- Home

- »

- Advanced Interior Materials

- »

-

Metal Casting Market Size & Share, Industry Report, 2033GVR Report cover

![Metal Casting Market Size, Share & Trend Report]()

Metal Casting Market (2025 - 2033) Size, Share & Trend Analysis Report, By Material (Iron, Steel, Aluminum), By Application (Automotive, Industrial, Building & Construction), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-298-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Casting Market Summary

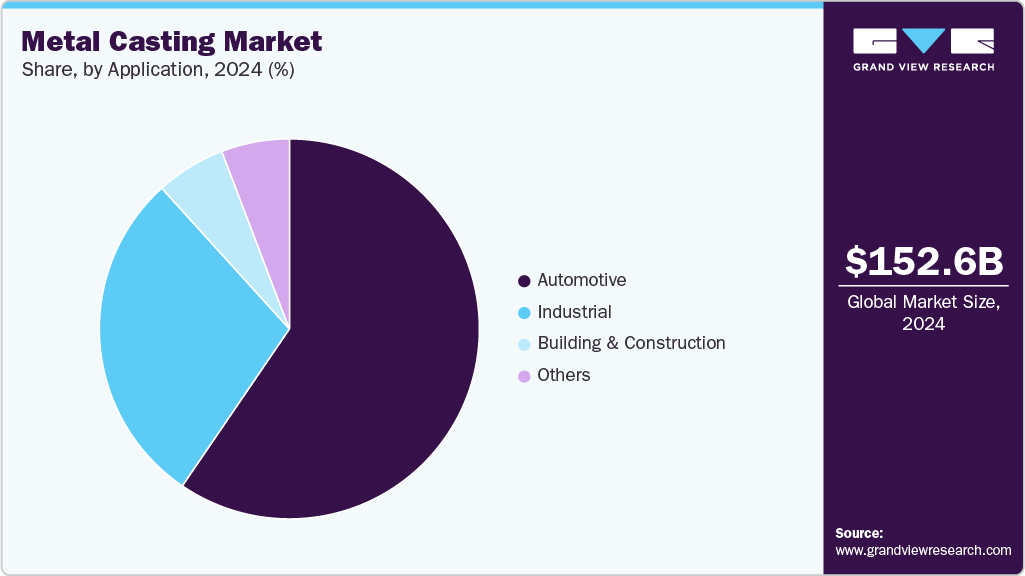

The global metal casting market size was estimated at USD 152.60 billion in 2024 and is projected to reach USD 233.88 billion by 2033, at a CAGR of 4.8% from 2025 to 2033. Metal castings are essential for producing complex and high-strength components at relatively lower costs.

Key Market Trends & Insights

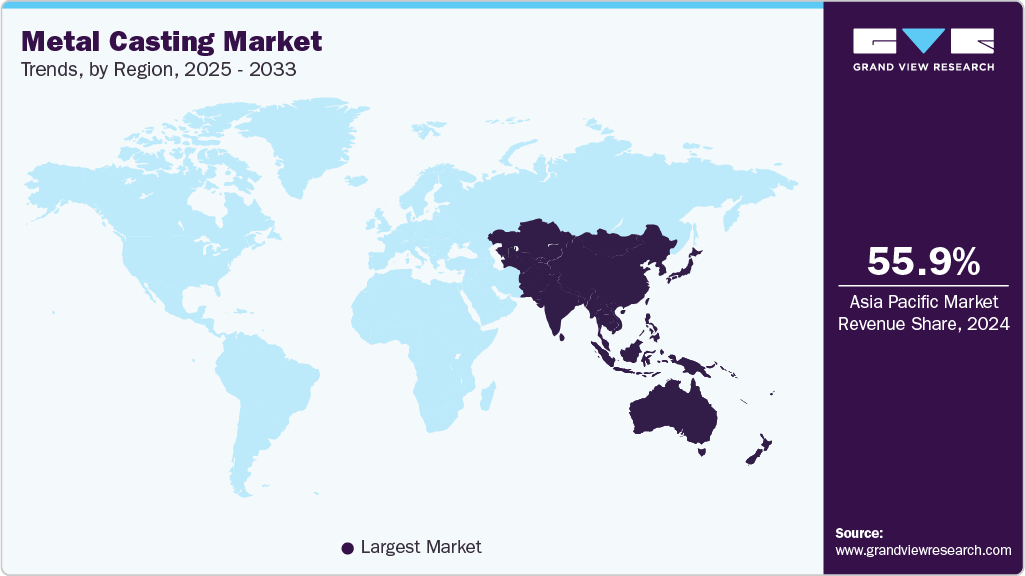

- Asia Pacific dominated the global metal casting market with the largest revenue share of 55.9%.

