- Home

- »

- Communications Infrastructure

- »

-

Data Center Transformer Market Size & Share Report, 2030GVR Report cover

![Data Center Transformer Market Size, Share, & Trends Report]()

Data Center Transformer Market (2025 - 2030) Size, Share, & Trends Analysis Report By Insulation Type (Oil Immersed, Dry), By Voltage, By Channel Partners (OEMs, Distributors, Online Retailers, Online Retailers, Electrical Contractors), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-563-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Transformer Market Summary

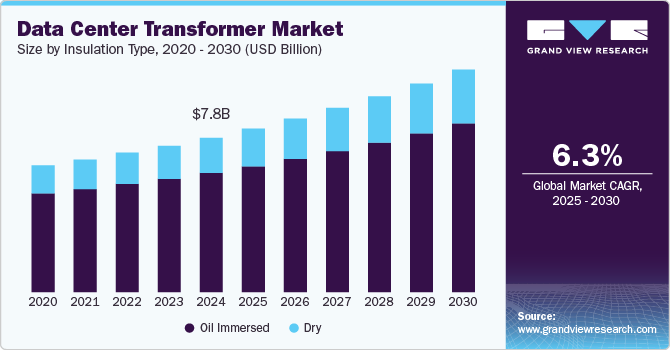

The global data center transformer market size was estimated at USD 7,774.9 million in 2024 and is projected to reach USD 11,205.3 million by 2030, growing at a CAGR of 6.3% from 2025 to 2030. Primarily, the market growth is driven by the rapid expansion of data centers globally, fueled by the growing demand for cloud computing, big data analytics, and internet services.

Key Market Trends & Insights

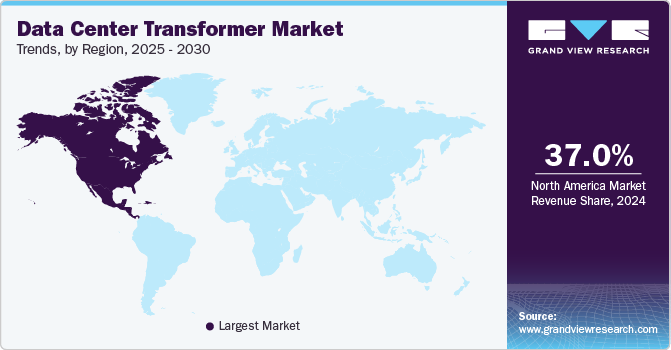

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, oil immersed accounted for a revenue of USD 6,000.2 million in 2024.

- Dry is the most lucrative insulation type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 7,774.9 Million

- 2030 Projected Market Size: USD 11,205.3 Million

- CAGR (2025-2030): 6.3%

- North America: Largest market in 2024

The increasing digitalization across industries, coupled with the rise of IoT (Internet of Things) and AI (Artificial Intelligence), has resulted in a surge of data processing and storage needs, necessitating more robust and efficient power infrastructure. Moreover, the adoption of renewable energy sources in data center operations has also created demand for energy-efficient transformers. The emphasis on reducing energy consumption and minimizing carbon footprints in large-scale data center facilities further propels the growth of the data center transformer market. Additionally, stringent regulations surrounding power efficiency and sustainability have encouraged data center operators to invest in advanced transformer technologies.

The rapid expansion of data centers globally significantly drives the data center transformer market by escalating the demand for reliable and efficient power solutions supporting large-scale operations. As data centers increase to accommodate growing digital storage and processing needs primarily driven by cloud computing, artificial intelligence, big data analytics, and IoT applications, there is a corresponding need for transformers designed to ensure consistent and stable power distribution. These transformers play a critical role in meeting high-energy demands while maintaining operational efficiency and reducing downtime, which is crucial in data-intensive environments. Additionally, as data centers aim to incorporate more sustainable energy sources, such as solar or wind, the market for energy-efficient transformers tailored to handle variable power inputs is further strengthened, making transformers an indispensable component in the modern data center infrastructure.

The data centers have witnessed unprecedented growth in technologies and services over the years. There has been an increase in IT spending by organizations to simplify operations and data storage capabilities. Rapidly growing data traffic is driving data storage demand, which has resulted in the continuous expansion of the global data center market. Data center structures are associated with more power consumption and are increasing in proportion and size day by day. Furthermore, the growing workload on the data centers has, in turn, increased the demand for better quality power supply. These factors further justify the presence of transformers in a data center and have contributed to the market's growth.

