Data Acquisition System Market Trends

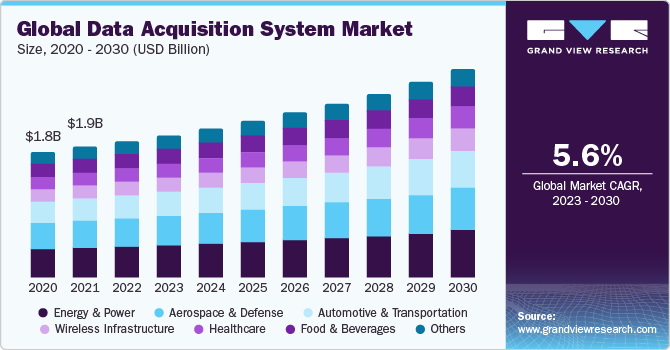

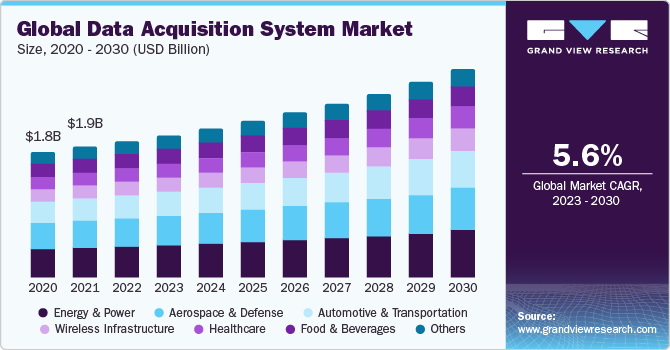

The global data acquisition system market size was valued at USD 1.94 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. This growth is primarily attributed to the increasing importance of data-driven decision-making across various industries. Companies are recognizing the value of real-time data analysis and monitoring, which is driving the demand for data acquisition systems. Innovations in sensor technology, connectivity, and data processing capabilities are leading to the development of more sophisticated data acquisition systems. These systems offer higher accuracy, faster data acquisition rates, and improved connectivity options, making them more effective and versatile tools for businesses.

The rise of the Internet of Things (IoT) has significantly influenced the Data Acquisition (DAQ) System Market. IoT-enabled data acquisition systems are gaining significant prominence, enabling remote monitoring and control of sensors and data from virtually anywhere. This trend is enhancing the flexibility and accessibility of data acquisition, particularly in applications that require real-time insights. Further, the increasing adoption of cloud-based data acquisition systems is a key trend in the Data Acquisition (DAQ) System Market. Cloud-based data acquisition systems offer several advantages, such as scalability, flexibility, and affordability.The development of new data acquisition technologies, such as artificial intelligence (AI) and machine learning (ML), is also contributing to the growth of the Data Acquisition (DAQ) System Market. AI and ML-powered data acquisition systems can automatically analyze data and identify patterns and trends that would be difficult or impossible for humans to identify.

Data acquisition systems have applications in a wide range of industries, including manufacturing, automotive, aerospace & defense, healthcare, energy, and environmental monitoring. Each industry has specific requirements for data collection, analysis, and reporting, and market participants are focusing on developing systems tailored to meet these diverse needs. Further, several systems are highly customizable to cater to the specific needs of different industries. This flexibility allows businesses to implement solutions that are precisely tailored to their unique data acquisition and analysis requirements, providing a competitive advantage.

Offering Insights

On the basis of offering, the market is segmented into hardware and software. The hardware segment accounted for the largest market share in 2022. The leading share is attributable to the essential role of hardware components as the foundation for data collection and its diverse requirements across various industries and applications. Hardware components, including sensors and signal conditioning devices, offer core functionality, ensuring the accuracy and reliability of data, and often need to operate as standalone systems in real-time environments. Their durability, regulatory compliance, interoperability, and a wide array of sensors and instruments make them indispensable, while cost considerations drive upfront investment priorities.

Speed Insights

On the basis of speed, the market is segmented intohigh-speed (>100 KS/S) and low-speed (<100 KS/S). The high-speed segment held the largest market share in 2022. This is owing to the increasing applications of high-speed data acquisition systems in a variety of industries, such as aerospace and defense, automotive, and healthcare, where there is a need to collect and process data quickly and accurately. Further, the development of new high-speed data acquisition technologies and the growing adoption of industrial automation and the Internet of Things (IoT) based technologies are also fostering the growth in demand for high-speed data acquisition systems.