- Metal casting market in the U.S. is expected to grow at a substantial CAGR of 4.3% from 2025 to 2033.

- By material, aluminum accounted for the largest market revenue share of over 40.0% in 2024.

- By application, the industrial segment is anticipated to register the fastest CAGR of 5.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 152.60 Billion

- 2033 Projected Market Size: USD 233.88 Billion

- CAGR (2025-2033): 4.8%

- Asia Pacific: Largest market in 2024

With growing vehicle production, particularly in electric and hybrid vehicles, the demand for lightweight, durable cast metal components such as engine blocks, chassis, and transmission housings has surged. Automakers are also shifting toward aluminum and magnesium castings to reduce vehicle weight, improve fuel efficiency, and meet emission regulations. Infrastructure and industrial development across emerging economies are other major drivers for the metal casting industry. In India, for instance, the government allocated over USD 130 billion in 2024 for infrastructure projects under the PM Gati Shakti plan, spurring demand for castings used in construction equipment, water distribution, and transportation systems. Similarly, in 2025, Saudi Arabia and the UAE ramped up investment in mega-projects like NEOM and Etihad Rail, requiring massive volumes of ductile iron and steel castings. Such large-scale infrastructure activities fuel demand for ferrous and non-ferrous cast products across construction, utilities, and public transportation networks.The renewable energy sector is contributing significantly to the expansion of the casting industry. In 2024 alone, global wind power capacity additions reached 116 GW, led by China, the U.S., and Germany. Wind turbine components such as rotor hubs, nacelle frames, and bearing housings are commonly produced using precision casting techniques due to their complex geometry and durability requirements. The scaling up of offshore wind farms in Europe and coastal Asia in 2025 further amplified the demand for corrosion-resistant metal castings, particularly stainless steel and specialized iron alloys.

Technological advancements in casting processes have strengthened the market's capability to meet high-precision industrial demands. As of 2025, more than 35 percent of mid-to-large foundries globally have adopted 3D printing for pattern making and rapid prototyping, reducing development time by over 40 percent. Countries such as Germany, Japan, and South Korea have seen widespread integration of automated molding lines and solidification simulation software, enabling consistent production of high-performance components for aerospace, marine, and defense applications. These innovations improve quality and address labor shortages by streamlining operations.

Sustainability and environmental compliance are increasingly shaping market strategies. In 2024, over 65 percent of European metal casting facilities reported using recycled materials as their primary feedstock, aligning with EU Green Deal policies. During the same year, the U.S. also witnessed a 12 percent increase in ferrous scrap recycling for casting applications. As environmental awareness grows and regulatory frameworks tighten, the demand for cast products made through eco-friendly practices is rising. These developments position metal casting as a key enabler of circular manufacturing systems while maintaining economic viability.

Drivers, Opportunities & Restraints

The primary driver of the metal casting industry is the expanding demand from the automotive, construction, and heavy machinery sectors. With global vehicle production surpassing 92 million units in 2024, the need for lightweight and durable components has surged. Automakers increasingly turn to aluminum and magnesium castings to reduce vehicle weight and improve fuel efficiency, especially in electric vehicles. Infrastructure development in emerging economies such as India, Indonesia, and the Middle East also creates large-scale demand for cast metal parts used in transport systems, pipelines, and structural components.

Significant opportunities exist in integrating advanced manufacturing technologies such as 3D sand printing, automated molding systems, and simulation-based solidification modeling. These technologies enhance casting precision, reduce production time, and enable design complexity, opening new avenues in aerospace, renewable energy, and medical device manufacturing. Moreover, the shift toward renewable energy infrastructure, with global wind turbine installations and hydro power expansion, presents a growing need for high-performance cast components. Recycled materials and green foundry practices also offer growth potential as industries and governments move toward circular and sustainable manufacturing.

Despite its strong prospects, the metal casting industry faces several restraints. High energy consumption and carbon emissions associated with melting and casting processes pose environmental and regulatory challenges, especially in Europe and North America. In 2025, many foundries are pressured to adopt cleaner technologies or risk non-compliance with tightening emissions norms.

