- Home

- »

- Medical Devices

- »

-

Dermatology Contract Manufacturing Market Report, 2033GVR Report cover

![Dermatology Contract Manufacturing Market Size, Share & Trends Report]()

Dermatology Contract Manufacturing Market (2025 - 2033) Size, Share & Trends Analysis Report By Dosage Form, By Service (Formulation Development, Analytical Method Development, Scale-Up & Process Validation), By Indication, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-831-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dermatology Contract Manufacturing Market Summary

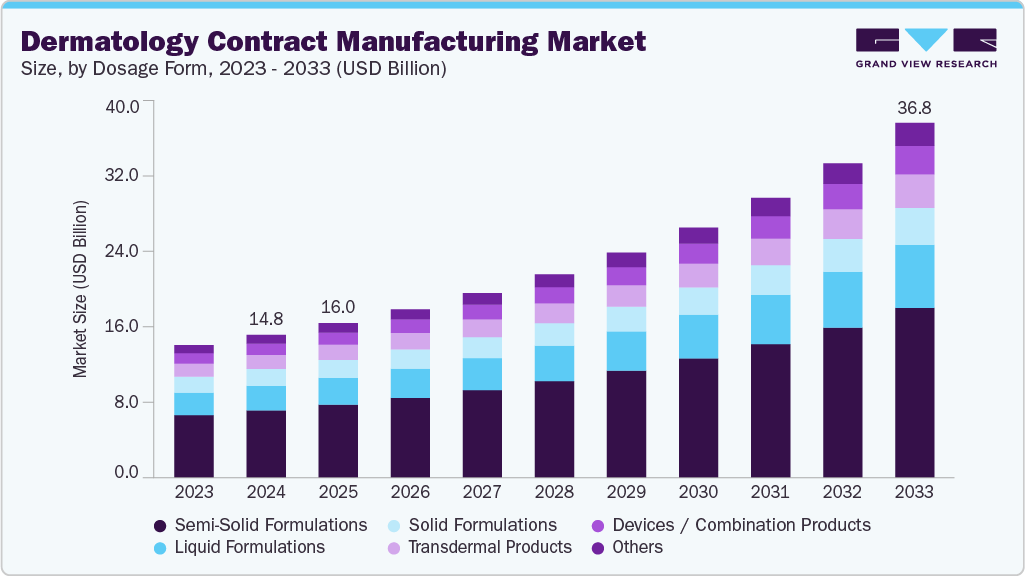

The global dermatology contract manufacturing market size was estimated at USD 14.80 billion in 2024 and is projected to reach USD 36.78 billion by 2033, growing at a CAGR of 11.79% from 2025 to 2033. The market is driven by a rising incidence of skin diseases, increased demand for aesthetic and cosmeceutical products, and the expanding outsourcing of services by pharmaceutical and skincare companies.

Key Market Trends & Insights

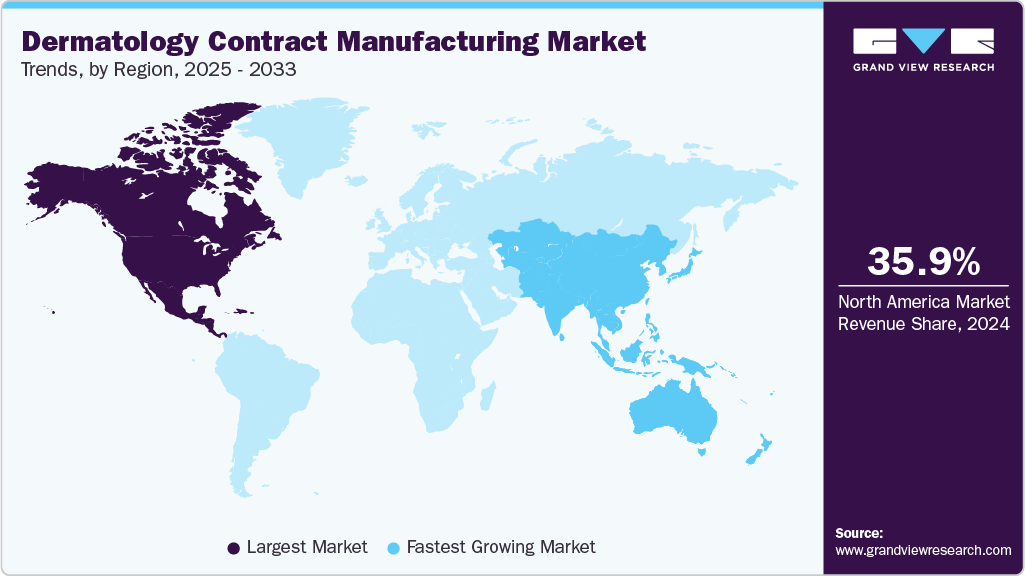

- North America dermatology contract manufacturing market held the largest share of 35.90% of the global market in 2024.

