- Home

- »

- Medical Devices

- »

-

Surgical Dressing Market Size, Share & Growth Report, 2030GVR Report cover

![Surgical Dressing Market Size, Share & Trends Report]()

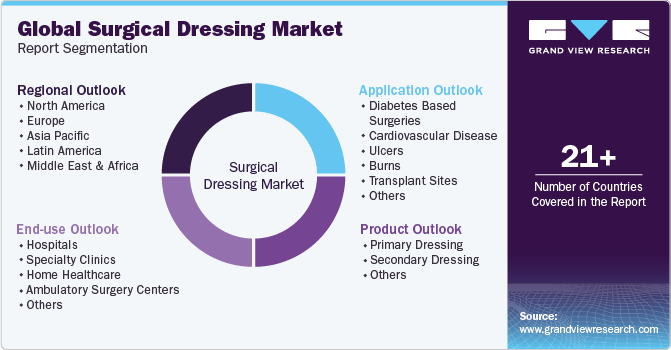

Surgical Dressing Market (2023 - 2030) Size, Share & Trends Analysis By Product, By Application, By End Use (Hospital, Specialty Clinics, Home Healthcare, Ambulatory Surgery Centers, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-537-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Dressing Market Summary

The global surgical dressing market size was estimated at USD 4.80 billion in 2022 and is projected to reach USD 7.40 billion by 2030, growing at a CAGR of 5.6% from 2023 to 2030. The market growth is majorly driven by the rising number of surgeries globally.

Key Market Trends & Insights

- North America dominated the market with the largest revenue share of 34.0% in 2022.

- Asia Pacific is anticipated to grow at the fastest CAGR of 7.7% over the forecast period from 2023 to 2030.

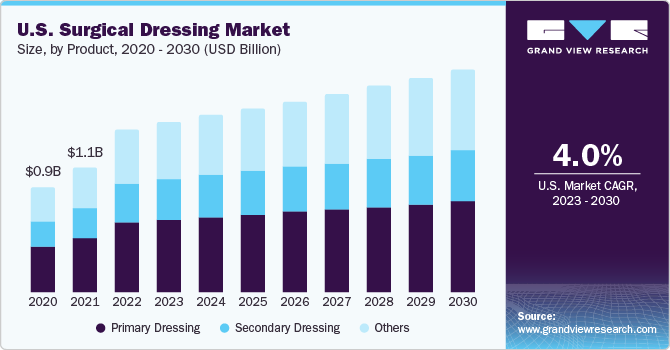

- Based on product, the primary segment dominated the market with the largest revenue share of 43.6% in 2022.

- Based on application, the cardiovascular disease segment is expected to grow at the fastest CAGR of 6.2% over the forecast period.

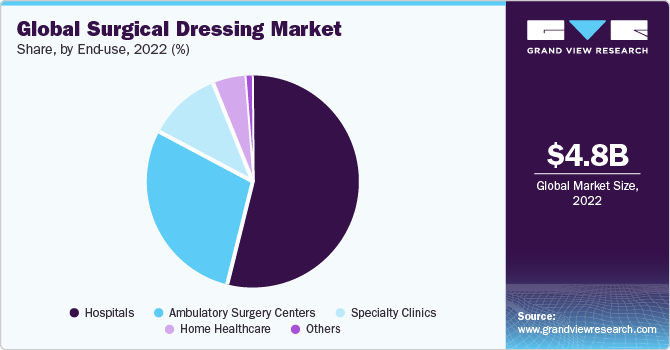

- Based on end use, the hospital segment dominated the market with the largest revenue share of 53.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.80 Billion

- 2030 Projected Market Size: USD 7.40 Billion

- CAGR (2023-2030): 5.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

As per an article published by NCBI in 2020, approximately 310 million major surgeries are performed yearly, amongst which approximately 40 to 50 million are performed in the U.S. and 20 million in Europe. Moreover, according to a survey by the National Quality Forum, the number of surgical procedures conducted in the U.S. is increasing yearly, and the rate of surgeries performed in ambulatory surgery centers has surged by 300% in the last decade. Furthermore, according to the American Society of Plastic Surgeons, approximately 18 million people in the U.S. underwent minimally invasive cosmetic surgical procedures in 2018.

