- Home

- »

- Medical Devices

- »

-

Dental Cement Market Size & Share, Industry Report, 2030GVR Report cover

![Dental Cement Market Size, Share & Trends Report]()

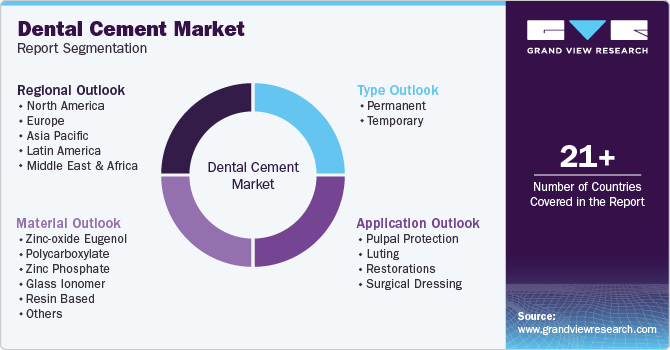

Dental Cement Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Zinc-oxide Eugenol, Polycarboxylate, Zinc phosphate), By Type (Permanent, Temporary), By Application (Pulpal Protection, Luting, Restorations), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-479-6

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Cement Market Size & Trends

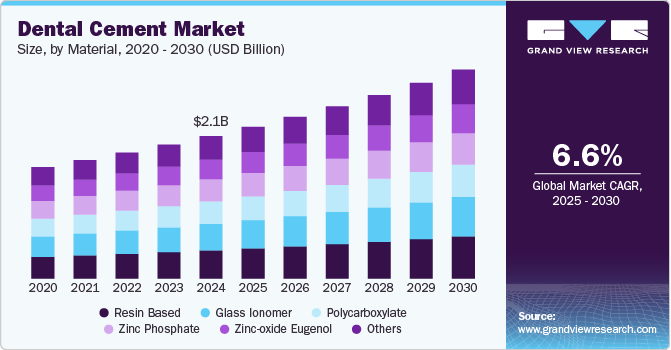

The global dental cement market size was valued at USD 2.1 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. The industry is primarily driven by the increasing prevalence of dental diseases, advancements in dental technology, and growing awareness regarding oral health. These drivers contribute significantly to the demand for dental cement, essential materials used in dental procedures such as restorations, crowns, bridges, and orthodontics. In November 2024, the World Health Organization reported that about 3.5 billion people are affected by oral diseases. Moreover, the rising incidence of dental caries among children is a crucial factor fueling market growth.

Technological advancements in dentistry have also played a crucial role in driving the dental cement industry. Innovations such as improved adhesive systems and bioactive materials have enhanced the performance and longevity of dental cement. Recent developments include resin-based cements that offer superior bonding capabilities and ease of use compared to traditional materials. In April 2024, the Journal of Functional Biomaterials examined the durability of glass ionomer cement (GIC) as a restorative material for primary and permanent teeth. Thirteen studies showed inconsistent GIC’s performance results, with significant concerns about bias and evidence quality. While GICs are considered suitable for both dentitions, further research is essential to determine the best materials for long-lasting restorations.

The increasing geriatric population, along with a growing number of dental clinics and practitioners offering extensive dental care services, are significant contributors to the expansion of the dental cement market. In June 2024, United Nations projections indicate that the global share of individuals aged 65 and older will rise from 5.5% in 1974 to 10.3% in 2024 and is expected to double to 20.7% by 2074. While developed nations have the highest percentages of older adults, many developing countries are rapidly aging and unprepared for the challenges this brings. Furthermore, projections indicate that by 2050, individuals aged 65 and above will outnumber children under five years old by more than twofold and will be roughly equal in number to children under twelve.

The market's growth is due to the increasing focus on preventive dental care and cosmetic dentistry. As patients demand more aesthetically pleasing and long-lasting restorations, the demand for high-performance cement, such as resin-based and bioactive cement, has surged. These materials offer better bonding, aesthetic appeal, and durability, making them ideal for restorative and cosmetic procedures. In January 2024, Delta Dental released new research emphasizing the crucial role of preventive dental care in mitigating serious oral diseases and enhancing overall health. The 13th annual Preventive Dental Care Study identified notable gaps in care, especially among older school-aged children, while observing a slow decrease in the number of older adults at high risk for tooth decay.

