- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Dietary Fibers Market Size, Share & Trends Report, 2030GVR Report cover

![Dietary Fibers Market Size, Share & Trends Report]()

Dietary Fibers Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (Fruits & Vegetables, Cereals & Grains), By Type (Soluble, Insoluble), By Application (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-712-4

- Number of Report Pages: 175

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dietary Fibers Market Summary

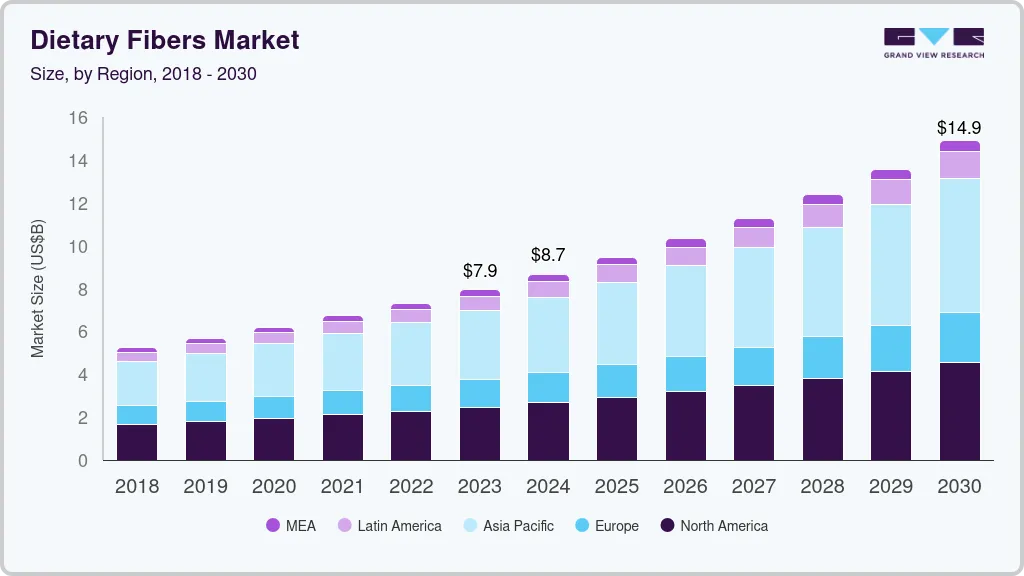

The global dietary fibers market size was estimated at USD 7.9 billion in 2023 and is projected to reach USD 14.93 billion by 2030, growing at a CAGR of 9.5% from 2024 to 2030. A significant shift from pharmaceutical to nutraceutical products among consumers and rising investments in the pharmaceutical industry are the factors anticipated to augment demand during the forecast period.

Key Market Trends & Insights

- The North American dietary fibers market is estimated to grow at a CAGR of 9.2% from 2024 to 2030.

- The dietary fibers market in the U.S.is projected to grow at a CAGR of 8.9% from 2024 to 2030.

- By raw material, cereals and grains segment dominated the market with a revenue share of over 48.0% in 2023.

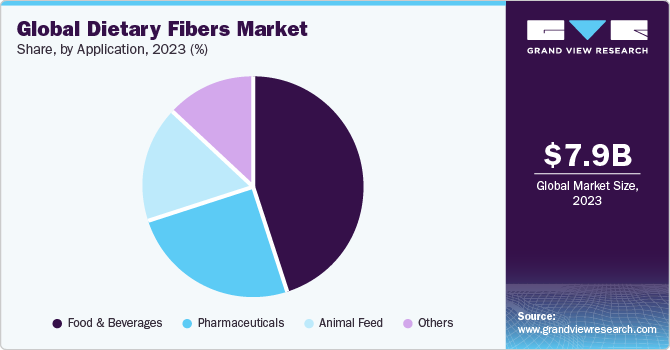

- By application, the food & beverage segment accounted for the highest revenue of USD 3.59 billion in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.9 Billion

- 2030 Projected Market Size: USD 14.93 Billion

- CAGR (2024-2030): 9.5%

- Asia Pacific: Largest market in 2023

Additionally, increasing consumer awareness regarding the importance of maintaining a healthy diet which leads to an active lifestyle by controlling lifestyle diseases such as hypertension, diabetes, and cardiovascular diseases, among other key benefits, may foster market growth. Fresh fruits and vegetables offer a wide range of both soluble and insoluble fiber types, catering to various health needs and nutritional preferences.

