- Home

- »

- Homecare & Decor

- »

-

Decorative Lighting Market Size, Share, Growth Report, 2030GVR Report cover

![Decorative Lighting Market Size, Share & Trends Report]()

Decorative Lighting Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sconce, Flush Mount), By Application (Commercial, Household), By Light Source, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-562-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Decorative Lighting Market Summary

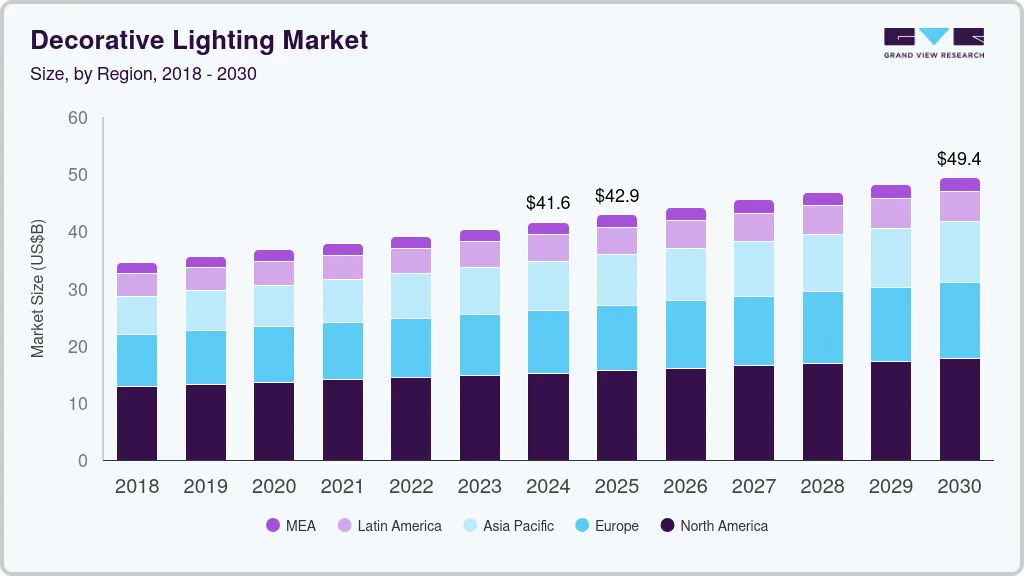

The global decorative lighting market size was estimated at USD 41,596.8 million in 2024 and is projected to reach USD 49,415.9 million by 2030, growing at a CAGR of 2.9% from 2025 to 2030. Rising urbanization and increasing disposable incomes increase home aesthetics and interior decoration spending.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, sconce accounted for a revenue of USD 14,604.5 million in 2024.

- Flush Mount is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 41,596.8 Million

- 2030 Projected Market Size: USD 49,415.9 Million

- CAGR (2025-2030): 2.9%

- North America: Largest market in 2024

As more people prioritize creating stylish living spaces, the demand for decorative lighting solutions surges. Additionally, technological advancements in lighting, such as the development of energy-efficient LED bulbs and smart lighting systems, attract consumers looking for modern and sustainable options.

The growing popularity of themed and mood lighting, driven by social media and interior design trends, contributes to market growth. Furthermore, the expanding hospitality industry emphasizes creating appealing and inviting environments, which boosts the demand for decorative lighting in hotels, restaurants, and other commercial spaces. These drivers, combined with increasing consumer awareness of the benefits of well-designed lighting, are expected to sustain the growth of the decorative lighting market in the coming years.

Product Insights

The sconce segment dominated the market with the largest revenue share of 34.2% in 2024. Wall sconces offer a versatile lighting solution that can enhance the ambiance of various settings, from residential spaces to commercial establishments. Their ability to provide both direct and ambient lighting makes them a preferred choice for interior designers and homeowners alike. Additionally, the wide variety of designs, styles, and finishes available in the sconce segment caters to diverse aesthetic preferences, further driving demand. The increasing trend of home renovation and the desire to create stylish, well-lit living environments also contribute to the strong performance of the sconce segment in the decorative lighting market.

