- Home

- »

- Medical Devices

- »

-

Dental Matrix Systems Market Size & Growth Report, 2030GVR Report cover

![Dental Matrix Systems Market Size, Share & Trends Report]()

Dental Matrix Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Circumferential Matrix Systems, Sectional Matrix Systems), By End Use (Dental Laboratories), By Region, And Segments Forecasts

- Report ID: GVR-4-68039-943-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Matrix Systems Market Size & Trends

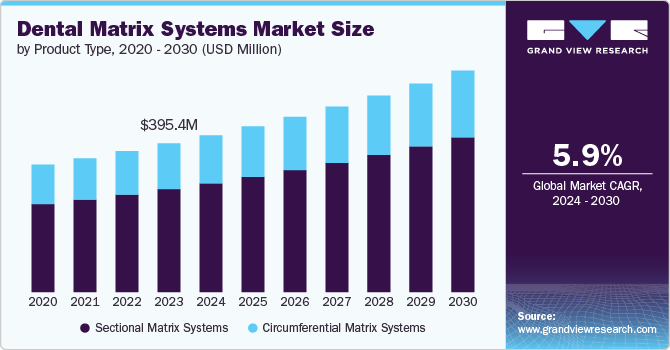

The global dental matrix systems market size was valued at USD 395.4 million in 2023 and is estimated to grow at a CAGR of 5.9% from 2024 to 2030. The market is expected to grow significantly in the coming years due to the growing demand for restorative dentistry. In addition, rising dental tourism in emerging economies is likely to boost the market. Key economies are expected to accelerate the adoption of technologically advanced products and solutions in dentistry. These advancements are expected to raise the effectiveness of services in the dentistry vertical.

People worldwide are becoming more conscious about maintaining oral health in their routine lives. There has been a significant rise in the incidence of oral diseases. Oral health issues are leading to an increasing demand for effective healthcare facilities, which is expected to boost opportunities in the market over the coming years. The growing prevalence of dental caries and tooth decay across the globe is expected to fuel the demand for dental treatment options. In addition, the rising demand for restorative and cosmetic dentistry is anticipated to drive the demand for dental matrix systems.

Regular dental checkups and visits may raise the demand for dental treatments and procedures. According to the U.S. CDC, around 84.9% of children aged 2 years to 17 years, nearly 64.0% of adults aged 18 years to 64 years, and nearly 65.6% of adults aged 65 years & above have visited a dentist at least once. Routine checkups include crowns, root canals, maxillofacial procedures, bonding treatments, and fillings. Thus, regular dental checkups are anticipated to fuel the market.

Product Type Insights

The sectional dental matrix systems segment dominated the market in 2023 with a revenue share of over 69.3%. Its dominance can be attributed to sectional matrix techniques being more predictable solutions to achieve contact areas. The sectional matrix is highly adopted to achieve a strong contact point in Class II restorations in the posterior sector with composite resin.

In the sectional matrix system, each tooth is parted into different segments with a matrix band that can be detached similar to detaching the rubber bands. This sectional matrix system is used to reduce soft tissue swelling and maximize implant exposure. Therefore, the sectional dental matrix systems are preferred by most dentists. The adoption of sectional matrix systems for composite restorations is increasing. Sectional matrices can help achieve tighter anatomical contacts and are dentist-friendly.

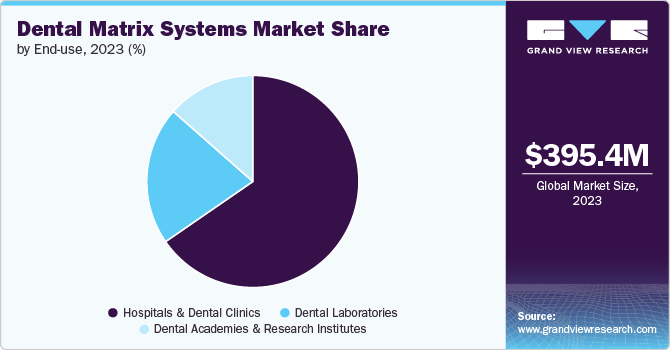

End Use Insights

The hospitals and dental clinics segment accounted for the largest revenue share of over 65.4% in 2023. The growing number of dental clinics across the globe and the wide adoption of cosmetic dentistry by small & large dental clinics are the major factors driving the segment. The rising number of clinics, especially in well-developed economies, is expected to boost the segment. Depending on location, dentists in developed economies are typically well compensated for their services and treatments through favorable public healthcare policies.

