- Home

- »

- Advanced Interior Materials

- »

-

Diamond Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Diamond Market Size, Share & Trends Report]()

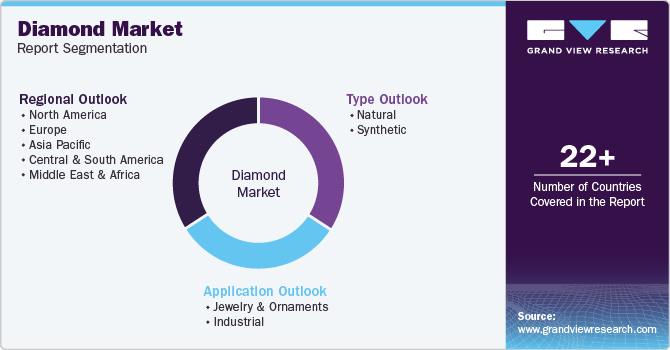

Diamond Market Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Application (Jewelry & Ornaments, Industrial), By Region (NA, EU, APAC, Central & South America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-111-5

- Number of Report Pages: 114

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Diamond Market Size & Trends

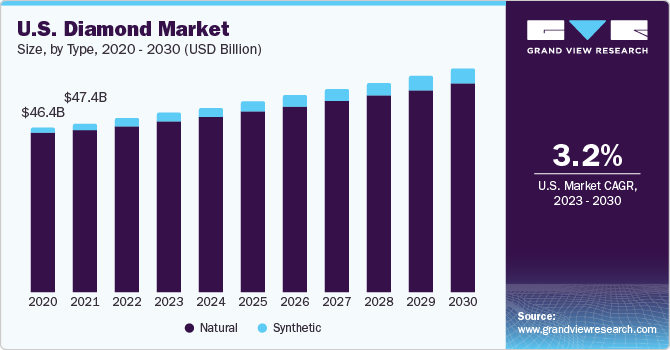

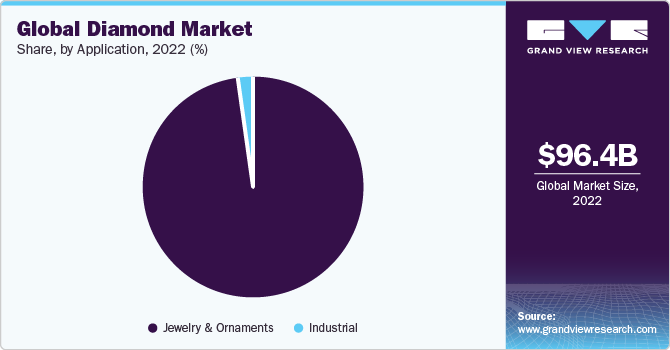

The global diamond market size was valued at USD 96.4 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.2% from 2023 to 2030. The growth of the industry is mainly attributed to the rising demand for jewelry usage, especially in emerging economies such as China and India. The value chain of the industry involves downstream, upstream, and midstream processes. The upstream process involves the exploration, production, and sorting of rough diamonds. The midstream process involves cutting and polishing rough diamonds to produce the finished product. The downstream process involves jewelry designing and setting from the polished diamond and its consequent retail sales.

As of 2022, Asia Pacific emerged as the second-largest market for diamond after North America. The strong demand from millennials in the region mainly contributes to the growth of the diamond jewelry industry. This indicates a large potential for the market to expand further. Considering the growing potential for diamond jewelry in the region, existing industry players are making attempts to further invest and expand their target audience.

China has been a major consumer of mined diamonds over the past several years. However, with growing technological advancements, the country is expected to become a leading supplier of synthetic or lab-grown products. Lab-grown diamonds are similar to mined diamonds in terms of their crystal structure, chemical composition, and physical & optical properties. The only difference is that mined diamond is extracted from the earth, while lab-grown diamond is created in a state-of-the-art laboratory. Synthetic diamonds produced in China are majorly used for industrial applications like abrasives.

The building & construction industry is expected to witness substantial growth over the coming years. According to Oxford Economics, global construction output is forecast to achieve 85% growth to be valued at USD 17.5 trillion by 2030. China, the U.S, and India are the major economies driving the global construction industry. Therefore, the positive outlook of construction activities represent a lucrative opportunity for the growth of the industrial diamonds market.

Fluctuations in diamond prices in recent years have impacted the concerned sector. These fluctuations are caused by socio-economic factors such as consumer perception, rough diamond production, currency fluctuations, and changing consumer buying patterns. Such price volatility negatively affects the profitability of manufacturers. For instance, De Beers Group reported a decline in profit margins in 2018 due to volatile market prices, increased expenditure, and fluctuating exchange rates. With increasing competitiveness, technological advancements, and rising demand for jewelry, companies such as Henan Huanghe Whirlwind and Sino-Crystal, which produce diamonds for industrial applications, have ventured into the jewelry segment.

Application Insights

The jewelry & ornaments segment accounted for the dominant revenue share of 98.0% in 2022. The growing middle-class population, coupled with the increasing spending power of millennials and gen Z, are key factors contributing to the growth of this segment. As per De Beers Group, millennials represent almost 60% of the U.S. jewelry market while millennials in China drive 80% of the total national demand for jewelry. Millennials tend to spend extra on travel experiences rather than luxury items. Thus, manufacturers and retailers are now actively considering the idea of attaching a story in their marketing campaigns that includes the lifecycle of a diamond from the mine to consumers.

The industrial application segment is expected to witness a CAGR of 2.8% over the forecast period. In this segment, lab-grown products or synthetic ones have considerably higher penetration. Industrial diamond is mainly used as an abrasive, hence its demand from sectors such as construction, metal machining, and exploration drilling has been increasing continuously since the past few decades. In construction, it is particularly used in applications such as wire sawing, hand sawing and core drilling.