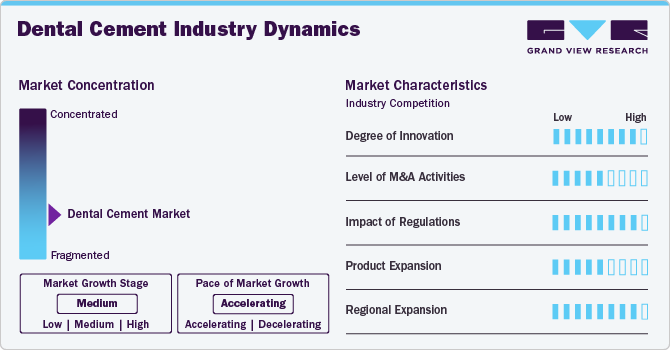

Market Concentration & Characteristics

The degree of innovation in the industry is high, driven by materials science and technology advancements. Recent innovations include the development of bioactive dental cement, such as calcium silicate-based cement, that promotes healing and integration with dental tissues. For instance, Shofu's BeautiLink SA is a self-adhesive, dual-cured resin cement formulated explicitly for zirconia restorations, commonly used in modern crowns.

The level of merger and acquisition activities in the industry is medium. While notable consolidations have been among significant players seeking to expand their product portfolios and geographic reach, the overall frequency of mergers and acquisitions has not surged dramatically. Companies strategically acquire smaller firms specializing in innovative technologies or niche products to enhance their competitive edge. However, the market remains fragmented, with numerous small- and medium-sized enterprises operating independently.

The impact of regulations on the industry is rated as high. Regulatory bodies such as the FDA in the U.S. and similar organizations worldwide impose stringent guidelines regarding product safety, efficacy, and quality control for dental materials. Compliance with these regulations is crucial for manufacturers aiming to introduce new products. The rigorous approval processes can slow innovation cycles but ultimately ensure that only safe and effective products reach consumers, influencing market dynamics significantly.

Product expansion within the industry is evaluated as medium. Manufacturers actively diversify their offerings by developing a more comprehensive range of cement tailored for specific applications such as orthodontics, prosthodontics, and restorative dentistry. For instance, in June 2022, Parkell introduced Predicta Bioactive Cement, a self-adhesive, dual-cure resin cement designed to fill and seal micro gaps while promoting hydroxyapatite formation, effectively preventing microleakage and protecting crown margins from secondary caries.

The dental cement market's regional expansion is classified as high. Companies are increasingly targeting emerging markets in Asia-Pacific, Latin America, and Africa due to rising disposable incomes, growing awareness about oral health care, and expanding healthcare infrastructure. This trend is supported by strategic partnerships with local distributors and investments in marketing initiatives to educate practitioners about advanced dental solutions.

Material Insights

The resin-based segment held the highest market share of 19.7% in 2024. It is also the fastest growing segment within the dental cement market due to its superior properties, including excellent adhesion, aesthetic appeal, and enhanced mechanical strength. The increasing demand for cosmetic dentistry is a significant driver of this segment’s growth, as patients seek materials that function well and blend seamlessly with natural teeth. Additionally, advancements in resin technology have led to the development of dual-cure and light-cure systems that offer versatility in clinical applications. For instance, 3M RelyX Universal Dental Resin Cement is a dual-paste cement in an ergonomic syringe with a Micro Mix tip, ideal for self-adhesive applications and effective when used with 3M Scotchbond Universal Plus Adhesive.

The resin-based segment’s dominance in the dental cement market can also be attributed to its adaptability across various dental procedures, including bonding, luting, and therapeutic applications. This versatility is essential as dental professionals seek materials catering to different clinical scenarios. Furthermore, the growing emphasis on minimally invasive dentistry propelled the demand for resin cements that provide strong adhesion and preserve tooth structure. In August 2023, PANAVIA SA Cement Universal received a Top Product Award from DENTAL ADVISOR for its ability to bond with nearly all substrates, including lithium disilicate, without needing a separate primer. This innovative cement simplifies procedures by combining a silane coupling agent and MDP monomer for strong, durable bonds with various materials while also allowing easy removal of excess cement and not requiring refrigeration.