Furthermore, the rising enrollment in dental courses is expected to drive this end use segment. According to NCBI, in India, in 2019, 270,000 dentists were registered with the Dental Council of India (DCI). The growing number of dental clinics & hospitals and the higher number of dental freshers graduating each year are likely to drive this segment.

Regional Insights

The North America dental matrix systems market dominated the global market with a revenue share of over 39.2% in 2023 and is expected to grow at a significant CAGR over the forecast period. This can be attributed to the increasing reimbursement for dental services and the growing number of dental problems in children & adults. The rising number of collaborations between research organizations and healthcare providers is also anticipated to propel the market in the coming years. Increasing government funding and awareness about dental treatment among the general population is expected to boost the region’s market further. The aforementioned factors are expected to boost the adoption of dental matrix systems over the forecast period.

U.S. Dental Matrix Systems Market Trends

The U.S. dental matrix systems market is expected to witness lucrative growth due to the increasing geriatric population, which is prone to dental problems, and the presence of advanced infrastructure & technology. The rising geriatric population and their demand for preventive & restorative dental services is expected to surge, as the number of U.S. individuals aged 65 years and older is projected to nearly double from 52 million in 2018 to 95 million by 2060.

Europe Dental Matrix Systems Market Trends

The Europe dental matrix systems market held the second-largest revenue share in 2023 due to technological advancements and the increasing number of service providers. Germany, France, Italy, and Hungary have some of the most advanced healthcare systems, offering a wide range of medical facilities. Technological advancements, such as high-resolution screening systems with a multitasking platform for dental surgeries, are expected to drive the market further over the forecast period.

Asia Pacific Dental Matrix Systems Market Trends

The APAC dental matrix systems market is expected to grow at the fastest CAGR of 7.0% over the forecast period, owing to favorable government initiatives, a large population, and the availability of developed healthcare facilities. Populated countries, such as China and India, have a heavy burden of dental & oral diseases. Dental professionals in these countries widely prescribe replacing lost natural teeth, a trend that is gaining prominence. Moreover, China and India are currently the largest tobacco-producing & consuming countries with the least smoking awareness. The growing adoption of new technologies and increasing awareness about dental care are expected to aid regional market growth. These factors are expected to drive the market in the region.

Key Dental Matrix Systems Company Insights

The global market is highly competitive and includes small and large manufacturers. These companies have established key business strategies, such as strategic partnerships & collaborations, product innovation, new product launches, joint ventures, contracts, and new service launches, to build their market standard & gain market share.

Rapid advancements in restorative dentistry technologies are expected to intensify competitiveness among market players. For instance, in September 2018, Dentsply Sirona launched Azento, a single tooth replacement in one box solution, which can be customized to meet the demand and timeframes of the patients & dental professionals. Furthermore, many manufacturers are collaborating to develop technologically advanced products and introduce them faster in the dentistry market.

Key Dental Matrix Systems Companies:

The following are the leading companies in the dental matrix systems market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- Scott’s Dental Supply

- Polydentia

- Kerr Dental

- Garrison Dental Solutions

- Dr. Walser Dental GmbH

- Clinician’s Choice Dental Products, Inc.

Dental Matrix Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 417.2 million

Revenue forecast in 2030

USD 589.1 million

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden, Denmark, Norway, Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dentsply Sirona; Scott’s Dental Supply; Polydentia; Kerr Dental; Garrison Dental Solutions; Dr. Walser Dental GmbH; Clinician’s Choice Dental Products Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Matrix Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels. It analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global dental matrix systems market report on the basis of product type, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Circumferential Matrix Systems

-

Sectional Matrix Systems

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Dental Clinics

-

Dental Laboratories

-

Dental Academic and Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

Japan

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental matrix systems market size was estimated at USD 395.4 million in 2023 and is expected to reach USD 417.2 million in 2024.

b. The global dental matrix systems market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 589.1 million by 2030.

b. The sectional dental matrix systems segment dominated the dental impression materials market in 2023. This is due to the fact that sectional matrix techniques offer more predictable solutions to achieve contact areas.

b. Key market players include; Polydentia, DENTSPLY Sirona, Kerr Dental, Garrison Dental Solutions, Dr. Walser Dental GmbH, Clinician’s Choice Dental Products, Inc., and others.

b. The dental matrix systems market growth is mostly driven by factors such as the growing dental restorative procedures, rising incidence of dental problems, and increased demand for cosmetic dentistry

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.