- Home

- »

- Medical Devices

- »

-

Diagnostic Device Contract Manufacturing Market Report, 2030GVR Report cover

![Diagnostic Device Contract Manufacturing Market Size, Share & Trends Report]()

Diagnostic Device Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (In Vitro Diagnostic Devices, Diagnostic Imaging Devices), By Service, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-575-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

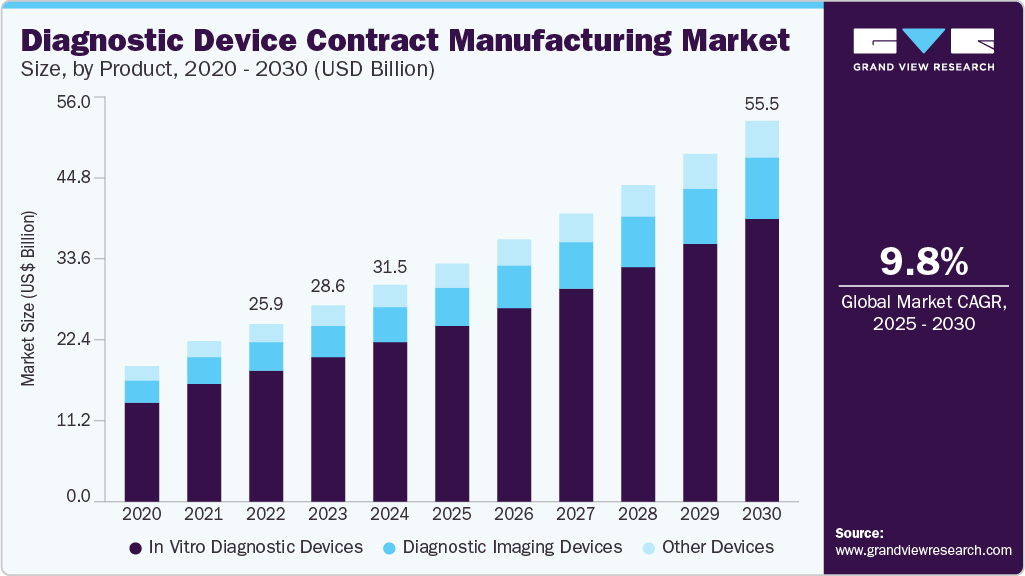

The global diagnostic device contract manufacturing market size was estimated at USD 31.49 billion in 2024 and is projected to grow at a CAGR of 9.84% from 2025 to 2030. The diagnostic device contract manufacturing industry’s growth is driven by rapid technological advancements, evolving healthcare needs, and strategic shifts in manufacturing models.

Key Highlights:

- In 2024, Asia Pacific dominated the diagnostic device contract manufacturing industry with a share of 41.37%.

- The diagnostic device contract manufacturing industry in the U.S. accounted for the highest share in North America

- In terms of product segment, the market is segmented into in vitro diagnostic devices, diagnostic imaging devices, and others

- In terms of service segment, the market is segmented into device development and manufacturing services, quality management services, packaging and assembly services, and others.

- In terms of application segment, the infectious disease segment accounted for the largest market share in 2024.

As diagnostic testing shifts towards decentralization, especially with the growing popularity of point-of-care and at-home diagnostics, Original Equipment Manufacturers (OEMs) are increasingly turning to contract manufacturers. Outsourcing supports improving the scalability, shortening time-to-market, and managing operational costs effectively. In addition, the presence of well-established manufacturing hubs of highly reliable, complex, and high-quality medical devices in the region has led to increased demand for diagnostic devices, which is crucial for enhancing healthcare efficiency. Moreover, the rising prevalence of diseases and the need for a range of medical devices are expected to be one of the major factors propelling the development of the diagnostic device contract manufacturing industry.