Material Insights

Manufacturers are actively adopting aluminum casting due to its lightweight properties, contributing to fuel efficiency and reduced emissions. As electric vehicle production scales up globally, the need for lightweight structural components such as engine blocks, battery housings, and body panels, is rising, encouraging foundries to expand their aluminum casting capabilities. In addition, improved recyclability and corrosion resistance make aluminum a preferred choice in durable applications with minimal maintenance.

The steel segment in the market is witnessing strong growth due to rising investments in infrastructure, energy, and heavy machinery industries. Steel castings offer high strength, toughness, and wear resistance, making them suitable for structural and load-bearing applications. Growing construction activity across Asia-Pacific, the Middle East, and Africa drives demand for steel components such as girders, beams, and structural connectors. In the energy sector, expanding thermal and renewable power generation capacity is supporting the use of steel castings in turbines, valves, and pressure vessels.

Application Insights

The surge in electric vehicle production significantly drives the automotive segment's rapid progress. In 2024, global electric vehicle sales surpassed 17 million units, accounting for over 14 million battery-electric vehicles and plug-in hybrids, marking a robust year-over-year increase of around 26%. This surge elevates EVs to over 14% share of new light-duty vehicles worldwide, with some regions reaching as high as 22% and rising EV sales fuel demand for lightweight, high-precision metal castings used in battery enclosures, motor housings, and chassis components. Advanced casting processes such as high-pressure die casting allow manufacturers to meet electric vehicles' stringent weight and performance standards, deploying optimized alloys and complex geometries.

Industrial is anticipated to register the fastest CAGR over the forecast period. Steel and iron castings remain vital in producing robust components such as gears, pumps, valves, compressor housings, and machinery bases. As global industrial activity grows, driven by infrastructure development, manufacturing modernization, and the expansion of power, oil & gas, and mining industries, foundries are scaling up capacities and adopting efficient production methods like investment casting and automated sand casting. These trends support cost-effective mass production of durable, high-tolerance components required in heavy-duty applications.

Regional Insights

The metal casting industry in North America is growing steadily due to strong demand from the automotive, aerospace, and defense industries. These sectors require high-precision components with complex geometries, which has increased the use of advanced casting techniques such as investment casting and pressure die casting. Automakers focus on lightweight materials like aluminum and magnesium to improve fuel efficiency, supporting non-ferrous metal castings. Rising investments in electric vehicles and hybrid technology have also opened new avenues for casting applications in battery housings, motor parts, and chassis components.

U.S. Metal Casting Market Trends

The metal casting industry in the U.S. is advancing due to growing demand from key sectors such as automotive and aerospace. For example, Ford and General Motors have expanded their use of aluminum castings in EV platforms to reduce vehicle weight and enhance battery efficiency. Tesla’s Gigafactories also utilize giga-casting techniques to produce large vehicle components in a single mold, streamlining production and cutting assembly time. In the aerospace sector, companies like Pratt & Whitney and GE Aerospace rely heavily on investment casting for turbine blades and other engine parts that must withstand extreme temperatures and stress.

Asia Pacific Metal Casting Market Trends

The metal casting industry in Asia Pacific is expanding due to strong growth in the automotive, construction, and industrial machinery sectors. As countries such as China, India, and Vietnam continue to invest in infrastructure development and urbanization, the demand for cast metal products such as pipes, valves, engine components, and structural parts has grown significantly. Rapid industrialization and government support for manufacturing under initiatives like "Make in India" and China's "New Infrastructure" strategy have increased the region's foundry activity and capacity expansion.

Europe Metal Casting Market Trends

The metal casting industry in Europe is expanding due to rising demand from automotive, aerospace, and industrial equipment manufacturers. Automakers across Germany, France, and Italy are increasingly adopting lightweight metal castings made from aluminum and magnesium to meet fuel efficiency standards and reduce vehicle emissions. This trend has accelerated with the shift toward electric vehicles, where cast components are used in battery housings, motor parts, and structural frames. Aerospace manufacturers such as Airbus rely on high-precision investment casting for engine components and airframe structures, supporting the growth of specialized foundries across the region.

