- Home

- »

- Organic Chemicals

- »

-

Deep Eutectic Solvents Market Size, Industry Report, 2030GVR Report cover

![Deep Eutectic Solvents Market Size, Share & Trends Report]()

Deep Eutectic Solvents Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By End-use (Pharmaceuticals & Healthcare, Foods & Beverages, Cosmetics, Chemical Industry, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-605-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Deep Eutectic Solvents Market Summary

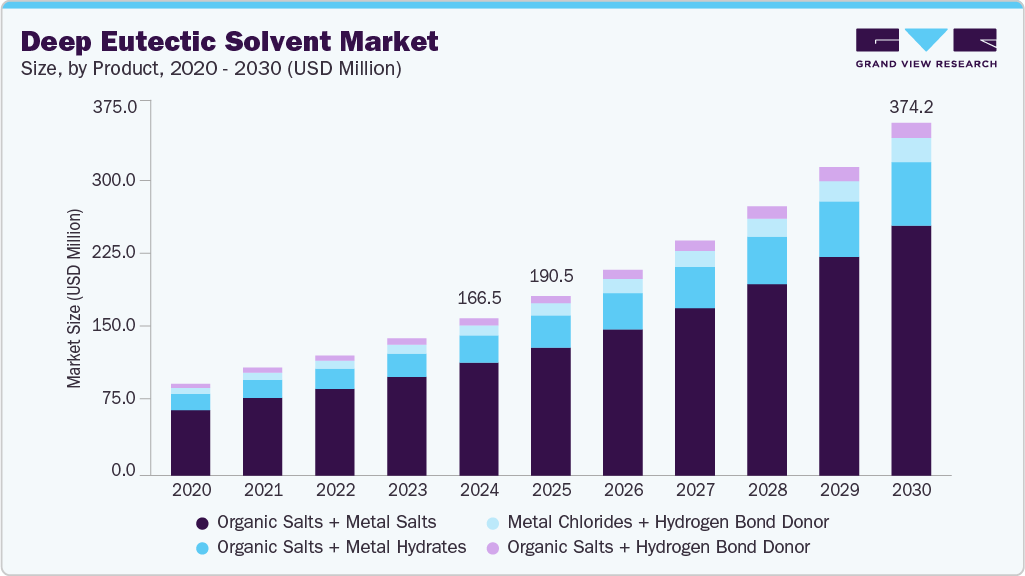

The global deep eutectic solvents market size was estimated at USD 166.5 million in 2024, and is projected to reach USD 374.2 million by 2030, growing at a CAGR of 14.5% from 2025 to 2030. The Deep Eutectic Solvent (DES) market is emerging as a key segment within the green chemistry and sustainable solvents industry.

Key Market Trends & Insights

- Asia Pacific dominated the deep eutectic solvents market with the largest revenue share of 40.4% in 2024.

- China is the dominant DES market within Asia Pacific region.

- Based on product, the organic salts + metal salts segment held the largest revenue share of 71.5% of the DES market in 2024.

- By end use, the chemical & materials industry segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 166.5 Million

- 2030 Projected Market Size: USD 374.2 Million

- CAGR (2025-2030): 14.5%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

DES is a class of environmentally benign solvents formed by mixing a hydrogen bond acceptor (HBA) and a hydrogen bond donor (HBD), which results in a significant depression of the melting point. These solvents are seen as sustainable and cost-effective alternatives to traditional organic solvents. The demand for environmentally friendly and sustainable chemical processes is a major driver of the global deep eutectic solvent industry. These solvents are gaining attention as a viable alternative to traditional organic solvents and ionic liquids due to their low volatility, non-toxicity, and biodegradability. As industries face increasing regulatory pressure to minimize the use of hazardous substances, especially volatile organic compounds (VOCs), there is a growing shift toward green solvents.

DES offers a safer and more sustainable option, aligning global sustainability goals and regulatory frameworks such as REACH and EPA guidelines. In addition to their environmental advantages, DES is relatively easy and cost-effective to synthesize, often using readily available bio-based components. This economic advantage makes them appealing across various sectors, including pharmaceuticals, cosmetics, food processing, and metal extraction. Furthermore, ongoing research into new DES formulations and their potential uses, such as in electrochemical systems, CO₂ capture, and biocatalysis, is expanding their industrial applicability. As innovations continue to improve performance and scalability, the adoption of DES is expected to accelerate across mature and emerging markets.