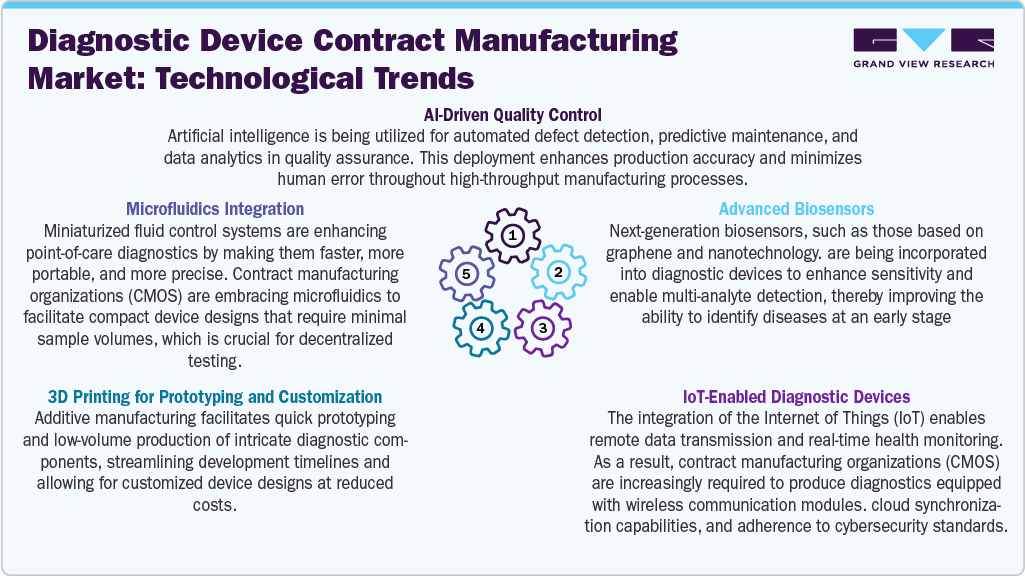

Emerging technologies like microfluidics, AI-driven quality assurance, advanced biosensors, and IoT integration are transforming the capabilities and design demands of medical devices. These advancements require precision engineering, adherence to strict regulatory standards, and high-quality manufacturing processes, where specialized Contract Manufacturing Organizations (CMOs) are expected to hold the competitive edge. Moreover, the rising use of 3D printing for rapid prototyping and low-volume production allows for customization and development cycles, driving the market growth.

The growth is further fueled by an increasing focus on early disease detection, an aging population, a growing burden of chronic diseases, and improved access to diagnostics in emerging economies. Furthermore, regional influences, including shifts in trade policy and U.S.-China tariffs, have prompted manufacturers to reevaluate global supply chains, leading to diversification in sourcing and production. These factors are expected to drive market growth.

Opportunity Analysis

The diagnostic device contract manufacturing market offers significant growth opportunities fueled by increasing global healthcare demands and the rapid advancement of diagnostic technologies. As OEMs are facing increasing pressure to expedite product development, lower costs, and adapt to changing regulatory environments, the companies are turning to specialized CMOs for device production.

Moreover, strong demand for In-Vitro Diagnostics (IVDs), molecular diagnostics, and point-of-care testing necessitates the need for rapid scaling, miniaturization, and precision engineering, which further provide new growth opportunities for the market. The emerging Asia Pacific market presents cost advantages and the development of diagnostic infrastructure, making it appealing as a manufacturing hub. At the same time, North America and Western Europe offer opportunities for high-complexity manufacturing, particularly in areas like AI-enabled diagnostics, connected devices, and wearable health technology.

CMOs that provide integrated services ranging from design for manufacturability and regulatory assistance to packaging and post-market services are well-positioned to attract OEMs that prefer single-source, comprehensive partnerships. Moreover, the shift towards value-based healthcare and home-based testing is driving the demand for portable and user-friendly devices, creating new opportunities for innovation-focused outsourcing. Investing in automation, regulatory expertise, and regional capacity will enable contract manufacturers to take advantage of changing diagnostic needs, digital integration, and the increasing demand for faster, decentralized diagnostics in both high-income and developing healthcare systems.

Impact of U.S. Tariffs on the Global Diagnostic Device Contract Manufacturing Market

U.S. tariffs on medical devices are anticipated to have a major impact on the global market. The introduction of these tariffs on imported medical devices and components has notably affected the global diagnostic device contract manufacturing sector. With around 69% of medical devices marketed in the U.S. produced outside the country, these tariffs have disrupted established supply chains, resulting in increased production costs and potential delays in device availability. Besides, one of the significant consequences is the rise in manufacturing costs due to tariffs on crucial raw materials and components, such as semiconductors and specialized metals. For instance, tariffs on semiconductors, a critical component of many diagnostic devices, have raised concerns about increasing costs and vulnerabilities within the supply chain.

Moreover, increasing expenses on healthcare providers and patients could lead to increased prices for diagnostic services and equipment. Further, the uncertainty surrounding trade policies has prompted companies to reevaluate their manufacturing strategies, with some considering reshoring or diversifying their supply chains to mitigate the risks associated with tariffs. Furthermore, the tariffs have ignited discussions about the necessity for enhanced domestic manufacturing capabilities to lessen dependence on foreign suppliers. However, establishing new manufacturing facilities is a lengthy and capital-intensive undertaking, presenting challenges for swift adaptation. In conclusion, U.S. tariffs have created significant obstacles for the global diagnostic device contract manufacturing market, impacting cost structures, supply chain dynamics, and strategic planning for manufacturers worldwide.

Technological Advancements

Technological advancements in diagnostic device contract manufacturing are transforming the industry by improving precision, shortening time-to-market, and facilitating the creation of next-generation solutions. A key trend is the adoption of microfluidics, which supports miniaturized assays for point-of-care testing and requires specialized manufacturing capabilities that CMOs are now providing. 3D printing plays a crucial role as well, enabling rapid prototyping and customization of components for low-volume or early-phase products, significantly accelerating development cycles.

Artificial intelligence is being integrated into manufacturing processes, particularly for quality control through AI-driven inspections that detect defects in real time and machine learning models that enhance production efficiency. The emergence of advanced biosensors, including nano-sensors and wearables prompting CMOs to implement cleanroom assembly and precision calibration systems. In addition, the rise of IoT-enabled diagnostics is increasing the demand for manufacturers skilled in electronics integration, wireless components, and cybersecurity compliance, making this a rapidly growing segment. These innovations collectively drive a more agile, scalable, and forward-thinking diagnostic device manufacturing landscape.