Type Insights

The permanent segment accounted for the largest revenue share of 52.5% in 2024. It is also the fastest-growing segment due to its critical role in restorative dentistry, particularly for procedures involving crowns, bridges, and other long-term dental restorations. Advancements in dental materials and technology led to the development of high-strength permanent cements that offer enhanced adhesion and durability, making them preferable for dentists and patients. For instance, Calibra Bio by Dentsply Sirona is a permanent, self-curing dental luting cement that minimizes microleakage and naturally protects marginal integrity. Its bioactive properties allow it to interact with the oral environment, forming a self-repairing hydroxyapatite layer that enhances durability.

The increasing demand for minimally invasive dental procedures influences the permanent segment's growth. As patients and practitioners seek solutions that provide durability and enhance the overall appearance of dental restorations, the adoption of high-strength permanent cement is expected to rise. Innovations in dental technology, such as the development of bioactive materials and advanced adhesive systems, further contribute to this trend. In October 2024, an article in the Journal of Dentistry explored the solubility of three common luting cements: glass ionomer (GI), resin-modified glass ionomer (RMGI), and resin cement (RC). The study found that resin cement had the lowest solubility, making it the most durable option for permanent dental restorations. RMGI and GI followed in terms of solubility. The findings highlight the importance of cement selection in ensuring the longevity and success of dental restorations.

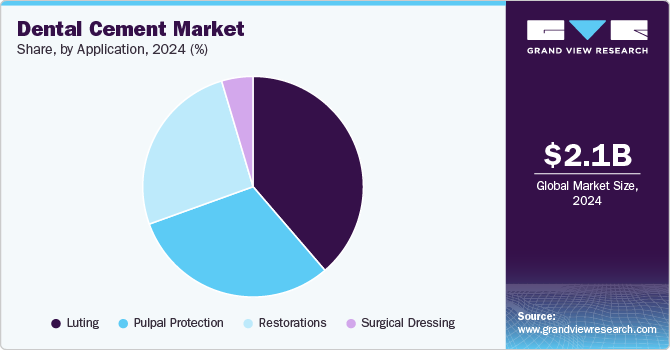

Application Insights

The luting segment held the largest revenue share of 38.7% in 2024 primarily due to its critical role in securing dental restorations such as crowns, bridges, and inlays to tooth structures. This segment is driven by several factors, including the increasing prevalence of dental caries and periodontal diseases, which necessitate restorative procedures. In April 2024, SDI Limited introduced Riva Cem Automix, a novel resin-modified glass ionomer cement. Riva Cem Automix is a self-curing, radiopaque paste that releases fluoride and serves as a luting cement. It is designed to permanently cement metal and ceramic restorations, including zirconia, porcelain, and orthodontic bands.

The restoration segment of the dental cement industry is experiencing the fastest-growing CAGR due to several key drivers, including an increasing prevalence of dental diseases, a rising senior population, and advancements in dental technology. As more individuals seek restorative dental procedures such as crowns, bridges, and fillings, the demand for high-quality dental cement has surged. In May 2024, HASS Bio enhanced its dental ceramics lineup by launching the Amber Mill H block and disc, building on the success of the initial hybrid block. The expanded range will feature new sizes (8T and 10T) and ten different shades, categorized by high and low translucency, designed to offer tailored dental solutions that seamlessly blend with patients' natural teeth for improved aesthetic results.

Regional Insights

North America dental cement industry dominated the global market with a 39.0% revenue share in 2024, driven by an increasing demand for aesthetic dental solutions. There is a growing preference for resin-based cement, which offers superior bonding strength and esthetic properties compared to traditional zinc phosphate cement. The ever-increasing number of dentists and dental clinics in Canada is anticipated to drive market growth further. In April 2024, Statistics Canada reported that a significant portion of children under five had never been to a dentist, with 79.8% of one-year-olds and 16.4% of four-year-olds not having visited. In contrast, 89.6% of Canadian children and youth aged 5 to 17 had seen a dental professional in the last year, including 93.1% of those with insurance and 78.5% without.

U.S. Dental Cement Market Trends

The dental cement market in the U.S. is characterized by rapid technological advancements and product launches to enhance clinical outcomes. Innovations such as self-adhesive cements are gaining traction due to their ease of use and reduced procedural time, which appeals to dentists and patients alike. In November 2023, 3M announced that its planned independent healthcare company would be named Solventum, derived from the words solving and momentum. The name reflects the company's commitment to finding innovative solutions for healthcare professionals and overcoming challenges in the industry, highlighting its potential for significant global impact.