- The dermatology contract manufacturing market in the U.S. is expected to grow significantly over the forecast period.

- Based on dosage form, the semi-solid formulations segment held the largest market share of 47.27% in 2024.

- Based on service, the formulation development segment held the largest market share in 2024.

- Based on indication, the acne segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.80 Billion

- 2033 Projected Market Size: USD 36.78 Billion

- CAGR (2025-2033): 11.79%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Some other factors contributing to market growth include advancements in nanotechnology, AI-based analytics, and continuous manufacturing, which enhance formulation precision, scalability, and product quality.In addition, increasing regulatory support, adherence to GMP standards, and improved market access are expected to drive the market growth. The regional expansion across the Asia Pacific and the Middle East, further fueled by cost advantages, skilled labor, and growing consumer demand, is also anticipated to propel the market forward. Thus, these factors are expected to drive the innovation-driven, efficient, and globally competitive dermatology manufacturing landscape.

In the global market, the rising incidence of skin diseases, including acne, psoriasis, eczema, and rosacea, is expected to drive demand for dermatology contract manufacturing. Furthermore, increasing pollution, stress, hormonal imbalances, and changing lifestyles are anticipated to contribute to the global burden of dermatological conditions. Thus, the increasing prevalence of pharmaceutical and cosmetic companies developing more effective topical, injectable, and biologic formulations is expected to boost market growth over the estimated time period. Such factors are expected to drive the market over the estimated time period.

Moreover, growing requirements for aesthetic and cosmeceutical products, driven by increasing consumer awareness of skincare, aging concerns, and a preference for non-invasive beauty treatments such as anti-aging creams, serums, dermal fillers, and skin-rejuvenation injectables, are further contributing to market growth. In addition, the trend towards personalized and premium skincare is encouraging brands to collaborate with the CDMOs for innovative, science-backed formulations and rapid product launches. Furthermore, the expansion of social media influence and the growth of middle-class populations in markets are expected to present new growth opportunities for dermatology-focused contract manufacturers across the globe.

Furthermore, growing trends towards personalized and premium skincare are reshaping the dermatology contract manufacturing market. Besides, most consumers are increasingly seeking solutions tailored to their skin type, genetics, and lifestyle, which is expected to drive the demand for customized formulations and advanced delivery systems. In addition, premium skincare products are increasingly featuring high-performance ingredients, clean-label formulations, and innovative textures that are gaining popularity across global markets. Furthermore, most CDMOs are leveraging data-driven formulation technologies, AI-based skin analysis, and precision manufacturing to support brands in developing dermatology and cosmeceutical products. This shift toward personalization, customer engagement, brand differentiation, and long-term growth opportunities within the dermatology manufacturing landscape is expected to drive the market over the estimated time period.

Opportunity Analysis

The market is expected to witness new emerging opportunities in the dermatology contract manufacturing market are primarily focused on the increasing demand for advanced and personalized skincare solutions. CDMOs are well-positioned to capitalize on the growing interest in biologic dermatologics, peptide-based formulations, and hybrid cosmeceutical products that offer both medical and aesthetic benefits. The adoption of cutting-edge technologies such as nanotechnology, microencapsulation, and transdermal delivery systems is opening new avenues for innovation-driven manufacturing partnerships. In addition, expanding into market segments such as topical biologics, anti-aging injectables, and prescription-based aesthetic treatments offers attractive, high-margin opportunities.

Sustainability has also become a significant trend, with a growing emphasis on production that utilizes clean-label ingredients and eco-friendly packaging, appealing to global brands that prioritize environmental responsibility. Regions such as the Asia Pacific, the Middle East, and Latin America are experiencing rapid market growth, driven by improvements in regulatory frameworks and local manufacturing incentives. CDMOs that invest in digital quality systems, AI-driven process optimization, and flexible capacity models are likely to reap the most benefits as the industry shifts toward precision dermatology and next-generation therapeutic skincare products.