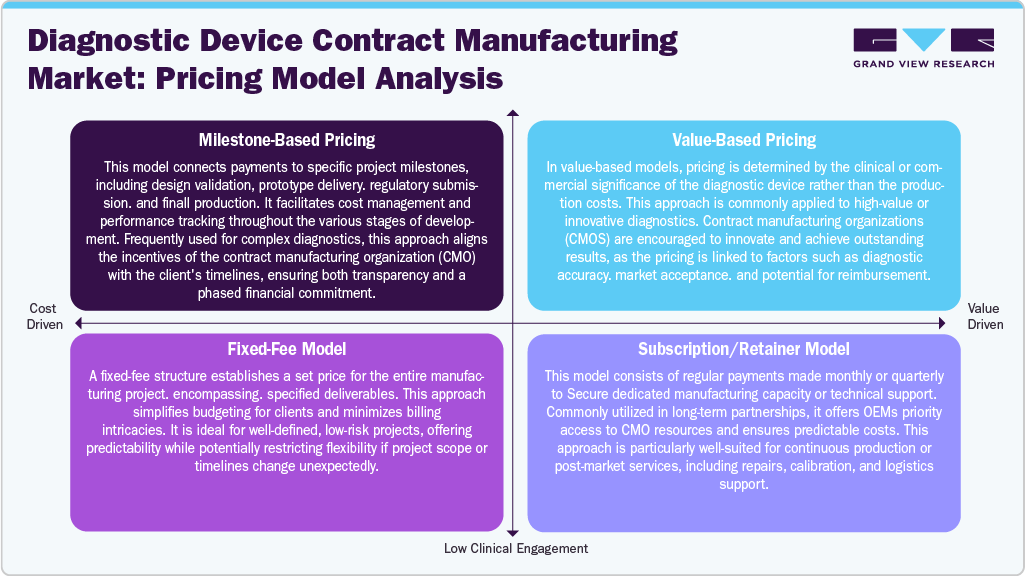

Pricing Model Analysis

In diagnostic device contract manufacturing, pricing models are customized to address the complexity, duration, and strategic requirements of each project. In milestone-based pricing, it breaks the payments into different phases of development, such as design finalization, prototype creation, clinical validation, and scaling up. This structured approach provides financial flexibility and promotes risk-sharing, enabling OEMs to manage costs incrementally while ensuring that CMOs remain aligned with project timelines and deliverables.

In addition, the value-based pricing focuses on the performance and market impact of the diagnostic product rather than simply the cost of manufacturing inputs. Under this model, CMOs receive compensation based on specific outcomes like diagnostic accuracy, market acceptance, or success in securing reimbursement. This approach encourages innovation and ensures that both parties work toward delivering high-performing, commercially viable devices.

Furthermore, fixed-fee pricing presents a single, predetermined cost for a clearly defined scope of work. This simplifies budgeting and offers cost certainty, making it well-suited for standardized production runs or manufacturing tasks that are well understood and carry minimal risk. Moreover, the subscription or retainer models involve regular, periodic payments in exchange for guaranteed access to manufacturing resources or technical services. This model fosters long-term partnerships, particularly when OEMs require consistent production, support services, or the ability to respond rapidly without the need for renegotiation for each engagement.

Market Concentration & Characteristics

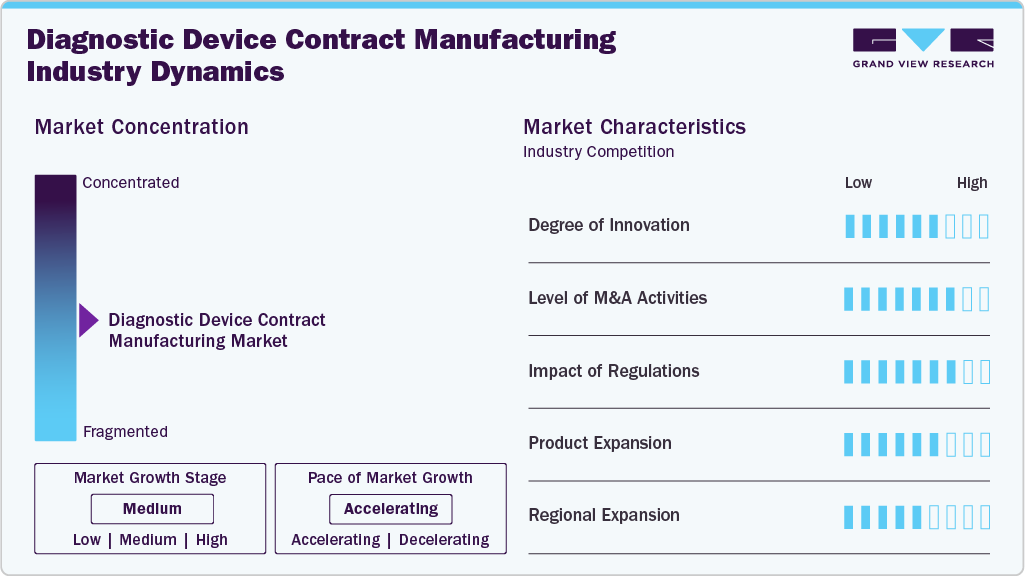

The diagnostic device contract manufacturing market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, product expansion, and regional expansion.