Europe Dental Cement Market Trends

The dental cement market in Europe is experiencing significant growth driven by an aging population and increasing awareness of oral health. The rise in dental procedures, mainly cosmetic dentistry, increased demand for advanced dental materials, including cement. Innovations like bioactive cement that promote healing and integration with natural tooth structure are gaining traction. In June 2024, a study on the socioeconomic factors affecting oral health in 12-year-olds across Europe found that higher national income and living in Western Europe were strongly linked to better oral health. Children in wealthier and Western countries had much lower odds of poor oral health than those in middle-income and Eastern countries.

The UK dental cement market is shifting toward permanent cement, driven by patients' increasing preference for long-lasting dental solutions. The rise in dental disorders, coupled with a growing focus on aesthetic outcomes, is pushing dental practitioners to seek advanced materials that offer functionality and aesthetic appeal. In July 2024, the British Dental Journal published an article discussing how award-winning solutions enhance treatments and improve patient restorations. RelyX Universal Resin Cement, produced by Solventum was recognized as the leading universal resin cement in the 2024 Dental Advisor Awards.

The dental cement market in France is characterized by a strong emphasis on research and development, leading to novel products tailored to specific clinical needs. The French government’s initiatives to improve healthcare access have increased dental visits, boosting demand for dental cement. Furthermore, the trend toward dental procedures prompted innovations in adhesive technologies requiring less preparation time and better bonding strength.

Asia Pacific Dental Cement Market Trends

The dental cement market in Asia Pacific is experiencing significant growth driven by increasing dental health awareness and rising disposable incomes. The region saw a surge in dental procedures, particularly in Japan and South Korea, where advanced dental technologies are being adopted. In April 2024, the IDEM 2024 International Dental Exhibition and Conference took place in Singapore, drawing orthodontic professionals from the Asia-Pacific region. The event showcased the latest innovations in dental technology and provided a platform for knowledge exchange among industry leaders and dentists.

Japan dental cement market is experiencing significant growth driven by increasing awareness of oral health, advancements in dental technology, and a rising demand for cosmetic dentistry. Key trends include the growing preference for resin-modified glass ionomer cements due to their superior bonding properties and aesthetic appeal and the shift toward digital dentistry, which enhances treatment precision and efficiency. For instance, in June 2024, a study examined the anti-staining properties of new and existing dual-cure resin cement for dental prosthetics. It found a moderate correlation between color change and water solubility and a strong correlation between stain compound amount and color change. Low-water-soluble cement, such as ZEN Universal Cement, benefits aesthetic dentistry.

The dental cement market in India is witnessing robust growth due to many factors, including a large target population and increasing awareness about oral hygiene. The Indian government’s initiatives towards improving healthcare access have led to more people seeking dental care services. A notable trend toward cosmetic dentistry among younger populations drives demand for aesthetic restorative materials such as resin-based cement. Introducing innovative products tailored to Indian conditions, such as cement designed for quick setting times suitable for busy urban lifestyles, also contributed to market dynamics.

Latin America Dental Cement Market Trends

The dental cement market in Latin America is experiencing a notable shift driven by increasing awareness of oral health and advancements in dental technology. A significant trend is the rising demand for aesthetic dental procedures, leading to an increased use of resin-based cements that offer better esthetic properties than traditional materials. The growing senior population in the region is contributing to the increasing need for dental services and products

Brazil dental cement market is characterized by rapid innovation and product launches to improve clinical outcomes and patient satisfaction. The Brazilian dental industry saw a surge in research and development activities, leading to the introduction of bioactive cements that promote healing and integration with natural tooth structures. In January 2022, a study revealed that Brazil has a significant burden of oral diseases, affecting nearly 100 million individuals, which corresponds to a prevalence of 45.3%. Key issues included untreated dental caries in both primary and permanent teeth, periodontitis, and edentulism, leading to over 970,000 years lived with disability.

