- Home

- »

- Advanced Interior Materials

- »

-

Abrasives Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Abrasives Market Size, Share & Trends Report]()

Abrasives Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Coated, Bonded), By Application (Automotive & Transportation, Heavy Machinery, Metal Fabrication, Electrical & Electronics Equipment), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-099-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Abrasives Market Summary

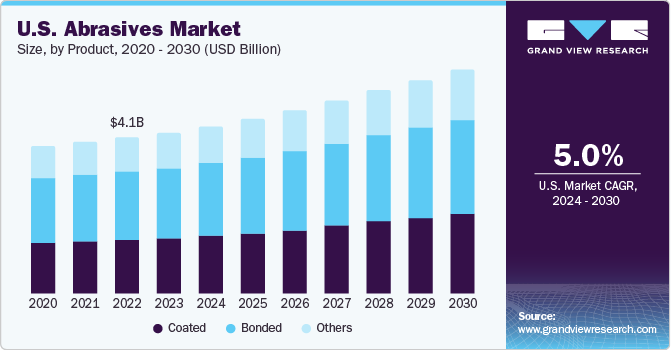

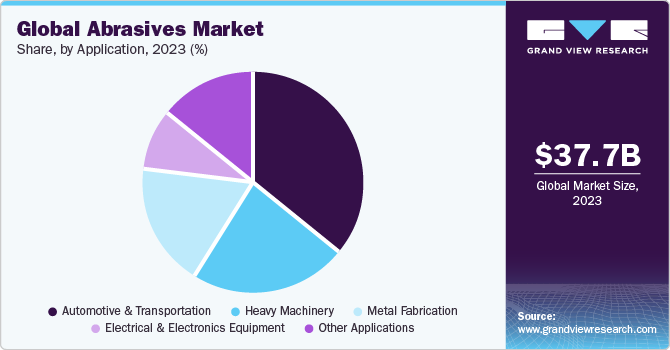

The global abrasives market size was estimated at USD 37.71 billion in 2023 and is projected to reach USD 52.59 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. One of the key growth drivers is the growing metal fabrication industry, due to the increasing demand for pre-engineered buildings & components and developments in manufacturing sector.

Key Market Trends & Insights

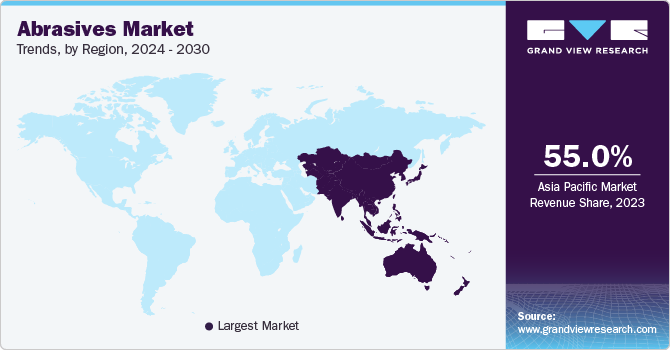

- Asia Pacific dominated the global abrasives market with a revenue share of over 55.0% in 2023.

- The U.S. abrasives market is anticipated to grow at a CAGR of 5.0% during the forecast period.

- By product, the bonded abrasives segment accounted for the largest revenue share of over 43.0% in 2023.

- By application, the automotive & transportation segment accounted for the largest revenue share of over 35.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 37.71 billion

- 2030 Projected Market Size: USD 52.59 billion

- CAGR (2024-2030): 5.0%

- Asia Pacific: Largest market in 2023

Growth of the metal fabrication industry is also driven by the rising demand from various end-use industries, including automotive, aerospace, agriculture, and medical. The market for abrasives is in a constant state of evolution due to technological advancements and a shortage of skilled labors.

The U.S. holds a crucial position in the global market. Despite the lack of significant growth in the manufacturing sector, which is primarily attributed to changing economic priorities affecting tariffs and internal investments, emphasis on domestic production, is expected to yield fruitful results for market growth in the country.

Growth of the electric vehicles (EVs) industry is expected to be another driving factor for abrasives market growth. For instance, in January 2024, VinFast Auto, a Vietnam-based EV manufacturer, announced plans to construct an integrated EV manufacturing facility with an investment of USD 2 billion in Tamil Nadu and India. The demand for EVs and their charging stations are increasing in Asia. This, in return, is anticipated to benefit abrasives consumption over coming years.

Furthermore, the growth of manufacturing sector in the developing Asian economies is boosting demand for super abrasives. For instance, in December 2023, Asian Development Bank (ADB) announced plans to inject USD 250 million into India’s industrial sector in order to develop manufacturing sector, supply chains, and foster regional and global value chains. The loan was a part of financial support as it aligns with Government of India’s National Industrial Corridor Development Program (NICDP) initiative scheme. Such initiatives are contributing to industrial growth in the country, thereby boosting the market growth.

