- Home

- »

- Processed & Frozen Foods

- »

-

Date Syrup Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![Date Syrup Market Size, Share & Trends Report]()

Date Syrup Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Conventional, Organic), By Application (Food & Beverage, Nutraceuticals, Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-376-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Date Syrup Market Size & Trends

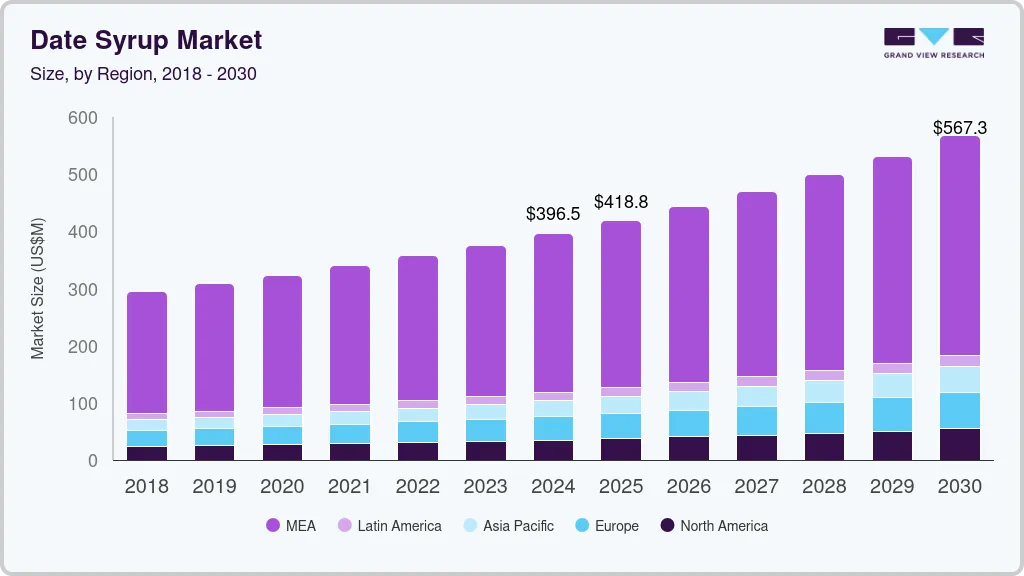

The global date syrup market size was estimated at USD 396.5 million in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. One of the primary drivers of the market is the growing awareness among consumers about the importance of health and wellness. As lifestyles become increasingly hectic and deskbound, more individuals are prioritizing their health and seeking natural, nutrient-rich foods. Date syrup, made from dates, is rich in vitamins, minerals, and antioxidants, making it a popular choice among health-conscious consumers. Studies have shown that dates contain essential nutrients like potassium, magnesium, and dietary fiber, which contribute to overall health.

The global trend towards reducing sugar intake has led to a surge in demand for natural sweeteners. Consumers are becoming more wary of the adverse health effects associated with refined sugars and artificial sweeteners, such as obesity, diabetes, and cardiovascular diseases. Date syrup, being a natural sweetener, fits well into this trend. It offers a healthier alternative with its lower glycemic index and nutritional benefits. According to a report published by the International Food Information Council in May 2022, approximately 73% of consumers in North America are trying to avoid or limit sugars in their diets. Such factors are expected to create key opportunities for market growth.

Sustainability is becoming a critical factor for consumers across the globe, owing to which companies are adopting sustainable initiatives to meet consumer demands. Date syrup production is often associated with sustainable agricultural practices, as date palms require minimal water and are resilient to harsh environmental conditions. Moreover, fair trade practices and ethical sourcing are gaining importance, with consumers showing a preference for products that support these values. Companies that emphasize sustainable and ethical sourcing of dates are likely to attract environmentally conscious consumers, thereby boosting market growth.

Dates have a traditional significance in many regions, particularly in the Middle East. The traditional use of dates and date syrup in various dishes, festivities, and religious ceremonies has sustained their demand over the years. The cultural acceptance and familiarity with date syrup in these regions provide a stable and reliable market. In addition, the increasing popularity of Middle Eastern cuisine globally has introduced date syrup to new markets, further driving its demand. Furthermore, the rise of e-commerce platforms has significantly contributed to the market growth. Online retail channels offer consumers convenience, a wide range of choices, and competitive pricing. The ability to reach a global customer base through e-commerce has enabled manufacturers to expand their market presence and increase sales.