The need to ensure effective power distribution across data centers has led to the advent of smart transformers. Smart transformers are equipped with intelligent electronic devices and control systems that allow the operator to remotely monitor the behavior of the transformer core, bushings, and windings, among other transformer components. The smart transformer also has a system that sends feedback about the power fluctuations to the grid so that voltage can be optimized according to the load requirement. The transformer also responds instantly to the fluctuations across the grid and acts as a voltage regulator, thus ensuring an optimum amount of voltage distribution across the data center. Thus, the market is anticipated to witness an elevated demand for smart transformers over the next few years.

Insulation Type Insights

The oil immersed segment accounted for the largest market share of over 77% in 2024. The adoption of oil immersed insulation transformers is primarily driven by their high efficiency, robust performance, and superior cooling capabilities. These transformers utilize insulating oils, which not only provide effective insulation but also serve as a medium for heat dissipation, allowing the transformer to handle larger loads and endure prolonged operational cycles. Their reliability in high-load applications makes them well-suited for use in industrial settings, utility grids, and large-scale infrastructure projects where consistent power delivery is essential. Furthermore, advancements in eco-friendly, biodegradable insulating oils have improved their environmental profile, making oil-immersed transformers a viable choice for regions with stringent environmental regulations.

The dry insulation type segment is expected to grow significantly during the forecast period. The adoption of dry type insulation transformers is driven by their enhanced safety, lower maintenance requirements, and suitability for indoor environments. Unlike oil-immersed models, dry-type transformers use air or other solid insulation materials, eliminating the need for flammable insulating fluids and significantly reducing fire hazards. This makes them particularly appealing in settings where safety is a priority, such as commercial buildings, hospitals, schools, and densely populated areas. Additionally, dry-type transformers offer a compact design and require minimal maintenance, which makes them ideal for urban installations with limited space and stringent safety standards. The increased focus on eco-friendly, oil-free insulation options further supports the rising demand for dry-type transformers, especially in regions with rigorous environmental and safety regulations.

Voltage Insights

The 1,250-3,750 kVA segment accounted for the largest market share of over 42% in 2024. The adoption of 1,250-3,750 kVA transformers in the data center market is driven by the rapid growth of small to medium-sized data centers that require reliable and scalable power infrastructure. This voltage range is well-suited for data centers that experience moderate workloads and seek efficient power distribution without needing extremely high capacity. The 1,250-3,750 kVA transformers offer an optimal balance between energy efficiency and operational cost, which is ideal for data centers focusing on sustainable energy management. These transformers are also easier to install and maintain, making them attractive for operators looking to optimize capital expenditures while maintaining reliable power performance in less intensive data center environments.

The over 3,750 kVA segment is expected to grow at a significant rate during the forecast period. The adoption of transformers in the over 3,750 kVA segment is primarily driven by the increasing demand for high-capacity power solutions in large-scale data centers and hyperscale facilities. As the data processing needs of industries continue to rise, driven by advancements in cloud computing, AI, and big data, these large data centers require transformers with higher voltage capacities to ensure uninterrupted and stable power delivery. The over 3,750 kVA transformers support critical infrastructure, enabling efficient load handling and operational stability even during peak demand. Additionally, as hyperscale facilities expand to accommodate growing digital services, transformers in this segment provide the necessary power efficiency and resilience to support high-density, energy-intensive environments, making them essential for large, mission-critical data center applications.