However, the abrasive market’s growth is anticipated to be restricted due to the unstable raw material prices. Mass production of abrasives requires large quantities of raw materials. Prices of bauxite and other source minerals fluctuate considerably, due to factors such as changing transportation costs impacted by energy prices, thereby affecting production cost and pricing of abrasives.

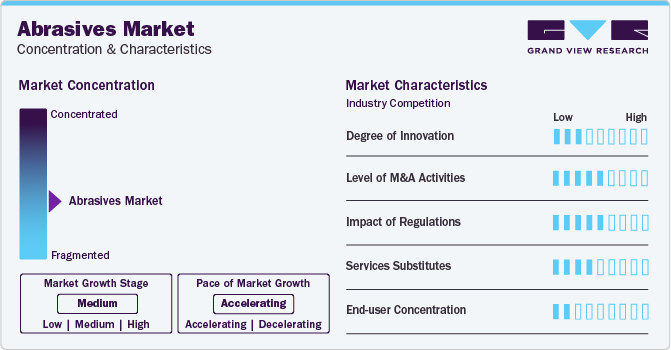

Market Concentration & Characteristics

Market growth stage is medium and pace is accelerating. The market is poised to witness strong growth due to the increasing demand for pre-engineered metal products. Companies are investing in R&D and innovation to introduce abrasives with high-performance, longevity, and sustainability. Innovative environment-friendly and smart abrasives technologies are focusing on evolving customer demands, operational efficiencies, and reducing environmental impact.

A moderate merger and acquisition activity level and expansion of manufacturing facilities by leading industry manufacturers also characterize the market. Strategic initiatives are a part of market consolidation efforts and they help expand product portfolio, global presence, technological advancements, entry into new markets, and achieving economies of scale.

The market is also subject to increasing diverse end-user concentration. Its performance is influenced by trends and economic cycles of various end-user industries such as construction, electronics, automotive, metal fabrication, and medical devices. Companies with a broader customer base can manage market fluctuations in a particular sector.

The market is subject to impact of regulatory frameworks concerning health, environmental, and safety concerns. It is impacted by regulations pertaining to disposal practices, abrasive materials, carbon emissions, and manufacturing processes. Abrasive products face intense competition from alternative technologies and services such as waterjet cutting, laser cutting, and other non-abrasive methods utilized in material processing industries. Therefore, investing in R&D is crucial for the market to sustain and ensure abrasive market services remain competitive compared to other service substitutes.

Product Insights

The bonded abrasives segment accounted for the largest revenue share of over 43.0% in 2023. Bonded abrasives include mounted wheels, snagging wheels, grinding wheels, and others, which are used for precision and rough grinding applications due to their high efficiency and enhanced operational capability.

Coated abrasives are expected to register the fastest CAGR from 2024 to 2030. These abrasives include sheet, belt, disc, roll, and flap-wheel products. Rising demand for this product type has compelled companies to expand their production capacities. For instance, in August 2023, VSM Abrasives, a leading Germany-based coated abrasives player in metal and wood materials, celebrated the expansion of their installed capacity at existing manufacturing facility with a new facility spreading across 50,000 square feet.

Coated abrasive products find application in white goods, sanitary ware, furniture, automobile, fabrication, construction, and auto ancillaries. Developments in stainless steel fabrication and wood working industries are also expected to boost the growth of this segment.

Application Insights

The automotive & transportation segment accounted for the largest revenue share of over 35.0% in 2023. In automotive industry, abrasives are used for various applications such as coarse and lacquer sanding. Additionally, diamond discs are the preferred choice for grinding and polishing automotive components to enhance surface finish.

Heavy machinery is amongst the fastest growing application segments of the market. Abrasives find application in metal cutting, grinding & crushing of mining equipment, and others. Growth of manufacturing sectors in developing economies' is expected to drive the demand for heavy machinery, thereby boosting abrasives consumption.

For instance, in April 2022, Hitachi Heavy Machinery Co., Ltd. announced expansion of its manufacturing facility for compact products such as mini wheel loaders and mini excavators. Production capacity is anticipated to increase by 30% by 2025. There is an increasing demand for equipment and machinery in North America and Europe. Such investments are anticipated to increase supply of machinery & equipment and benefit the market growth in the forthcoming years.

Electrical & electronics equipment is another lucrative segment, where abrasives are used for slicing and grinding electronic components. Various hard materials such as silicon, glass, quartz, and zirconia are used for producing circuit components and compact discs. The growing electrical & electronics manufacturing sector in various developing and developed nations due to the rising demand in global businesses is anticipated to bode well for the abrasive market.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 55.0% in 2023. Infrastructural developments, rising investments in manufacturing sector, and growth in EV production in developing economies, are some of the factors expected to augment this growth. Southeast Asian countries are potential markets for abrasives. For instance, as per the General Statistics Office of Vietnam, industrial production index increased by 5.8% in 2023 compared to 2022. Growth in manufacturing and processing industries were key drivers behind the boost of industrial sector. Developments in manufacturing sector of the country have augmented need for machinery and product demand.

