- Home

- »

- Next Generation Technologies

- »

-

Data Center Construction Market Size & Share Report, 2030GVR Report cover

![Data Center Construction Market Size, Share & Trends Report]()

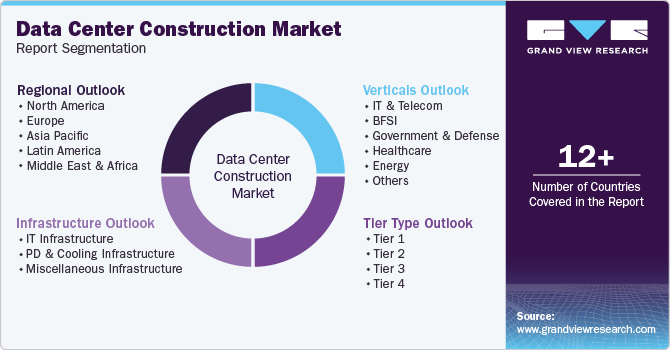

Data Center Construction Market Size, Share & Trends Analysis Report By Infrastructure (IT Infrastructure, PD & Cooling Infrastructure, Miscellaneous Infrastructure), By Tier Type, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-585-4

- Number of Report Pages: 82

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Data Center Construction Market Trends

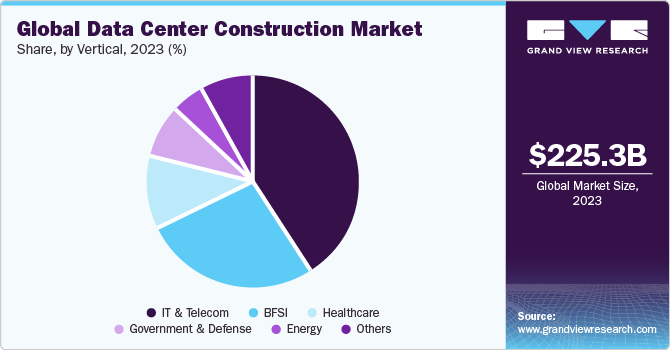

The global data center construction market size was estimated at USD 225.33 billion in 2023 and is anticipated to grow at a CAGR of 7.6% from 2024 to 2030. The resumption of the construction of various data center facilities, which was suspended temporarily as part of the lockdowns implemented in different parts of the world following the outbreak of the COVID-19 pandemic, and the commencement of new IT projects are anticipated to revive the market for data center construction. Meanwhile, the market is also anticipated to witness continuous investments in constructing hyperscale facilities, which house IT infrastructure, cooling equipment, and power equipment. Public cloud providers, such as Alibaba, Google, and Amazon.com, Inc., are anticipated to continue investing in upgrading their existing infrastructure, thereby creating growth opportunities for the market.

The construction process refers to activities involved in the planning, designing, and construction of a facility. The market of data center costs comprises IT infrastructure, several miscellaneous expenses, and power distribution and cooling solutions. A rise in data consumption and the enterprise demand for cloud computing are the factors driving the market growth. The Asia Pacific IT infrastructure market is expected to witness significant growth over the years. This growth can be attributed to a rise in networking equipment sales, including switches and routers. Companies, such as Huawei Technologies Co. Ltd., Dell Inc., and Hewlett Packard Enterprise Development LP, play a decisive role in the regional market growth.

The launch of new products by these companies in the servers and networking space contributes to the growth of the IT infrastructure segment across Asia Pacific. The establishment of multi-tenant or colocation facilities is anticipated to drive the growth of the market for data center construction over the forecast period. Incumbents of various industries and vertical industries are shifting to cloud computing, driving the demand for colocation services. In addition, the cost benefits associated with outsourcing storage requirements are anticipated to boost the multi-tenant facilities.

Market Concentration & Characteristics

The technology environment in the data center market is rapidly evolving, the companies are exploring high techniques and methods to develop high performance hardware. Thus, businesses are continuously investing in R&D activities to make the hardware ready for future challenges. For instance, in December 2023, DNA, a part of Telenor Group and a leading fixed and mobile communications service provider in Finland, deployed a cutting-edge data center fabric based on Juniper Networks’ innovative high-performance hardware and automation software leveraging NEC Corporation’s expertise in systems integration. The new data center infrastructure provided DNA with a unified platform for its internal IT services and business-to-business customer services. DNA also opted for Juniper Networks’ QFX Series switches to power its Telco Cloud sites across Finland. Such instances are indicative of how innovative data center solutions can meet the evolving needs of modern applications.

The standards and regulations in the market include HIPPA, PCI DSS, ISO & NIST, and privacy regulations like GDPR and CCPA. It contributes to the symphony of secure data management.

