- Home

- »

- Next Generation Technologies

- »

-

Data Center Construction Market Size, Industry Report, 2030GVR Report cover

![Data Center Construction Market Size, Share, & Trends Report]()

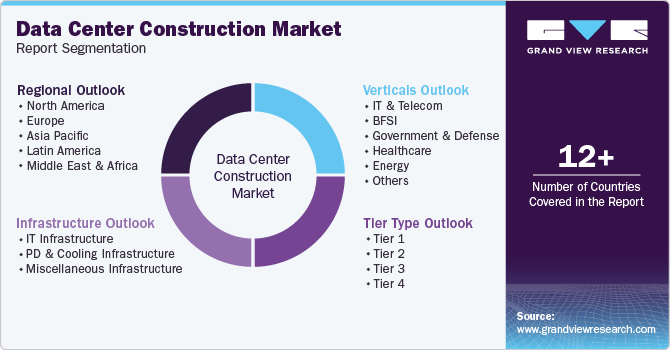

Data Center Construction Market (2025 - 2030) Size, Share, & Trends Analysis Report By Infrastructure (IT Infrastructure, PD and Cooling Infrastructure, Miscellaneous Infrastructure), By Tier Type, By Verticals, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-585-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Construction Market Summary

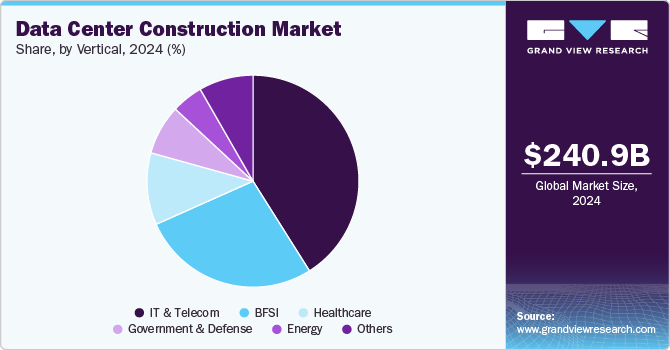

The global data center construction market size was estimated at USD 240.97 billion in 2024 and is projected to reach USD 456.50 billion by 2030, growing at a CAGR of 11.8% from 2025 to 2030, driven by the rising demand for digital infrastructure across industries. The rapid expansion of cloud computing, the proliferation of big data, and the increased adoption of artificial intelligence (AI) and Internet of Things (IoT) devices are major contributors.

Key Market Trends & Insights

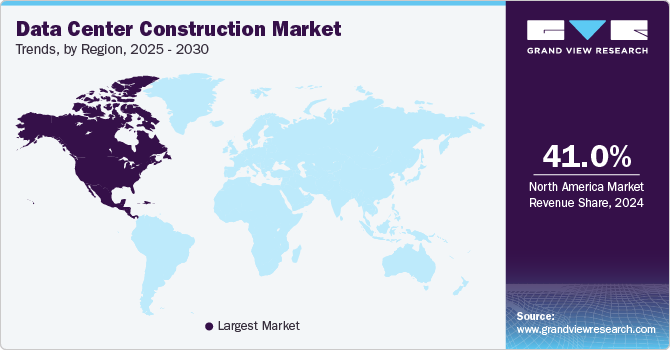

- North America held a significant share of over 41.0% in 2024.

- The U.S. is expected to grow significantly at a CAGR of 10.2% from 2025 to 2030.

- By infrastructure, the IT infrastructure segment accounted for the largest market share of over 81% in 2024.

- By tier type, the tier 3 segment dominated the market and accounted for a revenue share of over 58.0% in 2024.

- By vertical, the IT & telecom segment dominated the market and accounted for a revenue share of over 41.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 240.97 billion

- 2030 Projected Market Size: USD 456.50 billion

- CAGR (2025-2030): 11.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enterprises increasingly rely on cloud service providers (CSPs) and colocation data centers to manage large volumes of data, necessitating the construction of new, high-capacity facilities. In addition, the rise of edge computing is encouraging the establishment of smaller, localized data centers to reduce latency and support real-time data processing. The increasing investments from hyperscale data center operators such as Amazon Web Vertical (AWS), Microsoft Azure, and Google Cloud are also driving the data center construction industry’s growth. These companies are expanding their global footprint to meet the growing demand for cloud storage and computing power.