North America is anticipated to witness steady growth from 2024 to 2030, due to increasing demand from automotive, aerospace, and defence industries. The growth declined in 2020 & 2022 due to the COVID-19 pandemic and recessionary fears respectively. However, the rising emphasis on EV production in the region, coupled with the resumption of aircraft manufacturing operations, is anticipated to benefit market growth over the forecast period.

The growth in metal fabrication and machining industries in North America is also expected to provide lucrative growth opportunities to manufacturers. For instance, in November 2023, Klöckner & Co. announced acquisition of a U.S.-based metal fabricator, Industrial Manufacturing Services (IMS). This strategic deal was part of vertical integration and expansion of fabrication portfolio, amid growth of the fabrication businesses. This acquisition further aims to cater to the growing customer demand. Such investments are expected to augment product demand in the region.

Key Abrasives Company Insights

Some of the key players operating in the market include 3M, Saint-Gobain, and Bosch Limited.

-

3M is a leading market player, primarily focusing on diversification of abrasives portfolio and providing a wide range of products to various industries. It emphasizes investment in R&D and more on sustainability, eco-friendly materials, and technologically advanced manufacturing processes that align with growing demand for environmentally conscious solutions.

-

Saint-Gobain is another leading market player competing by adopting a strategic approach to global expansion through mergers & acquisitions to acquire complementary businesses and strengthen product offering portfolio. It invests heavily in R&D, focusing on development of advanced abrasives technologies.

KREBS & RIEDEL and Deerfos are some of the emerging market participants.

-

KREBS & RIEDEL provides specialized abrasives for unique applications and is concentrated in niche markets. It adopts advanced manufacturing processes to stay competitive, thereby enhancing product quality and efficiency. This strategic initiative makes it an emerging player, constantly evolving to meet target market demands.

-

Deerfos resorts to cost-effective abrasive solutions and target price sensitive markets to gain a competitive edge over competitors without hampering quality of product. This approach has helped them provide value driven product offerings and expand business portfolio.

Key Abrasives Companies:

The following are the leading companies in the abrasives market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these abrasives companies are analyzed to map the supply network.

- 3M

- Asahi Diamond Industrial Co., Ltd.

- Bosch Limited

- Deerfos

- CUMI

- Henkel AG & Co, KGaA

- sia Abrasives Industries AG

- Saint-Gobain

- SAK ABRASIVES LIMITED

- TYROLIT Group

Recent Developments

-

In October 2023, Tyrolit Group announced acquisition of Acme Holding Company, a U.S.-based abrasives manufacturer located in Michigan. It is a move to integrate business portfolio of grinding with specialty abrasives solutions. This makes Michigan manufacturing facility company’s seventh facility in U.S. and will proved to be influential in vital industries such as foundry, steel, and rail.

-

In October 2023, Saint-Gobain announced a partnership with Dedeco Abrasive Products, a specialty abrasives manufacturer, where Saint-Gobain would market Dedeco’s sunburst abrasive line. This partnership aligns with company’s comprehensive goal of delivering abrasive solutions.

Abrasives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 39.23 billion

Revenue forecast in 2030

USD 52.59 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; China; Japan; India; Australia; Brazil

Key companies profiled

3M; Asahi Diamond Industrial Co., Ltd; Bosch Limited; Deerfos; CUMI; Henkel AG & Co KGaA; sia Abrasives Industries AG; Saint-Gobain; SAK ABRASIVES LIMITED; TYROLIT Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Abrasives Market Report Segmentation

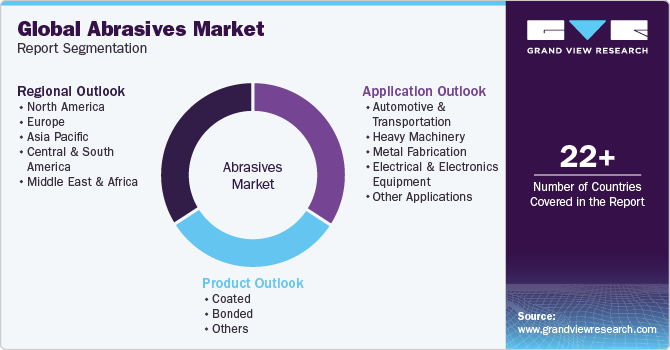

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global abrasives market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Coated

-

Bonded

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Heavy Machinery

-

Metal Fabrication

-

Electrical & Electronics Equipment

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global abrasives market size was estimated at USD 37.71 billion in 2023 and is expected to reach USD 39.23 billion in 2024.

b. The global abrasives market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 52.59 billion by 2030.

b. The automotive & transportation segment dominated the market with a revenue share of over 35.0% in 2023. The segment is witnessing significant growth owing to increasing demand from end-use industries such as automotive and transportation.

b. Some of the key vendors of the global abrasives market are Saint-Gobain, 3M, Bosch Limited, sia Abrasives, SAK ABRASIVES, among others.

b. The key factor that is driving the growth of the global abrasives market is the increasing demand for metal fabrication on account of growth in the manufacturing sector is anticipated to augment market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.