- Home

- »

- Next Generation Technologies

- »

-

Data Center Interconnect Market Size, Industry Report, 2030GVR Report cover

![Data Center Interconnect Market Size, Share, & Trends Report]()

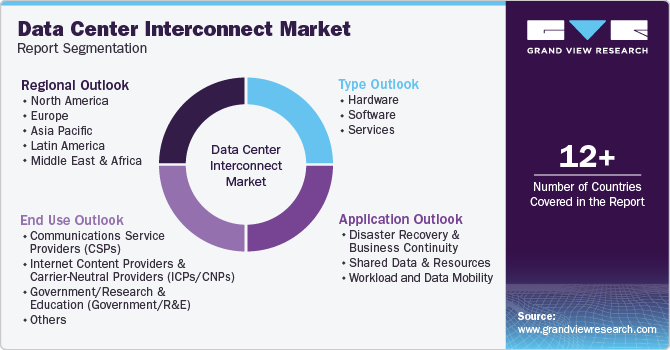

Data Center Interconnect Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type (Hardware, Software, Services), By Application (Workload And Data Mobility, Shared Data & Resources, Workload and Data Mobility), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-014-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Interconnect Market Summary

The global data center interconnect market size was estimated at USD 10.12 billion in 2024 and is projected to reach USD 20.37 billion by 2030, growing at a CAGR of 13.1% from 2025 to 2030. The data center interconnect (DCI) market plays a pivotal role in the infrastructure of modern data centers, enabling high-speed, high-capacity connectivity between geographically distributed facilities.

Key Market Trends & Insights

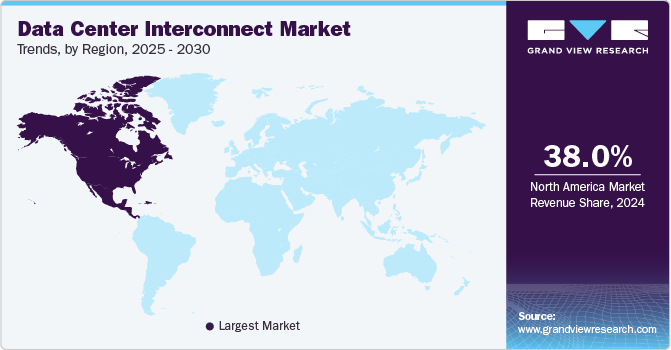

- The North America region held the largest market share of over 38% in the data center interconnect market in 2024.

- The U.S. DCI market held a dominant position in 2024.

- By type, the hardware segment accounted for the largest share of over 56% in 2024.

- By application, the disaster recovery and business continuity segment dominated the market in 2024.

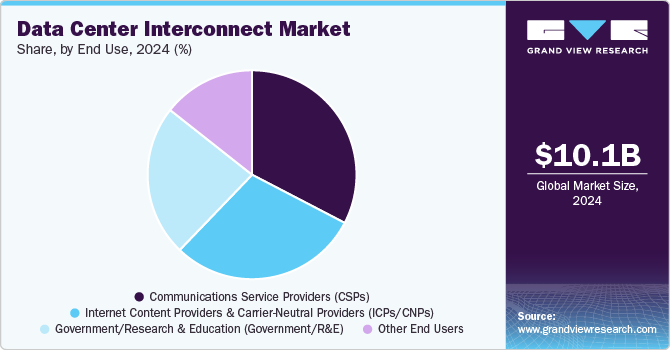

- By end use, the communications service providers (CSPs) segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.12 Billion

- 2030 Projected Market Size: USD 20.37 Billion

- CAGR (2025-2030): 13.1%

- North America: Largest market in 2024

DCI technology is essential for data-intensive applications such as cloud services, big data analytics, disaster recovery, and enterprise data mobility. Leading DCI solutions in this market range from optical transport systems to software-defined networking (SDN), supporting flexible and scalable data transfer between data centers. As enterprises, content providers, and telecommunications operators increasingly rely on multi-cloud and hybrid environments, demand for DCI solutions has surged. The market has witnessed rapid innovation, with key players offering advanced DCI services to meet the growing need for reliable, low-latency, and secure data connections. With the explosion of data, the rise of edge computing, and the need for efficient interconnectivity, DCI is becoming an integral part of digital transformation initiatives worldwide.