In March 2025, Thailand's investment board announced the approval of investments of USD 2.7 billion in data centers and cloud verticals. Among the approved projects are Beijing Haoyang Cloud & Data Technology data centers from China, Empyrion Digital from Singapore, and Thailand's GSA Data Center 02. Furthermore, technological advancements such as 5G networks and AI applications drive the need for high-performance computing infrastructure, fueling data center construction projects worldwide. Governments are also offering incentives and supporting digital infrastructure initiatives, further propelling market growth.

Sustainability and energy efficiency are becoming central to data center construction. Operators focus on building green data centers with efficient cooling systems, renewable energy sources, and innovative designs to minimize carbon footprints. The adoption of modular data center construction methods is also gaining traction, offering quicker deployment and scalability. Furthermore, the growing demand for data center redundancy and disaster recovery tier types is leading to the construction of Tier III and Tier IV data centers, ensuring uninterrupted operations and enhancing business continuity.

Moreover, the increasing data privacy regulations and the need for data sovereignty encourage enterprises to establish regional data centers. Countries are mandating localized data storage, leading to a surge in data center construction projects in emerging markets. As organizations prioritize digital transformation and adopt hybrid cloud models, the demand for robust, scalable, and efficient data center infrastructure will continue to drive market expansion.

Infrastructure Insights

The IT infrastructure segment accounted for the largest market share of over 81% in 2024. The IT infrastructure segment comprises networking equipment, servers, and storage sub-segments. The segment's growth is driven by the increasing demand for high-performance computing and storage tier types. With the rapid expansion of cloud computing, big data analytics, and artificial intelligence (AI) applications, organizations require robust IT infrastructure to process and manage vast amounts of data efficiently. Enterprises and cloud service providers (CSPs) are investing heavily in advanced servers, storage devices, and networking equipment to ensure seamless data management, contributing to the expansion of the IT infrastructure segment.

The PD and cooling infrastructure segment is anticipated to grow at a CAGR of 14.9% during the forecast period. The PD and cooling infrastructure segment consists of power distribution and cooling sub-segments. The segment's growth is driven by the increasing demand for efficient and reliable power management systems. As data centers continue to scale in size and capacity to meet the growing needs of cloud computing, artificial intelligence (AI), and big data analytics, ensuring uninterrupted power supply has become a top priority. Organizations invest in advanced power distribution units (PDUs), uninterruptible power supply (UPS) systems, and backup generators to minimize downtime and enhance operational resilience.

Tier Type Insights

The tier 3 segment dominated the market and accounted for a revenue share of over 58.0% in 2024, driven by the increasing need for reliable and scalable data storage and processing infrastructure. The surge in data generation from technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) is contributing to the expansion of the Tier 3 segment. Businesses dealing with large-scale data analytics, video streaming, and e-commerce platforms require data centers that ensure seamless operations without service disruptions.

The tier 2 is second highest growing segment over the forecast period, driven by the increasing demand for cost-effective infrastructure tier types, particularly from small and medium-sized enterprises (SMEs) and regional service providers. With the growth of edge computing and the Internet of Things (IoT), businesses are deploying Tier 2 facilities closer to end users to reduce latency and enhance application performance. These data centers are often strategically located in regional areas where large-scale, hyperscale facilities may not be viable, providing critical infrastructure for latency-sensitive applications like content delivery networks (CDNs), telecommunication verticals, and remote healthcare tier types.

Vertical Insights

The IT & telecom segment dominated the market and accounted for a revenue share of over 41.0% in 2024, driven by the exponential rise in data consumption, increasing cloud adoption, and the expansion of digital infrastructure. As IT companies and telecom operators accelerate their digital transformation initiatives, the need for robust data centers to store, process, and manage vast volumes of data has surged. Data-intensive applications like video streaming, cloud gaming, and enterprise software verticals contribute to this growth, compelling companies to invest in large-scale data center construction projects.