According to Regenexx, approximately 7 million orthopedic surgeries were performed in the U.S. in 2017, of which 242,000 adults below 65 years of age had a hip or knee implant. Surgeries may lead to surgical site infections if the wound is improperly cleaned. According to Infectious Disease Advisor, 5% of surgeries resulted in surgical site infections. Therefore, with the increase in the number of surgeries performed, the use of surgical wound dressings is anticipated to grow during the forecasted period.

Another significant factor driving the market growth is the rising number of cardiovascular disease-related surgeries which may further increase the demand for these products. For instance, as per the data published by Europe (Eurostat), transluminal coronary angioplasties were most common in Croatia and Germany in 2018, with an average of 411 and 409 performed per 100 000 inhabitants, respectively. Furthermore, the number of bariatric surgical procedures performed is expected to increase due to the rising disease prevalence of diabetes and obesity, which may be a driver for this industry. For instance, according to the American Society for Metabolic and Bariatric Surgery, in 2018, the total number of metabolic and bariatric procedures increased by 10.8%, i.e., from approximately 228,000 in 2017 to 252,000.

The increasing prevalence of chronic disorders, such as diabetes, is expected to drive market growth. For instance, according to the Centers for Disease Control and Prevention’s National Diabetes Statistics report of 2020, the number of diabetes patients has increased to an estimated 34.2 million, which comprises about 10.5% of the total population. According to a similar report, an estimated 26.8 million people have been diagnosed with diabetes, whereas 7.3 million people had diabetes and were yet to be diagnosed.

Moreover, 1.5 million new cases of diabetes were diagnosed alone in 2018, which included approximately 210,000 adolescents & children younger than 20 years of age. Thus, with an increase in the number of patients who have diabetes, the prevalence of diabetic foot ulcers is expected to increase. According to the University of Michigan Health, there is a 15% chance for a diabetic patient to develop diabetic foot ulcers. In contrast, there is a 14%-24% chance for patients who develop diabetic foot ulcers to have an amputation. Wound healing in diabetes patients is slow, and wounds may cause infection if not diagnosed properly. Thus, with the increase in the number of diabetes patients, the use of surgical dressings is expected to grow, thereby aiding industry growth.

Furthermore, the growing elderly population is expected to drive growth in the global surgical dressing market. Older people (aged ≥65) are currently the fastest-growing group of the general population in the U.S. According to National Population Projections by the U.S. Census Bureau 2017, nearly 1 in 4 U.S. citizens is likely to be an older adult by 2060. Also, the number of older populations is expected to reach 85.67 million by 2050. The elderly population is more susceptible to chronic wounds, and with an increase in age, the wound healing ability of the body slows down.

Moreover, according to the Wound Care Learning Network, older people are more likely to be diagnosed with pressure ulcers. For instance, according to the Wound Care Learning Network, 71% of patients with pressure ulcers were aged 60 & above, which highlights the vulnerability of the geriatric population to pressure ulcers. In addition, according to the Agency for Healthcare Research & Quality, more than 2.5 million people in the U.S. develop pressure ulcers yearly. Thus, along with the increasing elderly population, the rising incidence of pressure ulcers is expected to drive the industrial scale in the times to come.

The COVID-19 pandemic had negatively impacted the market, mainly due to elective surgical procedures cancellation or delays. Moreover, there was a slight impact on the number of patients visit to wound care centers and outpatient clinics, especially in the U.S. For instance, as per the research survey published by Tissue Analytics, a Net Health company, there was an estimated 40% decline in patient visits to wound care centers during March & April 2020 compared to 2019.

