- Home

- »

- Medical Devices

- »

-

Dermatome Device Market Size And Share Report, 2030GVR Report cover

![Dermatome Device Market Size, Share & Trends Report]()

Dermatome Device Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Powered, Drum), By End-use (ASCs, Hospitals), By Application (Plastic Surgery, Chronic Burn Care Treatments), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-977-4

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dermatome Device Market Size & Trends

The global dermatome device market size was valued at USD 151.03 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Increasing advancements in dermatome device to provide improved results with a high degree of accuracy and precision is anticipated to secure a strong market position during the forecast period. Factors, such as a rise in the number of burn cases, an increasing number of cosmetic surgeries, and a high incidence of pressure ulcers & skin infections, are expected to drive the market growth. The COVID-19 pandemic led to a significant fall in the sales of dermatome devices. Factors, such as lockdowns & strict government guidelines to avoid the spread of the virus and changes in medical priorities had a negative impact on the market. The postponement of many elective surgeries also resulted in a drop in overall market revenue.

However, although the market experienced a slight drop in revenue, the continued focus on trauma and serious burn patients helped in gathering a considerable amount of revenue during the pandemic. Moreover, the market recovered quickly in the second half of the pandemic post the opening of economies due to a large number of pending elective surgeries. The increase in screen time of many people, which led to a large number of people making a career on social media platforms that demanded them to meet the ideal looks for it, is expected to help the market flourish over the forecast period. Mass trauma and catastrophes, such as fires and explosions, can cause a number of serious and complex injuries, including burns. These can include electrical burns, chemical burns, thermal burns, etc., which are instigated by contact with hot liquids, flames, hot surfaces, and other sources of high heat.

A rise in the number of burn cases is one of the major factors that is expected to drive the market growth. According to a research article published in 2021, by the American Burn Association, more than 400,000 people receive treatment for burn injuries each year in the U.S. There is a significant rise in the cases of burn injuries that need the reconstitution of the burnt area with skin patches, which is majorly done by dermatome device. In addition, the increasing incidence of pressure ulcers is among the major concern at home and especially in hospitals. The lack of physical mobility or the presence of a physical disability may lead to pressure ulcers. It is more common among the geriatric population due to their reduced ability to move as a result of growing age. Therefore, a rise in the incidence of pressure ulcers is estimated to contribute to the market growth.

Product Insights

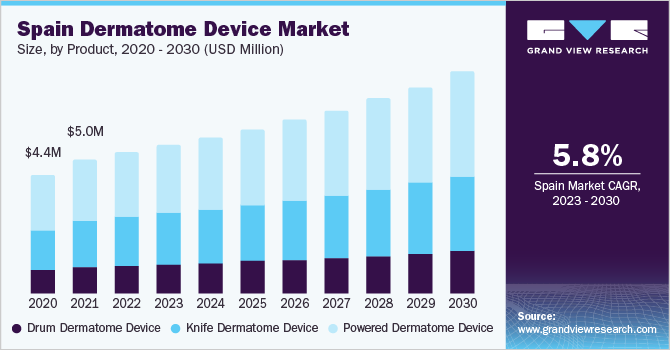

On the basis of products, the global market is segmented into drum, knife, and powered dermatome devices. The powered dermatome device segment dominated the market in 2022 with a market share of 91.7% in 2022 and this trend is expected to continue over the forecast period. This is due to the advantages of powered dermatome devices over drum and knife dermatome devices. The powered dermatome device segment is further segmented into pneumatic, battery-operated, and electric dermatome devices.

A powered dermatome provides consistent and reliable skin grafts and is easy to use making it an ideal choice for many surgeons. A pneumatic dermatome device held the highest revenue share owing to its growing popularity and increasing adoption rate. Air dermatomes are mostly used for large skin grafts due to their consistency and easy usage. Hence, increasing adoption of air dermatome devices, especially in skin grafts, is expected to boost segment growth. Although drum dermatomes were in high demand, the segment is estimated to witness sluggish growth in the years to come.

Application Insights

Based on applications, the global market is segmented into plastic surgery, reconstructive surgery, general surgery, chronic burn care treatments, and others. The chronic burn care treatments segment held the highest revenue share of 33.3% in 2022. This is due to the rising number of burns globally, especially in developing countries like India. According to data published by the National Library of Medicine, the estimated annual burn incidence in India is around 6-7 million each year. However, developed countries also have a huge burden of burn cases each year.

Plastic surgery is expected to be the fastest-growing segment with a CAGR of 6.1% over the forecast period. Factors, such as technological advancements in plastic surgery that have made it safer and reduced the recovery time as well as the cost of the procedure, have led to the growing popularity of plastic surgery. Individuals are now not that reluctant to undergo plastic surgery. Moreover, the growing disposable income and the rising influence of social media are other factors that are expected to boost segment growth over the forecast period.

