- Home

- »

- Medical Devices

- »

-

Dental Flap Surgery Market Size & Share Report, 2022-2030GVR Report cover

![Dental Flap Surgery Market Size, Share & Trends Report]()

Dental Flap Surgery Market (2022 - 2030) Size, Share & Trends Analysis Report By End-user (Hospitals, Dental Clinics), By Surgery Type (Triangular Flap, Rectangular Flap), By Region (APAC, North America), And Segment Forecasts

- Report ID: GVR-4-68039-964-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global dental flap surgery market was valued at USD 4.75 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.2% from 2022 to 2030. The global industry has witnessed a decline in 2020 during the COVID-19 pandemic due to a decrease in the number of patient visits in hospitals & dental clinics and a decrease in the number of dental surgery procedures. However, in 2021, there was no significant impact on the market as dental clinics were re-opened in many countries where the number of COVID-19 patients declined and the number of dental surgical procedures also increased. The factors that drive the industry growth include an increase in the prevalence of periodontitis disease globally and a rise in demand for triangular flap surgery.

For instance, according to the estimates published by the World Health Organization (WHO) 2019, the periodontal disease affected around 14% of the global adult population, with more than 1 billion cases worldwide. In addition, dental tourism is experiencing a surge in the developing market, which boosts the growth of the overall industry. Oral hygiene is one of the important parameters for overall wellbeing. Thus, the increase in awareness about oral hygiene is fueling the industry's growth. Moreover, a rise in the demand for advanced dental services is anticipated to create a favorable environment for dental service business expansion. Flap surgery is a type of gum surgery used for the treatment and repairing of periodontal pockets.

The periodontal pockets are bacterial-infected areas below the gum line where gum tissue has been detached from the tooth. These pockets have uncleaned space where bacteria can proliferate. Dental flap surgery involves the use of a periodontal probe in which infected gum tissue is separated from the teeth and folded back. Then, tartar and disease-causing bacteria are removed and gums are sutured back, so the gum tissue fits firmly around the teeth. Periodontal flap surgery is performed under local anesthetic. This procedure is generally performed in an outpatient setting. Periodontal flap surgery is required for patients suffering from bleeding gums, gum recession, heavy tartar buildup, exposed roots, and tooth mobility or loss. This surgery is mostly recommended for patients with moderate or advanced periodontitis.

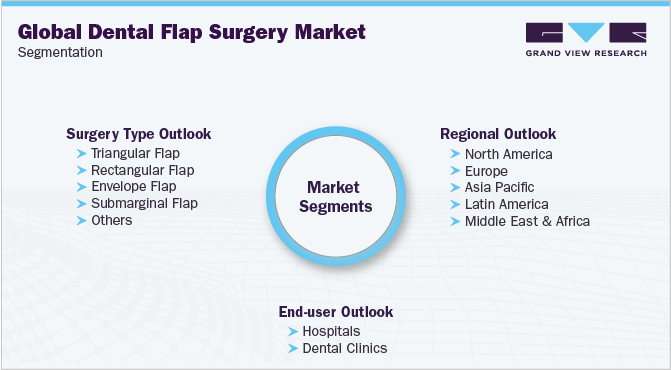

Surgery Type Insights

Based on surgery types, the global industry has been further categorized into triangular flaps, rectangular flaps, envelope flaps, submarginal flaps, and others. In 2021, the triangular flap segment dominated the global industry and accounted for the maximum share of more than 27.30% of the overall revenue. The triangular flap segment is expected to retain its dominant position throughout the forecast period owing to good visibility in roots, early wound healing, and patient satisfaction offered by these flaps. Furthermore, a rise in awareness levels among patients regarding triangular flap surgery and the increase in demand for dental surgical procedures for periodontal disease boost the growth of this segment. Triangular flap surgery is regarded as more conservative due to its less degree of tissue reflection.