Impact of U.S. Tariffs on the Dermatology Contract Manufacturing Market

U.S. tariffs on imported raw materials, packaging components, and active pharmaceutical ingredients (APIs) have increased production costs for dermatology contract manufacturers, particularly those sourcing from Asia. These tariffs disrupt global supply chains, prompting Contract Development and Manufacturing Organizations (CDMOs) to reassess sourcing strategies and strengthen domestic manufacturing capabilities. While short-term cost pressures may affect profit margins and pricing competitiveness, the policy shift is also driving investment in local API production, advanced formulation facilities, and strategic supplier partnerships within the U.S. Thus, tariffs are reshaping the dermatology manufacturing landscape toward greater self-reliance and supply chain resilience.

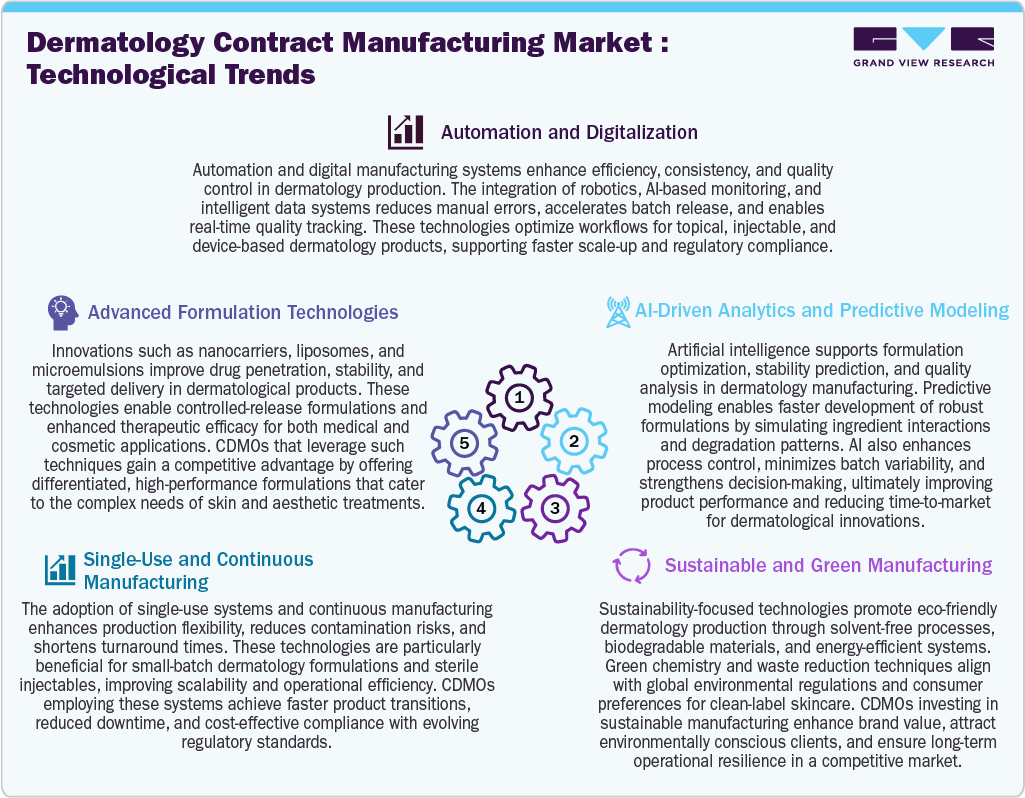

Technological advancements are reshaping the dermatology contract manufacturing market by enhancing productivity, innovation, and sustainability. Automation and digitalization improve efficiency through robotics, AI-enabled monitoring, and digital process control, ensuring precision and consistent product quality. Advanced formulation technologies such as nanocarriers, liposomes, and microemulsions enable better drug penetration, controlled release, and superior skin compatibility, driving innovation in both therapeutic and aesthetic dermatology. The adoption of single-use and continuous manufacturing systems increases flexibility, reduces contamination risks, and supports small-batch sterile production for personalized and high-value formulations.

AI-driven analytics and predictive modeling accelerate formulation design, stability testing, and process optimization by analyzing vast datasets for faster decision-making and reduced development timelines. Furthermore, sustainable and green manufacturing practices such as solvent-free processing, biodegradable materials, and energy-efficient systems are gaining importance to meet regulatory expectations and consumer demand for clean-label skincare. Thus, these technologies enable CDMOs to deliver high-quality, efficient, and environmentally responsible dermatology products in a competitive global market.

