- Home

- »

- Organic Chemicals

- »

-

Formaldehyde Market Size, Share & Growth Report, 2030GVR Report cover

![Formaldehyde Market Size, Share & Trends Report]()

Formaldehyde Market (2023 - 2030) Size, Share & Trends Analysis Report By Derivatives (Urea Formaldehyde, Melamine Formaldehyde), By End-use (Building & Construction, Furniture, Automotive), By Region, And Segment Forecasts

- Report ID: 978-1-68038-204-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Formaldehyde Market Summary

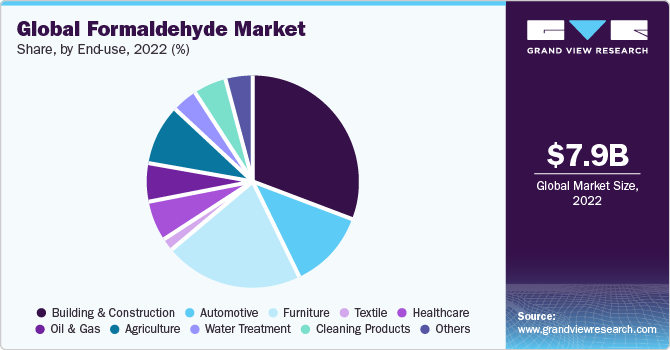

The global formaldehyde market size was valued at USD 7.92 billion in 2022 and is projected to reach USD 12.3 billion by 2030, growing at a CAGR of 5.7% from 2023 to 2030. The growing inclusion of formaldehyde in several end-use industries, such as building & construction, automotive, furniture, textile, healthcare, oil & gas, agriculture, water treatment, and cleaning products, is estimated to trigger market growth in the near future.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 54.0% in 2022.

- By end use, The building and construction segment accounted for the largest revenue share of around 30.0% in 2022.

- By derivatives, The Urea Formaldehyde (UF) segment accounted for the largest revenue share of 38.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 7.92 Billion

- 2030 Projected Market Size: USD 12.3 Billion

- CAGR (2023-2030): 5.7%

- Asia Pacific: Largest market in 2022

- Middle East & Africa: Fastest growing market

Formaldehyde is increasingly being used to manufacture disinfectants, vaccines, and personal care products, including mouthwash and toothpaste, on account of its exceptional antibacterial attributes. Thus, an increasing demand for these products is likely to boost the market growth for formaldehyde over the forecast period.

The production and consumption of formaldehyde are highly influenced by its demand from end-use industries. Thus, any fluctuations in product demand are anticipated to directly impact market expansion. During the COVID-19 pandemic, major end-use industries such as automotive, construction, and wood were shut down at the global level, which severely impacted the growth of the market. However, it was also extensively used to produce hard-gel capsules, vaccines, and antibiotics in the pharmaceutical sector, which had a positive effect on product demand.

Formaldehyde is made up of oxygen, hydrogen, and carbon. It is widely known for its antibacterial and preservative properties. It offers excellent performance and acts as a bonding agent in several end-use applications, while being very affordable. The U.S. is one of the highest consumers of formaldehyde in the construction sector, as the product offers lucrative revenue-generating opportunities to its manufacturers. The production of adhesives and glues for construction applications by utilizing formaldehyde is also rising across the globe, especially in the U.S.

Formaldehyde comes in several different forms such as molecular formaldehyde, trioxane, paraformaldehyde, and methanediol. The number of hydrogen compounds in each variant of formaldehyde differentiates them. These compounds are mainly used in industrial applications. The demand for the product is rising in the Asia Pacific region, owing to its increasing demand in the automotive and construction industries.

However, the high toxicity exhibited by formaldehyde is a major factor restricting market growth. Due to its hazardous nature, its application has become limited in the personal care and cosmetics sector. To spread awareness regarding this issue, companies are educating their customers about the needs and advantages of using the product as per regulatory standards.

