- Home

- »

- Communications Infrastructure

- »

-

Data Center Automation Market Size And Share Report, 2030GVR Report cover

![Data Center Automation Market Size, Share & Trends Report]()

Data Center Automation Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-008-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Automation Market Summary

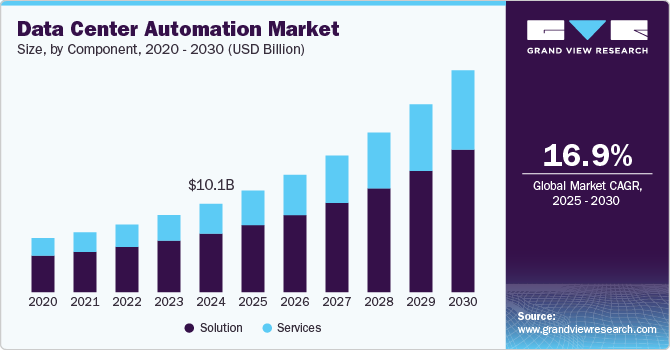

The global data center automation market size was estimated at USD 10,091.9 million in 2024 and is projected to reach USD 25,392.5 million by 2030, growing at a CAGR of 16.9% from 2025 to 2030. The growth is primarily driven by the escalating demand for efficiency, scalability, and reduced operational costs in managing modern data centers.

Key Market Trends & Insights

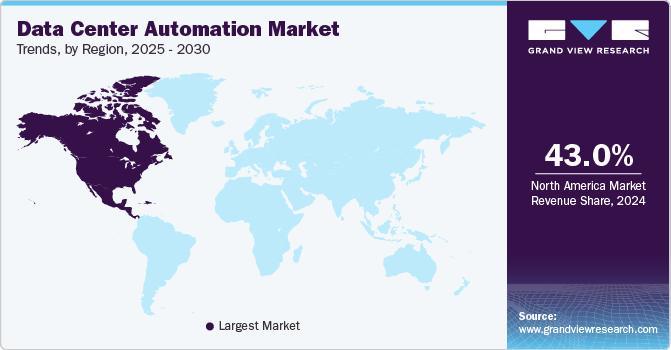

- North America data center automation market held the major share of over 43% in 2024.

- The U.S. is expected to grow significantly from 2025 to 2030.

- By component, the solution segment accounted for the largest market share of over 66% in 2024.

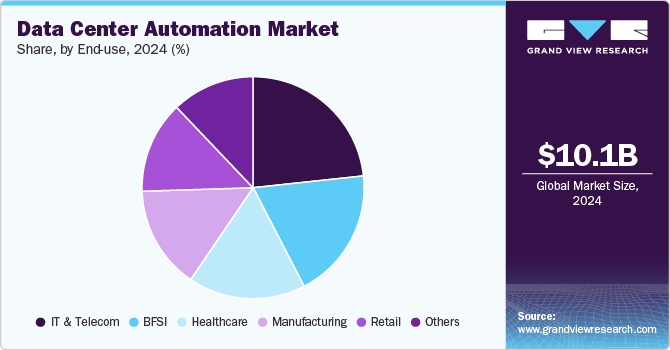

- By end-use, the IT & telecom segment accounted for the largest market share of about 23% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10,091.9 Million

- 2030 Projected Market Size: USD 25,392.5 Million

- CAGR (2025-2030): 16.9%

- North America: Largest market in 2024

As enterprises increasingly migrate to hybrid and multi-cloud environments, the need for automated systems to manage complex IT infrastructures has grown significantly.

Automation technologies enable data centers to streamline workflows, enhance resource allocation, and minimize human intervention, thereby reducing the potential for error and downtime. In addition, advancements in AI and machine learning are further propelling automation capabilities, enabling predictive maintenance, optimized energy usage, and improved system resilience. Rising data volumes from digital transformation initiatives across sectors such as finance, healthcare, and retail are also fueling this demand as companies seek to manage large datasets more effectively while ensuring compliance and security.

The escalating demand for efficiency, scalability, and reduced operational costs in managing modern data centers is a key driver of the data center automation market. As organizations face growing complexities in data management, fueled by surging data volumes and the adoption of hybrid and multi-cloud infrastructures, they increasingly seek automation solutions to streamline operations. Automation enables data centers to optimize resource allocation, enhance workload management, and lower operational expenses by reducing reliance on manual processes, which are often time-consuming and prone to error. Scalability, a critical requirement for adapting to fluctuating workloads, is supported by automation tools that allow data centers to adjust capacity without significant cost increases dynamically. Furthermore, automation mitigates downtime risks, enhances resilience, and enables predictive maintenance, thus directly contributing to cost efficiency and operational stability. This convergence of needs positions data center automation as essential for modern enterprises striving to remain competitive and agile in an increasingly data-intensive environment.