Innovation in contract manufacturing for diagnostic devices stems from the increasing integration of microfluidics, biosensors, and AI-driven testing platforms within IVD solutions. There is also a heightened emphasis on robotics and automated quality control systems, which optimize high-throughput production processes. Miniaturization and the advancement of portable point-of-care diagnostics have become key focus areas for research and development. In addition, smart diagnostics, compatibility with digital health platforms, and sustainable manufacturing practices are attracting more attention in the market. Furthermore, OEMs are increasingly utilizing CMOs' in-house capabilities for prototyping, validation, and design-for-manufacturability to expedite innovation cycles.

Regulatory bodies such as the FDA in the U.S. and the IVDR in the EU, along with other emerging markets, present significant challenges for contract manufacturers of diagnostic devices. The implementation of the EU's IVDR has extended product approval timelines and increased compliance costs, which in turn affect the return on investment for projects. Besides, countries like India and Brazil provide streamlined pathways that facilitate faster market entry. In addition, stringent post-market surveillance requirements and cybersecurity standards have heightened the demand for CMOs with robust regulatory affairs teams, shifting the competitive edge toward partners who can deliver comprehensive compliance documentation and testing traceability throughout the process.

The diagnostic device contract manufacturing industry is witnessing a moderate-to-high level of merger and acquisition (M&A) activity, propelled by established players aiming for vertical integration and enhanced capabilities in digital diagnostics and specialty in vitro diagnostics (IVDs). Significant innovations are also occurring through the acquisition of design firms and niche CMOs that specialize in advanced biosensor or molecular diagnostic technologies, primarily in regions such as North America, Western Europe, and East Asia.

Established CMOs are broadening their scope to provide comprehensive end-to-end services, which include assay development, packaging, sterile fill/finish, and aftermarket logistics. There is a growing trend among companies to invest in digital services, such as device-cloud integration, data security validation, and compatibility with remote diagnostics. This strategic expansion meets the needs of OEMs who seek to shorten their time-to-market and streamline their vendor ecosystems by partnering with fewer, but more capable, service providers.

Contract manufacturers are increasingly expanding their operations in the Asia-Pacific region, particularly in countries such as India, Malaysia, and Singapore, owing to cost advantages and favorable local policies. In Latin America, Brazil stands out as the key hub due to its substantial demand for diagnostic products. In addition, Eastern European countries like Poland and Hungary are becoming attractive for nearshoring production to the European Union. Meanwhile, markets in the Middle East, including the UAE and Saudi Arabia, are being approached for specialty diagnostic devices through joint ventures with local healthcare organizations and sovereign investment funds.

Product Insights

Based on product, the market is segmented into in vitro diagnostic devices, diagnostic imaging devices, and others. In vitro diagnostic devices are further segmented into IVD consumables and IVD equipment. In 2024, the in vitro diagnostic devices segment dominated the market, accounting for a revenue share of 73.66%. The rising demand for early disease detection, personalized medicine, and decentralized healthcare solutions primarily fuels the growth of this segment. The increasing adoption of point-of-care (PoC) testing further accelerates this growth by enabling faster diagnostics in unconventional settings such as homes, clinics, and remote areas. Besides, the integration of automation and artificial intelligence is transforming accuracy and reducing turnaround times for diagnostic devices. Furthermore, multiplex testing platforms are becoming more popular, allowing for the detection of multiple biomarkers. In addition, the innovations in microfluidics and lab-on-a-chip technologies are advancing miniaturization and portability, which aligns with the shift toward patient-centered healthcare models. These factors are expected to significantly contribute to market growth during the projected period.

The diagnostic imaging devices segment is expected to grow significantly during the forecast period. The growth is driven by technological advancements, improved healthcare access, and an increase in chronic illnesses. Besides, trends such as Artificial Intelligence (AI) and Machine Learning (ML) in imaging technologies enhance diagnostic precision, speed, and workflow efficiency. AI algorithms are being utilized for the early identification of conditions such as cancer, cardiovascular diseases, and neurological disorders, leading to better patient outcomes. Another significant trend is the push toward portable and point-of-care imaging solutions, which enable rapid, high-quality diagnostics in remote or underserved locations. Innovations like 3D imaging and Augmented Reality (AR) are transforming fields such as orthopedics and surgery by providing more detailed and interactive representations of patient anatomy. Furthermore, there is a growing preference for minimally invasive imaging techniques, like MRI and CT scans, which enhance patient comfort and decrease recovery times. The rising adoption of cloud-based platforms for storing and sharing imaging data is also optimizing workflows and facilitating collaborative diagnostics. These advancements are redefining the future of diagnostic imaging, making it more efficient, accessible, and centered around patient needs on a global scale.