In this market, the threat of substitutes can be termed low due to the specific and complex requirements of data center infrastructure. Data centers are critical for businesses to manage and process large amounts of data, and there are limited alternatives to traditional data center construction methods. However, some emerging trends and technologies could potentially disrupt the data center construction market, such as edge computing and cloud computing. Cloud computing offers businesses access to computing resources and storage over the internet, reducing the need for physical data centers.

Despite these emerging trends, the demand for traditional data center construction is expected to continue to grow, driven by the increasing adoption of digital technologies and the need for scalable and secure data storage solutions. The market growth is also being driven by the rising demand for hyperscale data centers, which companies are adopting to manage and process large amounts of data.

Infrastructure Insights

The IT infrastructure segment accounted for the largest market share of over 81% in 2023. The exponential growth of data generation across various industries necessitates robust IT infrastructure to store, process, and manage this vast amount of information. With the expansion of digital technologies, including IoT devices, cloud computing, and big data analytics, organizations increasingly rely on data centers to support their operations, leading to a surge in demand for IT infrastructure. The IT Infrastructure segment comprises networking equipment, server, and storage subsegments.

The PD and cooling infrastructure segment is anticipated to grow at a CAGR of 10.3% from 2024 to 2030 owing to the need to maintain optimum temperature and humidity levels across the data centers. The PD and cooling infrastructure segment consists of power distribution and cooling subsegments. Cooling systems are installed in data centers to manage the excessive heat generated by the processors, servers, and other IT equipment. Cooling systems also maintain appropriate humidity levels and protect the IT and electronic components from corrosion. An ideal working environment ensures the efficient working of data centers and mitigates the risks of potential downtime and data loss.

Tier Type Insights

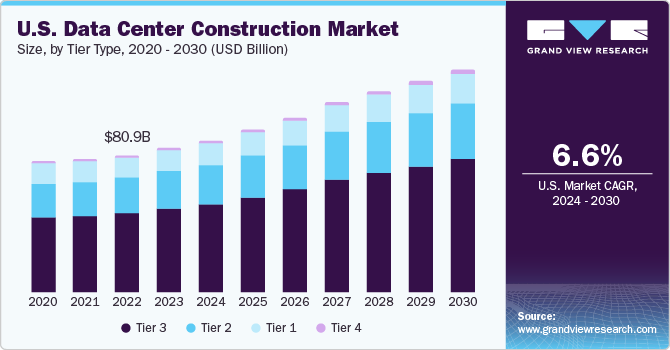

The tier 3 segment accounted for the largest market share of over 58% in 2023 due to the increased redundancy across data centers. The rising need for high-performance computing and increased storage capacity is another factor why the tier 3 segment has dominated the market. Tier 3 standards are popular among media providers, such as Netflix and Facebook, and among the incumbents in the financial and service industries.

The tier 4 segment is anticipated to grow at a CAGR of 10.2% from 2024 to 2030. Businesses across various industries recognize the critical importance of uninterrupted digital services and operations availability. Tier 4 data centers offer the highest fault tolerance and redundancy level, ensuring that critical services are not disrupted even during a component failure or maintenance activity.

Vertical Insights

The IT & telecom segment accounted for the largest share of over 40% in 2023. The segment's growth can be attributed to the proliferation of smartphones and the rise in active internet users globally. The continued rollout of 5G networks also allowed the segment to dominate the market in 2022, and the trend is expected to continue over the forecast period. The continued adoption of Network Function Virtualization (NFV) and Software-Defined Networks (SDN) as applications to support OTT Platforms, M2M communication, and online gaming is also expected to fuel the segment growth.

The BFSI segment is anticipated to grow at a CAGR of 7.9% during the forecast period. The BFSI industry is undergoing a digital revolution, embracing innovations, such as mobile banking, online payments, and automated financial services. These initiatives require an agile and scalable IT infrastructure, which data centers guarantee. By offering on-demand computing resources and flexible configurations, data centers empower financial institutions to quickly adapt to evolving customer needs and market trends. Data centers allow BFSI institutions to centralize and consolidate their IT infrastructure, reducing hardware redundancy and streamlining operations. This further optimizes resource utilization, minimizes energy consumption, and reduces operational costs.

Regional Insights

The North America data center construction market held the major share of over 42% in 2023. Data center operators in North America are developing scalable data centers with sustainable building, operations, and business methods that can accommodate the demands of hyperscale data centers. For instance, in January 2024, EdgeCore Digital Infrastructure, a data center operator, announced the completion of a USD 1.9 billion debt financing deal for its Mesa, Arizona, data center campus. Upon completion, the water-neutral, LEED-certified campus spread over 3.1 million square feet of space would sustain 450 MW of critical load and accommodate present and future client needs.