The growing awareness about the advances in the latest technologies and the growing use of solutions based on automation is expected to drive the growth of the data center automation market across various industries over the forecast period. Increasing automation trends in the manufacturing and healthcare industries are gaining global traction, which is driving the growth of the market. Several manufacturing companies are embracing data center automation to reduce operational expenses (OPEX) and increase the entire manufacturing process's effectiveness.

The rise of cloud computing, artificial intelligence, and machine learning to support data center management means less monotonous activities and more time and energy for high-level issues. The transition to AI-powered computing is also having a huge impact on data centers. Data center workers can prepare for the AI computing transition by broadening their understanding of AI and machine learning as applied to application use cases. This allows the business to develop new services and products and achieve a competitive advantage in the market.

Component Insights

The solution segment accounted for the largest market share of over 66% in 2024, driven by the need for integrated platforms that can streamline data center operations and enhance overall infrastructure efficiency. Solutions, including automation software and infrastructure management tools, enable organizations to automate repetitive tasks, optimize resource allocation, and improve data center uptime. These solutions also facilitate seamless integration with existing IT environments, allowing for more flexible and scalable infrastructure management. As data centers grow in complexity, organizations are increasingly investing in comprehensive solutions to reduce operational bottlenecks, enhance performance, and improve energy efficiency.

The services segment is expected to grow at a significant rate during the forecast period, propelled by the rising demand for expertise and support in implementing, maintaining, and optimizing automated data center systems. Services, such as consulting, integration, and managed services, are essential for organizations seeking to customize automation tools to meet specific operational needs and ensure smooth implementation. Moreover, ongoing support and maintenance services are crucial for sustaining performance, mitigating cybersecurity risks, and keeping automation systems up to date. As businesses face rapid technological changes, they rely on service providers to deliver expert insights, continuous support, and strategic guidance to maximize the long-term value of their automation investments.

Deployment Insights

The on-premise segment accounted for the largest market share in 2024, largely driven by organizations prioritizing data security, control, and regulatory compliance. On-premise solutions enable companies to maintain direct oversight over their infrastructure, which is particularly crucial for industries handling sensitive data, such as finance, healthcare, and government. This deployment approach allows for tailored security protocols and ensures that data resides within a controlled environment, mitigating potential risks associated with third-party data management. In addition, companies with legacy systems or specific operational requirements find on-premise automation beneficial for seamless integration and customization, supporting unique workloads and compliance standards without sacrificing control or visibility.

The cloud segment is expected to grow at a significant rate during the forecast period, propelled by the growing need for scalability, flexibility, and cost-effectiveness in data center management. Cloud-based automation allows organizations to expand or reduce their infrastructure dynamically, enabling agile responses to fluctuating workloads without the need for significant capital investments in physical infrastructure. This model supports a faster deployment of automation tools, reduces maintenance overhead, and enables remote management, which is advantageous for global enterprises and distributed teams. Furthermore, advancements in cloud security and compliance frameworks are alleviating concerns over data privacy, making cloud-based automation increasingly viable across various industries looking to streamline operations, enhance resilience, and lower operational costs.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2024. The adoption of the data center automation market among large enterprises is primarily driven by their need to manage vast, complex IT infrastructures with greater efficiency, scalability, and resilience. With extensive data volumes and highly distributed environments, large organizations seek automation solutions to streamline workflows, reduce manual oversight, and optimize resource utilization. Automation tools enable large enterprises to minimize downtime, lower operational costs, and respond to growing demands for data processing and storage while ensuring compliance with regulatory requirements. In addition, automation supports robust security measures, predictive maintenance, and real-time monitoring, all of which are essential for enterprises managing critical operations on a global scale. This focus on improving operational agility and resilience makes data center automation a strategic investment for large enterprises.

The small & medium enterprise segment is expected to grow at a significant rate during the forecast period. For small and medium enterprises (SMEs), the adoption of data center automation is largely driven by the need for cost efficiency, agility, and simplified IT management. SMEs often operate with limited resources, making automation a valuable tool for optimizing operational processes without requiring extensive human intervention. Automation solutions enable SMEs to improve productivity, maintain uptime, and scale their infrastructure as their business grows without incurring significant costs. In addition, by automating routine tasks, SMEs can allocate their resources toward innovation and growth-focused initiatives. The cloud-based deployment of automation solutions is particularly appealing to SMEs, offering flexible, affordable options that eliminate the need for substantial capital investments in physical infrastructure while still providing robust support for their evolving IT needs.