Pricing models in the industry are evolving toward greater flexibility and value-based structures. Traditional cost-plus pricing remains prevalent, especially for standardized topical formulations, while milestone-based and project-based pricing are gaining traction for complex biologics, injectables, and customized skincare solutions. CDMOs increasingly align pricing with service scope, regulatory complexity, and technology integration levels. Long-term partnerships or volume-based contracts offer clients cost efficiencies and stability, while premium pricing applies to advanced capabilities such as sterile manufacturing and nanotechnology-based delivery systems. Thus, competitive differentiation now hinges on offering transparent, performance-driven pricing aligned with client outcomes and time-to-market goals.

Market Concentration & Characteristics

The dermatology contract manufacturing industry growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Innovation is essential in dermatology contract manufacturing, propelled by advancements in formulation science, nanotechnology, and innovative delivery systems like liposomes and transdermal patches. CDMOs enhance the product stability, efficacy, and scalability through automation, AI-driven quality analytics, and continuous processing across creams, gels, and injectables.

The market is witnessing emerging M&A activity as CDMOs seek to fuel the dermatology-specific capabilities, including semi-solid formulation and sterile manufacturing. Acquisitions facilitate portfolio diversification and entry into segments such as biologic dermatologics and aesthetic injectables.

Stringent regulations from the FDA, EMA, and local authorities significantly influence dermatology manufacturing, focusing on GMP compliance, stability testing, and precise labeling. These standards compel CDMOs to integrate advanced analytical tools and quality systems, fostering reliability and client confidence in outsourced dermatology solutions.

Top CDMOs are broadening their offerings beyond conventional topical products to include injectables, combination devices, and personalized dermatology formulations. Comprehensive services from formulation development to commercial-scale fill-finish aid brands in accelerating the product launches and enhancing competitiveness in the market.

Growing skincare demand in emerging markets is driving CDMOs to establish a stronger regional presence in Asia-Pacific, Latin America, and the Middle East. Strategic investments in facilities in India, China, and South Korea are enhancing local production capabilities, ensuring regulatory compliance, and minimizing supply chain risks while increasing client accessibility.

Dosage Form Insights

On the basis of dosage form, in 2024, the semi-solid formulations segment held the largest market share in the market, accounting for a revenue share of 47.27%. The segment growth is attributed to the increasing emphasis on creams, ointments, gels, and lotions that are designed for topical drug delivery. Most contract manufacturers offer end-to-end services, including formulation development, scale-up, stability testing, and packaging, to ensure compliance with regulatory standards. Furthermore, the growth of customized, cosmeceutical, and prescription dermatology products is expected to drive market growth over the estimated time period. In addition, most semi-solid formulations are targeted to therapeutic actions, which further enhance targeted therapeutic effects, patient compliance, and controlled drug release for treating various skin disorders. Moreover, growing investments in bioprocessing technologies, single-use systems, and capacity expansion are expected to drive segment growth. Such factors are expected to drive the market.

The liquid formulations segment is expected to exhibit the fastest-growing CAGR over the forecast period in the market, driven by increasing demand for tailored topical and transdermal applications. Besides, these formulations facilitate uniform drug distribution, rapid absorption, and ease of application, making them ideal for treating a wide range of skin conditions and contributing to segment growth. In addition, the growing number of patent expirations of blockbuster biologics and increasing demand for cost-effective therapies are expected to drive the market. Moreover, contract manufacturers offering integrated services such as formulation development for innovative delivery are expected to drive the market over the estimated time period.

Service Insights

Based on the service, in 2024, the contract manufacturing segment held the largest market share, driven by increasing demand for comprehensive production services for creams, ointments, gels, foams, sprays, and transdermal products. Other factors contributing to segment growth include the growing demand for dermatological treatments, expanding skincare product portfolios, and increasing outsourcing trends among leading brands, which seek flexibility and faster market entry. Besides, the growth of advanced manufacturing technologies, GMP-certified facilities, and a global supply chain for contract manufacturing is expected to support market growth over the forecast period. Such factors are expected to drive the segment growth.