Latin America Metal Casting Market Trends

The metal casting industry in Latin America is expanding due to increasing industrial activity and infrastructure development across Brazil, Argentina, and Mexico. Construction of roads, bridges, railways, and urban infrastructure has boosted the demand for cast iron and steel components used in structural frameworks, drainage systems, and heavy machinery. Brazil dominates the regional casting landscape with a strong base of iron foundries, driven by its large construction and manufacturing sectors. On the other hand, Argentina is seeing growing investment in automotive manufacturing, which supports engine blocks, chassis parts, and transmission housings made through casting.

Middle East & Africa Metal Casting Market Trends

The metal casting industry in the Middle East and Africa is evolving with significant developments across sectors such as oil and gas, construction, automotive, and power generation. In the Gulf countries, especially Saudi Arabia and the UAE, large-scale infrastructure and energy projects are increasing the demand for cast components used in pipelines, pumps, valves, and heat exchangers. These countries are investing in foundry upgrades to produce corrosion-resistant and high-strength castings suited for high-temperature and high-pressure applications in oil and gas. In addition, ongoing refinery expansions and petrochemical plant developments require reliable casting inputs for complex machinery.

Key Metal Casting Company Insights

Some of the key players operating in the market include Alcast Technologies Ltd., Calmet Inc. and others

-

Alcast Technologies Ltd. is a Canada-based company headquartered in Hamilton, Ontario, known for its expertise in high-quality aluminum and zinc die casting. Established in 1994, the company serves various industries including automotive, aerospace, lighting, and electronics. Alcast is equipped with advanced vertical and horizontal die casting machines, which allow for the production of precision components with complex geometries. Alcast specializes in high-pressure aluminum and zinc components in metal castings, often using alloys such as A380, A383, and ZA-12.

-

Calmet Inc. is an international manufacturing and supply company that provides metal castings and precision machined parts to clients across North America and Europe. With manufacturing facilities based in India and China, Calmet offers ferrous and non-ferrous castings, catering to automotive, hydraulics, agriculture, power transmission, and heavy equipment industries. Calmet’s casting offerings include grey iron, ductile iron, malleable iron, steel, aluminum, brass, and bronze. The company provides services such as heat treatment, CNC machining, galvanizing, electroplating, and painting to enhance the performance and durability of its cast components.

Key Metal Casting Companies:

The following are the leading companies in the metal casting market. These companies collectively hold the largest market share and dictate industry trends.

- Alcast Technologies Ltd.

- Ahresty Corporation

- Calmet Inc

- Dynacast Ltd

- Endurance Technologies Limited

- GF Casting Solutions (Georg Fischer AG)

- MES, Inc. (Metrics Holdings)

- Proterial, Ltd

- Rheinmetall AG

- Ryobi Limited

Recent Development

-

In November 2024, CFS Foundry announced the launch of advanced metal casting and CNC machining services, elevating its capabilities to produce high-quality, precision-engineered metal components for various industries. The company specializes in diverse casting techniques, including die casting, investment casting, and stainless steel casting, leveraging state-of-the-art facilities and strict quality assurance protocols. Focusing on innovation and customer satisfaction, CFS Foundry integrates CNC machining into its processes, ensuring components meet precise specifications and are delivered as ready-to-use solutions.

Metal Casting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 161.22 billion

Revenue forecast in 2033

USD 233.88 billion

Growth Rate

CAGR of 4.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

August 2025

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil

Key companies profiled

Alcast Technologies Ltd.; Ahresty Corporation; Calmet Inc.; Dynacast Ltd.; Endurance Technologies Limited; GF Casting Solutions (Georg Fischer AG); MES, Inc. (Metrics Holdings); Proterial, Ltd.; Rheinmetall AG; Ryobi Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Casting Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal casting market report based on material, application, and region.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Iron

-

Steel

-

Aluminum

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Industrial

-

Building & Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some of the key players of the global metal casting market are Alcast Technologies Ltd., Ahresty Corporation, Calmet Inc., Dynacast Ltd., Endurance Technologies Limited, GF Casting Solutions (Georg Fischer AG), MES, Inc. (Metrics Holdings), Proterial, Ltd., Rheinmetall AG, Ryobi Limited, and others.

b. The key factor driving the growth of the global metal casting market is the increasing demand from the automotive, construction, and industrial machinery sectors.

b. The global metal casting market size was estimated at USD 152.60 billion in 2024 and is expected to reach USD 161.22 billion in 2025.

b. The global metal casting market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 233.88 billion by 2033.

b. The aluminum segment dominated the market with a revenue share of 40.8% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.