Industry Vertical Insights

Based on industry vertical, the market is segmented into energy & power, automotive & transportation, aerospace & defense, wireless infrastructure, healthcare, food & beverages, and others. The aerospace and defense sector held the largest market share in 2022 due to the increasing complexity and critical nature of its systems. This industry deals with intricate systems like aircraft and defense equipment, where precise and real-time data acquisition is paramount for safety and reliability. Meeting stringent regulatory and safety standards is also a priority, leading to the adoption of advanced data acquisition systems to ensure accurate and reliable data collection. Additionally, the sector's focus on performance optimization has driven demand for data acquisition in monitoring and analyzing the efficiency and reliability of aircraft, engines, and critical components, contributing to the segment's growth.

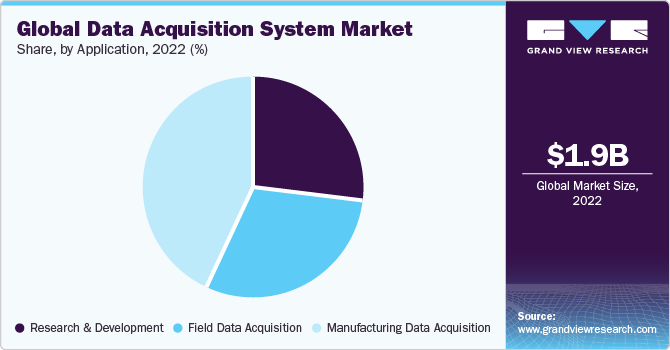

Application Insights

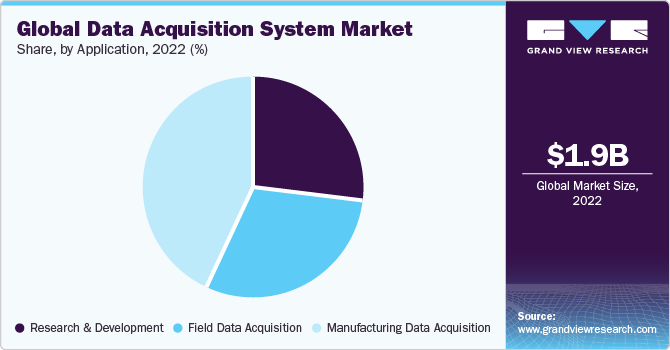

Based on application, the market is segmented into research & development, field data acquisition, and manufacturing data acquisition. The manufacturing data acquisition segment held the largest market share in 2022. The growing demand for automation and process control in the manufacturing industry is driving the growth of the manufacturing DAQ system market. The development of new data acquisition technologies, such as cloud-based data acquisition systems and industrial IoT (IIoT) data acquisition systems, is also contributing to the growth of this market.

Regional Insights

North America dominated the market with the largest revenue share in 2022, primarily due to a substantial number of early technology adopters in the region, driven by favorable governmental policy changes, increased industrial automation adoption, and emerging intelligent manufacturing initiatives. Industries in North America are prominently implementing digital transformation initiatives. This involves the use of data acquisition systems for process optimization, predictive maintenance, and quality control. The convergence of data acquisition, automation, and analytics is a notable trend ascending the market growth.

Further, Asia Pacific is expected to witness leading growth over the forecast period. This growth is attributed to the adoption of cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT), expanded production capacity, more stringent regulations governing product testing and measurement, and substantial government backing for the manufacturing sector. China, as the largest automotive market in the Asia Pacific, is a key driver of this trend, with the presence of multiple automotive original equipment manufacturers (OEMs) and production facilities fueling demand for data acquisition (DAQ) systems in the region.

Competitive Insights

Key players in the Data Acquisition (DAQ) System market include Emerson Electric Co., ABB Ltd., General Electric, Teledyne Technologies Inc., National Instruments Corp., Honeywell International Inc., Yokogawa Electric Corporation, Campbell Scientific Inc., imc Test & Measurement GmbH, Schneider Electric, AMETEK, Inc., Rockwell Automation Corporation, Dewetron GmbH, and Siemens AG. Vendors in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. In June 2023, imc Test & Measurement unveiled its latest modular data collection system known as imc ARGUSfit. This system comprises the imc ARGUSfit base unit and can be seamlessly combined with supplementary amplifier and fieldbus interface modules, including options like MAY FD. This modularity enables exceptional flexibility for applications in automotive and machinery testing and monitoring, allowing for easy and customizable assembly.