The formulation development segment is expected to grow at a notable CAGR, driven by increasing demand for cost efficiency, scalability, and regulatory compliance. Biopharmaceutical companies increasingly outsource manufacturing to CDMOs to reduce capital expenditure and accelerate timelines. In addition, contract manufacturing typically offers advanced infrastructure, specialized expertise, and global quality standards, enabling the seamless production of complex biologics, biosimilars, and advanced therapies. In addition, strong investments in single-use systems, continuous bioprocessing, and digitalized operations are ensuring higher productivity and flexibility, supporting market growth. Moreover, the growing emphasis on advanced technologies, such as nanocarriers and controlled release systems, is anticipated to drive the market over the estimated time period.

Indication Insights

On the basis of indication, the acne segment dominated the market with the largest revenue share in 2024. The segment growth is attributed to the continuous demand for effective topical and oral formulations, as well as the increasing requirement for a range of products, such as creams, gels, foams, and cleansers, containing active ingredients like retinoids, benzoyl peroxide, and antibiotics. Moreover, dermatology products benefit from a growing preference for cosmeceuticals and OTC acne treatments, which is expected to drive dermatology manufacturing in the acne therapeutic area. Furthermore, growing innovation in delivery systems, such as nanoemulsions and microencapsulation, enhances therapeutic efficacy and skin tolerability, which is expected to drive commercial requirements in the market.

The alopecia segment is poised to depict a notable CAGR over the forecast period, driven by the increasing incidence of hair loss disorders and rising consumer awareness of aesthetic and therapeutic hair care solutions. Besides, the growing demand for topical and injectable formulations is expected to drive the market over the forecast period. Also, most contract manufacturers are focusing on advanced formulation technologies, which are expected to enhance product efficacy and absorption. Moreover, the growing demand for personalized and regenerative treatments further fuels market growth. Such factors are expected to drive the market over the estimated time period.

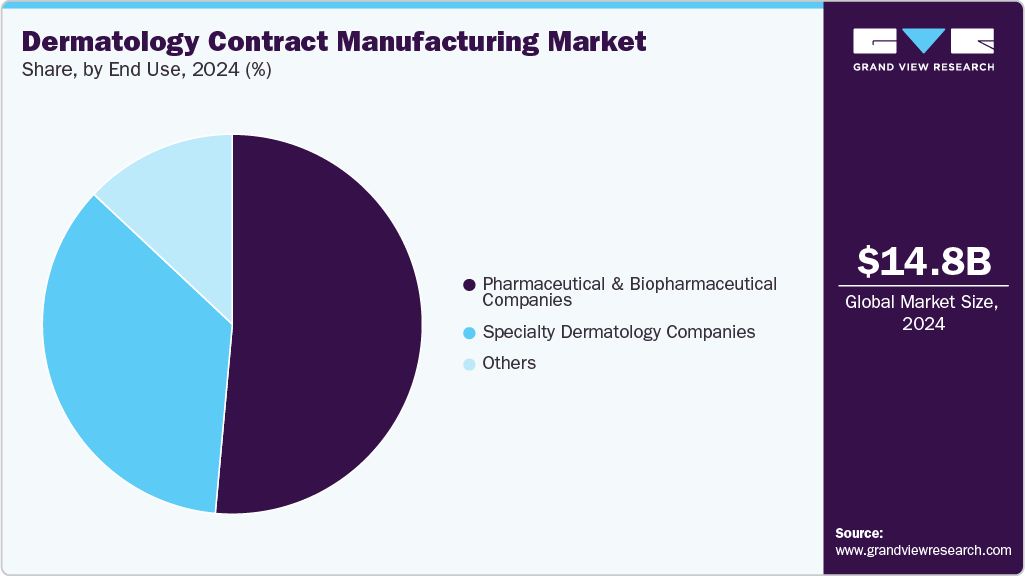

End Use Insights

On the basis of end use, the pharmaceutical and biopharmaceutical companies segment accounted for the largest share in 2024. The segment is driven by end-to-end development and production services. These companies increasingly outsource formulation development, analytical testing, and large-scale manufacturing to specialized CDMOs to reduce costs, accelerate time-to-market, and ensure regulatory compliance. Other factors contributing to segment growth include rising demands for end-to-end development and production services. Also, most of the companies are increasingly outsourcing formulation development, analytical testing, and large-scale manufacturing to specialized CDMOs to reduce costs, accelerate time-to-market, and ensure regulatory compliance. Moreover, the rising requirements for biosimilar and cosmeceutical dermatology products are anticipated to expand market growth opportunities over the estimated time period.