In addition, it is simple to close the gum flap and gives a relatively tension-free closure. Moreover, triangular flap surgery is useful in mid-root perforation repair and periapical surgery of short roots and mandibular posterior teeth. The triangular flap surgery is considered a more conventional method as it avoids the raising of soft tissue from the buccal aspect of the second molar. The triangular flap is recommended for posterior teeth and maxillary incisors. The main advantages of the triangular flap are the absence of papilla retraction, almost complete absence of scars, and absence of gingival recession. Moreover, postsurgical stabilization is more feasible with triangular flaps than rectangular flap surgery. However, some disadvantages of this surgery are vertical incision penetrates alveolar mucosa, gingival attachment is severed, and tension is created.

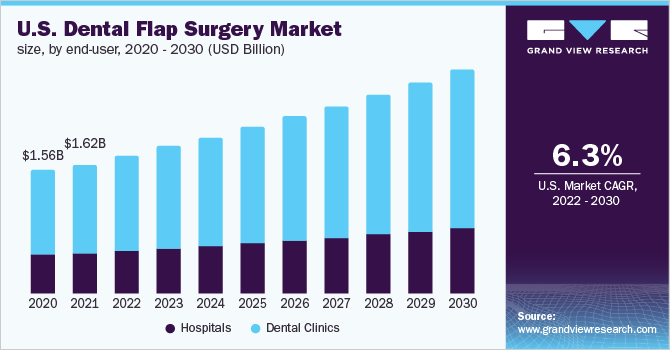

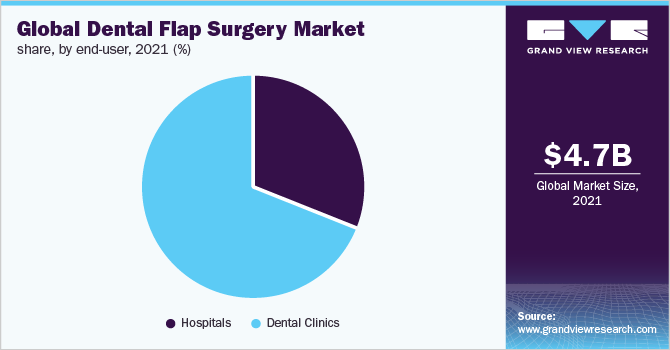

End-user Insights

Based on end-user, the global industry has been further divided into dental clinics and hospitals. In 2021, the dental clinics end-user segment dominated the global industry and accounted for the maximum share of more than 68.80% of the overall revenue. The majority of patients visit dental clinics due to the availability of specialists. A rise in the number of dental flap surgeries performed in dental clinics boosts the growth of this segment. More than 80% of the dental practice clinics are run by the owners. The number of independent dental practices is increasing globally. This trend is expected to continue in the coming years due to the cost efficiency and availability of specialists & technologically advanced dental equipment.

In addition, dental clinics lay greater emphasis on innovative modes of treatment and patient care, which is expected to lower costs and increase the adoption of dental services across all sections of society. Moreover, dental clinics generally have general dentists as well as specialists available to aid with most of the dental needs of people. Furthermore, they focus on patient education to prevent oral diseases and offer treatment options for gum disease. During the initial phase of the COVID-19, the industry faced many issues as the dentist’s clinics and hospitals were at a higher risk of spreading the COVID-19 infection. The dental clinics were closed during the initial phase. However, dental practices are getting back to their normal procedures after a decrease in the number of COVID-19 patients.

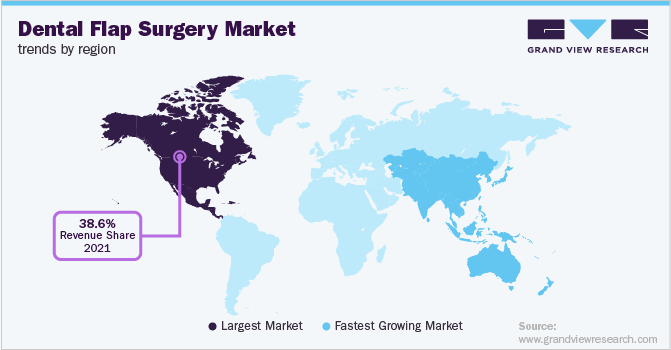

Regional Insights

North America dominated the global industry in 2021 and accounted for the maximum share of more than 38.60% of the overall revenue. North America has a highly regulated & developed healthcare infrastructure. Factors, such as preventive approaches toward oral care & hygiene, the presence of private dental clinics, a surge in disposable income, and rising R&D activities in dentistry are the major factors that are expected to boost the growth of the regional market. The rise in government funding for dental treatment programs is likely to contribute to the growth of the industry. In addition, a rise in the number frequency of people seeking routine dental care, especially elder people, is one of the key factors driving the market growth.