Service Insights

Based on service, the market is segmented into device development and manufacturing services, quality management services, packaging and assembly services, and others. In 2024, the device development and manufacturing services segment dominated the market, driven by technological advancements, increased healthcare accessibility, and a rise in chronic diseases. In addition, some other factors contributing to segment growth are the growing adoption of AI and ML into imaging devices, which enhance diagnostic accuracy, speed, and workflow efficiency. Besides, shifting trends towards portable and point-of-care imaging enable rapid, high-quality diagnostics in remote or underserved areas. In addition, technologies such as 3D imaging and AR are transforming fields such as orthopedics and surgery by providing more detailed and interactive views of patient anatomy. In addition, there is growing demand for minimally invasive imaging techniques, such as MRI and CT scans, which improve patient comfort and shorten recovery times. These innovations are shaping the future of diagnostic imaging, making it more efficient, accessible, and centered on patient needs on a global scale. These trends are expected to drive market growth over the estimated period.

The quality management services segment is expected to grow at a significant CAGR during the forecast period. Strict regulatory standards and a growing demand for dependable, high-performance devices drive the segment growth. Besides, trends such as the adoption of artificial intelligence & machine learning for automated quality control allow for real-time defect identification and enhance product uniformity, which further contribute to market growth. In addition, rising focus on digital traceability as it ensures compliance with regulations and streamlines audit processes, contributes to market growth. Moreover, manufacturers are embracing risk-based QMS approaches to focus on key factors that influence device safety and effectiveness. Furthermore, ongoing improvement initiatives are being introduced to boost device reliability and performance with the evolving demands of the market.

Application Insights

The infectious disease segment accounted for the largest market share in 2024. Infectious disease diagnostic devices are rapidly evolving, driven by the increase in communicable diseases, enhanced pandemic preparedness, and a growing need for early and accurate detection. These diagnostic devices are essential for quickly identifying pathogens to prevent the spread of disease and facilitate timely treatment. Besides, recent trends in PoC diagnostics, enabling rapid testing in clinics, homes, and remote areas without relying on centralized laboratories, have fueled market growth. In addition, molecular diagnostics have gained increased attention due to their high sensitivity and specificity. Moreover, innovations in biosensors, microfluidics, and wearable diagnostics are improving testing speed and convenience. In addition, AI-powered diagnostic platforms and cloud-connected devices are enhancing technological advancements in devices. The shift towards decentralized testing and scalable solutions is prompting increased investment in portable and multiplex testing platforms. As global health systems strive to enhance resilience, infectious disease diagnostic devices are playing a crucial role in surveillance, screening, and public health management.

The oncology segment is expected to grow at a considerable CAGR during the forecast period. The segment growth is driven by the increasing emphasis on early detection and personalized treatment. Currently, these diagnostic devices are becoming more sophisticated with molecular diagnostics, liquid biopsy, and Next-Generation Sequencing (NGS) to identify cancer at earlier stages with enhanced accuracy & quality. Besides, the trend toward non-invasive and minimally invasive diagnostic techniques is driving advancements in blood-based biomarkers and imaging-enhanced technologies. In addition, AI and ML are widely used to enhance diagnostic accuracy and speed, facilitating better interpretation of complex datasets. The emergence of companion diagnostics, which correlate diagnostic results with targeted therapies, is further contributing to the expansion of precision oncology. As healthcare systems prioritize the reduction of cancer mortality and the improvement of patient outcomes, the demand for fast, reliable, and accessible diagnostic tools continues to grow, which is expected to drive the market growth over the forecast period.