Dietary fibers are extracted from different sources via wet processing, dry processing, chemical, gravimetric, physical, enzymatic, and microbial methods. A combination of the aforementioned methods may also be used to achieve the desired results. Different treatment methods emit different results on the structure of dietary fibers. Innovations in terms of the production process and immense potential for dietary fibers to be used in a wide range of food products are anticipated to drive market demand. Overall, the U.S. fruit and vegetable production has been steadily increasing in recent years, driven by consumer demand for healthy options and technological advancements. Growers are responding to the demand for fiber by researching and developing new varieties with higher fiber content or specific fiber profiles.

COVID-19 had a marginal impact on the dietary fibers market. Dietary fibers can be found in a wide range of products, such as pharmaceuticals, dietary supplements, and animal feed. Dietary fibers are also used to boost immunity and muscle mass. Hence, during the pandemic, the demand for dietary fiber products in the market was high. In addition, customers began to incorporate dietary fibers into their daily diets, which influenced overall market growth. Fruits and vegetable businesses are focusing on products addressing challenges like diabetes management, gluten-free options rich in fiber, or fiber supplements targeted at prebiotics for specific gut concerns.

According to research from the National Institutes of Health, more than 60 to 70 million Americans experience distinct digestive health issues. Furthermore, according to the Harvard School of Public Health, adults and children need at least 20-30 grams of dietary fiber each day. Additionally, consuming dietary fiber reduces the risk of a number of illnesses, including heart disease, diverticular disease, constipation, and diabetes. The aforementioned factors are expected to increase dietary fiber demand. The USDA Dietary Guidelines for Americans recommend that adults consume 25-35 grams of dietary fiber per day. This recommendation is based on scientific evidence linking adequate fiber intake to a reduced risk of chronic diseases such as heart disease, diabetes, and certain cancers.

Easy availability of cereals & grains such as oats, whole wheat, rye, corn, popcorn, barley, brown rice, wild rice, buckwheat, triticale, bulgur, and millet is expected to drive demand for the dietary fibers in the U.S. Despite the fact that dietary fibers are best known for the physiological functions, they are indigestible. Fibers cannot be used as a source of energy because they are immune to hydrolysis and passes through the body in an undamaged state. This factor becomes a challenge when used as a component in food and beverage applications.

Dietary fibers help humans to avoid constipation and maintain a healthy digestive system. People suffering from Irritable bowel syndrome (IBS) are frequently advised to increase and modify the amount of fiber in their diet. Likewise, this is anticipated to increase the demand for dietary fiber supplements among people suffering from IBS globally. Dietary supplements offer a convenient way to increase fiber intake for individuals who struggle to get enough from their diet alone.

Market Concentration & Characteristics

The growth of this market can be attributed to increasing consumer awareness of the gut microbiome's role in overall health and well-being is driving demand for fiber-rich foods and supplements to promote gut balance and digestion. Growing interest in fibers with specific functional benefits, like prebiotics for immune health or specific fibers for cholesterol management, is creating new market segments.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small-and medium-sized companies operating in the industry in a bid to facilitate regional expansion.Increasing concentration through mergers and acquisitions can create challenges for smaller players and potentially limit overall market dynamism.

Other functional ingredients like probiotics and prebiotics can offer similar health benefits, posing some competition for dietary fibers. While substitutes offer alternative options, the overall market for dietary fibers is expected to grow steadily, driven by increasing health awareness and demand for functional ingredients. Rising popularity of plant-based diets is increasing demand for plant-derived fiber sources like inulin, psyllium, and resistant starches.

Consumers are increasingly demanding clear information about the origin and processing of their food, requiring companies to demonstrate transparency and traceability in their fiber sources. Furthermore, navigating complex approval processes can delay product launches and limit marketing claims, hindering market penetration.

Raw Material Insights

Cereals and grains dominated the market with a revenue share of over 48.0% in 2023. These fibers lower the risk of developing cardiovascular conditions like coronary heart disease and stroke. Oat, flaxseed, bean, and oat bran fibers also aid in lowering levels of low-density lipoprotein, lowering total blood cholesterol levels.

Beta-glucan, pentose, and arabinoxylans are some of the important soluble fibers found in whole grains like wheat, rye, and barley, while insoluble fibers like lignin, cellulose, and hemicelluloses are found in cereals like rice, maize, and wheat bran. The market for dietary fibers is anticipated to grow due to the increasing demand for beta-glucan as an immunity booster in the pharmaceutical and nutraceutical sectors.

Fruits such as purple passion fruit, Metamucil, orange, avocado, figs, and vegetables such as sweet potato and turnip are known to contain high levels of fiber. Growing awareness regarding the importance of consuming these fruits and vegetables in the day-to-day diet is expected to play a significant role in the segment's growth during the forecast period.