Middle East & Africa Dental Cement Market Trends

The dental cement market in the Middle East and Africa is growing rapidly due to the rising prevalence of dental disorders, which has increased the demand for restorative procedures. As oral health awareness improves, more individuals seek tooth damage and cavities treatments. Advancements in dental materials and technology further drive the adoption of high-quality dental cement, supporting market growth in the region. In April 2023, a study examined the knowledge and practices of restoration repair among dental students in central Saudi Arabia. Of 316 respondents, most had been educated on and practiced restoration repair, favoring it over replacement to preserve tooth structure. Composite was the preferred material and defect size largely influenced decision-making. The study highlights the importance of evaluating clinical teaching methods.

Saudi Arabia dental cement market is witnessing robust growth fueled by several unique factors. The country’s Vision 2030 initiative aims to improve healthcare services, including oral health, which has resulted in increased investments in healthcare infrastructure and awareness campaigns about oral hygiene. In May 2023, a study published in BMC Oral Health evaluated the knowledge of dental students and interns regarding dental luting cements at three Colleges of Dentistry in Saudi Arabia. The findings indicated that while students had a foundational understanding of cement selection based on restoration type, there is a need to improve their management of dental implants and porcelain laminate veneers.

Key Dental Cement Company Insights

Key companies in the industry are actively pursuing various strategic initiatives to enhance their market presence. These initiatives include investing in research and development to innovate and improve the properties of dental cement, which aims to achieve better clinical outcomes and enhance patient comfort. To meet the global market's diverse needs, these players focus on product diversification, offering various types of cement suitable for different dental procedures.

Key Dental Cement Companies:

The following are the leading companies in the dental cement market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Danaher Corporation

- Dentsply Sirona

- Ivoclar Vivadent

- SHOFU Dental GmbH

- BISCO, Inc.

- SDI Limited

- DMG America LLC

- FGM Dental Group

- MEDENTAL INTERNATIONAL

Recent Developments

-

In November 2024, Mitsui Chemicals unveiled the i-TFC Luminous II dental material line, created by its subsidiary, SUN MEDICAL. This range includes post-and-core materials that utilize a low-polymerization-shrinkage monomer to enhance adhesion, reducing shrinkage by 28%. Additionally, this product features SHOFU’s S-PRG filler, marking the inaugural collaboration between Mitsui Chemicals, SUN MEDICAL, and SHOFU.

-

In July 2024, Shofu Dental Corporation launched BeautiLink SA, a self-adhesive resin cement tailored for zirconia restorations, at the California Dental Association annual meeting. Zirconia is now the preferred material for dental crowns, with 98% of dentists using it for posterior crowns. BeautiLink SA offers strong retention and excellent marginal integrity for lasting bonds in zirconia applications.

-

In April 2024, SHOFU INC. and SUN MEDICAL CO., LTD. revealed that Shofu Dental Brasil will begin selling SUN MEDICAL’s Super-Bond dental adhesive in Brazil. This adhesive, which features 4-META and TBB, has been popular among dental professionals since its launch in 1982, appreciated for its strong bonding performance in various dental applications worldwide.

Dental Cement Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.2 billion

Revenue forecast in 2030

USD 3.0 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

3M; Danaher Corporation; Dentsply Sirona; Ivoclar Vivadent; SHOFU Dental GmbH; BISCO, Inc.; SDI Limited; DMG America LLC; FGM Dental Group; MEDENTAL INTERNATIONAL

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Cement Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental cement market report based on material, type, application and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Zinc-oxide eugenol

-

Polycarboxylate

-

Zinc phosphate

-

Glass ionomer

-

Resin based

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Permanent

-

Temporary

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pulpal Protection

-

Luting

-

Restorations

-

Surgical Dressing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental cement market size was estimated at USD 2.1 billion in 2024 and is expected to reach USD 2.2 billion in 2025.

b. The global dental cement market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 3.0 billion by 2030.

b. North America dominated the dental cement market with a share of 39.0% in 2024. This is attributable to well-developed healthcare infrastructure, high disposable income, and extensive research & development activities.

b. Some key players operating in the dental cement market include 3M Company; FGM Produtos Odontológicos; Ivoclar Vivadent AG; Danaher Corporation; Dentsply Sirona; DMG Chemisch-Pharmazeutische Fabrik GmbH; SHOFU Dental GmbH.

b. Key factors that are driving the market growth include the growing prevalence of dental disorders and technological & material advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.