However, post-pandemic, the sector is expected to recover gradually as healthcare providers have shifted to new modes of care for surgical wounds, such as virtual consultations and telehealth platforms. Following the latest insights published on MobiHealthNews (HIMSS) in October 2021, the National University of Singapore, in collaboration with Singapore General Hospital, developed VeCare. It’s a point-of-care wound evaluation platform that comprises a smart bandage with sensors and a smartphone app for remote wound monitoring. The wearable device can detect factors of chronic wounds within 15 minutes. Furthermore, several studies have found that telemedicine options are a cost-effective way to improve wound care outcomes while increasing patient compliance and satisfaction. The Centers for Medicare and Medicaid Services (CMS) recently updated the list of reimbursable such services. Thus, the market is anticipated to gain a significant growth rate in the post-pandemic period due to the abovementioned factors.

Product Insights

The primary segment dominated the market with the largest revenue share of 43.6% in 2022. This is due to increased demand for several primary dressing products, such as hydrogels, alginates, and foam dressings. Foam dressing is a particularly absorbent wound treatment. Foam dressings require fewer changes than other forms of dressings. Foam dressings are effective for wounds with many exudates, such as weeping ulcers, deep cavity wounds, wounds produced by debridement, etc. They are commonly prescribed for their most important advantage: providing a wet, warm environment that promotes healing. These dressings are typically used for full or partial-thickness wounds with moderate to extensive drainage. Furthermore, these dressings act as a cushion to cover the damaged area and a barrier against bacteria during compression therapy. It is believed that the ability of these dressings to be utilized as primary or secondary dressings during accidents and other serious situations will promote their adoption.

The others segment is expected to grow at the fastest CAGR of 7.0% during the forecast period. Negative pressure wound therapy (NPWT) is often considered the best therapeutic option, particularly for deep acute wounds and persistent chronic wounds such as leg ulcers. Increased incidence of accidents and traumatic events, rising chronic wounds such as diabetic foot ulcers, and technological enhancements in NPWT devices are some factors driving the segment’s growth. Moreover, NPWT is expected to gain a market share due to the advantages of the device, such as rapid wound healing, increased patient compliance, and decreased chances of infection in the patient. The majority of clinical investigations have indicated that this therapy is successful in the treatment of superficial wounds. Furthermore, using NPWT locally in infected wounds has benefits such as wound drainage, angiogenesis promotion, proteinase excretion, and reduced local and systemic bacterial load. According to a study published in the Journal of Trauma 2018, NPWT combined with silver dressings helps to reduce infection.

Application Insights

The cardiovascular disease (CVD) segment is expected to grow at the fastest CAGR of 6.2% over the forecast period. CVD-based surgeries are expected to increase due to their increasing disease burden. It has been estimated by the WHO that over 3/4th of the deaths due to CVD occur in developing countries. The primary causes of heart disease are high junk food consumption, sedentary lifestyles, and mental stress. According to the WHO, approximately 17.9 million people die from cardiovascular diseases yearly, accounting for approximately 31% of all deaths worldwide.

Moreover, around 23.6 million people are expected to die from cardiovascular diseases by 2030. The rising prevalence of cardiac diseases has led to a surge in CVD surgeries. For instance, according to lifespan.org data (2018), around 500,000 open-heart surgeries are performed each year in the U.S. Thus, with a rising number of cardiac surgeries, demand for surgical dressings is expected to surge significantly over the forecast period.

The diabetes-based surgeries segment is expected to grow significantly over the forecast period. The increasing incidence of diabetes and diabetic foot ulcers is a major factor driving the segment’s growth. According to the National Library of Medicine, diabetic foot ulcers may affect more than 25% of the diabetic population, leading to foot amputation in 20% of patients. Moreover, according to American Diabetes Association, in 2018, an estimated 34.2 million people, i.e., 10.5% of the total U.S. population, had diabetes. Nearly, about 1.6 million U.S. residents have type 1 diabetes, which includes about 187,000 adolescents and children. Moreover, according to a similar source, approximately 1.5 million people in the U.S. are diagnosed with diabetes each year.