End-use Insights

The IT & telecom segment accounted for the largest market share of about 23% in 2024, primarily driven by the industry’s need to manage vast data volumes, maintain network uptime, and deliver seamless digital services. As digital connectivity and mobile data usage surge, IT and telecom companies rely on automation to streamline data center operations, optimize resource allocation, and minimize manual processes. Automation enables them to support rapid scaling, handle unpredictable workloads, and ensure high availability for critical infrastructure. Moreover, data center automation supports proactive monitoring, predictive maintenance, and robust security protocols, which are essential for minimizing downtime and maintaining uninterrupted service delivery in this highly competitive and fast-evolving industry. As IT and telecom companies expand their infrastructure to support 5G, IoT, and other advanced technologies, automation provides the necessary operational agility and efficiency to keep pace with these advancements.

The BFSI segment is expected to grow at a significant rate during the forecast period. In the BFSI sector, the adoption of data center automation is primarily driven by stringent regulatory requirements, data security needs, and the demand for operational efficiency. Financial institutions handle sensitive and high-volume transactions, which require consistent reliability, speed, and security. Automation in data centers helps BFSI companies achieve greater control over their IT environments, ensuring compliance with industry regulations, enhancing data protection, and reducing the risks associated with human error. In addition, automation enables real-time data processing, reduces latency, and supports 24/7 operational continuity, all of which are critical for financial transactions and customer services. With automation, BFSI organizations can improve disaster recovery capabilities, enhance fraud detection, and manage their IT resources more efficiently, enabling them to adapt to changing market demands and deliver secure, uninterrupted services to customers.

Regional Insights

North America data center automation market held the major share of over 43% in 2024. In North America, the market is witnessing a significant trend towards hybrid cloud environments, driven by the increasing adoption of multi-cloud strategies among enterprises. Organizations are seeking to integrate their on-premise infrastructure with cloud services to enhance flexibility and scalability while optimizing operational costs. Furthermore, there is a growing emphasis on advanced technologies such as AIML for predictive analytics and intelligent automation, which help in optimizing resource allocation and improving operational efficiency.

U.S. Data Center Automation Market Trends

The data center automation market in the U.S. is expected to grow significantly from 2025 to 2030. Edge computing is becoming increasingly important in Data Center Automation (EDM) as companies in the U.S. are looking to process data closer to its source, especially with the growth of the Internet of Things (IoT) devices. This approach reduces latency and bandwidth usage by performing data processing and analysis at the edge of the network, which is crucial for applications that require real-time insights and actions.

Europe Data Center Automation Market Trends

The data center automation market in Europe is growing significantly at a CAGR of over 16% from 2025 to 2030. In Europe, the market is characterized by a strong focus on sustainability and energy efficiency. European organizations are increasingly adopting automation solutions that enable better resource management and reduce energy consumption, aligning with the region's stringent environmental regulations and sustainability goals. The trend towards green data centers is gaining momentum, with businesses investing in technologies that optimize cooling systems, energy usage, and waste management processes.

The UK data center automation market is expected to grow rapidly in the coming years. In the UK, data center automation is driven primarily by rapid digital transformation across industries. With a focus on improving operational efficiency, reducing energy consumption, and meeting sustainability goals, enterprises are increasingly adopting automation solutions. The government's emphasis on digital infrastructure development and the rising demand for cloud computing further bolster the market.

The Germany data center automation market held a substantial market share in 2024. Germany's data center automation market is propelled by the country's established industrial base and commitment to Industry 4.0. The need to streamline data center operations and support IoT-based initiatives encourages automation. In addition, strict regulations regarding data security and energy efficiency push organizations toward advanced automation to ensure compliance.

Asia Pacific Data Center Automation Market Trends

The data center automation market in the Asia Pacific is growing significantly at a CAGR of over 18% from 2025 to 2030. In the Asia Pacific region, the market is experiencing rapid growth, driven by the expanding digital transformation initiatives across various industries. The increasing demand for cloud services and the proliferation of data centers in emerging economies are fostering a heightened focus on automation to streamline operations and manage the growing data influx. In addition, governments and enterprises are investing in infrastructure development and smart technologies, leading to a surge in the adoption of automation solutions that enhance efficiency, scalability, and cost-effectiveness.