A large share of this region can be attributed to the increase in dental expenditure in North America, rise in government funding for dental treatments, and the growth in public awareness about dental flap surgery. On the other hand, APAC will grow at the fastest CAGR from 2022 to 2030 on account of a rise in the number of clinics, an increase in dental tourism, and growing awareness among patients regarding oral care. Furthermore, a rise in the number of dental procedures, a high prevalence of periodontitis disease, and a surge in public awareness about dental surgical procedures are the major factors that boost the growth. The majority of the dental clinics in APAC are private. The healthcare infrastructure in APAC is growing with advanced equipment & technology. Various dental companies and countries, such as India and China, are introducing awareness programs regarding dental care.

Key Companies & Market Share Insights

Due to the social distancing and pandemic guidelines in the early phase of the pandemic, dental procedures were closed in many countries. It had a negative impact on the overall industry. Therefore, dental care service providers are concentrating on introducing new ways to improve the experience for patients. In 2020, Aspen Dental introduced its digital check-in platform, which is available in their 820 offices in 41 states in the U.S. This platform will be useful for patients in managing their dental visits suitably.

Moreover, industry participants rely on regional expansion to strengthen their market presence. In 2021, Ambitious U.K. Dental Group announced to introduce 400 clinic franchises across the country within three years. The additional dental clinics are anticipated to decrease the waiting time of patients traveling abroad for dental procedures. Some of the major players in the global dental flap surgery market are:

-

Aspen Dental Management, Inc.

-

Apollo White Dental

-

Coast Dental

-

Dr. Joy Dental Clinic

-

Smiles by Dr. Santos, LLC

-

Axis Dental

-

Great Expressions Dental Centers

-

HM Hospital Madrid

-

Humanitas Hospital

-

Partha Dental Clinics

Dental Flap Surgery Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 5.11 billion

Revenue forecast in 2030

USD 8.91 billion

Growth rate

CAGR of 7.2% from 2022 to 2030

Base year for estimation

2021

Historic data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Surgery type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; India; China; Australia; South Korea; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Aspen Dental Management Inc.; Apollo White Dental Coast Dental; Dr. Joy Dental Clinic; Smiles by Dr. Santos, LLC; Axis Dental; Great Expressions Dental Centers; HM Hospital Madrid; Humanitas Hospital; Partha Dental Clinics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Flap Surgery Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental flap surgery market report based on surgery type, end-user, and region:

-

Surgery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Triangular Flap

-

Rectangular Flap

-

Envelope Flap

-

Submarginal Flap

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Dental Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia-Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global dental flap surgery market size was estimated at USD 4.75 billion in 2021 and is expected to reach USD 5.11 billion in 2022.

b. The global dental flap surgery market is expected to grow at a compound annual growth rate of 7.2% from 2022 to 2030 to reach USD 8.91 billion by 2030.

b. North America dominated the dental flap surgery market with a share of 38.7% in 2021. This is attributable to the rise in preventive approaches towards oral care & hygiene, the presence of private dental clinics, and rising R&D activities in dentistry.

b. Some key players operating in the dental flap surgery market include Aspen Dental Management Inc., Apollo White Dental, Coast Dental, Dental Services Group, Gentle Dentistry, LLC, Axis Dental, Great Expressions Dental Centers, HM Hospital Madrid, Humanitas Hospital, and Ceram Hospital

b. Key factors that are driving the dental flap surgery market growth include an increase in the prevalence of periodontitis disease globally, an increase in awareness about oral hygiene, and a rise in demand for triangular flap surgery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.