- Home

- »

- Beauty & Personal Care

- »

-

Diaper Rash Cream Market Size, Industry Report, 2030GVR Report cover

![Diaper Rash Cream Market Size, Share & Trends Report]()

Diaper Rash Cream Market (2024 - 2030) Size, Share & Trends Analysis Report By Ingredients (Zinc-Oxide Based, Zinc-Oxide Free), By Nature (Organic, Conventional), By Application (Infants, Adults), By Distribution Channel, By Region And Segment Forecasts

- Report ID: GVR-3-68038-331-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Diaper Rash Cream Market Size & Trends

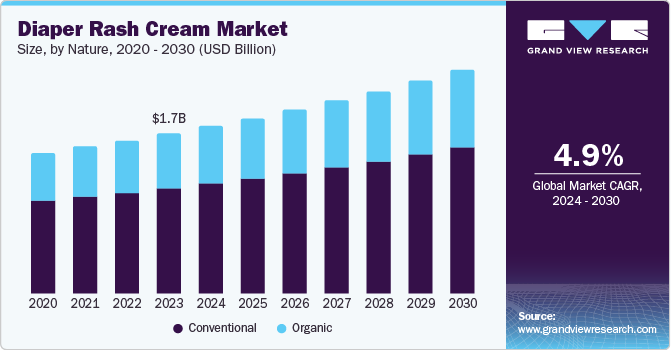

The globaldiaper rash cream market size was valued at USD 1.74 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. Rising awareness regarding infant health is a major factor driving the industry. Furthermore, the increasing prevalence of chronic diseases and bedridden patients fuels the demand for rash cream and opens new avenues for the market. An increasing focus on preventive healthcare is influencing the diaper rash cream market. Parents are becoming more proactive about preventing potential health issues rather than waiting to address them after they arise. This preventive approach drives the use of diaper rash creams as a preventive measure to avoid skin irritations and rashes before they occur.

The rise in birth rates, particularly in developing regions, directly impacts the diaper rash cream market. As the number of newborns increases, so does the demand for baby care products, including diaper rash creams. Higher birth rates lead to increased diaper sales, which drives the need for associated products such as rash creams. In the U.S., the provisional birth rate for women aged 25-29 was 90.0 births per 1,000 women in 2020, which increased to 91.0 births per 1,000 women in 2023. The trend towards organic and natural products is another significant factor fueling the market. Parents are increasingly looking for safer, chemical-free options for their babies, leading companies to innovate and expand their product lines to include organic diaper rash creams.

Growing awareness among parents about the importance of baby health and hygiene has significantly contributed to the demand for diaper rash creams. Parents are more conscious of preventing and treating diaper rash effectively to ensure their baby’s comfort and well-being. This heightened awareness drives the adoption of diaper rash creams that offer soothing relief and prevent skin irritations caused by prolonged exposure to moisture.

Ingredient Insights

The zinc-oxide based segment accounted for the largest revenue share of 70.8% in 2023. Zinc oxide's primary function is to act as a protective barrier between the baby's skin and moisture, which aids in reducing irritation and inflammation. Its anti-inflammatory properties also contribute to its ability to soothe and heal irritated skin. This effectiveness makes it a preferred choice among parents and healthcare professionals for managing diaper rash, driving demand for products containing this ingredient.

The zinc-oxide free segment is expected to witness significant growth over the forecast period. There is a growing consumer demand for natural and hypoallergenic baby care products. Parents are becoming more cautious about the ingredients in products used on their infants, pursuing options free from potentially irritating substances. Zinc oxide-free diaper rash creams cater to this demand by offering alternatives that avoid zinc oxide, which some parents prefer to avoid due to concerns about sensitivity or allergies. This shift towards natural and hypoallergenic formulations drives the growth of zinc oxide-free options in the market.

Nature Insights

The conventional segment accounted for the largest market revenue share in 2023. Conventional diaper rash creams typically offer versatility in their formulations, catering to a wide range of skin types and conditions. Whether for mild irritation or severe rashes, conventional creams include active ingredients such as zinc oxide, petrolatum, and lanolin, which effectively provide protection and healing. This versatility requires a broad consumer base, driving consistent demand. Additionally, Conventional diaper rash creams cater to a wide demographic, including budget-conscious consumers and those who prefer tried-and-tested products. The ability to serve a wide and diverse consumer base drives the demand for conventional creams.