U.S. Data Center Construction Market Trends

The data center construction market in the U.S. is estimated to grow at a CAGR of 6.6% from 2024 to 2030. Businesses in the country are seeking reliable and secure data processing and storage solutions due to a significant increase in cyber threats and data breaches and an increasingly stringent regulatory environment. Moreover, the growing adoption of cloud applications and advanced technologies, such as artificial intelligence, across industries is driving the need for modern data centers.

Europe Data Center Construction Market Trends

The Europe data center construction market inEurope is growing significantly at a CAGR of 7.8% from 2024 to 2030. The strong digital economy and growing need for cloud computing in the region is driving the market growth. As of 2022, Europe had approximately 2400 data centers. The construction of new data center facilities in Europe is expected to be driven by the presence of several data center co-location service providers in the region.

The UK data center construction market is growing significantly at a CAGR of 7.4% from 2024 to 2030. The rapid digitization of industries, such as BFSI, media & entertainment, and e-commerce, along with the consecutive rise in the volume of data generated and processed have favored the demand for data centers in the country.

The data center construction market in Germany will grow significantly at a CAGR of 8.1% from 2024 to 2030. The market is expected to benefit from the growing focus of the country’s government and private organizations on establishing green data centers.

The Italy data center construction market is likely to register a CAGR of 8.8% from 2024 to 2030. The growing demand for data center services from small- and medium-scale businesses is contributing to the growth of the country’s market. Furthermore, Italy is making significant investments in energy networks, renewable energy projects, and sustainable transportation and is focusing on reducing energy imports to lower its carbon footprint.

Asia Pacific Data Center Construction Market Trends

The data center construction market in Asia Pacific is estimated to grow at a CAGR of 8.9% from 2024 to 2030. Asia Pacific had approximately 1,300 data centers in 2022, a number expected to increase over the forecast period. Rapid digitization and growing adoption of cloud computing across industries are expected to drive the regional market. Data center demand in the region is also driven by increased cloud adoption, data localization, and the adoption of emerging technologies, such as 5G and the Internet of Things (IoT).

The China data center construction market is growing significantly at a CAGR of 5.5% from 2024 to 2030. The China market growth is driven by rising investments from cloud service providers, such as Huawei Cloud, Kingsoft Cloud, Tencent Cloud, and AliCloud, into advanced data centers.

The data center construction market in Japan is expected to grow at a CAGR of 7.6% from 2024 to 2030 owing to the increasing number of data center colocation service providers in the nation. As of 2022, the country had approximately 207 data centers. Furthermore, Tokyo, the country’s capital, is expected to increase its data center footprint, becoming Asia's second-largest data center hub after Beijing.

The India data center construction market is projected to register a CAGR of 8.3% from 2024 to 2030 due to the growing demand for data center services across various sectors, such as e-commerce and fintech. For instance, in September 2023, SOLIS-IDC, an IT services provider based in South Korea, invested USD 2 billion to construct a new data center in India. This investment will fund the building and operation of the data center, as well as the required infrastructure and advanced security measures to guarantee the safety of sensitive data.

Middle East & Africa Data Center Construction Market Trends

The data center construction market in Middle East & Africa is expected to grow at a CAGR of 6.2% from 2024 to 2030. The increasing investments by government entities in digital infrastructure companies are expected to drive market growth. For instance, in May 2023, DigitalBridge Group announced a partnership with the Public Investment Fund (PIF), the sovereign wealth fund of Saudi Arabia, as an investor in a new project aimed at building data centers around the Gulf Cooperation Council (GCC) and in Saudi Arabia. The collaboration would initially invest in data center investments and explore other digital infrastructure elements, including towers, fiber, small cell, and edge infrastructure, in the future.

The Saudi Arabia data center construction market is expected to grow at a CAGR of 7.1% from 2024 to 2030. The improvements in the connectivity between submarines and inland networks is expected to drive market growth in the region.

Key Data Center Construction Company Insights

Some of the key companies operating in the market include Acer Inc., Cisco Systems, Inc., and Dell Inc. among others are some of the leading participants in the data center construction market.

-

Acer Inc. is a multinational company that designs, develops, markets, sells, and supports various computer hardware and electronics products. Acer's product portfolio includes personal computers, laptops, tablets, smartphones, projectors, servers, storage devices, displays, peripherals, and virtual reality devices. The company markets its products under the Acer, Gateway, Packard Bell, and eMachines brands. As part of its product portfolio, it offers data center products, including servers and storage solutions. The company's servers are designed to meet the needs of various industries and applications, from small businesses to large enterprises

-

Cisco Systems Inc. is a technology company that offers computer networking products. It manufactures and distributes networking equipment, offering a wide range of products and services related to the communications and information technology industry. The company's product portfolio includes switching, routing, wireless computing, collaboration, security, and optimized application experiences products

IPXON Networks, KIO, and HostDime Global Corp. are some of the emerging market participants in the data center construction market.