The specialty dermatology companies segment is the second-fastest-growing segment in the market, driven by the rising need for dermatology products in therapeutic areas such as acne, psoriasis, rosacea, and alopecia. Furthermore, most companies rely heavily on contract manufacturing for formulation innovations, clinical-scale production, and regulatory-compliant commercialization. Further, outsourcing often provides access to advanced technologies without requiring significant capital investment. Moreover, rising demand for targeted, high-efficacy dermatological treatments and premium skincare products is anticipated to boost the collaboration among specialty companies and CDMOs. Such factors are expected to drive the market over the estimated time period.

Regional Insights

The North America dermatology contract manufacturing industry held the largest revenue share of 35.90% in 2024,attributed to the growing demand for advanced topical formulations, the increasing prevalence of skin disorders, and the rising demand for cosmeceutical products. In addition, shifting trends among pharmaceutical and skincare brands towards outsourcing, driven by a favorable regulatory framework and the leverage of CDMOs' expertise in complex semi-solid and transdermal formulations, as well as regulatory compliance and cost-efficient production, are expected to contribute to market growth. Moreover, the market is expected to witness new growth opportunities in the region, driven by strategic collaborations, stringent FDA standards, and a growing preference for customized, premium dermatology products. Such factors are expected to drive the market growth over the estimated time period.

U.S. Dermatology Contract Manufacturing Market Trends

The dermatology contract manufacturing industry in the U.S. accounted for the largest market share in the North America market, driven by increasing demand for specialized topical, transdermal, and cosmeceutical formulations, the rising prevalence of skin disorders, and a shift toward advanced skincare solutions. Further, most contract manufacturers are expanding their capabilities through technological advancements in nano-emulsions, biologics, and delivery systems, thereby enhancing product efficacy and differentiation. Moreover, the growing expansion of FDA-approved manufacturing facilities and a surge in dermatology products are expected to drive the market growth. Such factors are expected to drive the innovation, scalability, and faster market entry in the competitive dermatology segment.

The Canada dermatology contract manufacturing industry isdriven by increasing demand for high-quality topical and cosmeceutical products, rising prevalence of skin disorders, and favorable government initiatives promoting innovation in the market. Moreover, the country's market benefits from expanding R&D investments by pharmaceutical and skincare brands, as well as the rising preference of outsourcing among skincare brands to access advanced formulation capabilities, GMP-certified facilities, and regulatory expertise, while reducing operational costs. This is expected to drive market growth. Furthermore, growing focus on healthcare infrastructure & regulatory compliance, quality standards, and adoption of natural, clean-label, and personalized dermatology formulations is strengthening the market position.

Europe Dermatology Contract Manufacturing Market Trends

The dermatology contract manufacturing industry in Europe is expected to grow at a significant CAGR during the forecast period, driven by expanding requirements for advanced topical, transdermal, and aesthetic dermatology products, stringent regulatory standards, and a robust pharmaceutical base. Besides, the rising incidence of skin diseases and increasing consumer preference for premium cosmeceuticals and dermatology products are expected to drive the market growth over the estimated time period. Some other key trends driving this market include expertise in formulation innovation, compliance with EMA regulations, and flexible production capabilities. Demand for specialized services, sustainable manufacturing, clean beauty trends, and digitalized production processes among pharmaceutical and dermatology companies is expected to drive the market.

The Germany dermatology contract manufacturing industry held a considerable share in 2024. This market is driven by a robust pharmaceutical manufacturing infrastructure, an advanced research and development (R&D) ecosystem, and stringent regulatory compliance standards. Further, the country has made significant investments in biotechnology and nanotechnology, supporting innovation in topical and transdermal formulations, which is expected to drive market growth over the estimated period. In addition, the growing adoption of digital technologies, increasing partnerships among dermatology brands, and rising trends towards dermatologically tested formulations are expected to drive the market growth over the forecast period.

The dermatology contract manufacturing industry in the UK held the largest share in 2024, driven by increasing demand for innovative skincare and prescription dermatology products, strong government support, and the rising prevalence of eczema, acne, and psoriasis, which in turn drives investment in advanced topical and biologic formulations. In addition, the CDMOs are increasingly witnessing rising requirements due to expertise in formulation, flexible production models, and adherence to GMP standards. Moreover, the growing focus on personalized skincare and the rapid expansion of private-label brands are enhancing outsourcing opportunities.