Type Insights

Based on type, the conventional segment led the market with the largest revenue share of 84.6% in 2023. Conventional date syrup is generally less expensive to produce and purchase than organic date syrup. This cost advantage makes it more accessible to a broader range of consumers and manufacturers, particularly in price-sensitive markets. Conventional dates are more widely available than organic dates. The larger supply of conventional dates ensures a steady production of date syrup, meeting the high demand from various industries, including food and beverage, nutraceuticals, and cosmetics.

The organic segment is expected to grow at the fastest CAGR of 13.6% from 2024 to 2030. There is a growing trend towards organic and natural products as consumers become more health-conscious and cautious of synthetic additives and pesticides. Organic date syrup, free from chemical fertilizers and pesticides, appeals to this health-conscious demographic. Organic farming practices are perceived as more environmentally sustainable. Consumers who prioritize sustainability and eco-friendly products are more likely to choose organic date syrup, driving its market growth. Organic date syrup is often positioned as a premium product, catering to consumers who are willing to pay a higher price for quality and purity. This premium positioning allows manufacturers to target niche markets and health-focused segments.

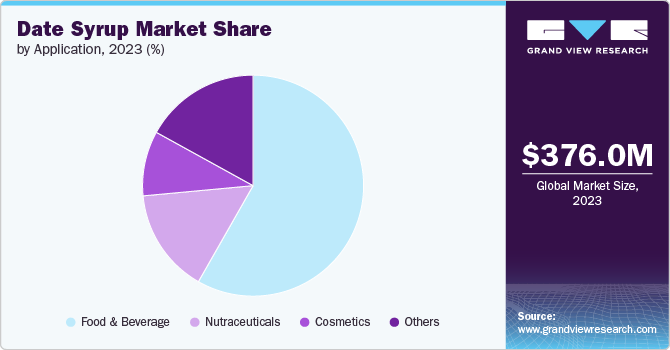

Application Insights

Based on application, the food & beverage segment led the market with the largest revenue share of 58.3% in 2023. Date syrup is a versatile ingredient that can be used in a wide range of food products, including bakery items, confectioneries, dairy products, beverages, sauces, and dressings. Its rich, caramel-like flavor and natural sweetness make it a preferred alternative to refined sugar and artificial sweeteners. With rising health awareness, consumers are increasingly seeking healthier alternatives to sugar. Date syrup, being a natural sweetener with a lower glycemic index, fits this demand perfectly. It also retains many of the nutrients found in whole dates, such as fiber, vitamins, and minerals, making it a more nutritious option.

The nutraceutical segment is expected to grow at the fastest CAGR of 6.2% from 2024 to 2030. There is a global shift towards preventive healthcare, with consumers looking to prevent diseases rather than treat them. Nutraceuticals, which include dietary supplements and functional foods, are perceived as safe and effective options for maintaining health. Date syrup, with its rich nutrient profile and antioxidant properties, is increasingly being incorporated into these products. Date syrup is known for its various health benefits, including its high antioxidant content, which helps combat oxidative stress, and its natural sugars, which provide a sustained energy release. These properties make it an attractive ingredient for nutraceutical products aimed at boosting energy, supporting digestive health, and enhancing overall well-being.

Regional Insights

The date syrup market in North America is expected to grow at a considerable CAGR over the forecast period. There is a growing demand for organic and natural products in North America. Consumers are increasingly seeking organic date syrup for its perceived health benefits and sustainability. Manufacturers in North America are introducing innovative date syrup products, catering to diverse consumer preferences. This includes flavored date syrup, fortified date syrup, and organic variants, which attract a broader consumer base.

U.S. Date Syrup Market Trends

The date syrup market in U.S. accounted for a market share of 80% in North America in 2023. High levels of consumer awareness about health and wellness in the U.S. drive the demand for natural sweeteners like date syrup. The focus on reducing sugar intake and choosing healthier alternatives is particularly strong. The U.S. market has a strong preference for organic products, driven by health and environmental concerns. Organic date syrup, in particular, is seeing significant demand as consumers seek out clean-label and non-GMO products.

Europe Date Syrup Market Trends

The date syrup market in Europe is expected to grow at a significant CAGR during the forecast period. The rise of gourmet and artisanal food products in Europe has brought attention to high-quality, natural sweeteners like date syrup, which is valued for its rich flavor and nutritional benefits. European chefs and food manufacturers are incorporating date syrup into innovative recipes and premium products, further driving its popularity. Moreover, as European consumers become more adventurous in their food choices, there is a growing appreciation for exotic and traditional ingredients from different parts of the world. This cultural curiosity has led to an increased demand for Middle Eastern and North African cuisines, where date syrup is a staple.