End-Use Insights

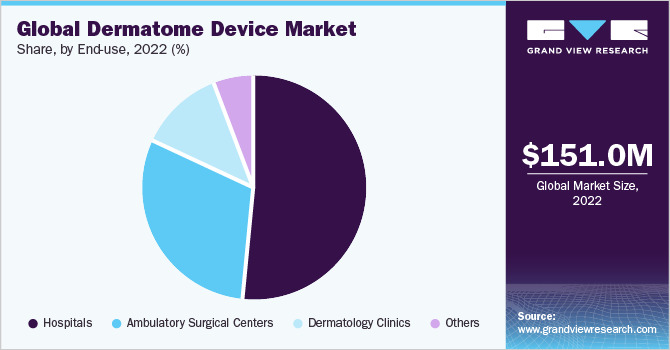

Based on end-uses, the global market is segmented into hospitals, Ambulatory Surgical Centers (ASCs), dermatology clinics, and others. The hospitals segment accounted for the highest revenue share of 51.3% in 2022. This is because, in most trauma or burn cases, the patient is usually taken to the hospital. The hospital setting also provides a wide range of options for surgical procedures i.e. general surgery, cosmetic surgery, and treatment of chronic burn cases all can be carried out in this setting. Thus, increasing product usage in hospitals is expected to foster market growth.

The Ambulatory Surgical Centers (ASCs) segment is expected to witness the maximum growth over the forecast period. This is due to the rising popularity of aesthetic or cosmetic surgeries being carried out in ASCs. Moreover, it offers advantages like reduced cost by minimizing the overall patient stay post-procedure. Thus, making it an ideal option for individuals that do not need prolonged hospital stays, thereby fueling the market demand.

Regional Insights

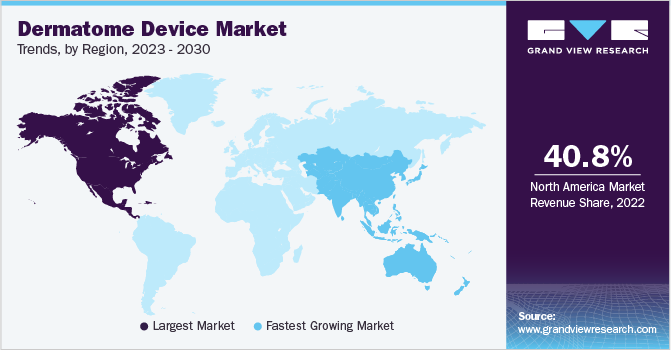

North America dominated the global market with an overall share of 40.8% in 2022. This can be attributed to factors, such as well-established healthcare infrastructure, presence of established market players, and favorable reimbursement scenario. In addition, the country has secured its position in the top 3 countries with the highest number of plastic surgeries. The country has the highest number of plastic surgeons, globally. Thus, rising cases of plastic surgeries are anticipated to boost product demand over the forecast period.

However, Asia Pacific is expected to be the fastest-growing region with a CAGR of 6.5% over the forecast period. This is due to the rising burn cases in developing countries like India, Malaysia, and Indonesia. According to an article published in the Journal of Burn Care & Research, in 2022, South and South-East Asia are the most burdened regions that account for 30-40% of all global burn cases. Moreover, the growing popularity of cosmetic procedures in the region coupled with increasing disposable income is projected to fuel the market growth over the forecast period.

Key Companies & Market Share Insights

Zimmer Biomet, Integra Lifesciences, and Aesculap, Inc. dominated the global market in 2021. Key players are focusing on widening their presence in the industry by carrying out strategic initiatives, such as acquisitions and partnerships. Several major players are acquiring smaller companies to strengthen their industry position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. For instance, in March 2022, Zimmer Biomet announced the completion of the ZimVie spinoff, its former dental and spine business. The spinoff was carried out to strengthen its position as a global leader in the medical technology space. Some of the prominent players in the global dermatome device market include:

-

Zimmer Biomet

-

Integra Lifesciences

-

B. Braun Melsungen AG

-

Aesculap, Inc.

-

Surtex Instruments Ltd.

-

DeSoutter Medical

-

Shaanxi Xingmao Industry Co., Ltd.

-

Aygun Surgical Instruments Co., Inc.

-

Humeca BV

-

Nouvag AG

-

Novo Surgical Inc.

Dermatome Device Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 157.75 million

Revenue forecast in 2030

USD 231.0 million

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zimmer Biomet; Integra Lifesciences; B. Braun Melsungen AG; Aesculap, Inc.; Surtex Instruments Ltd.; DeSoutter Medical; Shaanxi Xingmao Industry Co., Ltd.; Aygun Surgical Instruments Co., Inc.; Humeca BV; Nouvag AG; Novo Surgical Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dermatome Device Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the dermatome device market based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Drum Dermatome Device

-

Knife Dermatome Device

-

Powered Dermatome Device

-

Pneumatic Dermatome Device

-

Battery Operated Dermatome Device

-

Electric Dermatome Device

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic Surgery

-

Reconstructive Surgery

-

General Surgery

-

Chronic Burn Care Treatments

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Dermatology Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global dermatome device market size was estimated at USD 151.03 million in 2022 and is expected to reach USD 157.75 million in 2023.

b. The global dermatome device market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 231.0 million by 2030.

b. North America dominated the dermatome device market with a share of 40.9% in 2022. This is attributable to the availability of advanced healthcare infrastructure and increasing adoption of cosmetic surgeries in the U.S.

b. Some key players operating in the dermatome device market include Zimmer Biomet, Integra Lifesciences, B,Braun Melsungen AG, Aesculap, Inc., Surtex Instruments Ltd., DeSoutter Medical, Shaanxi Xingmao Industry Co., Ltd., Aygun Surgical Instruments Co., Inc., Humeca BV, Nouvag AG and Novo Surgical Inc.

b. Key factors that are driving the dermatome device market growth include rise in number of burn cases, increasing number of cosmetic surgeries, and increasing incidence of pressure ulcers and skin infections.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.