The China data center automation market held a substantial market share in 2024. China's data center automation market benefits from strong government support for technology development. The rapid expansion of internet services, cloud adoption, and e-commerce drive the need for efficient data centers. Furthermore, automation is crucial to managing large-scale data facilities and reducing operational costs in this highly competitive environment.

The Japan data center automation market held a substantial market share in 2024. In Japan, the data center automation market is influenced by the country's focus on technology-driven innovation. Automation is essential in Japan's aging workforce context, where labor shortages make efficient data center management critical. Furthermore, the growth of AI and IoT solutions in Japan has heightened the need for automated data centers to support complex, data-intensive applications.

In India, the data center automation market is growing rapidly, driven by the rise of digital initiatives across sectors. India's data center automation market is growing due to increasing digitalization and the government's Digital India initiative. The demand for seamless data management from sectors such as telecom, IT, and BFSI is pushing companies toward automation to enhance productivity. In addition, the rise of cloud services and edge computing contributes to the adoption of data center automation solutions.

Key Data Center Automation Company Insights

Key players operating in the data center automation market include ABB, BMC Software, Inc., Cisco Systems, Inc., Citrix Systems, Inc., FUJITSU, Hewlett Packard Enterprise Development LP, Microsoft, Oracle, ServiceNow, and VMWare. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, ATS Global announced a partnership with ABB that enhances its capabilities in data center automation. This collaboration enables the design and implementation of solutions utilizing ABB Ability, ABB's platform for the control, monitoring, and optimization of mission-critical data center infrastructure, incorporating mechanical (BMS), electrical (EPMS), DCIM, and SCADA functionalities. ABB Ability offers numerous advantages, including the elimination of manual data entry for utilization metrics and other KPIs, real-time access to both aggregate and granular overviews of data center infrastructure, and the automation of cooling and electrical systems for continuous optimization and improved uptime. Coupled with the organization's extensive experience in over 100 mission-critical projects, this partnership is expected to enhance customer uptime and increase system availability, supported by prompt local assistance.

-

In June 2024, Cisco Systems announced a series of advancements intended to transform data center infrastructure, IT operations, and enterprise defenses. In collaboration with NVIDIA, Cisco introduced the Cisco Nexus HyperFabric AI cluster solution, an innovative end-to-end arrangement designed to expand generative AI workloads efficiently. This solution incorporates Cisco’s AI-native networking abilities with NVIDIA’s AI software and accelerated computing, further enhanced by VAST’s robust data storage platform.

Key Data Center Automation Companies:

The following are the leading companies in the data center automation market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- BMC Software, Inc.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- FUJITSU

- Hewlett Packard Enterprise Development LP

- Microsoft

- Oracle

- ServiceNow

- VMWare

Data Center Automation Market Report Scope

Report Attribute

Details

Market size in 2025

USD 11.61 billion

Revenue forecast in 2030

USD 25.39 billion

Growth rate

CAGR of 16.9% from 2025 to 2030

Base year

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB, BMC Software, Inc.; Cisco Systems, Inc.; Citrix Systems, Inc., FUJITSU; Hewlett Packard Enterprise Development LP; Microsoft; Oracle; ServiceNow; VMWare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center automation market report based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Storage

-

Server

-

Network

-

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Retail

-

Healthcare

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center automation market size was estimated at USD 10.09 billion in 2024 and is expected to reach USD 11.61 billion in 2025

b. The global data center automation market is expected to grow at a compound annual growth rate of 16.9% from 2025 to 2030 to reach USD 25.39 billion by 2030

b. North America region dominated the data center automation market with a share of over 43% in 2024. In North America, the data center automation market is witnessing a significant trend towards hybrid cloud environments, driven by the increasing adoption of multi-cloud strategies among enterprises. Organizations are seeking to integrate their on-premise infrastructure with cloud services to enhance flexibility and scalability while optimizing operational costs.

b. Some key players operating in the data center automation market include ABB, BMC Software, Inc., Cisco Systems, Inc., Citrix Systems, Inc., FUJITSU, Hewlett Packard Enterprise Development LP, Microsoft, Oracle, ServiceNow, and VMWare

b. The data center automation market is primarily driven by the escalating demand for efficiency, scalability, and reduced operational costs in managing modern data centers. As enterprises increasingly migrate to hybrid and multi-cloud environments, the need for automated systems to manage complex IT infrastructures has grown significantly. Automation technologies enable data centers to streamline workflows, enhance resource allocation, and minimize human intervention, thereby reducing the potential for error and downtime.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.