- Home

- »

- Next Generation Technologies

- »

-

Data Catalog Market Size & Share, Industry Report, 2030GVR Report cover

![Data Catalog Market Size, Share & Trends Report]()

Data Catalog Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Metadata Management Tools Type, By Deployment Mode, By Data Consumer, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-024-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Catalog Market Summary

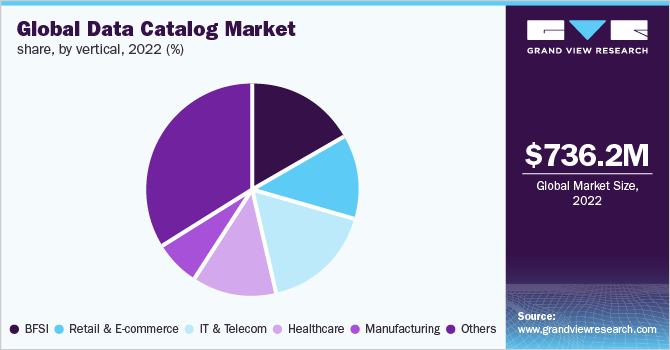

The global data catalog market size was valued at USD 736.2 million in 2022 and is expected to reach USD 3.86 billion by 2030, growing a compound annual growth rate (CAGR) of 23.2% from 2023 to 2030. A data catalog is a consolidated solution that gives authorized individuals easy access to company's most current and trustworthy business data.

Key Market Trends & Insights

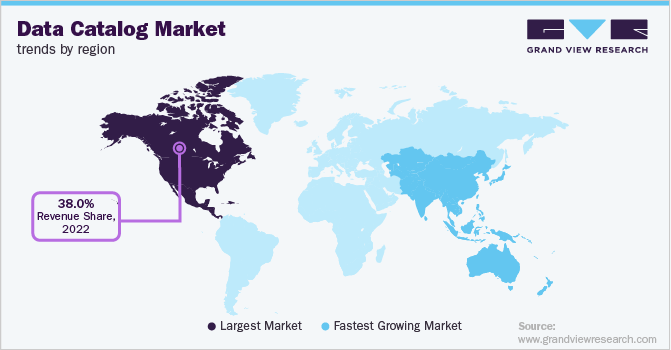

- North America dominated the market in 2022, accounting for over 38% share of the global revenue.

- By metadata management tools type, the technical metadata segment led the market in 2022, accounting for over 54% share of the global revenue.

- By deployment mode, the on-premises segment led the market in 2022, accounting for over 55% share of the global revenue.

- By data consumer, the enterprise applications segment witnessed the highest market share in 2022, accounting for over 43% of global revenue.

- By vertical, IT telecom segment alone held the largest revenue share of over 16% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 736.2 Million

- 2030 Projected Market Size: USD 3.86 Billion

- CAGR (2023-2030): 23.2%

- North America: Largest market in 2022

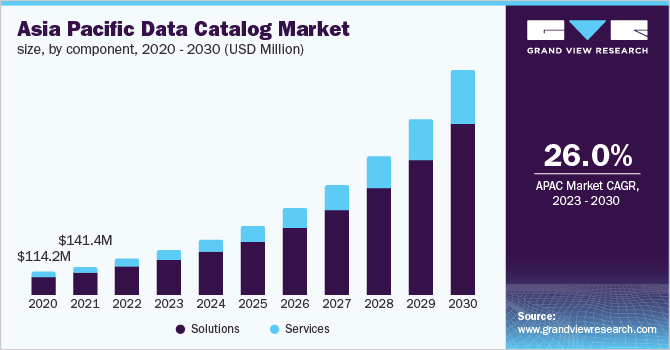

- Asia Pacific: Fastest growing market

It acts as a repository for all information and data sources in a company, enabling technical and commercial users to search, order, and get datasets needed to finish projects, carry out everyday business operations, and produce analytical reports. Data cataloging is becoming essential for every large firm due to the abundance of data. Additionally, data visualization approaches that create a narrative can have significant advantages once the data cataloging system has been established. Modern data catalogs gather metadata from numerous data sources, such as cloud object storage, data lakes, data warehouses, and NoSQL databases. The more sophisticated digital workplace platforms provide data catalog features to offer a sole source of reliable information. It is important for organizations to choose a data catalog that features versatile searching and filtering capabilities, gathers technical metadata from various connected data assets, and is automated using AI and machine learning.