Market Concentration & Characteristics

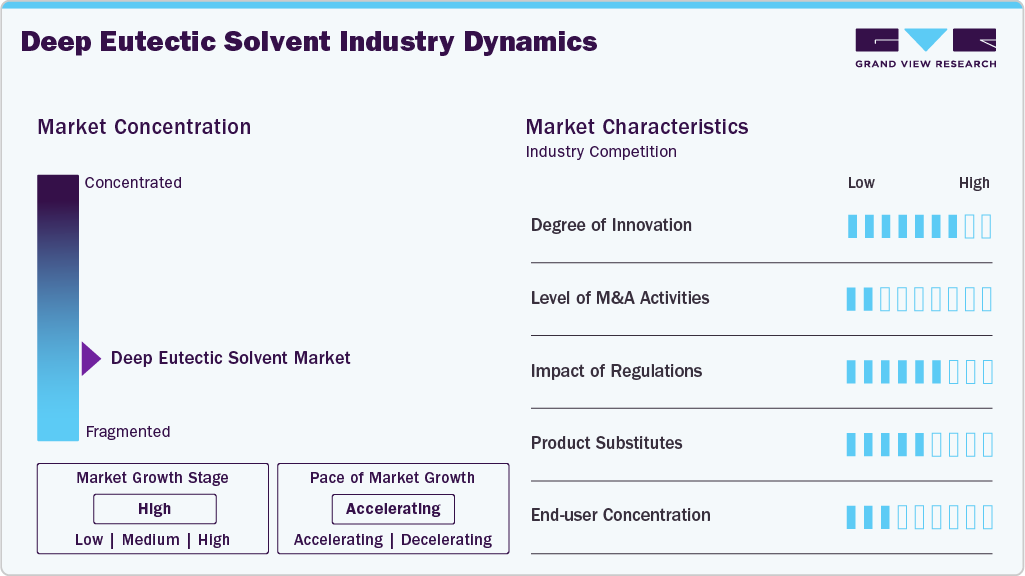

The deep eutectic solvent market growth is high, and the pace of growth is accelerating. The market is characterized by a high degree of innovation, driven by academic research, public-private partnerships, and a push for sustainable alternatives to conventional solvents. New formulations are being developed for specific industrial needs such as metal recovery, pharmaceutical processing, and energy storage. For instance, in Dec 2023, researchers supported by the National Natural Science Foundation of China developed a novel ultra-microporous carbon material doped with nitrogen and oxygen using DES-assisted hydrothermal carbonization (DES-HTC) and KOH activation of microalgae. This material exhibited exceptional CO₂ adsorption capacity (4.37 mmol/g at 25°C), pushing it toward commercialization. Innovations are focused on improving solvent performance, biodegradability, and applicability in challenging chemical environments. As DES are highly tunable, this opens vast room for tailored innovation, giving companies the opportunity to differentiate based on proprietary formulations and novel uses.

The global deep eutectic solvents market is currently fragmented in nature. It consists of a mix of small to medium-sized companies, research-focused start-ups, and a few established chemical firms. No single company holds a dominant market share, as the market is still in its early developmental phase. A limited number of players are engaged in large-scale commercial production, while the majority are involved in research, niche applications, or custom formulations. This fragmentation reflects the experimental stage of DES commercialization and the diversity of potential application areas still being explored.

The merger and acquisition (M&A) activity level in this market is currently low, largely due to the early-stage and fragmented nature of the industry. Most collaborations occur through research agreements or technology partnerships, rather than through full acquisitions. The threat of product substitutes is moderate, primarily from traditional solvents and ionic liquids. While DES offers environmental advantages, many industries still rely on well-established solvent systems deeply integrated into their processes. Ionic liquids, although more expensive, provide similar benefits and may compete directly in high-performance applications.

Regulations play a significant role in shaping this market, acting more as an enabler than a constraint. Growing environmental regulations that restrict the use of volatile organic compounds (VOCs) and hazardous chemicals are creating favorable conditions for DES adoption. In addition, DES often does not fall under the same stringent hazardous chemical classifications, simplifying its approval for industrial use. The end-use concentration in the deep eutectic solvent industry is low. DES is used across a broad range of industries, from pharmaceuticals and cosmetics to food processing, metallurgy, and energy.

Product Insights

The organic salts + metal salts segment held the largest revenue share of 71.5% of the DES market in 2024. These formulations are widely used due to their versatility, ease of preparation, and ability to dissolve a wide range of inorganic and organic compounds. Their superior solvating properties make them particularly effective in electroplating, metal recovery, and catalytic applications. Their compatibility with industrial processing conditions, such as high ionic conductivity and thermal stability, has made them the preferred choice for sectors like materials science and metallurgy. As regulatory bodies tighten restrictions on conventional solvents, the demand for these robust and less hazardous alternatives continues to rise, reinforcing their dominance in R&D and commercial applications.