The rapid expansion of construction activities in developing countries is predicted to benefit the segment’s growth. The building & construction industry is expected to witness substantial growth over the coming years. According to Oxford Economics, the volume of global construction output is predicted to grow by 85% and reach USD 17.5 trillion by 2030. China, the U.S, and India are the major economies driving the construction industry across the globe.

Type Insights

The natural diamonds segment dominated the market with a revenue share of 94.5% in 2022. They are rare and are primarily used for jewelry applications. Finding and processing them includes complex processes, which makes them costly in the jewelry industry. Despite the challenges imposed by cheaper lab-grown jewelry counterparts, the allure of natural diamonds still exists, and is predicted to remain in strong demand over the coming years.

The synthetic diamond segment is expected to advance at the fastest CAGR of 8.0% during the forecast period. These diamonds are produced using High-Pressure, High-Temperature (HPHT), and Chemical Vapor Deposition (CVD) processes. They are mainly used for industrial purposes such as drilling and cutting. In the past few years, the share percentage of synthetic jewelry has increased due to a substantial reduction in its cost of production. The cost of producing a lab grown diamond through CVD technique came down from USD 4,000 in 2008 to USD 300-500 in 2020.

Regional Insights

North America led the diamond market, accounting for the largest revenue share of 51.3% in 2022. Ascending product demand for industrial applications is one of the key factors contributing to the penetration of synthetic diamonds in this region. Under industrial application, the major sectors include machinery manufacturing, construction, and mining services (drilling and exploration for natural gas, oil, and minerals).

Buildings, highways, stone cutting, and repair applications accounted for a majority of the consumption of synthetic diamonds for industrial purposes in 2022. Additionally, precision manufacturing of ceramic parts for the aerospace sector, laser radiation tools, and heat sinks in circuits are projected to contribute to the ascending demand for synthetic diamonds in industrial applications.

On the other hand, the Asia Pacific region is expected to advance at the fastest CAGR of 3.5% during the forecast period. The growing usage of jewelry and ornaments in developing nations such as China and India is fueling the demand for diamonds in the region. This has led market players to increase their investments, considering such promising sales in the future. Industrial diamonds are utilized extensively in the construction industry, where they are used in various types of equipment used to cut concrete surfaces, polish concrete floors, as well as other applications.

The construction industry in India is expected to emerge as one of the fastest-growing industries globally by 2030. This growth can be attributed to the supportive policies undertaken by the government of India to bolster urban infrastructure in order to meet the rapidly growing demand of the urban population for housing. Government initiatives such as Housing for All and Smart City Mission are contributing to the growth of the construction sector in the country.

Key Companies & Market Share Insights

The global market for diamonds is characterized by the presence of several small and medium-scale players operating in a particular country or region, along with a few major companies such as ALROSA, Rio Tinto, and De Beers Group catering to the global market. These companies are also involved in upstream business activities. However, it is difficult to enter the upstream sector owing to the presence of established players. The prices of natural diamonds change continuously owing to supply & demand uncertainty. However, there are zero production constraints associated with lab-grown products. Thus, major manufacturers are focusing on introducing lab-grown diamonds for jewelry purposes.

Key Diamond Companies:

- Petra Diamonds Limited

- Rio Tinto

- Trans Hex Group

- Lucara Diamond

- ALROSA

- De Beers

- Mountain Province Diamonds

- Arctic Canadian Diamond Company

- Gem Diamonds

Recent Developments

-

In July 2023, Burgundy Diamond Mines Limited, a diamond mining firm, completed the acquisition of Arctic Canadian Diamond Company (ACDC). ACDC owns Ekati mine in the Northwest Territories region of Canada. The move is expected to help Burgundy Diamond Mines in its strategy of vertical integration across the diamond value chain

-

In July 2023, De Beers Group entered into an agreement with the Botswana government to increase the number of rough stones provided to the African nation. The plan intends to enhance the capacity of the company’s facility and increase the number of rough stones by 50 percent over the next decade

-

In May 2023, Blackstone Inc., one of the world’s largest alternative assets managing company, announced the acquisition of the diamond grading firm ‘International Gemological Institute’ (IGI) for USD 535 million. The acquisition is a significant milestone concerning Blackstone’s expansion plans in India

-

In September 2022, RSL, a Canadian firm, announced that it had produced the country’s first lab-grown diamond gem at its manufacturing facility in Quebec, which is expected to give the company a headstart in the field of synthetic diamonds in the country

Diamond Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 99.42 billion

Revenue forecast in 2030

USD 123.83 billion

Growth rate

CAGR of 3.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Belgium; Poland; China; Japan; India; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Petra Diamonds Limited; Rio Tinto; Trans Hex Group; Lucara Diamond; ALROSA; De Beers; Mountain Province Diamonds; Arctic Canadian Diamond Company; Gem Diamonds

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diamond Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global diamond market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Jewelry & Ornaments

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Belgium

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global diamond market size was estimated at USD 96.4 billion in 2022 and is expected to reach USD 99.42 billion in 2023.

b. The global diamond market is expected to grow at a compound annual growth rate of 3.2% from 2023 to 2030 to reach USD 123.83 billion by 2030.

b. Jewelry & Ornaments dominated the diamond market with a share of 98% in 2022. This is attributable to growing middle-class population coupled with increasing spending power of millennials and generation Z.

b. Some key players operating in the diamond market include De Beers Group, ALROSA and Rio Tinto.

b. Key factors that are driving the market growth include rising demand from jewelry application especially in emerging economies in Asia Pacific like India and China.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."