The extraction of insights from incoming data is extremely relevant as Internet of Things (loT) grows. The majority of unstructured data, including email exchanges, account details, and previous iterations of linked documents gathered from numerous sources, does not aid in business decision-making. Therefore, firms choose data catalogs to synthesize and arrange their corporate data from multiple sources into one clear and easy format. Data catalog solutions are being used by several industry verticals, including banking, financial services, and insurance (BFSI), healthcare, retail, and e-commerce, to produce insightful data that helps them formulate business plans and make crucial business decisions.

A data catalog can be built using a variety of tools and strategies. Using third-party tools or custom-building toolsets is an option, and both have benefits and disadvantages. Despite lower overall tool and licensing costs, acquiring, ingestion, and presenting a custom data catalog to users requires more time and effort. The time taken to acquire, process, and present metadata is reduced using third-party solutions as they offer ready-to-use functionality. However, the total cost of the tool and the license is more.

Component Insights

The solution segment projected the highest revenue share of over 79% in 2022 and the segment is anticipated to hold the maximum share throughout the forecast period. A data catalog solution is a cooperative workspace for various data users to explore an enterprise's data environment. Owing to a data catalog solution, users can discover, understand, and trust an organization's data assets. Tables, BI dashboards, views, columns, ETL logs, categories, SQL queries, and notebooks are a few instances of data assets.

The services segment is estimated to grow significantly over the forecast period. By utilizing metadata management services, a business improves the quality of its data while enabling better visibility and traceability. Most data catalog services offer a lineage of data across platforms, pipelines, datasets, graphs, dashboard services, summary statistics, and tagging and documenting skills. For instance, in July 2020, Compact Solutions was acquired by Informatica to increase the company's capacity for extended metadata processing. The acquisition reinforces Informatica's current position in automation and AI powered by metadata. By comprehending and prioritizing all data and determining how it should be handled and transferred, Informatica Enterprise Data Catalog, with the advanced metadata connectivity from Compact Solutions, will speed up analytics, data governance, privacy, and data warehouse modernization activities.

Metadata Management Tools Type Insights

The technical metadata segment led the market in 2022, accounting for over 54% share of the global revenue. The prominent use of data governance and management is expected to cause the market to dominate at a growth rate. Technical properties that are crucial for the presentation of data are referred to as technical metadata. These physical characteristics help in the loading of information from primary sources. Technical metadata organizes the many data sources and associated attributes, such as data source, location, credentials, and mapping, and includes structural information, such as foreign key attributes. Physical database tables, backup policies, access restrictions, mapping documentation, and many more are a few examples of technical information.

The business metadata segment is estimated to grow significantly over the forecast period. Business metadata focuses on giving data context inside the enterprise. Business metadata also maps the relationships between items in a data catalog, such as those between databases, datasets, and columns. All types of information can be cataloged using enterprise-level software. For instance, an enterprise's Business Semantics Management (BSM) involves tools and processes to manage the business metadata and minimize ambiguities.

Deployment Mode Insights

The on-premises segment led the market in 2022, accounting for over 55% share of the global revenue. However, demand for on-premises deployment is expected to witness a drastic decline in the forecast years due to the high cost associated with it. In addition to the initial capital expenditure needed to buy servers and other gear, organizations must also spend money to upgrade or repair the system. Hardware often breaks down and needs to be replaced, and as replacements need to be done annually, additional costs also increase.