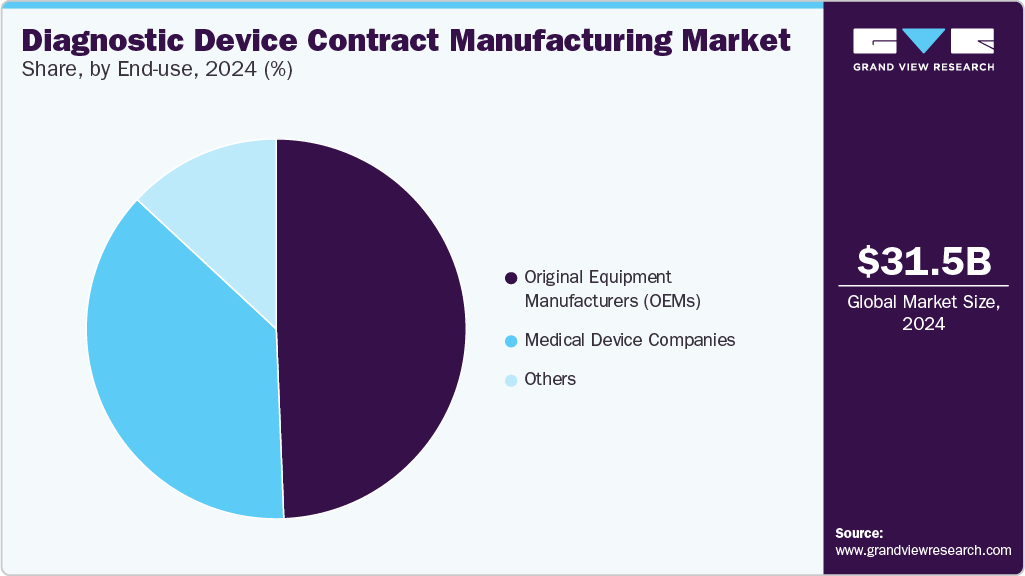

End Use Insights

Based on end use, the market is segmented into original equipment manufacturers (OEMs), medical device companies, and others. The original equipment manufacturers (OEMs) segment accounted for the largest market share in 2024. OEMs are crucial to the growing demand for diagnostic devices, driven by the need to expand product portfolios, accelerate time-to-market, and address evolving clinical needs. Besides, with the growing focus on personalized medicine, remote diagnostics, and real-time monitoring, the OEMs are in search of advanced, scalable, and compliant diagnostic solutions. This has led OEMs to shift towards contract manufacturing partners for rapid prototyping, regulatory expertise, and cost-effective production. The integration of digital health technologies, including connectivity and artificial intelligence, is prompting OEMs to seek more sophisticated diagnostic platforms. This trend emphasizes innovation, quality, and global competitiveness in the diagnostics sector is anticipated to drive segment growth.

The medical device companies segment is expected to grow at a significant CAGR during the forecast period. Medical device companies are increasingly seeking diagnostic devices to broaden their product offerings, enhance integrated care solutions, and address the rising healthcare demands. Besides, as the point-of-care testing, digital health, and chronic disease monitoring continue to expand, these medical device companies are investing in diagnostic technologies that deliver rapid and accurate results. In addition, most of the medical device companies are collaborating with contract manufacturers to ensure scalable production, regulatory compliance, and access to technical expertise. The growing focus on personalized diagnostic devices and preventive healthcare is driving the demand for advanced diagnostics that incorporate artificial intelligence and connectivity features. As healthcare systems emphasize early detection and real-time monitoring, medical device companies are recognizing diagnostics as a key component of healthcare systems. These factors are expected to drive the market over the estimated time.

Regional Insights

North America is expected to grow at a significant CAGR over the forecast period. This growth can be attributed to rising demand for early disease detection, rising personalized diagnostic device options, and the management of chronic conditions. In addition, diagnostic device contract manufacturing plays a critical role in the medical device industry, with growing dependency on point-of-care and at-home diagnostics. Besides, growing aging populations and increased consumer awareness contribute to market growth. In addition, by utilizing contract manufacturing for diagnostic devices, the companies can produce high-quality products without the need to invest in their own manufacturing facilities. This strategy enables medical device firms to concentrate on innovation and expand their market reach while outsourcing the production of diagnostic tools.

Moreover, the increasing focus on molecular and rapid diagnostics has increased the need for OEMs to outsource production, allowing for better scalability and speed. In addition, technological advancements, such as automation, robotics, and intelligent diagnostic solutions, are enhancing manufacturing efficiency. Furthermore, the complexities of regulatory compliance and rising cost pressures are motivating companies to partner with specialized CMOs for innovating diagnostic devices. Such factors are expected to drive the market over the estimated period.

U.S. Diagnostic Device Contract Manufacturing Market Trends

The diagnostic device contract manufacturing industry in the U.S.accounted for the highest share in North America, driven by a surge in demand for early diagnostics, a strong presence of established market players, and an increasing need for affordable diagnostic solutions. These contract manufacturing services provide opportunities to minimize manufacturing sites' cost, thereby reducing waste and enhancing efficiency and quality. According to Syrma Johari MedTech Ltd., approximately 70% of medical decisions regarding treatment are based on diagnostic results, which significantly fuels market expansion. In addition, trends such as the growing integration of digital features in diagnostic devices and the rising need for contract manufacturing are expected to further propel market growth in the upcoming years. Furthermore, automation is transforming the manufacturing landscape, enabling quicker, more cost-effective, and compliant production of diagnostic devices. Such factors are expected to drive the market over the estimated period.

The Canada diagnostic device contract manufacturing market is driven by a robust healthcare system and supportive government initiatives for innovation in diagnostic devices. The increasing prevalence of diseases, an aging population, and an increased focus on early disease detection are driving trends toward the development of new diagnostic devices. This is anticipated to boost outsourcing activities in the region. In addition, the diagnostic devices landscape is fueled by growing requirements for outsourcing companies that cater to the manufacturing and regulatory compliance needs of diagnostic devices manufacturers, thereby increasing outsourcing activity in the region. These factors, combined with Canada's robust healthcare infrastructure and focus on innovation, are driving the country's emergence as a significant player in the global diagnostic device contract manufacturing landscape.

Europe Diagnostic Device Contract Manufacturing Market Trends:

Europe diagnostic device contract manufacturing industry’s growth is driven by the presence of advanced technologies and a robust infrastructure, which enhances healthcare services and patient care. In addition, increased demand for efficient and scalable production methods, such as contract manufacturing for diagnostic device innovations, fuels the market's growth. Besides, the rising prevalence of chronic conditions, including cancer, diabetes, and cardiovascular diseases, is expected to increase the need for diagnostics and treatment options. Furthermore, factors such as growing regulatory requirements, advancements in technology, greater complexity of devices, and the necessity for cost efficiency and quicker approval processes are expected to boost demand for diagnostic device contract manufacturing. Such factors are expected to drive the market over the estimated period.