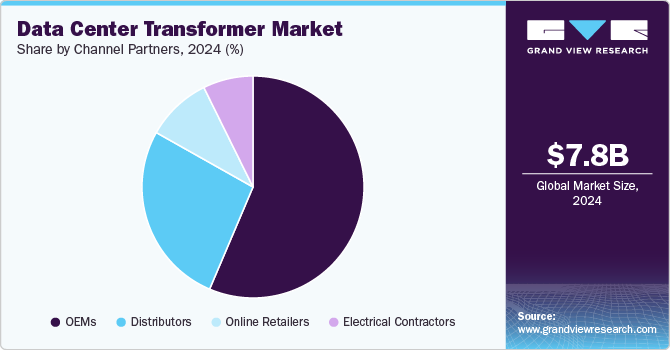

Channel Partners Insights

The OEMs segment accounted for the largest market share in 2024, driven by the demand for customized, high-quality transformers tailored to specific operational requirements in data centers. OEMs can offer end-to-end solutions that include design, engineering, and installation support, ensuring that transformers meet the stringent performance standards needed for mission-critical applications in data centers. Additionally, data center operators prefer working directly with OEMs to access advanced, innovative technologies that enhance efficiency and reliability. The increased emphasis on sustainable energy practices also fuels demand for OEMs, as they are often at the forefront of developing energy-efficient transformers that align with environmental and regulatory standards. Furthermore, direct engagement with OEMs enables data centers to maintain control over quality, compatibility, and long-term maintenance support, making OEMs a preferred choice for large-scale and custom transformer solutions.

The distributors segment is expected to grow at a significant rate during the forecast period. The adoption of distributors as channel partners in the data center transformer market is driven by the need for quick and efficient access to transformer equipment, especially for small to medium-sized data centers and urgent installations. Distributors provide a flexible supply chain, allowing data center operators to source transformers without extended lead times associated with custom manufacturing. This segment appeals to operators seeking standardized transformer models, which are readily available and often come with pre-negotiated pricing, making the procurement process cost-effective and timely. Distributors also offer logistical support and local inventory, enabling data centers to deploy or replace transformers as needed rapidly.

Regional Insights

North America data center transformer market held the largest share of over 37% of the data center transformer market in 2024. In North America, the data center transformer market is witnessing a trend toward increased adoption of energy-efficient and sustainable transformer technologies. This includes a growing preference for dry-type transformers due to their enhanced safety and reduced environmental impact. Additionally, the shift towards modular and prefabricated power solutions accelerates construction timelines and improves overall efficiency. The rise of hyperscale data centers also drives demand for high-capacity transformers, further emphasizing the need for robust power management solutions.

U.S. Data Center Transformer Trends

The data center transformer market in the U.S. is expected to grow significantly from 2025 to 2030. In the U.S., the data center transformer market is driven by rapid digitalization and the increasing demand for cloud services. There is a notable trend toward the deployment of advanced transformers that support grid resilience and integrate with renewable energy sources. The market is also experiencing a rise in using advanced Uninterruptible Power Supply (UPS) systems that enhance power reliability. Furthermore, significant investments in manufacturing and infrastructure are expected to bolster production capabilities, addressing supply shortages in the sector.

Europe Data Center Transformer Trends

The data center transformer market in Europe is growing significantly at a CAGR of over 5% from 2025 to 2030. Stringent environmental regulations and a strong emphasis on sustainability characterize European data center transformer market. The adoption of transformers utilizing renewable energy sources is gaining traction, aligning with the European Union's goals for carbon neutrality. Additionally, innovations in transformer design, such as the use of biodegradable insulating oils, are becoming increasingly common. The integration of digital technologies in power management systems is also a significant trend, enabling real-time monitoring and optimization of transformer performance.

Asia Pacific Data Center Transformer Trends

The data center transformer market in the Asia Pacific is growing significantly at a CAGR of over 8% from 2025 to 2030. The Asia Pacific region is experiencing rapid growth in the data center transformer market, fueled by urbanization and increasing internet penetration. The trend toward establishing large-scale data centers is leading to a surge in demand for high-capacity transformers. Additionally, there is a growing focus on energy-efficient solutions and smart grid technologies, aligning with regional initiatives for energy conservation and sustainability. The adoption of modular transformer solutions is also on the rise, enabling faster deployment and scalability in response to the expanding digital landscape.

Key Data Center Transformer Company Insights

Key players operating in the network emulator market include ABB, Eaton, General Electric, Hitachi Energy, HYOSUNG HEAVY INDUSTRIES, Legrand, Mitsubishi Electric Corporation, Schneider Electric, SGB-SMIT Group, Siemens, Toshiba Corporation, Vertiv Group Corp., and Virginia Transformer Corp. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Data Center Transformer Companies:

The following are the leading companies in the data center transformer market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Eaton

- General Electric

- Hitachi Energy

- HYOSUNG HEAVY INDUSTRIES

- Legrand

- Mitsubishi Electric Corporation

- Schneider Electric

- SGB-SMIT Group

- Siemens

- Toshiba Corporation

- Vertiv Group Corp.