The cloud segment is estimated to grow significantly over the forecast period. Due to the many advantages of cloud deployment, cloud-based data catalog solutions are outpacing on-premises alternatives. These advantages include reduced operational expenses, straightforward deployments, and greater scalability in networked resources. Cloud-based solutions provide a comprehensive set of transformation procedures to achieve business goals. They also give businesses using real-time analysis more operational freedom and simplify real-time deployment. For instance, TIBCO Software, AWS, and IBM are significant cloud data catalog solution providers.

Data Consumer Insights

The enterprise applications segment witnessed the highest market share in 2022, accounting for over 43% of global revenue. A data catalog in an enterprise application aims at making the data inventory of an organization accessible to all users. The market for enterprise applications is expanding due to the rising demand from organizations for a single solution to assist them in resolving business issues. Enterprise application software, which can be tailored for particular business needs and deployed across corporate networks on various platforms, is used by businesses. It integrates several applications, including customer relationship management (CRM), business intelligence, supply chain management, and e-commerce systems. These apps improve employee performance as the number of mobile users in organizations increases. Additionally, this helps to enhance communication and boosts organizational effectiveness.

The business intelligence tools segment is estimated to grow significantly over the forecast period. Business intelligence (BI) integrates business analytics, data mining, data visualization, infrastructure, data tools, and best practices to assist organizations in making more data-driven decisions. To conduct efficient analytics, business intelligence teams use data catalogs to centralize dashboards and automate reporting. BI is expanding as businesses need assistance with various business-related choices using statistical modeling techniques. For creating and managing data models, algorithms, and queries, BI tools such as Hadoop demand in-depth technical knowledge. BI tools are fed with vast volumes of data to develop a deep level of expertise used to produce useful results. This demand has led to BI tools being one of the biggest data consumers in the data catalog market.

Vertical Insights

The IT telecom segment alone held the largest revenue share of over 16% in 2022. The highest share can be attributed to the vast network metadata used in the industry. Network metadata provides comprehensive details of network communications by keeping a record of all communications within the current network architecture, such as switches, firewalls, routers, and packet brokers. As an analyzer gathers packet data, sorted, processed, and indexed with graphs and statistics regarding network traffic, usage, capacity, and application performance, network metadata is scalable and can enable full network monitoring. Technical metadata and business metadata are fundamentally information about data. Most security agencies also rely on metadata insights while building these security solutions.

The BFSI segment is predicted to foresee significant growth in the forecast years. The segment growth is attributed to the high importance of data governance in the sector. The data catalog displays a business's data assets and locations, while data governance identifies data owners and consumers. It aids users in managing their data. As a result, many data users know where to turn whenever a data query arises. Increasing data volumes have prompted data catalogs to become essential tools in the portfolio of data governance capabilities. The enterprise framework offered by data governance also promotes teamwork and collaboration among data users in various departments to synthesize all the technical and commercial information of an organization's data assets.

Regional Insights

North America dominated the market in 2022, accounting for over 38% share of the global revenue. The extensive use of digital technology and the expanding demand for business intelligence solutions have expanded across North America. A tremendous demand for data catalog systems and services has been generated by the acceptance of self-service analytics, rapid traditional organization expansion, and gathering of enormous volumes of data from all industries. These elements have fueled the data catalog market's expansion in the area.

Asia Pacific is anticipated to register the highest CAGR from 2023 to 2030. A significant share of datasets is produced in the region due to pervasive digitalization. Therefore, it has increased the demand for data catalog services and helped the business in this area expand. Additionally, as more individuals in the APAC region use applications to accomplish their everyday duties, the region's mobile and web application development is growing quickly. Most mobile and online applications require access to vast amounts of corporate data, allowing for interoperability between those platforms and enterprise systems, thus driving market growth. Mobile and online apps use standard protocols, mobile-first libraries, and infrastructure to specify and expose multiple data sources that operate on various mobile and web-based platforms.