The nuts & seeds segment is projected to grow at a CAGR of over 10% from 2024 to 2030, driven by their increasing use on account of their nutritional value. Increasing use of organic ingredients in the manufacturing process of nuts & seeds is one of the primary reasons contributing to the growing demand for these products. The nuts & seeds segment is expected to witness growth in emerging economies owing to their high protein content.

Legumes are a source of three forms of dietary fiber, including insoluble fiber, soluble fiber, and resistant starch, that are responsible for many protective effects of the legumes. The growing adoption of legumes in numerous applications such as bakeries, snacks, and nutrition bars is one of the critical reasons for boosting segment growth.

Type Insights

The market for soluble dietary fibers was the largest in 2023 and is anticipated to expand at a CAGR of 9.0% during the forecast period. Fruits, nuts, vegetables, cereals, whole grains, and seeds are the sources of soluble types that are safe for consumption by both animals and humans. While pectin, found in fruits such as pears and apples, aids in curing acid reflux and gut health, fibers found in vegetables such as inulin and fructooligosaccharide (FOS) aid in regulating intestine function. Nutritional benefits offered by soluble dietary fibers help in binding the cholesterol in the gut and prevent its absorption, leading to lower LDL levels and improved heart health.

The soluble dietary fibers are frequently used as a flavor-enhancing ingredient in many different foods and beverages as well as a fat and sugar replacement in a number of food applications, including bakery, frozen dairy desserts, and confectionery goods. Additionally, increasing research and development on inulin and other soluble fibers, like pectin and polydextrose, is anticipated to expand the market's overall product offering in the coming years.

Insoluble dietary fibers are expected to grow at a CAGR of over 10% from 2024 to 2030, owing to the rising consumption of functional foods, increased consumer health consciousness, and changing diet patterns. Furthermore, insoluble dietary fibers derived from corn, rice, oats, wheat, potato, peas, and legumes aid in preventing various health problems, such as constipation, high cholesterol, obesity, and hyperglycemia.

Insoluble dietary fibers do not form a gel-like substance and smoothly pass through the intestines, thus improving bowel function. The insoluble dietary fiber market is expected to witness augmented growth in the coming years on account of rising demand for functional foods and increasing health consciousness among consumers.

Application Insights

The food & beverage segment accounted for the highest revenue of USD 3.59 billion in 2023. This trend is anticipated to continue during the forecast period due to the rising consumer awareness regarding the significance of dietary fibers in daily meals. The dominance of the application segment can also be attributed to the remarkable growth of the functional foods industry owing to a rise in per capita income, which has enhanced the spending capacities of consumers.

The pharmaceutical application segment is projected to witness rapid growth at a CAGR of 9.1% from 2024 to 2030, owing to the many benefits associated with consuming dietary fibers. Some of these benefits include maintaining bowel health, lowering cholesterol levels, and controlling blood sugar levels. Various types of fibers, such as cellulose, hemicelluloses, pectin, and lignin, are used in the pharmaceuticals segment.

Animal feed application in the dietary fibers market is expected to witness significant growth, at a CAGR of 9.6%, from 2024 to 2030, on account of the rising awareness regarding animal health, such as the use of dietary fibers in weight management diet and obesity of the animals. Additionally, improvement in the intestinal health of the animals and ascending demand for animal-derived food products is further propelling the market demand.

The other applications include personal care and cosmetic products. Growing demand for dietary fibers in developing economies and increasing awareness regarding personal care and hygiene are anticipated to promote industry growth during the forecast period. The growing personal care sector is expected to stimulate demand for dietary fibers during the forecast period.

Regional Insights

The Asia Pacific dietary fibers market is anticipated to witness the highest CAGR of 10.1% from 2024 to 2030 in terms of revenue. Asia Pacific led the market and accounted for over 40.0% share of the global revenue in 2023. Countries such as China, Indonesia, and Japan are expected to be the leading producers of foods and beverages during the next few years. Promising trends in the food & beverage industry in the Asia Pacific are estimated to spur demand for dietary fibers during the forecast years.

Chinese consumers are now following international food trends due to their exposure to global food products. Consumers are, therefore, observed to have an increased preference towards healthy products with high nutritional benefits, especially in the time of COVID-19, where nutritional intake has become a priority for many people while making choices related to food, which may help in market growth.

The North American dietary fibers market is estimated to grow at a CAGR of 9.2% from 2024 to 2030. North America has been the largest market for immunity-boosting and health-enhancing products in 2023. Nutritional care has seen a major evolution in the region, with consumers becoming highly aware of packaged food products' ingredients. The new trending diets and lifestyles adopted by the people in the North American region have rendered the consumption of dietary fibers highly significant.