The metal chlorides + hydrogen bond donor segment is expected to grow at the fastest CAGR of 15.2% from 2025 to 2030. These DES formulations are particularly suitable for applications requiring strong Lewis acidic environments, such as catalysis, corrosion inhibition, and electrochemical synthesis. Their ability to form stable yet reactive systems makes them suitable for next-generation applications, including energy storage and nanomaterials processing. The growing interest in sustainable battery electrolytes and advanced manufacturing techniques is propelling research into this DES category. Ongoing innovation focused on improving their thermal resistance, reusability, and functional compatibility with metals and complex organics is expected to fuel their adoption across high-value industries.

End-use Insights

The chemical & materials industry segment held the largest revenue share in 2024. This dominance is primarily due to increasing adoption of DES as an environmentally friendly alternative in chemical synthesis, metal processing, electroplating, and polymer dissolution. The ability of these solvents to replace traditional toxic solvents without compromising performance has made them particularly attractive for chemical manufacturers looking to comply with stringent environmental regulations. In metal finishing and recovery, DES enables selective extraction of rare earth and heavy metals with higher efficiency and lower ecological impact. As R&D continues to focus on improving the physicochemical properties of DES, such as thermal stability and reusability, its role in sustainable chemical manufacturing is expected to grow.

The food & beverage processing segment is expected to grow at the fastest CAGR from 2025 to 2030. The increasing use of DES in natural product extraction, including flavors, antioxidants, essential oils, and bioactives, is expected to drive the growth of this segment in the coming years. Unlike traditional solvents, DES are non-toxic and often composed of food-grade components, which makes them ideal for extracting sensitive compounds while maintaining food safety standards. In addition, DES is being explored for applications in decontamination, food preservation, and nutrient enhancement. The tunable solvent properties and clean-label appeal of DES align well with consumer and regulatory demands for natural and safe food processing technologies.

Regional Insights

North America deep eutectic market is backed by a strong focus on green chemistry, advanced research infrastructure, and stringent environmental regulations. The region’s chemical and pharmaceutical industries are actively adopting sustainable solvents, and academic institutions are leading efforts to commercialize DES through collaborative research and pilot projects. Government support for eco-friendly technologies and increasing awareness related to VOC-related risks have stimulated the demand.

U.S. DES Market Trends

The U.S. dominates the North American DES market, driven by robust R&D in sustainable materials and high adoption across specialty chemicals and pharmaceuticals. Federal initiatives to promote clean technologies and green manufacturing create favorable conditions for DES integration, particularly as replacements for hazardous solvents. The presence of leading universities and research centers, many of which are exploring DES for applications in energy storage, biocatalysis, and rare earth extraction, is accelerating innovation and commercialization.

Europe DES Market Trends

Europe DES market is projected to grow at the fastest CAGR of 14.9% from 2025 to 2030. This growth is fueled by strong regulatory pressure from the EU to replace toxic and non-biodegradable solvents under REACH regulations. Furthermore, Europe has been a pioneer in promoting green chemistry through its Circular Economy Action Plan, which encourages the adoption of sustainable processes in industrial and consumer applications. Academic-industry collaborations and funding under programs like Horizon Europe are accelerating DES research, especially for recycling, food processing, and pharmaceutical applications.

Germany leads the DES market in Europe, owing to its strong chemical and materials manufacturing base and a proactive stance on sustainability. German industries are increasingly adopting DES for metal surface treatment, specialty coatings, and battery chemistry, driven by economic and regulatory incentives.

Asia Pacific DES Market Trends

The Asia Pacific DES market held the largest revenue share of 40.4% in 2024. Rapid industrialization, growing focus on sustainable production, and increasing investments in the chemical, food, and pharmaceutical sectors are driving the market in this region. The region’s emphasis on cost-effective and scalable green technologies has accelerated the integration of DES in metal extraction, electrochemistry, and biomass processing. Additionally, supportive policy frameworks and expanding manufacturing base are providing strong growth opportunities for DES suppliers across emerging economies in the region.

China is the dominant DES market within Asia Pacific region, propelled by aggressive industrial expansion and strong government policies supporting green technology adoption. The country is increasingly using DES in mining, metallurgy, and battery manufacturing to reduce environmental impact and improve processing efficiency.