Key Companies & Market Share Insights

Notable companies have adopted product launches and developments as their main business strategy to grow their market share, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, collaborations, and spur invention. Companies are acquiring early data catalog suppliers with more extensive product lines. For instance, in January 2020, Hitachi Vantara bought Waterline. Integrating Waterline Data technology with Hitachi Vantara's Lumada Data Services lineup will make a common metadata framework available to customers to mitigate data silos dispersed throughout the data center, cloud, and machines and devices at the edges of their networks. Customers can quickly acquire insights and stimulate innovation by applying DataOps to unified datasets. At the same time, suppliers with different backgrounds are expanding their toolkits to include data cataloging, including Tableau, Alteryx, IBM Watson, and Informatica. Some of the most recent arrivals into the market for data management have a categorization of data built in from the beginning. According to Ramesh Menon, Product Management VP at Infoworks, it is impossible to perform DataOps without a data catalog. Some of the prominent players in the global data catalog market include:

-

Alation Inc.

-

Apache Software Foundation

-

Hitachi Vantara Corporation

-

IBM Corporation

-

Informatica Inc.

-

Microsoft Corporation

-

Oracle Corporation

-

Precisely Inc.

-

Talend Inc.

-

Zaloni, Inc.

Recent Developments

-

In May 2023, Precisely announced the launch of Precisely Data Integrity Suite, a unified data catalog system. It enables customers to quickly integrate data into the cloud, and gain an easy access to other data capabilities

-

In October 2021, Alation Inc. announced the acquisition of Lyngo Analytics, a California based company. The acquisition aimed at creating better user experience within the data catalog, and improving data intelligence

-

In June 2021, Hitachi Vantara acquired Io-Tahoe, a data management innovator. The acquisition aimed to use Io-Tahoe's AI-driven data management software in Hitachi Vantara’s Lumada DataOps Suite to enhance the data integration, and catalog capabilitie

Data Catalog Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 896.6 million

Revenue forecast in 2030

USD 3.86 billion

Growth rate

CAGR of 23.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, metadata management tools type, deployment mode,data consumer, vertical, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Brazil.

Key companies profiled

Alation Inc.; Apache Software Foundation; Hitachi Vantara Corporation; IBM Corporation; Informatica Inc; Microsoft Corporation; Oracle Corporation; Precisely Inc.; Talend Inc.; Zaloni, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Catalog Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global data catalog market report based on component, metadata management tools, deployment mode, data consumer, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solutions

-

Standalone Solution

-

Integrated Solution

-

-

Services

-

Professional Service

-

Support and Maintenance Services

-

Consulting Services

-

Deployment and Integration Services

-

-

Managed Services

-

-

-

Metadata Management Tools Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Business Metadata

-

Technical Metadata

-

Operational Metadata

-

-

Deployment Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Data Consumer Outlook (Revenue, USD Million, 2017 - 2030)

-

Business Intelligence Tools

-

Data Integration and ETL

-

Reporting and Visualization

-

Query and Analysis

-

-

Enterprise Applications

-

ERP

-

Supply chain management system

-

-

Mobile and Web Applications

-

Heat Map Analytics

-

Web Behavioral Analysis

-

Market Automation

-

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail & E-commerce

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million,2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global data catalog market size was estimated at USD 736.2 million in 2022 and is expected to reach USD 896.6 million in 2023.

b. The global data catalog market is expected to grow at a compound annual growth rate of 23.2% from 2023 to 2030 to reach USD 3.86 billion by 2030.

b. North America dominated the data catalog market with a share of 39.9% in 2022. This is attributable to the extensive use of digital technology and the expanding demand for business intelligence solutions in the region.

b. Some key players operating in the data catalog market include Alation Inc.; Apache Software Foundation; Hitachi Vantara Corporation; IBM Corporation; Informatica Inc; Microsoft Corporation; Oracle Corporation; Precisely Inc.; Talend Inc.; and Zaloni, Inc.

b. Key factors that are driving market growth include an abundance of data in large firms and the need for data visualization to manage, analyze and interpret big data to form business strategies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.