The diagnostic device contract manufacturing market in Germany held the highest share in 2024. This growth can be attributed to the increasing adoption of advanced diagnostic devices and the advancements in wearable health monitoring technology. In addition, outsourcing benefits the diagnostic device production, including optimized R&D efforts for enhanced productivity, compliance with regulations, cost efficiencies, and easier access to the market, further contributing to market expansion. Furthermore, the rising incidence of chronic illnesses has created a rising demand for rapid and accurate diagnostic testing, which further accelerates market growth.

The UK diagnostic device contract manufacturing market is anticipated to grow significantly over the forecast period. The country's growth is driven by a rising emphasis on product safety and quality, along with the increasing integration of automation and robotics to improve manufacturing precision and efficiency. In addition, strict regulatory frameworks and the growing need for innovative diagnostic devices are anticipated to boost market growth. Furthermore, the rising prevalence of chronic diseases and the shifting trends toward personalized medicine are expected to drive the demand for advanced diagnostic devices, further propelling the market growth.

Asia Pacific Diagnostic Device Contract Manufacturing Market Trends

In 2024, Asia Pacific dominated the diagnostic device contract manufacturing industry with a shareof 41.37%. The region’s growth is driven by factors such as rising demand for cost-effective and scalable production of diagnostic devices. Besides, increased investments in R&D, a strong presence of established medical device companies, and rising healthcare spending are expected to propel the market during the estimated period. In addition, strong government support in countries such as China, India, and South Korea contributes to market growth. Moreover, the evolving landscape of diagnostic devices is likely to boost demand for new medical devices in the region, driven by the rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular conditions that require prompt and accurate diagnostic tests for early detection and treatment. In addition, a large and diverse patient population, coupled with a growing need for affordable healthcare solutions, further enhances market growth. Moreover, an increase in partnerships and strategic alliances is anticipated to drive the growth.

The diagnostic device contract manufacturing market in China is driven by an efficient regulatory framework, increasing domestic demand for diagnostic solutions, and a strong manufacturing infrastructure. Besides, ongoing healthcare innovations and the country’s role as a strategic hub for OEMs, coupled with cost advantages, a skilled workforce, and expanding capabilities in advanced diagnostics, are anticipated to create new growth opportunities for the market. Furthermore, the rising complexities of regulatory requirements and rapid innovations in diagnostic devices are driving contract manufacturing partnerships in the diagnostic devices sector. Moreover, increased focus on product development and advancements in quality control are also expected to contribute significantly to market growth. These factors are expected to support market growth.

The diagnostic device contract manufacturing market in Japan is driven by the growing medical devices industry, rapid technological advancements, and increasing demand for outsourcing services, along with rising healthcare expenditures. Besides, the introduction of new medical devices further amplifies the need for contract manufacturing in the medical device industry, thereby supporting market expansion. In addition, the ongoing innovation in high-tech medical devices, advancements in wearable health monitors, and the growing necessity for rapid and accurate diagnostic tests are expected to propel the market growth over the forecast period. Furthermore, the presence of well-established healthcare infrastructure and a strong focus on medical device innovation are likely to drive the landscape of diagnostic device contract manufacturing in the country.

India diagnostic device contract manufacturing market is driven by increasing demand for advanced medical devices, stringent regulatory standards, and ongoing technological advancements. In addition, the country has emerged as a favored destination for innovations in diagnostic devices due to a diverse patient population, lower labor costs, enhanced healthcare infrastructure, and a significant pool of skilled professionals. Moreover, growing competition among market players and a strong emphasis on diagnostic device innovation are further driving the market growth.

Latin America Diagnostic Device Contract Manufacturing Market Trends

The diagnostic device contract manufacturing industry in Latin America is fueled by the developing medical devices industry. Besides, factors such as increasing life expectancy, growing awareness of home healthcare services, and a rising demand for technologically advanced medical devices for long-term care are contributing to this expansion. Furthermore, the expanding demand for medical devices is anticipated to drive the need for cost-effective diagnostic solutions. These factors are expected to drive market growth over the forecast period.

The Brazil diagnostic device contract manufacturing market is driven by advancements in in-vitro diagnostics, an increasing demand for diagnostic devices, and a supportive regulatory environment. In addition, the growing prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular conditions, has increased the need for diagnostic devices for early detection. Besides, the combination of versatility, specialized expertise, focus on emerging regulations, and commitment to quality product innovations makes the diagnostic device contract manufacturing a unique offering for medical device companies.

Middle East & Africa Diagnostic Device Contract Manufacturing Market Trends

The MEA diagnostic device contract manufacturing industry is expected to experience steady growth in the upcoming years. Countries such as South Africa, Saudi Arabia, the UAE, and Kuwait are increasingly adopting high-tech medical devices and advancing in IVD, which further supports market expansion. In addition, rising demand for rapid & accurate diagnostic tests for early detection is anticipated to drive the market growth. Moreover, the expansion of manufacturing operations in the MEA region, along with the development of strategic partnerships to facilitate local medical device approvals and global market entry, is contributing to this growth. Moreover, the region presents significant opportunities with its untapped market for a growing number of medical device companies to develop innovative diagnostic devices. These factors are anticipated to boost demand for the diagnostic device contract manufacturing.

