash cam, the demand for 1-channel products will continue to grow. These devices are an excellent investment for anyone who wants to protect themselves on the road and ensure that they have evidence in case of an accident.

The 2-channel product segment is projected to grow at a compound annual growth rate (CAGR) of more than 10.5% from 2024 to 2030. Motorists have now started installing 2-channel cameras to record both the front and inside of the vehicle to preserve evidence in case of a road mishap. Commercial users of cameras, such as trucking companies and taxi operators, increasingly prefer 2-channel dashcams over 1-channel ones. The latter cannot be upgraded/may cause higher costs by adding a secondary unit to capture footage inside the vehicle.

Video Quality Insights

SD & HD video quality segment dominated the global market and recorded the largest revenue share in 2022. Primarily, consumers are becoming increasingly aware of the importance of high-quality video footage in providing evidence in case of accidents or other incidents on the road. With SD and HD video recording capabilities, dash cams can capture clear and detailed footage that can be used to prove fault or exonerate drivers. Moreover, the availability of affordable and advanced cameras with SD and HD video recording capabilities has made it easier for consumers to invest in these devices. Prices range from budget-friendly options to high-end models with advanced features; consumers can choose the dash cam that best suits their needs and budget.

Full HD & 4K video quality segment is anticipated to grow at a compound annual growth rate (CAGR) of over 10% from 2024 to 2030. Factors contributing to the growth of Full HD and 4K video quality in the market are the increasing demand for real-time monitoring and remote access. With these capabilities, dash cams can provide high-quality video footage that can be accessed remotely or in real-time, allowing fleet managers to track the location and behavior of their drivers. Furthermore, compliance with regulations and insurance requirements is another factor driving the growth of Full HD and 4K video quality in the market. In many countries, commercial vehicles are required to have recording devices installed to comply with federal regulations. Full HD and 4K video recording capabilities can meet these requirements and provide clear and detailed footage that can be used to reduce insurance costs and avoid fines and penalties.

Distribution Channel Insights

Online distribution channels accounted for the highest compound annual growth rate (CAGR) of around 11.0% from 2024 to 2030. The online purchasing of dash cams offers exciting discounts and best price options as compared to the in-store options, which is expected to drive the preference for the same. A minor challenge in online purchases is the shipping charges required to be paid areas. The online delivery of dash cams requires a longer time as compared to direct purchases at brick-and-mortar stores. Customers can own a device instantaneously by purchasing it in retail stores. Online retailers have been heavily investing in processes to enhance their customer service. They often replace the wrong or damaged order delivered at no extra cost.

Regional Insights

North America dashboard camera market is expected to grow at a CAGR of nearly 8.0% from 2024 to 2030 owing to the ongoing trend of advanced driver-assistance systems (ADAS) integration in automotive industry and the rising need to avoid road accidents and thefts. The consumer demand in the region is driven by high public awareness of the potential security benefits associated with the dashboard camera.

U.S. Dashboard Camera Market Trends

The U.S. dashboard camera market is expected to grow at a CAGR of over 7.3% from 2024 to 2030. This growth can be attributed to the rising significance of dashcam footage in the settlement of insurance claims. Insurance companies in the U.S. are encouraging consumers to use dashcams in order to combat fraudulent claims.

Europe Dashboard Camera Market Trends

Europe accounted for the largest revenue share of 33% of the dashboard camera market in 2023. As road traffic continues to increase across European countries, there is a growing need for measures to enhance safety on the roads. Dash cams play a crucial role by providing a record of events in case of accidents or disputes, aiding authorities, and insurance companies in determining fault and liability. European countries have specific laws regarding dash cams wherein they should not interfere while driving or be used as a mode for leaking personal vehicular information.

The UK dashboard camera market is expected to grow at a CAGR of nearly 9% from 2024 to 2030. Dashboard camera market growth in U.K. is driven by factors such as increased awareness of the benefits of dashcams, a supportive regulatory landscape, and technological advancements in the automotive industry.

Dashboard camera market in Germany is expected to witness a CAGR of around 7.0% from 2024 to 2030. The flourishing automotive sector, rising consumer preferences for safety and security features in their vehicles, and strict government regulations are contributing to growth of the dashcam market in Germany.

France dashboard camera market is expected to witness high growth from 2024 to 2030. The government regulations regarding the usage of dashcams and insurance incentives are expected to boost the growth of the market in France.

Asia Pacific Dashboard Camera Market Trends

Asia Pacific is expected to exhibit the highest growth rate of over 12.0% from 2024 to 2030. The increasing affordability of dashcams has made them more accessible to a broader consumer base. As technology has advanced, the cost of manufacturing these devices has decreased, making them affordable for a wider range of consumers across the region. The online distribution channel is also gaining momentum in the region as the dashboard camera being popular in India. This affordability factor has played a pivotal role in driving market growth, especially in countries with a rising middle class and an expanding urban population.

China dashboard camera market is expected to witness a CAGR of over 10.0% from 2024 to 2030. The demand for dashcams in China is driven by a growing number of traffic accidents and road violations, along with high product adoption by commercial fleets, including taxi services and trucking companies.

The Japan dashboard camera market is expected to grow at a CAGR of over 13% from 2024 to 2030. Supportive government initiatives and regulatory environment, technological advancements, and the rising need to avoid fraudulent insurance claims drive the growth of the Japanese dashcam market.