The organic segment is anticipated to register a significant CAGR over the forecast period. Parents today are more informed and concerned about the potential impact of synthetic chemicals on their baby’s delicate skin. This awareness drives them towards products free from harmful chemicals, synthetic fragrances, and artificial preservatives. Organic diaper rash creams, formulated with naturally derived ingredients, are in need among health-conscious consumers, leading to higher demand. This increasing consumer preference for natural and organic products drives the demand for organic diaper rash cream.

Application Insights

The infants segment accounted for the largest market revenue share in 2023. Infants have delicate and sensitive skin that is highly susceptible to irritation and rashes, particularly in the diaper area. The thinness of an infant’s skin, combined with its underdeveloped barrier function, makes it prone to rashes caused by moisture, friction, and exposure to irritants in diapers. This high vulnerability drives the need for specialized diaper rash creams to protect, soothe, and heal infant skin, ensuring it remains healthy and rash-free.

The adult segment is anticipated to register the fastest CAGR over the forecast period. In hospital and long-term care settings, diaper rash creams for adults are common, especially for bedridden patients or those with limited mobility. Due to constant pressure and moisture exposure, these patients are at higher risk of developing pressure ulcers and skin breakdown. Diaper rash creams are a preventive measure to protect the skin and promote healing. The growing need for effective skincare solutions in healthcare environments drives the demand for adult diaper rash creams.

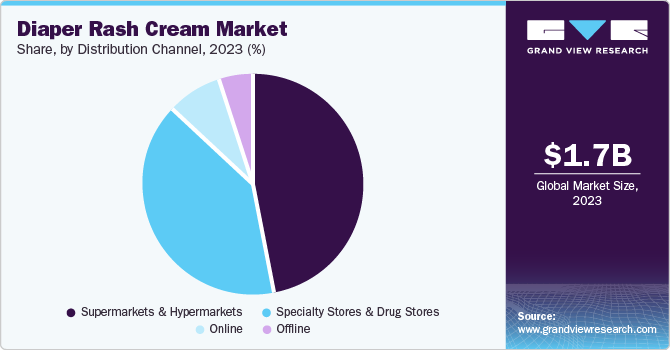

Distribution Channel Insights

The supermarkets & hypermarkets segment accounted for the largest market revenue share in 2023. Supermarkets and hypermarkets are easily accessible to a large population. They are often located in central or suburban areas with abundant parking and extended operating hours. Consumers easily pick up diaper rash creams with regular groceries and household items, reducing the need for additional trips to specialty stores. The convenience of shopping at supermarkets and hypermarkets drives the demand for diaper rash cream.

The online segment is anticipated to grow at the fastest CAGR over the forecast period. Consumers can browse, compare, and purchase products from the comfort of their homes, avoiding the need to visit physical stores. This convenience is particularly suitable for busy parents with limited time for shopping trips. The ability to shop 24/7, access a wide range of products, and have them delivered directly to their doorsteps makes online shopping a demanding option for purchasing diaper rash creams. Additionally, the rise of direct-to-consumer (DTC) brands and subscription services has also contributed to the growth of the online diaper rash cream market. DTC brands often sell exclusively online, avoiding retail channels to offer high-quality products at competitive prices.

Regional Insights & Trends

North America diaper rash cream market is expected to witness significant growth over the forecast period. There is a growing emphasis on infant health and hygiene among parents due to increased access to information and education. Parents are more informed about the importance of preventing and treating diaper rash to ensure their baby's comfort and health. Educational campaigns by healthcare providers and pediatric associations highlight proper diapering techniques and protective creams, leading to greater adoption of diaper rash creams as a part of regular infant care routines. This increased awareness drives market growth by encouraging consistent and preventive use of these products.

U.S. Diaper Rash Cream Market Trends

The U.S. diaper rash cream market is expected to witness significant growth over the forecast period. In the U.S., healthcare professionals, particularly pediatricians, play a critical role in influencing consumer decisions regarding baby care products. Parents highly trust pediatricians' recommendations for choosing safe and effective diaper rash creams. Many brands collaborate with healthcare providers to gain endorsements or certifications, significantly boosting product credibility and consumer confidence. The strong influence of medical recommendations ensures that high-quality, dermatologist-approved diaper rash creams are in demand.