U.S. dietary fibers market

The dietary fibers market in the U.S.is projected to grow at a CAGR of 8.9% from 2024 to 2030. Easy availability of cereals & grains such as oats, whole wheat, rye, corn, popcorn, barley, brown rice, wild rice, buckwheat, triticale, bulgur, and millet is expected to drive demand for the dietary fibers in the U.S. Further, the consumption of fruits & vegetable is expected to have a positive impact on growth of the U.S. dietary fibers market, on account of growing concerns about various health issues including obesity, high cholesterol levels, and cancer. California, Florida, Washington, Oregon, and Georgia are major specialty crops, and fruits & vegetable producing states in the U.S.

Key Companies & Market Share Insights

The global dietary fibers market is characterized by the presence of a few well-established players such as BENEO, Lonza, DuPont de Nemours, Inc., Archer Daniels Midland Company (ADM), Batory Foods, Ingredion Incorporated, Roquette Freres, PURIS, Tate & Lyle, Emsland Group, Cargill, Incorporated, Kerry Inc., The Green Labs LLC, Nexira, Far best Brands, J.RETTENMAIER& SOHNE GmbH + Co KG, Taiyo International, AGT Food and Ingredients. Owing to changing consumer trends, numerous companies are expanding their product portfolio to gain a competitive advantage in the market. Manufacturers are increasingly engaged in R&D activities related to the products that are used in the manufacturing of dietary fibers. They are also expanding their production capacities to meet the growing demand for dietary fibers from the application industry.

Key Dietary Fibers Companies:

The following are the leading companies in the dietary fibers market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these dietary fibers companies are analyzed to map the supply network.

- BENEO

- Lonza

- DuPont de Nemours, Inc.

- Archer Daniels Midland Company (ADM)

- Batory Foods

- Ingredion Incorporated

- Roquette Freres

- PURIS

- Tate & Lyle

- Emsland Group

- Cargill, Incorporated

- Kerry Inc.

- The Green Labs LLC

- Nexira

- Farbest Brands

- J. RETTENMAIER & SOHNE GmbH + Co KG

- Taiyo International

- AGT Food and Ingredients

Recent Developments

-

In September 2020, Batory Foods entered into an agreement with BioHarvest Sciences Inc., a developer of patent-protected and proprietary Biofarming technology. The agreement was signed exclusively to enter the US Edible CBD Market and US Nutraceuticals Market so as to strategically diversify Batory Foods’ product portfolio.

Dietary Fibers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.66 billion

Revenue forecast in 2030

USD 14.93 billion

Growth rate (Revenue)

CAGR of 9.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, Spain, Italy, France, China, India, Japan, South Korea, Australia & New Zealand, Brazil, Argentina, South Africa, UAE

Key companies profiled

BENEO, Lonza, DuPont de Nemours, Inc., Archer Daniels Midland Company (ADM), Batory Foods, Ingredion Incorporated, Roquette Freres, PURIS, Tate & Lyle, Emsland Group, Cargill, Incorporated, Kerry Inc., The Green Labs LLC, Nexira, Far best Brands, J.RETTENMAIER& SOHNE GmbH + Co KG, Taiyo International, AGT Food and Ingredients

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dietary Fibers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global dietary fibers market report on the basis of raw material, type, application, and region:

-

Raw Materials Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Fruits & Vegetables

-

Cereals & Grains

-

Nuts & Seeds

-

Legumes

-

-

Type Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Insoluble

-

Cellulose

-

Hemicelluloses

-

Chitin & Chitosan

-

Lignin

-

Oat Bran

-

Wheat Fiber

-

Others

-

-

Soluble

-

Inulin

-

Pectin

-

Beta-Glucan

-

Corn Fibers

-

Others

-

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dietary fibers market size was estimated at USD 6.73 billion in 2021 and is expected to reach USD 7.31 billion in 2022.

b. The dietary fibers market is expected to grow at a compound annual growth rate of 9.2% from 202 to 2030 to reach USD 14.93 billion by 2030.

b. The soluble segment dominated the dietary fibers market with a share of 54% in 2021, owing to its extensive use as a flavor-enhancing additive in various food & beverage products, such as frozen dairy desserts, and bakery & confectionery products.

b. Some of the key players operating in the dietary fibers market include BENEO; ADM; Lonza; Cargill, Incorporated; DuPont; Ingredion Incorporated; Roquette Frères; Puris; Emsland Group; Kerry Inc.; The Green Labs LLC; Nexira; Tate & Lyle; Farbest Brands; J. RETTENMAIER & SÖHNE GmbH + Co KG; Taiyo International; AGT Food and Ingredients; Batory Foods.

b. The key factors that are driving the dietary fibers market include increasing consumption of insoluble dietary fiber supplements owing to their nutritional specifications, such as controlling blood sugar levels and lowering of cholesterol levels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.