- Virginia Transformer Corp

Recent Developments

-

In March 2024, Schneider Electric announced plans to invest USD 140 million in its U.S. manufacturing operations, resulting in the creation of approximately 750 new manufacturing jobs nationwide by 2024. Initially, the company will allocate USD 85 million to renovate and equip an existing 500,000-square-foot manufacturing facility in Mt. Juliet, Tennessee, while also upgrading its current manufacturing operations in Smyrna, Tennessee. Both locations will focus on the production of medium voltage power distribution and custom electrical switchgear products, thereby enhancing support for critical infrastructure, various industries, and the growing demand for data center solutions in the U.S.

-

In August 2023, Eaton announced a plan to invest over USD 500 million in North American manufacturing to advance energy transition, electrification, and digitalization across various industries. As part of this initiative, Eaton is expanding its Nacogdoches, Texas, facility by 200,000 square feet, more than doubling its current size. This expansion will increase Eaton's production capacity for voltage regulators, supporting utility customers across North America in accelerating grid modernization and resilience efforts. The expansion in Texas will also free up capacity at Eaton's largest manufacturing facility in Waukesha, Wisconsin. In Waukesha, Eaton is investing in new equipment to boost the production of three-phase transformers, which serve utility, data center, large commercial, and industrial applications.

Data Center Transformer Market Report Scope

Report Attribute

Details

Market size in 2025

USD 8.24 billion

Revenue forecast in 2030

USD 11.21 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Insulation type, voltage, channel partners, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

ABB; Eaton; General Electric; Hitachi Energy; HYOSUNG HEAVY INDUSTRIES; Legrand; Mitsubishi Electric Corporation; Schneider Electric; SGB-SMIT Group; Siemens; Toshiba Corporation; Vertiv Group Corp.; and Virginia Transformer Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

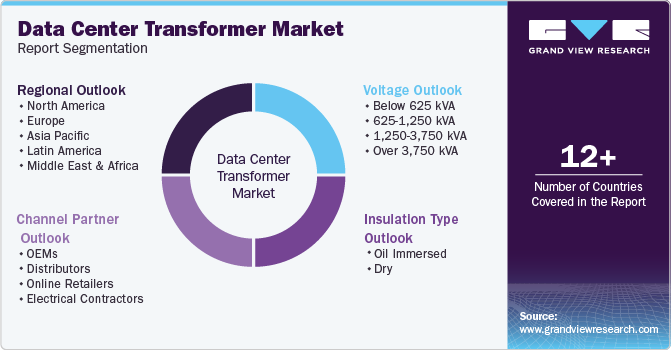

Global Data Center Transformer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the data center transformer market report based on insulation type, voltage, channel partners, and region.

-

Insulation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil Immersed

-

Dry

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 625 kVA

-

625-1,250 kVA

-

1,250-3,750 kVA

-

Over 3,750 kVA

-

-

Channel Partners Outlook (Revenue, USD Million, 2018 - 2030)

-

OEMs

-

Distributors

-

Online Retailers

-

Electrical Contractors

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center transformer market size was estimated at USD 7.77 billion in 2024 and is expected to reach USD 8.24 billion in 2025

b. The data center transformer market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 11.21 billion by 2030

b. North America region dominated the data center transformer market with a share of over 37% in 2024. In North America, the data center transformer market is witnessing a trend toward increased adoption of energy-efficient and sustainable transformer technologies. This includes a growing preference for dry-type transformers due to their enhanced safety and reduced environmental impact.

b. Some key players operating in the data center transformer market include ABB, Eaton, General Electric, Hitachi Energy, HYOSUNG HEAVY INDUSTRIES, Legrand, Mitsubishi Electric Corporation, Schneider Electric, SGB-SMIT Group, Siemens, Toshiba Corporation, Vertiv Group Corp., and Virginia Transformer Corp.

b. Several key factors are driving the data center transformer market. One of the primary drivers is the rapid expansion of data centers globally, fueled by the growing demand for cloud computing, big data analytics, and internet services. The increasing digitalization across industries, coupled with the rise of IoT (Internet of Things) and AI (Artificial Intelligence), has resulted in a surge of data processing and storage needs, necessitating more robust and efficient power infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.