South Africa Diagnostic Device Contract Manufacturing market is driven by an increase in local manufacturing, the expansion of regulatory frameworks, and a rising demand for diagnostic devices among hospitals and healthcare facilities. In addition, shifting market dynamics and improved accessibility of diagnostic device products in underserved regions are expected to further contribute to market growth.

Key Diagnostic Device Contract Manufacturing Company Insights

The key players operating across the market are adopting inorganic strategic initiatives such as partnerships, mergers, acquisitions, service launches, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in January 2024, the Integer Holdings Corporation mentioned the acquisition of Pulse Technologies. This contract manufacturer specializes in the complex micro-machining of medical device components for USD 140 million. This acquisition will support the company with Integer's strategy to strengthen its capabilities and expand its capacity in the market.

Key Diagnostic Device Contract Manufacturing Companies:

The following are the leading companies in the diagnostic device contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Jabil Inc.

- Flex Ltd.

- Becton Dickinson and Company (BD)

- TE Connectivity Ltd.

- Plexus Corp

- Sekisui Diagnostics LLC

- Sanmina Corporation

- Celestica Inc.

- Nipro Medical Corporation

- Integer Holdings Corporation

- West Pharmaceutical Services Inc.

- Benchmark Electronics Inc.

- Kimball Electronics Inc.

- KMC Systems

- Savyon Diagnostics Ltd.

Recent Developments

-

In April 2025, T&D Diagnostics mentioned its plans to manufacture products in India. The company mentioned the partnership with Genenest to manufacture its FIA product range in India. Under this partnership, Genenest will handle the production of T&D’s Starkwert range of FIA products in India. In addition, the Genenest aims to get contract manufacturing projects from high-cost manufacturing countries in North America and Western Europe to India.

-

In February 2024, Ginkgo Bioworks announced its acquisition of Proof Diagnostics, a company specializing in life sciences tools, diagnostics, & computational discovery. The company is known for developing genome engineering tools for both diagnostic & therapeutic use while developing smart, portable systems for detecting infectious & other diseases.

Diagnostic Device Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.69 billion

Revenue forecast in 2030

USD 55.47 billion

Growth rate

CAGR of 9.84% from 2025 to 2030

Historical year

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Jabil Inc.; Flex Ltd.; Becton Dickinson and Company (BD); TE Connectivity Ltd.; Plexus Corp; Sekisui Diagnostics LLC; Sanmina Corporation; Celestica Inc.; Nipro Medical Corporation; Integer Holdings Corporation; West Pharmaceutical Services Inc.; Benchmark Electronics Inc.; Kimball Electronics Inc.; KMC Systems; Savyon Diagnostics Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diagnostic Device Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global diagnostic device contract manufacturing market report based on product, service, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

In Vitro Diagnostic Devices

-

IVD Consumables

-

IVD Equipment

-

-

Diagnostic Imaging Devices

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Device Development and Manufacturing Services

-

Quality Management Services

-

Packaging and Assembly Services

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Diabetes

-

Oncology

-

Cardiology

-

Orthopedics

-

Neurology

-

Gastroenterology

-

Gynecology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Original Equipment Manufacturers (OEMs)

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global diagnostic device contract manufacturing market size was estimated at USD 31.49 billion in 2024 and is expected to reach USD 34.69 billion in 2025.

b. The global diagnostic device contract manufacturing market is expected to grow at a compound annual growth rate of 9.84% from 2025 to 2030 to reach USD 55.47 billion by 2030.

b. The in vitro diagnostic devices segment dominated the diagnostic device contract manufacturing market, with a share of 73.66% in 2024. The segment's growth is driven by rising demand for early disease detection, personalized medicine, and decentralized healthcare solutions. The increasing adoption of point-of-care (PoC) testing is expected to accelerate the segment growth by enabling faster diagnostics in unconventional settings such as homes, clinics, and remote areas.

b. Some key players operating in the diagnostic device contract manufacturing market include Jabil Inc., Flex Ltd., Becton Dickinson and Company (BD), TE Connectivity Ltd., Plexus Corp, Sekisui Diagnostics LLC, Sanmina Corporation, Celestica Inc., Nipro Medical Corporation, Integer Holdings Corporation, West Pharmaceutical Services Inc., Benchmark Electronics Inc., Kimball Electronics Inc., KMC Systems, and Savyon Diagnostics Ltd. among others

b. Key factors that are driving the market growth include rapid technological advancements, evolving healthcare needs, and strategic shifts in manufacturing models. In addition, the presence of well-established manufacturing hubs of highly reliable, complex, and high-quality medical devices in the region has led to increased demand for diagnostic devices, which is crucial for enhancing healthcare efficiency. Moreover, the rising prevalence of diseases and the need for a range of medical devices are expected to propel the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.