-

IPXON Networks offers high-performance solutions for small businesses. IPXON Networks offers a range of products and services related to the data center industry, including networking equipment, cloud services, and systems management services. The company's offerings are designed to provide high-performance solutions for small businesses, enabling them to manage more users, devices, and things connected to their networks

-

KIO is a provider of data center solutions with a focus on colocation, cloud, and managed services. KIO offers a range of products and services related to the data center industry, including colocation services, cloud services, and managed services. The company's colocation services provide customers with secure and reliable data center space, power, and cooling, while its cloud services offer customers access to scalable and flexible computing resources

Key Data Center Construction Companies:

The following are the leading companies in the data center construction market. These companies collectively hold the largest market share and dictate industry trends.

- Acer Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Fujitsu

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM

- Lenovo

- Oracle

- INSPUR Co., Ltd.

- Ascenty

- ABB

- Hitachi, Ltd.

- Equinix, Inc.

- Gensler

- Schneider Electric

- HostDime Global Corp.

- IPXON Networks

- KIO

- Vertiv Group Corp.

Recent Developments

-

In April 2024, AGM Group Holdings Inc., a technology company, signed a Memorandum of Understanding with RED DOT ANALYTICS PTE. LTD. to construct AI hyper-connected, GPU-driven data centers. The partnership aims to leverage AGMH's technology expertise and RDA's AI services capabilities to develop advanced, GPU-powered data center infrastructure to support AI applications and workloads

-

In September 2023, Digital Realty announced the development of a Tier 4 facility in Rome, Italy. Plans envisaged the construction of ROM1 commencing in Q4/2023 following land acquisition and pre-development planning. It was aligned with Digital Realty's PlatformDIGITAL expansion strategy, empowering customers to deploy critical infrastructure. The 22-hectare site, strategically located near the coast, facilitates future subsea cable landings and reinforces seamless interconnections, signifying Digital Realty's commitment to expanding its presence in Italy and supporting the growing demand for reliable and robust data center solutions

-

In March 2023, Vertiv announced formalizing a distribution partnership with iPoint, a multi-brand distributor of computer peripherals and electronic gadgets for businesses and individuals in Bahrain. The partnership envisaged Vertiv enhancing iPoint’s incumbent portfolio with its robust IT infrastructure and power solutions for data centers and edge applications while accelerating market presence in Bahrain and the Gulf Cooperation Council (GCC) region

-

In March 2023, NTT Ltd., via NTT Global Data Centers Corp., announced investments worth USD 90 million to establish Bangkok 3 Data Center (BKK3), the company's biggest data center in Thailand. Launching in H2/2024, BKK3 would offer the highest IT capacity of 12MW over the 4,000-meter square of dedicated space, catering to enterprises and hyperscale users. The facility promises scalable, flexible IT infrastructure, cost-effectiveness, and optimized power efficiency. The company's commitment to providing advanced data center solutions to regional businesses is demonstrated by supporting high densities, marking 30kW per rack in Thailand as part of the country's digital growth

Data Center Construction Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 240.07 billion

Market value forecast in 2030

USD 371.87 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Market value in USD billion and CAGR from 2024 to 2030

Report coverage

Market value forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Infrastructure, tier type, vertical, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key Companies Profiled

Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM; Lenovo; Oracle; INSPUR Co., Ltd.; Ascenty; ABB; Hitachi, Ltd.; Equinix, Inc.; Gensler; Schneider Electric; HostDime Global Corp.; IPXON Networks; KIO; Vertiv Group Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Construction Report Segmentation

This report forecasts market growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the data center construction market report based on infrastructure, tier type, vertical, and region:

-

Data Center Construction Infrastructure Outlook (Market Value, USD Billion, 2018 - 2030)

-

IT Infrastructure

-

Networking Equipment

-

Server

-

Storage

-

-

PD and Cooling Infrastructure

-

Power Distribution

-

Cooling

-

-

Miscellaneous Infrastructure

-

-

Data Center Construction Tier Type Outlook (Market Value, USD Billion, 2018 - 2030)

-

Tier 1

-

Tier 2

-

Tier 3

-

Tier 4

-

-

Data Center Construction Vertical Outlook (Market Value, USD Billion, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Government & Defense

-

Healthcare

-

Energy

-

Others

-

-

Data Center Construction Regional Outlook (Market Value, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center construction market size was estimated at USD 225.33 billion in 2023 and is expected to reach USD 240.07 billion in 2024.

b. The global data center construction market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 371.87 billion by 2030.

b. North American region dominated the data center construction market with a share of 42.03% in 2023. This is attributable to investments made for mega data center projects.

b. Some key players operating in the data center construction market include Acer Inc., Cisco Systems, Inc., Dell Inc., Fujitsu, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., IBM, and Lenovo

b. Key factors that are driving the data center construction market growth include increasing internet usage, high adoption of cloud computing, and rising investment in hyperscale data centers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."