Asia Pacific Date Syrup Market Trends

The date syrup market in Asia Pacific is expected to grow at a CAGR of 8.4% from 2024 to 2030. The growing health and wellness trend in the Asia Pacific region is leading to increased demand for natural sweeteners and healthier alternatives to refined sugar. Date syrup fits well into this trend, offering a nutritious and natural option. The rapid growth of the food and beverage industry in the region is also contributing to the demand for date syrup. It is used as a natural sweetener in various food products, including snacks, beverages, and desserts. In addition, rising disposable incomes in emerging economies like China and India are driving the demand for premium and health-focused products, including date syrup. As consumers have more purchasing power, they are willing to spend on nutritious and high-quality food products.

Middle East & Africa Date Syrup Market Trends

Middle East & Africa dominated the date syrup market with a revenue share of 70.6% in 2023. The Middle East is one of the largest producers of dates globally, providing an abundant supply of raw materials for date syrup production. Countries like Saudi Arabia, Iran, and the UAE are major contributors to the global date market. The Middle East not only consumes a large portion of date syrup domestically but also exports significant quantities to other regions. The high quality and unique flavor profile of Middle Eastern date syrup are well-regarded in international markets. Moreover, the consumption of dates and date syrup is deeply rooted in the dietary habits and culinary traditions of the region. This cultural affinity ensures a steady demand for date syrup.

Key Companies & Market Share Insights

Manufacturers in the global market are employing various strategies to capitalize on the growing demand and ensure sustained market growth. These steps include product innovation, quality assurance, sustainable practices, strategic partnerships, effective marketing, and expanding distribution channels.

Key Date Syrup Companies:

The following are the leading companies in the date syrup market. These companies collectively hold the largest market share and dictate industry trends.

- Parsunday Symbol Co.

- Ario Co

- Al Barakah Dates Factory LLC

- Rapunzel Naturkost

- Sun Seas Business Group

- AL FOAH

- Lion Dates

- RatinKhosh

- Bateel

- Just Date

Recent Developments

-

In August 2023, Just Date announced the launch of its Organic Date Sugar in Sprouts Farmers Market stores across the U.S. Just Date's products are made from upcycled dates, providing a naturally sweet and nutrient-dense alternative to traditional sugar. This initiative was taken by the company to expand their reach and provide consumers with better-for-you sweetening options

-

In March 2023, The Groovy Food Company has launched a new organic Date Syrup, a versatile and all-natural sweetener that serves as a delicious alternative to refined sugar. This newly launched product is available at Tesco and Ocado for £2.80 per 340g bottle, this low-fat, vegan, and low-GI sweetener is made from 100% dates

Date Syrup Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 418.8 million

Revenue forecast in 2030

USD 567.3 million

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Netherlands, China; Japan; India; Brazil; Saudi Arabia, UAE

Key companies profiled

Parsunday Symbol Co.; Ario Co; Al Barakah Dates Factory LLC; Rapunzel Naturkost; Sun Seas Business Group; AL FOAH; Lion Dates; RatinKhosh; Bateel; and Just Date

Customization scope

Free Report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Date Syrup Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global date syrup market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Nutraceuticals

-

Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global date syrup market size was estimated at USD 376.0 million in 2023 and is expected to reach USD 396.5 million in 2024.

b. The global date syrup market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030 to reach USD 567.3 million by 2030.

b. Food & beverage application dominated the date syrup market with a share of 58.3% in 2023. With rising health awareness, consumers are increasingly seeking healthier alternatives to sugar. Date syrup, being a natural sweetener with a lower glycemic index, fits this demand perfectly resulting in its rising use in food & beverages.

b. Some key players operating in the date syrup market include Parsunday Symbol Co.; Ario Co; Al Barakah Dates Factory LLC; Rapunzel Naturkost; Sun Seas Business Group; AL FOAH; Lion Dates; RatinKhosh; Bateel; and Just Date.

b. One of the primary drivers of the date syrup market is the growing awareness among consumers about the importance of health and wellness. As lifestyles become increasingly hectic and deskbound, more individuals are prioritizing their health and seeking natural, nutrient-rich foods including date syrup.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.