The rise in data consumption due to IoT, 5G, and streaming services has significantly increased data traffic, necessitating more robust interconnectivity. Furthermore, enterprises’ disaster recovery and business continuity needs are propelling DCI demand, with data replication across sites essential for risk management and data redundancy. Advancements in SDN and network function virtualization (NFV) also make DCI solutions more scalable and efficient, enhancing their appeal across industries. Lastly, hyperscale data centers-such as those of tech giants-are expanding their networks, thus requiring DCI solutions to support high-speed, large-scale data flow.

Edge computing and 5G deployment will further boost the market, as data processing decentralizes, requiring faster and more reliable data transfers across broader networks. Innovations in SDN, artificial intelligence, and machine learning are likely to transform DCI infrastructure, offering self-healing networks that optimize bandwidth and latency. Moreover, cybersecurity will play an increasingly important role, with companies investing in DCI solutions that ensure data protection and compliance with global regulations. Expanding applications in industries like finance, healthcare, and retail will also contribute to market growth, as these sectors increasingly rely on data replication and disaster recovery capabilities. As hyperscale data centers proliferate and network demands grow, the DCI market is poised for strong, sustained expansion.

Type Insights

The hardware segment accounted for the largest share of over 56% in 2024. The adoption of 5G networks and edge computing is accelerating demand for Data Center Interconnect (DCI) hardware that can handle large volumes of decentralized data efficiently. 5G enables ultra-fast data speeds and low-latency connections, essential for real-time applications in industries like healthcare, automotive, and IoT. Edge computing, by processing data closer to its source, reduces latency and bandwidth issues. However, it requires robust DCI hardware to seamlessly connect distributed edge locations with central data centers. This hardware-such as high-speed routers, optical transceivers, and switches-ensures the rapid, reliable data exchanges needed for 5G and edge applications, making it a foundational element in modern network infrastructure. Together, 5G and edge computing drive DCI hardware’s market growth.

The software segment is expected to grow steadily over the forecast period. The demand for network automation is growing as organizations aim to streamline data center operations and minimize human error. DCI software enables centralized control, automating routine tasks and simplifying management across interconnected data centers. This automation enhances efficiency, reduces operational costs, and ensures consistency in complex environments, making it essential for companies handling high data volumes and aiming for optimized, resilient network infrastructure.

Application Insights

The disaster recovery and business continuity segment dominated the market in 2024. As businesses increasingly adopt cloud and hybrid infrastructures, ensuring reliable disaster recovery across multiple data centers has become crucial. Data Center Interconnect (DCI) solutions facilitate seamless connectivity between on-premises systems and cloud environments, allowing for efficient data redundancy and real-time backup. This integration ensures continuous data availability and minimizes data loss in the event of an outage, supporting business continuity. DCI’s robust interconnectivity across distributed infrastructures enables organizations to enhance backup capabilities and improve disaster recovery processes.

The shared data & resources segment is expected to grow at steadily over the forecast period. The rise of multi-cloud strategies among businesses is driving demand for data center interconnect (DCI) solutions, which enable seamless connectivity between various cloud providers and on-premises data centers. This connectivity allows organizations to efficiently share resources across diverse environments, enhancing operational flexibility and scalability. By utilizing DCI, companies can avoid vendor lock-in, ensuring they can select the best services from multiple cloud providers while optimizing their IT infrastructure and resources.

End Use Insights

The communications service providers (CSPs) segment dominated the market in 2024.The expansion of 5G networks is significantly driving demand for advanced data center interconnect (DCI) solutions. As 5G technology enables faster data transmission and supports a massive influx of Internet of Things (IoT) devices and smart technologies, the resulting surge in data traffic presents challenges for communication service providers (CSPs). To effectively manage and distribute this data across their networks, CSPs require robust interconnectivity solutions that ensure low latency and high reliability. DCI solutions facilitate seamless connectivity between centralized data centers and edge computing resources, enabling CSPs to optimize their infrastructure and enhance overall network performance. This capability is crucial for delivering the speed and responsiveness that 5G applications demand, thereby cementing DCI's role in 5G network infrastructure.

The Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs) is expected to grow steadily over the forecast period.The growing adoption of multi-cloud strategies among ICPs and CNPs is driving demand for data center interconnect (DCI) solutions. These solutions enable seamless connectivity across multiple cloud environments, allowing providers to leverage the best services from different vendors. This capability facilitates efficient resource sharing, enhances operational flexibility, and helps ICPs and CNPs optimize their infrastructures, ultimately improving service delivery and meeting diverse customer needs.

Regional Insights

The North America region held the largest market share of over 38% in the data center interconnect market in 2024.North America is home to several leading telecommunications companies, well-established suppliers, and incumbents of various end-use industries and industry verticals. All these entities are aggressively adopting the latest technologies to improve corporate productivity and work efficiency. A well-developed ICT infrastructure and the presence of large data center clusters in the U.S., such as New York, Los Angeles, Chicago, and Washington DC, also bode well for the growth of the regional market.

U.S. Data Center Interconnect Market Trends

The U.S. DCI market held a dominant position in 2024. The U.S. is experiencing a significant increase in data consumption driven by the rise of digital services, streaming platforms, and social media. This growing demand creates a pressing need for robust data center interconnect (DCI) solutions that can efficiently manage high data traffic. Effective DCI solutions ensure seamless connectivity across data centers, enabling businesses to handle the vast amounts of data generated while maintaining optimal performance and user experience.

Asia Pacific Data Center Interconnect Trends

The DCI market in Asia Pacific is growing significantly at a CAGR of 13.7% from 2025 to 2030. The Asia Pacific region is experiencing significant digital transformation as organizations increasingly adopt cloud computing, big data analytics, and IoT technologies. This shift drives the demand for efficient data center interconnect (DCI) solutions, which are essential for enabling seamless data transfer and connectivity across distributed systems. By ensuring reliable and high-speed connections, DCI solutions support organizations in leveraging their digital capabilities, enhancing operational efficiency, and improving overall business performance.

The Japan data center interconnect market is expected to grow rapidly in the coming years. Japan's advanced digital economy and high internet penetration create a strong demand for reliable data connectivity. Businesses need robust data center interconnect (DCI) solutions to effectively manage the increasing data traffic from online services, cloud applications, and IoT devices, ensuring seamless and efficient communication across their networks.

DCI market in China held a substantial market share in 2024. In China, the vast scale of operations across numerous enterprises creates a strong emphasis on network resilience. Businesses prioritize building robust data infrastructures to mitigate risks associated with downtime and data loss. Data Center Interconnect (DCI) solutions play a crucial role by providing essential redundancy and disaster recovery capabilities, ensuring that data remains accessible and secure even during disruptions. This focus on resilience is vital for maintaining operational continuity and protecting critical information.

Europe Data Center Interconnect Trends

The data center interconnect market in Europe was identified as a lucrative region in 2024. The European Union's stringent data protection regulations, such as the General Data Protection Regulation (GDPR), significantly influence data handling practices in the region. These regulations necessitate secure and compliant methods for managing sensitive data. As a result, there is a growing demand for data center interconnect (DCI) solutions that ensure data residency and sovereignty, allowing organizations to meet regulatory requirements while maintaining the integrity and security of their data across different jurisdictions.

Data center interconnect market in the UK is expected to grow rapidly in the coming years as the country is undergoing significant digital transformation across key sectors like finance, healthcare, and retail. The UK is experiencing significant data consumption driven by the growth of digital services, e-commerce, and online streaming. This increasing demand for data requires robust data center interconnect (DCI) solutions to facilitate efficient data transfer and connectivity between data centers, ensuring seamless operations and enhanced user experiences.

The Germany data center interconnect market is expected to hold a significant market share in the coming years. The rollout of 5G network in Germany has significantly increased the demand for advanced data center interconnect (DCI) solutions. These solutions are essential for managing the immense data traffic generated by connected devices, ensuring efficient data flow and enabling low-latency communication necessary for applications that depend on real-time data processing.