Key Deep Eutectic Solvents Company Insights

The deep eutectic solvent industry is characterized by a mix of specialized chemical companies, innovative startups, and established industrial players actively investing in green solvent technologies. These companies are driving the commercialization of DES through advancements in formulation chemistry, scalable production methods, and application-specific solutions across industries such as chemicals, energy, food processing, and pharmaceuticals. Strategic collaborations, R&D partnerships, and a strong focus on sustainability are key factors shaping the competitive landscape.

-

Proionic: Proionic is a key player in the development of ionic liquids and deep eutectic solvents. It is recognized for its proprietary production technology (the “HF process”), which ensures high purity and scalability. The company collaborates with chemical manufacturers and research institutions to offer customized DES solutions, especially in electrochemistry, metal processing, and green extraction applications.

-

Iolitec Ionic Liquids Technologies GmbH: Iolitec is a major innovator in the DES and ionic liquids space. The company offers a wide portfolio of eutectic formulations tailored for R&D and industrial use. Iolitec is actively involved in projects targeting energy storage, catalysis, and biomass valorization, making it a significant contributor to the commercial growth of DES-based technologies in Europe and beyond.

Key Deep Eutectic Solvents Companies:

The following are the leading companies in the global deep eutectic solvents market. These companies collectively hold the largest market share and dictate industry trends.

- Proionic

- Iolitec Ionic Liquids Technologies GmbH

- DES Solutio

- Merck KGaA

- Thermo Fisher Scientific Inc.

- BASF

- Solvay

- The Chemours Company

Recent Developments

-

In May 2025, a research article from ACS Publ lithium ications reported the promising application of deep eutectic solvents (DESs) for direct air capture (DAC) of CO₂. The study identified a DES composed of tetrabutylphosphonium bromide and triethylene glycol in a 1:2 molar ratio (DES2) as the most effective, exhibiting strong CO₂ affinity and selectivity under atmospheric conditions due to its favorable molecular interactions and polarity.

-

In April 2024, Arkema acquired a nearly 78% majority stake in Proionic, a start-up specialized in ionic liquids crucial for next-generation lithium-ion batteries, including solid and flexible types. This acquisition enhances Arkema's portfolio of high-performance materials and supports its strategy to offer innovative, sustainable solutions, such as ionic liquids and applications in biomass processing and metal treatment. Proionic's expertise in ionic liquids synthesis and recycling aligns with Arkema's goal to develop safer, more efficient, and sustainable batteries, positioning the company strongly in the evolving battery and ionic liquids markets, including potential overlaps with Deep Eutectic Solvents (DESs) due to their related roles in green.

Deep Eutectic Solvents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 190.5 million

Revenue forecast in 2030

USD 374.2 million

Growth rate

CAGR of 14.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in tons, Price in kg, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Proionic; Iolitec Ionic Liquids Technologies GmbH; DES Solutio; Merck KGaA; Thermo Fisher Scientific Inc.; BASF; Solvay; The Chemours Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Deep Eutectic Solvents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global deep eutectic solvent market report based on product, end-use, and region:

-

Product Outlook (Price, USD/Kg; Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Organic Salts + Metal Salts

-

Organic Salts + Metal Hydrates

-

Organic Salts + Hydrogen Bond Donor

-

Metal Chlorides + Hydrogen Bond Donor

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals & Healthcare

-

Food & Beverage Processing

-

Cosmetics & Personal Care

-

Chemical & Materials Industry

-

Others

-

-

Region Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global deep eutectic solvents market size was estimated at USD 166.5 million in 2024 and is expected to reach USD 190.5 million in 2025.

b. The global deep eutectic solvents market is expected to grow at a compound annual growth rate of 14.5% from 2025 to 2030 to reach USD 374.2 million by 2030.

b. The Asia Pacific dominated the deep eutectic solvents market with a share of 40.38% in 2024. This is attributable to the strong demand from the chemical, pharmaceutical, and metal processing industries. Rapid industrialization and supportive green chemistry policies in countries like China and India further boosted adoption.

b. Some key players operating in the deep eutectic solvents market include DEScycle, Brainerd Chemical, Arkema (Proionic GmbH), NADES Design, and GATTEFOSSE SAS.

b. The deep eutectic solvents market is driven by increasing demand for green and sustainable solvents, growing applications in metal extraction, pharmaceuticals, and electrochemistry, along with regulatory pressure to reduce volatile organic compounds and adopt environmentally friendly chemical processing methods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.