Europe Diaper Rash Cream Market Trends

The Europe diaper rash cream market accounted for the largest revenue share in 2023. Diaper rash creams are widely available across various distribution channels in Europe, including supermarkets, hypermarkets, drugstores, specialty baby stores, and online platforms. The extensive retail network ensures easy accessibility for consumers, enhancing convenience and encouraging regular purchases. The growth of e-commerce has further expanded availability, allowing consumers to order products online with home delivery options. Promotional activities, discounts, and combo offers across these channels drive sales by making products more affordable.

The UK diaper rash cream market is expected to witness significant growth over the forecast period. The demand for organic and natural products is particularly strong in the UK, where health-conscious consumers are increasingly concerned about the ingredients in the products they use on their children. Parents prefer diaper rash creams with natural, non-toxic ingredients free from harsh chemicals, parabens, and artificial fragrances. This trend towards clean and green products has led to the growth of organic and natural diaper rash creams.

Asia Pacific Diaper Rash Cream Market Trends

Asia Pacific is expected to witness the fastest CAGR over the forecast period. Diaper rash creams are widely available across various regional retail channels, including supermarkets, drugstores, mass merchandisers, specialty baby stores, and online platforms. The extensive retail network ensures that these products are easily accessible to consumers in urban or rural areas. Additionally, the rapid expansion of e-commerce platforms such as Amazon, Lazada, Alibaba, and others has significantly contributed to the growth of the diaper rash cream market. The convenience of online shopping, combined with the ability to compare prices, read reviews, and receive home deliveries, drives the market demand.

China diaper rash cream market is expected to witness significant growth over the forecast period. The increasing elderly population in China has led to a rise in adult diaper use, subsequently driving demand for diaper rash creams suitable for adults. Age-related health issues, such as incontinence, require protective skin care products to prevent rashes and maintain skin integrity. The growth in long-term care facilities and home care services also contributes to this demand, as caretakers seek effective solutions to manage and prevent skin issues associated with long diaper use. This expanding demographic leads to market growth and product development customized to adult needs.

Key Diaper Rash Cream Company Insights

Key players in diaper rash cream market include Himalaya Wellness Company., Johnson & Johnson Services, Inc., Bayer AG, Tubby Todd Bath Co. and others.

-

Tubby Todd Bath Co. specializes in natural and gentle bath and skincare products for babies, children, and adults. The company offers a range of items, including body washes, shampoos, lotions, and diaper rash creams.

Key Diaper Rash Cream Companies:

The following are the leading companies in the diaper rash cream market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Unilever

- Tubby Todd Bath Co.

- Himalaya Wellness Company.

- Beiersdorf Inc.

- Sebapharma

- Babo Botanicals

- Johnson & Johnson Services, Inc.

- The Honest Company, Inc.

- Summers Laboratories, Inc.

Recent Developments

-

In May 2022, BabyChakra launched 14 new organic, phenoxyethanol, and artificial fragrance-free products to enhance kids' health and hygiene. The product line includes natural strengthening baby shampoo, moisturizing baby body wash, bamboo water-based wipes, organic coconut oil, natural diaper rash cream, and others.

-

In March 2022, Being Mama launched its new line of baby products, including baby lotion, face cream, baby wash, baby powder, diaper rash cream, baby soap, and others. All the active ingredients used in the products are natural, and their range of products is highly recommended for moisturizing, nourishing, and supplying your baby's delicate skin.

Diaper Rash CreamMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.83 billion

Revenue forecast in 2030

USD 2.44 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, nature, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, Australia, South Korea, Brazil, South Arabia

Key companies profiled

Bayer AG, Unilever, Tubby Todd Bath Co., Himalaya Wellness Company., Beiersdorf Inc., Sebapharma, Babo Botanicals, Johnson & Johnson Services, Inc., The Honest Company, Inc., Summers Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diaper Rash Cream Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the diaper rash creammarket report based on ingredients, nature, application, distribution channel and region.

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Zinc-Oxide based

-

Zinc-Oxide free

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infant

-

Adult

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores & Drug Stores

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.