Key Data Center Interconnect Company Insights

Some of the key companies in the data center interconnect market include Cisco Systems, Inc., Juniper Networks, Inc., Broadcom Inc., Ciena Corporation, Nokia Corporation and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Cisco Systems, Inc. plays a significant role in the data center interconnect (DCI) market by providing advanced networking solutions that enhance connectivity and data transfer between data centers. Cisco's DCI offerings include high-capacity routers and software-defined networking technologies, enabling efficient management of increased data traffic. Their solutions support cloud environments and hybrid infrastructures, addressing the growing demand for reliable and scalable interconnectivity.

-

Ciena Corporation is a prominent player in the data center interconnect (DCI) market, specializing in high-capacity optical networking solutions. Their products facilitate seamless data transmission between data centers, addressing the growing demand for bandwidth and connectivity. Ciena's DCI solutions are designed to optimize network performance and enhance operational efficiency, making them essential for organizations transitioning to cloud and hybrid environments.

Key Data Center Interconnect Companies:

The following are the leading companies in the data center interconnect market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Broadcom Inc.

- Arista Networks, Inc.

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Mellanox Technologies (now part of NVIDIA)

- Ciena Corporation

- Extreme Networks, Inc.

- Fujitsu Limited

- IBM Corporation

- Infinera Corporation

- Adtran

- ZTE Corporation.

Recent Developments

-

In March 2024, Infinera Corporation announced its new ICE-D intra-data center optics, offering high-speed connectivity of up to 1.6 Tb/s. This technology, utilizing indium phosphide photonic integrated circuits, reduces power consumption per bit by up to 75%. It aims to support the growing bandwidth demand driven by AI applications, projecting nearly tenfold market growth by 2027. Infinera's solutions focus on cost-efficiency and scalability for data center operators.

-

In February 2024, Huawei Technologies Co., Ltd. introduced the OptiXtrans DC908 Pro, a next-generation Data Center Interconnect (DCI) platform at MWC Barcelona 2024. It boasts significant advancements, including single-wavelength transmission at 1.2 Tbit/s over 240 km, enhanced reliability at 99.999%, and improved intelligence for simplified deployment. This platform addresses increasing data demands in the AI era, making it a critical solution for efficient and secure data transmission between data centers.

Data Center Interconnect Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.99 billion

Revenue forecast in 2030

USD 20.37 billion

Growth rate

CAGR of 13.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; and South Africa.

Key companies profiled

Cisco Systems, Inc.; Juniper Networks, Inc.; Broadcom Inc.; Arista Networks, Inc.; Nokia Corporation; Huawei Technologies Co., Ltd.; Mellanox Technologies (now part of NVIDIA); Ciena Corporation; Extreme Networks, Inc.; Fujitsu Limited; IBM Corporation; Infinera Corporation; Adtran; ZTE Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Interconnect Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global data center interconnect market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

Professional Services

-

Managed Services

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Disaster Recovery and Business Continuity

-

Shared Data & Resources

-

Workload and Data Mobility

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Communications Service Providers (CSPs)

-

Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs)

-

Government/Research and Education (Government/R&E)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center interconnect market size was estimated at USD 10.12 billion in 2024 and is expected to reach USD 10.99 billion in 2025.

b. The global data center interconnect market is expected to grow at a compound annual growth rate of 13.1% from 2025 to 2030 to reach USD 20.37 billion by 2030.

b. North America dominated the data center interconnect market with a share of 38.0% in 2024. This is attributable to a developed technological infrastructure in the region.

b. Some key players operating in the data center interconnect market include Cisco Systems, Inc.; Juniper Networks, Inc.; Broadcom Inc.; Arista Networks, Inc.; Nokia Corporation; Huawei Technologies Co., Ltd.; Mellanox Technologies (now part of NVIDIA); Ciena Corporation; Extreme Networks, Inc.; Fujitsu Limited; IBM Corporation; Infinera Corporation; Adtran; ZTE Corporation.

b. Key factors driving the market growth include the growing adoption of data centers and migration towards the cloud.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.