The flush mount segment is expected to grow at the fastest CAGR of 3.4% over the forecast period. Flush mount fixtures are particularly popular in homes with lower ceilings, as they offer a stylish yet unobtrusive lighting solution. Their compact design fits seamlessly against the ceiling, providing ample illumination without taking up much space. The increasing trend towards minimalist and modern home interiors also boosts the demand for flush mount lighting. Additionally, advancements in LED technology are making these fixtures more energy-efficient and longer-lasting, appealing to eco-conscious consumers.

Light Source Insights

The LED segment dominated the market with the largest revenue share in 2024. LED lights are known for their energy efficiency, consuming significantly less power than traditional lighting solutions, which appeals to eco-conscious consumers and those looking to reduce electricity costs. Additionally, LEDs have a longer lifespan, reducing the need for frequent replacements and offering better value for money over time. The versatility of LED technology allows for a wide range of applications and design possibilities, from vibrant color-changing lights to subtle, ambient illumination. Innovations in smart lighting systems, where LEDs play a central role, are also gaining popularity, enabling users to control their lighting environment through smartphones and voice assistants easily. These attributes make LEDs the preferred choice in the decorative lighting market, driving their dominant market share.

The fluorescent segment is expected to witness a significant CAGR over the forecast period. The increasing demand for energy-efficient lighting solutions is a major contributor, as fluorescent lights consume less energy than traditional incandescent bulbs. Additionally, increasing awareness of environmental sustainability and the need to reduce carbon footprints encourage consumers and businesses to opt for fluorescent lighting. The segment's cost-effectiveness and longer lifespan make it an attractive option for residential and commercial applications.

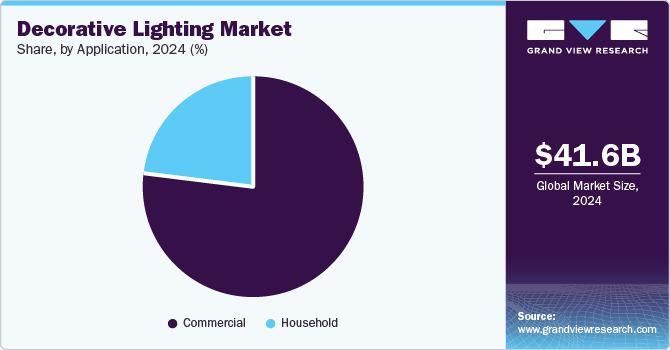

Application Insights

The commercial segment dominated the market with the largest revenue share in 2024. This growth is driven by the expanding hospitality industry, including hotels, restaurants, and resorts, all of which invest heavily in creating appealing and inviting environments for their guests. Additionally, office spaces and retail stores increasingly focus on aesthetics to enhance customer experience and employee productivity. The rise of smart cities and infrastructural development projects also contributes to the demand for modern and efficient lighting solutions. The emphasis on energy efficiency and sustainability further drives the adoption of advanced lighting technologies in commercial settings. As businesses continue to prioritize ambiance and eco-friendly practices, the commercial segment remains a key driver of growth in the decorative lighting market.

The household segment is expected to grow at the fastest CAGR over the forecast period. With more people spending time at home and prioritizing their living environments, there is an increased demand for decorative lighting that enhances home aesthetics and functionality. The rise in home renovation projects and the trend of personalized interior design are boosting the adoption of stylish and innovative lighting solutions. Additionally, the growing awareness of energy efficiency and the benefits of LED technology encourage homeowners to upgrade their lighting systems. The influence of social media and online platforms, where homeowners can easily access and get inspired by various lighting ideas, further fuels this growth. As consumers continue to invest in creating beautiful and comfortable living spaces, the household segment is poised for significant expansion in the decorative lighting market.

Regional Insights

North America dominated the global decorative lighting market, with the largest revenue share of 36.6% in 2024. The region's high disposable incomes enable consumers to invest in premium and innovative lighting solutions. Additionally, a robust real estate market fuels demand for stylish and functional lighting fixtures in both residential and commercial properties. The growing trend of smart homes and connected lighting systems also plays a significant role, as tech-savvy consumers embrace the convenience and customization of smart lighting.

U.S. Decorative Lighting Market Trends

The U.S. decorative lighting market dominated the North American market with the largest revenue share in 2024. The high standard of living and substantial disposable incomes in the U.S. empower consumers to invest in premium, innovative lighting solutions. The booming real estate market, characterized by numerous residential and commercial developments, fuels the demand for stylish and functional lighting fixtures. Moreover, the growing adoption of smart home technologies and connected lighting systems caters to the tech-savvy U.S. consumer base, which values customization and convenience. Additionally, the emphasis on sustainability and energy efficiency drives the popularity of LED lighting and other eco-friendly options.

