- Home

- »

- Medical Devices

- »

-

Global Dental Compressors Market Size & Share Report, 2030GVR Report cover

![Dental Compressors Market Size, Share & Trends Report]()

Dental Compressors Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Dental Lubricated Compressors, Dental Oil-Free Compressors), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-377-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global dental compressors market size was valued at USD 360.9 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. The dental air compressor is considered as the core of dental surgery. The dental air compressor, in contrast to the normal air compressor, is a unique and high-quality compressor that is used in dentistry or medical practise.

The most crucial dental tool in a dental office is powered by the dental air compressor. Growth in the dental equipment and consumables market is anticipated to be fuelled by the rising frequency of dental problems and the presence of cooperative government policies. The primary driver driving the market during the forecast period is likely the rise in dental problems across the globe.

More elderly people are visiting dentist offices to preserve their oral health for retaining natural teeth. Dental visits have increased globally due to the rising incidences of dental issues caused by bad lifestyles such as chewing tobacco, smoking, and alcohol usage. Furthermore, due to the manufacturers' focus on significant R&D to assist the healthcare industry with the leading solutions, demand for dental compressors is anticipated to positively influence the market throughout the forecast period.

The introduction of COVID-19 adversely affected the dental market as the bulk of elective treatments were put off. Most dental offices were shut down since it was considered as an elective and high-contact service. As many countries went into lockdown, the supply of medical products and the raw materials needed to make them were disrupted. The supply chain had been severely damaged by the forced quarantine in China because the nation was no longer a major country for manufacturing.

Few nations have prohibited the exportation of necessary medical devices, particularly those that are needed in the fight against COVID-19, due to the sharp rise in demand for these items. All the above-mentioned factors in turn had affected the market for dental compressors.

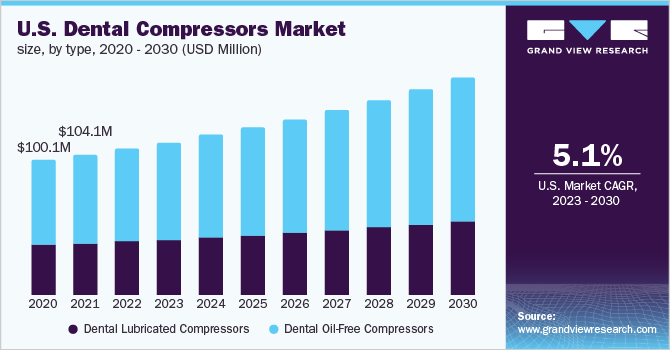

Type Insights

The type segment has been divided into dental-lubricated compressors and oil-free compressors. In terms of market share, dental oil-free compressors dominated the sector in 2022 with a market share of 60.8%. These devices' great endurance and minimal maintenance requirements are some of the key aspects that contribute to their significant market dominance. Additionally, it is anticipated that high usage rates of these devices in emerging and underdeveloped regions will fuel development during the forecast period.

Dental oil-free compressors are anticipated to increase their share of the market during the forecast period. Oil-free compressors are less expensive and lighter in weight. Leading market players engage in ongoing R&D to introduce new products with cutting-edge technology. For instance, Air Techniques has introduced the Air Star 12 and Air Star 40, which use membrane technology, are essentially maintenance-free, and deliver pure, ultra-dry compressed air for dental use.

The healthcare sector today uses oil-free dental compressors the most. During the forecast period, it is anticipated that rising demand for dental compressors with reduced noise and vibration and a compact shape to conserve space will propel the market growth.

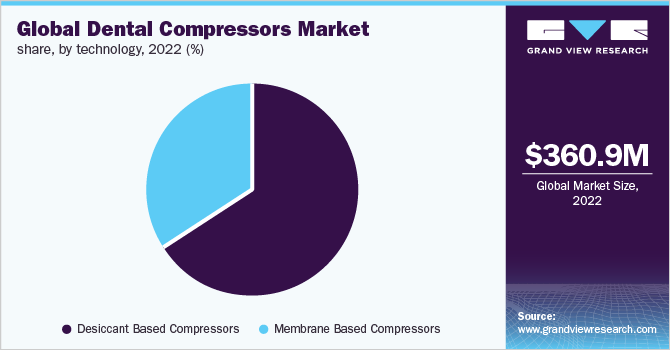

Technology Insights

The dental compressor market is divided into membrane-based and desiccant-based compressors based on technology. In 2022, desiccant-based compressors held a large market share of around 65.9%. Two chambers make up desiccant dryers, also known as regenerative desiccant dryers. Compressed air is passed through a chamber-containing desiccant, which is in charge of adsorbing the moisture and lowering the air dew points as a result.

The desiccant dryers have a considerable market share because of their potential to significantly lessen the workload. In the next six years, segment growth is anticipated to be fuelled by the features such as desiccant dryers' ability to produce very low dew points without the risk of freezing up and their moderate operating costs.

On the other hand, revenue share growth for membrane-based compressors is anticipated to grow during the forecast period. By allowing the compressed air to travel through a membrane, membrane dryers remove moisture from it. Membrane dryers are useful since they can be put closer to the site of usage due to their size.

Application Insights

Dental air compressors are used for a variety of dental care equipment, including scalers, chair valves, and handpieces. Dental handpieces accounted for the majority of the market for dental air compressors in 2022, held around 50.3% share, and were the application area that generated the highest income. Its considerable percentage is mostly due to the high usage rates and the increased prevalence of the procedures such as teeth cleaning and tooth decay treatment.