Currently, in the U.S., diabetic foot ulcers are responsible for more hospital admissions compared to any other diabetic complication. In addition, according to NCBI, diabetes has become a leading cause in the U.S. of nontraumatic amputation. Surgical wound dressing products such as hydrogels or dressings with silver and collagen are majorly used for treating diabetic foot ulcers, as they allow rapid healing. Thus, with an increase in the number of patients who have diabetes, and a rise in the prevalence of diabetic foot ulcers, the segment is expected to propel during the forecast period.

End Use Insights

The hospital segment dominated the market with the largest revenue share of 53.9% in 2022, owing to the increasing number of surgical procedures, rising incidence of diabetic foot ulcers, and increasing number of hospitals. For instance, as per the latest survey by the American Hospital Association, the total number of hospitals in the U.S. was counted to be 6,093 in 2022. Similarly, as per reports, there has been a constant increase in the number of hospitals in the UK, as the number of hospitals has increased to 1,978 in 2019. Moreover, according to the Australian Institute of Health and Welfare, the number of hospitalizations in Australia has increased. In 2019 – 2020, 11.1 million people were hospitalized in Australia, of which 6.7 million were hospitalized in a public hospital, whereas 4.4 million were in private hospitals. Thus, with an increasing number of hospitals, and hospitalization cases, the segment is expected to grow significantly over the forecast period.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR of 6.4% during the forecast period. Developed countries such as the U.S. and UK have well-equipped ambulatory surgery centers (ASCs), where surgical procedures are more economical, and the patients may not have to stay overnight. The range and number of ASCs are increasing in developed and developing countries, adding to the number of surgical procedures conducted worldwide. According to Advancing Surgical Care, as of 2021, there are 5,758 Medicare-certified ambulatory surgical centers in the U.S. In addition, favorable reimbursement coverages are being provided concerning services provided by ASCs. Thus, with an increase in the number of ASCs and the number of surgeries being performed, demand for surgical dressings is expected to increase. Hence, ASCs are a huge potential market for surgical dressings.

Regional Insights

North America dominated the market with the largest revenue share of 34.0% in 2022, with the U.S. accounting for a major share. The dominance is due to the region's improved healthcare infrastructure and increasing surgical procedures. For instance, according to Life Span Organization, about 500,000 open-heart surgeries were performed in the U.S. in 2018. Moreover, according to AHA Journals, approximately 40,000 children undergo congenital heart surgery in the U.S. As such surgeries take time to heal, advanced wound care products help heal such wounds quickly.

Similarly, an increase in the incidence of chronic wounds in the U.S. is expected to boost industry growth. According to an NCBI, approximately 2% of the U.S. population is estimated to be affected by chronic wounds. Furthermore, firms like Cardinal Health, Coloplast A/S, Integra Lifesciences, and others have a vast portfolio of surgical dressings and have a high market share in the U.S. As a result of the factors mentioned above, the U.S. is likely to dominate the market.

Asia Pacific is anticipated to grow at the fastest CAGR of 7.7% over the forecast period from 2023 to 2030. Developing countries such as China, India, and Japan are anticipated to boost the market growth in the Asia Pacific region. Moreover, a large population base and rising disposable income are further driving the market growth in this region. In addition, the rapidly growing medical tourism industry can also be attributed to the increase in demand for surgical dressing products in this region.

Furthermore, the most important trend in the Asia advanced surgical dressings market is the significant surge in R&D initiatives.