Asia Pacific Dermatology Contract Manufacturing Market Trends

The Asia Pacific dermatology contract manufacturing industry is driven by rapid growth in the pharmaceutical and cosmeceutical industries, as well as increasing awareness of skincare solutions. Furthermore, in the region, the growing population and rising demand for affordable yet high-quality dermatology products are expected to drive market growth. In addition, countries such as China, India, Japan, and South Korea are major contributors due to cost advantages, skilled labor, and improved GMP-compliant infrastructure. Moreover, growing advancements in formulation technologies and rising adoption of natural and herbal dermatology products are accelerating regional growth.

The dermatology contract manufacturing industry in Japan accounted for the largest share in the Asia Pacific in 2024. Market growth is driven by increased demand for premium skincare products, including anti-aging, sensitive-skin, sun-care, cosmeceutical, and prescription dermatology products. Besides, an aging population and rising healthcare awareness are expected to drive market growth. Moreover, the development of advanced R&D capabilities, precision manufacturing, and adherence to stringent regulatory standards are expected to boost market growth. Furthermore, local and global brands increasingly outsource to leverage Japan's expertise in nanotechnology, transdermal systems, and clean beauty formulations. Such factors are expected to offer new growth opportunities to the market over the estimated time period.

The India dermatology contract manufacturing industry is projected to register a considerable CAGR during the forecast period, driven by its increasing demand for topical and cosmeceutical products, strong domestic pharmaceutical production, and cost-efficient manufacturing. Similarly, other factors contributing to market growth include the rising prevalence of skin disorders, urbanization, and a growing consumer preference for affordable dermatology solutions, which are expected to support market expansion. Besides, the growing number of international and local brands that are outsourcing formulation development is expected to drive the market over the estimated time period.

The dermatology contract manufacturing industry in China is driven by rising consumer spending on skincare, increasing incidence of dermatological conditions, and expanding requirement for cosmeceutical products. Besides, the country is emerging as a hub for advanced manufacturing infrastructure, cost advantages, and supportive government policies, which promote large-scale outsourcing by both domestic and global brands. Moreover, growing investment in R&D and a rising number of partnerships are expected to drive the market growth.

Latin America Dermatology Contract Manufacturing Market Trends

The dermatology contract manufacturing industry in Latin Americais projected to register a significant CAGR during the forecast period, driven by rising demand for affordable skincare, cosmeceutical, and therapeutic dermatology products. In addition, the growing awareness of skin health, along with increased access to dermatological care support in Brazil and Mexico, is anticipated to drive the market over the forecast period. Moreover, most CDMOs benefit from the cost efficiency, local ingredient sourcing, and growing partnerships with global skincare brands.

The Brazil dermatology contract manufacturing industry is experiencing robust growth, driven by the strong cosmetic and pharmaceutical industries, high consumer demand for skincare and cosmeceutical products, and a growing focus on dermatological health. Besides, the country's rising disposable incomes and preference for natural, tropical, and anti-aging formulations further enhance the market growth.

Middle East & Africa Dermatology Contract Manufacturing Market Trends

The dermatology contract manufacturing industry in the Middle East is growing steadily due to rising demand for advanced skincare, cosmeceutical, and prescription dermatology products. Countries like Saudi Arabia and the UAE are emerging as regional hubs, attracting cost-effective, GMP-certified manufacturing and localized expertise. Such factors are expected to drive biopharmaceutical capabilities and resilience.

The South Africa dermatology contract manufacturing industry is expected to depict a robust CAGR during the forecast period. The market is driven by rising awareness of skin health, growing demand for affordable skincare, and the expansion of both the pharmaceutical and cosmetic industries. In addition, strong regulatory frameworks, multinational brands, and access to patient populations are expected to drive the market over the forecast period.

Key Dermatology Contract Manufacturing Company Insights

The global market is experiencing significant growth, with the major market players including Akums Drugs & Pharmaceuticals Ltd., Glamris Dermacare, Lifevision Healthcare, and Allrite Group among others. These companies offer comprehensive services driving innovation and efficiency in dermatology industry. For instance, in January 2024, Aarti Drugs Limited mentioned the production of dermatology products at its newly established facility in Tarapur. which is next to its existing manufacturing units, the 40,000 sq. ft. facility is equipped with advanced technology and built to meet the highest industry standards. This expansion marks a strategic step toward enhancing the company’s footprint in the skincare segment and supporting its broader mission to advance healthcare innovation.

Key Dermatology Contract Manufacturing Companies:

The following are the leading companies in the dermatology contract manufacturing market. These companies collectively hold the largest Market share and dictate industry trends.