Europe Decorative Lighting Market Trends

The European decorative lighting market was identified as a lucrative region in 2024. The increasing adoption of energy-efficient LED lighting solutions is a major contributor, as consumers and businesses alike prioritize sustainability and cost savings. The "home sweet home" trend, which emphasizes creating comfortable and aesthetically pleasing living spaces, has also boosted demand for decorative lighting in this region.

The UK decorative lighting market is expected to grow significantly over the forecast period. Economic stability in the country has led to higher consumer spending on non-essential items, including decorative lighting. Additionally, the presence of major market players and a well-established retail infrastructure make a wide range of decorative lighting products easily accessible to consumers.

Asia Pacific Decorative Lighting Market Trends

Asia Pacific decorative lighting market is expected to grow at the fastest CAGR of 3.8% over the forecast period. This rapid growth is driven by several factors, including the region's increasing urbanization and rising disposable incomes. As more people move to urban areas and seek to enhance their living spaces, the demand for decorative lighting solutions rises. Additionally, the growing middle class in countries such as China and India contributes to higher consumer spending on home decor. The trend towards smart homes and adopting energy-efficient lighting solutions, such as LED lights, are also significant in driving market growth.

The Indian decorative lighting market is expected to grow at a significant CAGR over the forecast period. This growth is driven by several factors, including economic development, rapid urbanization, and growing awareness about interior design. Furthermore, the growing number of middle-class people and rising disposable incomes are also contributing to higher consumer spending on home décor, including decorative lighting.

Key Decorative Lighting Company Insights

Some key companies in the decorative lighting market include Acuity, Philips Lighting, Home Depot, Hubbell, Generation Brands, Juno, Lowe’s, GE Lighting, LSI, and others. Companies are introducing new designs to increase their customer base. Furthermore, several companies are implementing various strategic initiatives, such as mergers and acquisitions and partnerships with other leading companies.

-

Acuity Brands, operating under the brand Lithonia Lighting, provides various decorative lighting solutions, including sconces, chandeliers, and pendant lights, known for their durability and aesthetic appeal. The company focuses on delivering energy-efficient and sustainable lighting options for both residential and commercial spaces.

-

Philips Lighting offers an extensive collection of decorative lights, such as chandeliers, pendant lights, and wall sconces, designed to enhance the ambiance of any space. Philips emphasizes sustainability and innovation, focusing strongly on LED technology and smart lighting solutions that allow users to customize their lighting experience.

Key Decorative Lighting Companies:

The following are the leading companies in the decorative lighting market. These companies collectively hold the largest market share and dictate industry trends.

- ACUITY BRANDS, INC.

- Philips Lighting (Signify Holding)

- Home Depot

- Hubbell

- Generation Brands

- Juno

- Lowe’s

- GE Lighting

- LSI Industries

- OSRAM GmbH

Recent Developments

-

In October 2024, Surya Roshni announced that it is all set to brighten the festive season with its latest collection of decorative lighting solutions. The collection includes the Jagmag String Light, Rope Light, and Profile Strip Light, among others, designed to offer versatility, ease of installation, and low power consumption.

-

In September 2024, Kingswood Capital Management, a Los Angeles-based private equity firm, announced the acquisition of Kichler Lighting from Masco Corp. for an estimated USD 125 million.

Decorative Lighting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 42.90 billion

Revenue forecast in 2030

USD 49.42 billion

Growth rate

CAGR of 2.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, light source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; South Africa; Saudi Arabia

Key companies profiled

ACUITY BRANDS, INC.; Philips Lighting (Signify Holding); Home Depot; Hubbell; Generation Brands; Juno; Lowe’s; GE Lighting; LSI Industries; OSRAM GmbH

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Decorative Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global decorative lighting market report based on product, light source, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Chandeliers

-

Pendants

-

Sconce

-

Flush Mount

-

Others

-

-

Light Source Outlook (Revenue, USD Million, 2018 - 2030)

-

LED

-

Fluorescent

-

Incandescent

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Household

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.