The BFSI segment is expected to grow at a significant CAGR over the forecast period, driven by the rapid digitalization of financial verticals and the increasing adoption of cloud-based tier types. Financial institutions increasingly rely on data centers to store, manage, and analyze vast amounts of data generated from transactions, online banking, mobile applications, and digital payment platforms. The demand for real-time data processing, low-latency vertical, and enhanced customer experiences is pushing banks and insurers to invest in modern data center infrastructure.

Regional Insights

The data center construction market in North America held a significant share of over 41.0% in 2024, driven by the increasing demand for cloud verticals, the proliferation of data-intensive applications, and the rapid digital transformation across industries. The region's dominance in global cloud computing, led by major cloud service providers (CSPs) like Amazon Web Vertical (AWS), Microsoft Azure, and Google Cloud, is fueling the expansion of hyperscale data centers. These companies continuously invest in large-scale facilities to accommodate growing workloads from enterprises migrating to the cloud, contributing to the overall market growth.

U.S. Data Center Construction Industry Trends

The U.S. data center construction market is expected to grow significantly at a CAGR of 10.2% from 2025 to 2030, driven by the dominance of cloud service providers (CSPs) and the increasing adoption of artificial intelligence (AI) and big data analytics. Major companies like Amazon Web Vertical (AWS), Microsoft Azure, and Google Cloud are rapidly expanding their data center infrastructure to meet growing demands from enterprises transitioning to the cloud. Moreover, the rise of content delivery networks (CDNs), driven by video streaming platforms like Netflix and YouTube, necessitates large-scale data storage and low-latency connectivity.

Europe Data Center Construction Industry Trends

The data center construction market in Europe is anticipated to register considerable growth from 2025 to 2030, driven by the region's strong emphasis on data privacy regulations and the growing demand for local data storage. The implementation of the General Data Protection Regulation (GDPR) has encouraged enterprises to build regional data centers to ensure compliance. Cloud service providers and enterprises invest heavily in developing data centers in key regions such as Ireland, the Netherlands, and Sweden, benefiting from favorable climates and renewable energy availability.

Germany data center construction market held a substantial market share in 2024, driven by its central location, advanced digital infrastructure, and strong regulatory environment. The country’s stringent data protection laws and preference for data sovereignty are prompting companies to establish local data centers.

Asia Pacific Data Center Construction Industry Trends

The data center construction industry market in Asia Pacific is expected to register the highest CAGR of 13.3% from 2025 to 2030, fueled by the rapid adoption of digital technologies, e-commerce expansion, and the increasing consumption of data. Countries like China, Japan, India, and Singapore are major contributors, with strong investments from both domestic enterprises and global cloud providers. The rise of mobile internet usage, online gaming, and video streaming verticals is driving the demand for large-scale data centers.

Japan data center construction market is expected to grow rapidly in the coming years, driven by the country's advanced technology ecosystem, increasing cloud adoption, and the proliferation of IoT and AI applications. Tokyo and Osaka are the primary data center hubs, benefiting from robust digital infrastructure and connectivity. The rapid growth of digital verticals, including video streaming, e-commerce, and gaming, generates substantial demand for data storage and processing capacity.

The data center construction market in China held a substantial market share in 2024, driven by the country’s massive digital economy, the expansion of cloud computing, and government initiatives supporting digital infrastructure development. Leading Chinese cloud service providers such as Alibaba Cloud, Tencent Cloud, and Huawei Cloud continuously invest in large-scale data centers to meet the surging demand for cloud verticals and AI applications.

Key Data Center Construction Company Insights

Key players in the data center construction industry are Acer Inc., Cisco Systems, Inc., Dell Inc., IPXON Networks, KIO, and HostDime Global Corp. These companies are focusing on various strategic initiatives, including new product development, partnerships and collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Data Center Construction Companies:

The following are the leading companies in the Data Center Construction Market. These companies collectively hold the largest market share and dictate industry trends:

- ABB

- Acer Inc.

- Ascenty

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- Fujitsu

- Gensler

- Hewlett Packard Enterprise Development LP

- Hitachi, Ltd.

- HostDime Global Corp.

- Huawei Technologies Co., Ltd.

- IBM

- INSPUR Co., Ltd.

- IPXON Networks

- KIO

- Lenovo

- Oracle

- Schneider Electric

- Vertiv Group Corp.