- Akums Drugs & Pharmaceuticals Ltd.

- Glamris Dermacare

- Lifevision Healthcare

- Allrite Group

- Medconic Dermaceutics

- Shinom Cosmeceuticals

- WISDERM

- Marvex Pharma

- Servocare Lifesciences

- Zestwin Lifesciences

- Cledral Life Sciences

- Cosmenova

- Hanisan Healthcare

- Thea Janus

- Genesis Biotec

Recent Developments

-

In October 2024, Emcure announced the launch of a new wholly owned subsidiary, Emcutix Biopharmaceuticals, dedicated solely to the dermatology segment in India. The new entity will concentrate on both therapeutic and aesthetic dermatology, reflecting the company’s strategic move to strengthen its presence and innovation capabilities within the skin health domain. This launch is expected to drive the market.

-

In July 2024, Galderma mentioned that the Swedish Medical Products Agency has granted significant updates to its manufacturing license, supporting the company’s innovation and expansion strategy. Following a successful GMP inspection of Galderma’s Center of Excellence in Uppsala, Sweden, the updated license permits the company to manufacture and conduct bioanalytical testing for RelabotulinumtoxinA (QM1114). RelabotulinumtoxinA, a next-generation liquid neuromodulator in Galderma’s Injectable Aesthetics portfolio, which is developed using the company’s proprietary PEARL technology. These regulatory updates highlight Galderma’s technical expertise and expanding production capabilities, reinforcing its commitment to advancing dermatological innovation and enhancing its global leadership in the field.

Dermatology Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.02 billion

Revenue forecast in 2033

USD 36.78 billion

Growth rate

CAGR of 11.79% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Dosage form, service, indication, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Akums Drugs & Pharmaceuticals Ltd.; Glamris Dermacare; Lifevision Healthcare; Allrite Group; Medconic Dermaceutics; Shinom Cosmeceuticals; WISDERM; Marvex Pharma; Servocare Lifesciences; Zestwin Lifesciences; Cledral Life Sciences; Cosmenova; Hanisan Healthcare; Thea Janus; Genesis Biotec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dermatology Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dermatology contract manufacturing market report based on dosage form, service, indication, end use, and region.

-

Dosage Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Semi-Solid Formulations

-

Creams

-

Ointments

-

Gel

-

Others

-

-

Liquid Formulations

-

Sprays

-

Foams

-

Dermal Injectables

-

Others

-

-

Solid Formulations

-

Transdermal Products

-

Devices / Combination Products

-

Others

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Formulation Development

-

Analytical Method Development

-

Scale-Up & Process Validation

-

Contract Manufacturing

-

Clinical / Batch Manufacturing

-

Commercial Manufacturing (CM)

-

-

Packaging & Labelling

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Acne

-

Psoriasis

-

Rosacea

-

Alopecia

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biopharmaceutical Companies

-

Specialty Dermatology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global dermatology contract manufacturing market size was estimated at USD 14.80 billion in 2024 and is expected to reach USD 16.02 billion in 2025.

b. The global dermatology contract manufacturing market is expected to grow at a compound annual growth rate of 11.79% from 2025 to 2033 to reach USD 36.78 billion by 2033.

b. The semi-solid formulations segment dominated the dermatology contract manufacturing market with a share of 47.27% in 2024. The market growth is driven by an increasing emphasis on creams, ointments, gels, and lotions designed for topical drug delivery. Most contract manufacturers offer end-to-end services, including formulation development, scale-up, stability testing, and packaging, to ensure compliance with regulatory standards. Furthermore, the growth of customized, cosmeceutical, and prescription dermatology products is expected to drive market growth.

b. Some key players operating in the dermatology contract manufacturing market include Akums Drugs & Pharmaceuticals Ltd., Glamris Dermacare, Lifevision Healthcare, Allrite Group, Medconic Dermaceutics, Shinom Cosmeceuticals, WISDERM, Marvex Pharma, Servocare Lifesciences, Zestwin Lifesciences, Cledral Life Sciences, Cosmenova, Hanisan Healthcare, Thea Janus, and Genesis Biotec

b. Key factors driving market growth include rising incidence of skin diseases, increased demand for aesthetic and cosmeceutical products, and expanding outsourcing by pharmaceutical and skincare companies. Some other factors contributing to market growth include advancements in nanotechnology, AI-based analytics, and continuous manufacturing, which enhance formulation precision, scalability, and product quality. Such factors are contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.