Dashboard camera market in India is expected to grow at an exponential growth rate of 16% from 2024 to 2030 due to the high rate of road accidents, government mandates to use dashcams for commercial vehicles, and the constantly growing vehicle market.

Middle East and Africa (MEA) Dashboard Camera Market Trends

Middle East and Africa (MEA) dashboard camera market is anticipated to reach USD 4.73 billion by 2030. The rising number of commercial vehicles, such as taxis and trucks, is boosting the demand for dashcams in the MEA region to ensure passenger safety and monitor driver behavior. The rise of online distribution channels in the region is expected to create lucrative growth opportunities for the dashboard camera market.

Saudi Arabia dashboard camera market is anticipated to grow at a CAGR of over 11% from 2024 to 2030. Dashboard camera market in Kingdom of Saudi Arabia (KSA) is driven by increased tourism in the country, which creates demand for rental cars equipped with dashcams. In addition, the rising number of luxury cars and rising awareness of the need for road safety boosts the market’s growth.

Key Dashboard Camera Companies:

The following are the leading companies in the dashboard camera market. These companies collectively hold the largest market share and dictate industry trends.

- ABEO Technology CO., Ltd

- Amcrest Technologies, LLC

- CNSLink Ltd.

- Cobra Electronics Corporation

- DigiLife Technologies Co. Ltd

- DOD Technologies, Inc

- FINEDIGITAL INC.

- Garmin Ltd.

- Lukas Dashcam

- Nexar Inc.

- Panasonic Corporation

- Pittasoft Co. Ltd.

- Qubo (Hero Electronix)

- Shenzhen Zhixingsheng Electronic Co., Ltd.

- STEELMATE COMPANY LIMITED

- TourMate

- WatchGuard Technologies, Inc.

- Waylens, Inc.

Recent Development

-

In October 2023, Qubo, a smart device brand owned by Hero Electronix, introduced new dashcam products called Dashcam Pro X and Dashcam Pro 3K, with advanced features such as GPS tracking, loop recording, time-lapse, and front and rear cameras to track vehicles in real-time.

-

In September 2023, Firsttech LLC, launched DroneMobile XC Dash Cam. It seamlessly integrates with compatible remote start and security systems so users can see what is happening in and around their cars in real-time.

-

In January 2023, Garmin Ltd. launched Garmin Dash Cam Live, which is connected to the LTE network and allows drivers to access a live exterior view of their vehicle.

-

In September 2021, WatchGuard Technologies, Inc. launched the new in-car video device system with artificial intelligence support. The device offers an array of solutions, including a dash camera, and is often used by the police.

Dashboard Camera Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.03 billion

Revenue forecast in 2030

USD 7.64 billion

Growth Rate

CAGR of 9.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Thousand Units and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Product, Video Quality, Application, Distribution Channel, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, U.K., France, Italy, Spain, China, India, Japan, South Korea, Australia & New Zealand, Malaysia, Singapore, Taiwan, Brazil, Mexico, Saudi Arabia, South Africa

Key companies profiled

ABEO Technology CO., Ltd; Amcrest Technologies, LLC; CNSLink Ltd.; Cobra Electronics Corporation; DigiLife Technologies Co. Ltd; DOD Technologies, Inc; FINEDIGITAL INC.; Garmin Ltd.; PPL, incorporated association; Nexar; Panasonic Corporation; Pittasoft Co. Ltd.; Qubo; Shenzhen Zhixingsheng Electronic Co., Ltd.; STEELMATE COMPANY LIMITED; WatchGuard Technologies, Inc.; Waylens, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dashboard Camera Market Report Scope

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dashboard camera market report based on technology, product, video quality, application, distribution channel, and region.

-

Technology Outlook (Revenue, USD Million, Volume, Thousand Units; 2018 - 2030)

-

Basic

-

Advanced

-

Smart

-

-

Product Outlook (Revenue, USD Million, Volume, Thousand Units; 2018 - 2030)

-

1-Channel

-

2-Channel

-

Rear View

-

-

Video Quality Outlook (Revenue, USD Million, Volume, Thousand Units; 2018 - 2030)

-

SD & HD

-

Full HD & 4K

-

-

Application Outlook (Revenue, USD Million, Volume, Thousand Units; 2018 - 2030)

-

Commercial Vehicle

-

Personal Vehicle

-

-

Distribution Channel Outlook (Revenue, USD Million, Volume, Thousand Units; 2018 - 2030)

-

Online

-

In-Store

-

-

Regional Outlook (Revenue, USD Million, Volume, Thousand Units; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

Malaysia

-

Singapore

-

Taiwan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dashboard camera market size was estimated at USD 3.68 billion in 2022 and is expected to reach USD 4.03 billion in 2023.

b. The global dashboard camera market is expected to grow at a compound annual growth rate of 9.6% from 2023 to 2030 to reach USD 7.64 billion by 2030.

b. Europe accounted for the highest dashboard camera market share of more than 33% in terms of revenue in 2022.

b. Some key players operating in the dashboard camera market include Garmin, Ltd., DigiLife Technologies Co., Ltd. (Affirmed by HP, Inc.), Cobra Electronics Corporation, Pittasoft Co., Ltd and Panasonic Corporation

b. Key factors that are driving the dashboard camera market growth include the rising awareness of vehicular safety, quicker insurance claims, and to protect against rising vehicle thefts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.