Recent Developments

-

In December 2024, ABB Electrification inaugurated a Smart Buildings & Smart Power Technology Hub in London, UK, offering customers an interactive experience with its advanced power distribution and building automation tier types. The facility features fully operational circuit breakers, interconnected switchgear, sensors, and KNX controllers, providing hands-on technical training opportunities. Designed for customer engagement, technical sessions, and corporate events, the hub showcases ABB's commitment to driving innovation in data centers and commercial and residential buildings.

-

In October 2024, Dell Technologies introduced new integrated rack-scalable systems, servers, storage, and data management tier types under its AI Factory, designed to power large-scale AI workloads. The 21-inch Dell IR7000 is optimized for maximum CPU and GPU density, featuring wider and taller server sleds to support advanced architectures. Built with native liquid cooling capabilities, the rack can manage deployments of up to 480KW while capturing nearly 100% of generated heat. Offering flexibility, it supports both Dell and third-party networking tier types. With the Dell Integrated Rack Scalable Systems (IRSS), businesses can streamline AI infrastructure deployment through a plug-and-play, energy-efficient design.

-

In February 2024, Cisco Systems Inc. and NVIDIA announced a collaboration to provide AI infrastructure tier types designed for seamless deployment and management in data centers. Utilizing Ethernet-based networking, the tier types will be available through Cisco's extensive global channel, offering professional verticals and support from key partners. Notable customers like European cloud vertical provider ClusterPower are adopting these AI and machine learning tier types to enhance their data center operations and support client infrastructure needs.

Data Center Construction Report Scope

Report Attribute

Details

Market size in 2025

USD 261.31 billion

Revenue forecast in 2030

USD 456.50 billion

Growth rate

CAGR of 11.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report vertical

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Infrastructure, tier type, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ABB, Acer Inc.; Ascenty; Cisco Systems, Inc.; Dell Inc.; Equinix, Inc.; Fujitsu; Gensler; Hewlett Packard Enterprise Development LP; Hitachi, Ltd.; HostDime Global Corp.; Huawei Technologies Co., Ltd.; IBM; INSPUR Co., Ltd.; IPXON Networks; KIO; Lenovo; Oracle; Schneider Electric; Vertiv Group Corp.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Data Center Construction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center construction market report based on game infrastructure, tier type, vertical, and region:

-

Infrastructure Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT Infrastructure

-

Networking Equipment

-

Server

-

Storage

-

-

PD and Cooling Infrastructure

-

Power Distribution

-

Cooling

-

Air

-

Computer Room Air Conditioners (CRAC)

-

Computer Room Air Handlers (CRAH)

-

Rear Door Heat Exchangers

-

Others

-

-

Liquid

-

Direct-to-Chip Liquid Cooling

-

Immersion Cooling

-

Rear Door Heat Exchanger with Liquid

-

-

-

Others

-

-

Miscellaneous Infrastructure

-

-

Tier Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tier 1

-

Tier 2

-

Tier 3

-

Tier 4

-

-

Verticals Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Government & Defense

-

Healthcare

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center construction market size was estimated at USD 240.97 billion in 2024 and is expected to reach USD 261.31 billion in 2025.

b. The global data center construction market is expected to grow at a compound annual growth rate of 11.8% from 2025 to 2030 to reach USD 456.50 billion by 2030.

b. North American region dominated the data center construction market with a share of over 41.0% in 2024, driven by the increasing demand for cloud vertical, the proliferation of data-intensive applications, and the rapid digital transformation across industries.

b. Some key players operating in the data center construction market include ABB, Acer Inc., Ascenty, Cisco Systems, Inc., Dell Inc., Equinix, Inc., Fujitsu, Gensler, Hewlett Packard Enterprise Development LP, Hitachi, Ltd., HostDime Global Corp., Huawei Technologies Co., Ltd., IBM, INSPUR Co., Ltd., IPXON Networks, KIO, Lenovo, Oracle, Schneider Electric, Vertiv Group Corp.

b. Key factors that are driving the data center construction market growth include the rapid expansion of cloud computing, the proliferation of big data, and the increased adoption of artificial intelligence (AI) and Internet of Things (IoT) devices. Enterprises are increasingly relying on cloud service providers (CSPs) and colocation data centers to manage large volumes of data, necessitating the construction of new, high-capacity facilities

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.