These trends are predicted to contribute to technological advancement. For instance, in July 2020, the University of South Australia developed a unique coating containing a specific antioxidant that, when applied to any wound dressing, can lower inflammation while breaking up infection to aid in rapid wound healing. Additionally, in August 2019, Flinders supported a USD 5.25 million research initiative in Australia with Wound Innovations and global partner Paul Hartmann Pty Ltd. This research focused on 'Wound Management in the Aged Care Sector,' emphasizing chronic illnesses like bedsores, which are more common among the elderly. These R&D advancements are projected to result in major releases of technologically better surgical wound dressings, boosting market growth potential throughout the forecast period.

Key Companies & Market Share Insights

Competitive rivalry and the degree of competition in the industry are expected to intensify over the forecasted period due to the presence of many players. Furthermore, leading players are involved in collaborations, product launches, mergers & acquisitions to strengthen their product portfolios. For instance, in October 2021, Healthium Medtech Limited, a global medical technology company focused on products used in surgical, post-surgical, and chronic care, announced the launch of Trushield NXT surgical wound dressing. Trushield NXT combines the advantages of a 3D hydro cellular substrate and patented infection prevention technology to offer a complete wound care system that provides 360-degree wound protection. It also provides exudate and moisture management while remaining waterproof. Its patented technology continuously inhibits pathogen growth with a unique non-leaching, non-depleting kill mechanism. It has patents in the U.S., Europe, and India.

Similarly, in November 2018, MÓ§lnlycke announced the launch of Mepilex Border Flex. The new Mepilex Border Flex dressing is designed to support fewer dressing changes, lowering dressing costs and waste while promoting optimal healing. Thus, with various strategies acquired by leading players, the market is expected to impel during the forecast period. Some prominent players in the global surgical dressing market include:

-

3M

-

Smith & Nephew

-

Mölnlycke Health Care AB

-

ConvaTec Group PLC

-

Johnson & Johnson Private Limited

-

Baxter

-

Coloplast Corp

-

Medtronic

-

Derma Sciences Inc. (Integra LifeSciences)

-

Cardinal Health

Surgical Dressing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.06 billion

Revenue forecast in 2030

USD 7.40 billion

Growth Rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

3M; Smith & Nephew; Mölnlycke Health Care AB; ConvaTec Group PLC; Johnson & Johnson Private Limited; Baxter; Coloplast Corp; Medtronic; Derma Sciences Inc. (Integra LifeSciences); Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Dressing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical dressing market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Dressing

-

Foam Dressing

-

Alginate Dressing

-

Soft Silicone Dressing

-

Composite Dressing

-

Hydrogel Dressing

-

Hydrocolloid Dressing

-

Film Dressing

-

-

Secondary Dressing

-

Absorbents

-

Bandages

-

Muslin Bandage Rolls

-

Elastic Bandage Rolls

-

Triangular Bandages

-

Orthopedic Bandages

-

Elastic Plaster Bandages

-

Other Bandages

-

-

Adhesive Tapes

-

Protectives

-

Other Secondary Dressings

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetes Based surgeries

-

Cardiovascular Disease

-

Ulcers

-

Burns

-

Transplant Sites

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Ambulatory Surgery Centers

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical dressing market size was estimated at USD 4.80 billion in 2022 and is expected to reach USD 5.06 billion in 2023.

b. The global surgical dressing market is expected to grow at a compound annual growth rate of 5.56% from 2023 to 2030 to reach USD 7.40 billion by 2030.

b. North America dominated the surgical dressing market with a share of 34.4% in 2021. This is attributable to increasing lifestyle disorders, increasing awareness about organ transplantation, and a rise in the number of ambulatory surgical centers.

b. Some key players operating in the surgical dressing market include Medline Industries, Inc. Smith & Nephew, Medtronic, 3M, Coloplast, ConvaTec, Inc., Mölnlycke Health Care AB, and Johnson and Johnson.

b. Key factors that are driving the surgical dressing market growth include the increasing prevalence of organ transplant surgeries, the increasing number of ambulatory surgical centers, and increasing lifestyle disorders across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.