The market for dental chair valves is anticipated to expand at a profitable rate throughout the forecast period. One of the most crucial pieces of equipment in any dental care facility is the chair because it enables the dentist to continuously adjust their posture to better examine the patient's mouth. Dental chairs are equipped with air compressor-operated valves that make them movable. One of the main causes of its growth rate is the rising adoption of dental chairs and the growing number of dentists and clinics.

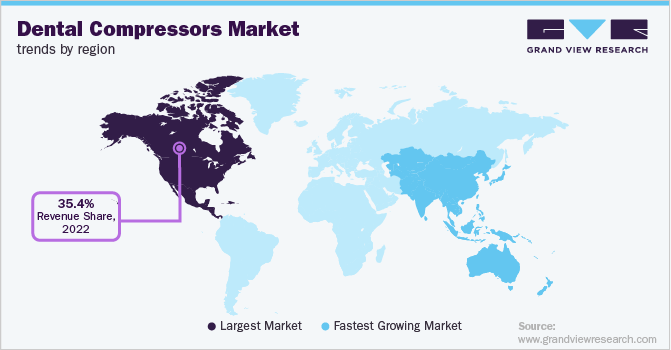

Regional Insights

North America accounted for approximately 35.4% share of the global market's revenue in 2022, due to its advanced healthcare infrastructure and relatively higher healthcare spending levels in developed countries The U.S. is predicted to strengthen the regional market the most out of all the countries. Additionally, the region's market is anticipated to grow due to increasing patient awareness.

Additionally, it is projected that the industry in the United States would grow in the near future due to the existence of established companies in the area. Strategic actions taken by the major firms have accelerated the market expansion. For instance, in order to enter the market, ELGI Equipment Limited introduced its Rot air brand of air compressors in the United States in March 2020.

Around the anticipated forecast period, the market for dental air compressors in Asia Pacific is expected to expand at a profitable CAGR of more than 5.9%. This rapid expansion is attributed to a number of causes, including the existence of unexplored prospects, growing healthcare infrastructure, consumer spending power, and patient awareness levels.

Key Companies & Market Share Insights

Players in the global dental compressors market are concentrating on increasing their global market share. Manufacturers are putting a lot of effort into developing novel products to cater to a vast client base, which will help the dental compressors market to expand. A number of foreign markets players are merging, acquiring, and applying new technologies to boost their commercial capability and raise their chances of capturing a sizable revenue share.

For instance, the well-known dental solutions provider Midmark Corp. announced its collaboration with Bien-Air Dental SA in February 2022. The venture intends to integrate the renowned dental technologies from the two businesses into a simple care delivery system. Also, In September 2020, Midmark Corp, announced to partner with DDS, Jeff Carter, and Pat Carter, IIDA of Practice Design Group to offer the Impact Design seminar series virtually in 2020. Some of the prominent players in the global dental compressors market include:

-

Midmark Corporation

-

Gnatus

-

Air Techniques

-

Kaeser Dental

-

Quincy Compressors

-

General Air Products, Inc.

-

Durr Dental

-

Slovadent, Dental EZ Group

-

Aixin Medical Equipment Co, Ltd

Dental Compressors Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 376.38 million

Revenue forecast in 2030

USD 530.5 million

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Brazil; Mexico; Argentina; China; India; Japan; Australia; South Korea; Thailand; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Gnatus; Midmark Corporation; Air Techniques; Kaeser Dental; Quincy Compressors; Durr Dental; Aixin Medical Equipment Co, Ltd; Slovadent, Dental EZ Group; General Air Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

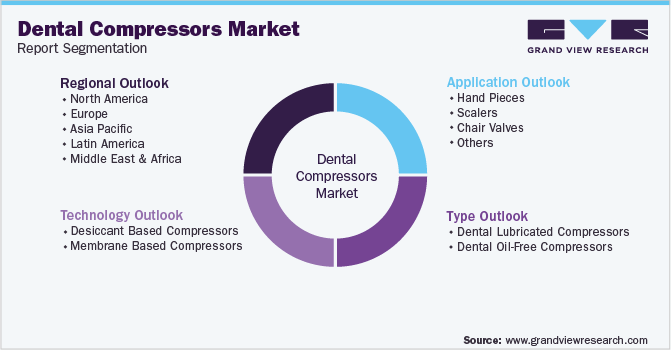

Global Dental Compressors Market Segmentation

This report forecasts revenue growth at global, regional, and country levels in addition to providing an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental compressors market report based on the type, technology, application, and region:

-

Type Outlook, (Revenue, USD Million, 2018 - 2030)

-

Dental Lubricated Compressors

-

Dental Oil-Free Compressors

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Desiccant Based Compressors

-

Membrane Based Compressors

-

-

Application Outlook, (Revenue, USD Million, 2018 - 2030)

-

Hand Pieces

-

Scalers

-

Chair Valves

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

- Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental compressors market size was estimated at USD 360.9 million in 2022 and is expected to reach USD 376.38 million in 2023.

b. The global dental compressors market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 530.5 million by 2030.

b. North America dominated the dental compressors market with a share of 35.4% in 2022. This is attributable to the presence of sophisticated healthcare infrastructure, high patient awareness levels coupled with relatively higher healthcare spending levels

b. Some key players operating in the dental compressors market include Midmark, Dürr Dental, Gnatus, Kaeser Dental, Air Techniques, Aixin Medical Equipment Co., Ltd, Foshan Core Deep Medical Apparatus Co. Ltd., Quincy Compressors, Slovadent, Dental EZ Group, Diplomat Dental Solutions, and General Air Products, Inc.

b. Key factors that are driving the market growth include rising demand for dental procedures, Increasing prevalence of dental disorders, Introduction of favorable government initiatives pertaining to the dental equipment and consumables markets, Rising geriatric population and their demand for preventive, restorative and surgical services for dental care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.