End-use Insights

The building and construction segment accounted for the largest revenue share of around 30.0% in 2022. This is attributed to the growing utilization of formaldehyde in numerous construction materials, which helps improve the tensile strength and toughness of building materials. The demand for the product is increasing in the U.S. owing to the presence of several multinational players in the construction industry and rising residential development in major states such as Arizona, Florida, Georgia, Nevada, Texas, and Washington.

The furniture segment is projected to exhibit a significant CAGR in the forecast period. Formaldehyde is used to make different types of furniture items, such as bed frames, couches, desks, and stools. The product is, however, regulated by the Environmental Protection Agency (EPA) owing to its toxicity. These regulations decrease the emissions from products that are made with composite wood, to reduce customer exposure to formaldehyde. They apply to products produced from composite wood, such as veneers, medium-density fiberboards, hardwood plywood, and particleboards, among others.

In the agriculture sector, formaldehyde is used as a soil disinfectant, nitrogen fertilizer, seed dressing, and in the preservation of grain. It is used in fertilizers to enhance the quality of soil, protect plants from diseases, and help them grow faster. Furthermore, it helps eliminate bacteria and ensures that poultry is safe from diseases. Thus, the above-mentioned factors are likely to fuel the demand for the product in the agriculture and poultry sectors in the coming years.

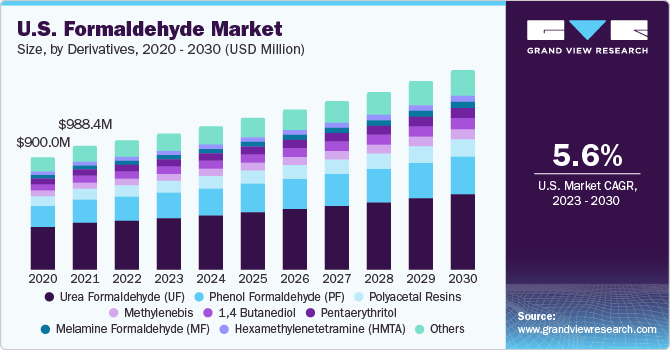

Derivatives Insights

The Urea Formaldehyde (UF) segment accounted for the largest revenue share of 38.3% in 2022. This is attributed to the growing use of the product in several end-use applications, including textiles, foundry sand, paper, electrical appliances, agriculture, and wood glue. The product is in demand due to its high tensile strength, flexural modulus, low water absorption, elongation at break, high heat distortion temperature, high surface hardness, mold shrinkage, and volume resistance.

Moreover, UF is used to treat textile fabrics by enhancing their wrinkle and shrink resistance. It is also used in the agriculture industry as the main source of nitrogen fertilizers. In construction activities, UF is widely used as an adhesive and insulating agent, which is likely to fuel the growth of the UF segment in the formaldehyde market over the forecast period.

The Phenol Formaldehyde (PF) segment is expected to expand at the fastest CAGR of 6.1% during the forecast period. The melamine formaldehyde (MF) segment is also poised to expand at a significant CAGR, owing to its rising demand globally due to properties such as moisture resistance, thermal stability, scratch resistance, flame retardancy, strength, and hardness. Characteristics such as gloss, hardness, and ability to retain a dust-free surface make MF a better substitute than UF for plastic food containers and plastic plates. These factors are likely to boost product demand over the forecast period.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 54.0% in 2022. The dominant share can be attributed to the rapid growth of the adhesives, automobile, furniture, and electrical and electronics manufacturing sectors in the region. The product is in demand on account of its low price, high reactivity, and high-quality performance. In addition, the significantly growing construction and automotive industries in Asia Pacific economies, especially in China and India, are likely to trigger strong demand for the product.

Europe was the second-largest market for formaldehyde in 2022. Increasing demand for formaldehyde from the furniture industry in countries, including Russia, Italy, and Germany, is expected to boost regional market growth over the forecast period. Germany is a leading consumer of formaldehyde in Europe on account of the increasing product demand in fiberglass mats in building and construction applications.

The Middle East & Africa region is expected to advance at the fastest CAGR of 9.7% during the forecast period. Central and South America (CSA) is also expected to witness high demand for formaldehyde from different end-use applications, such as cosmetics, healthcare, photography, paint, and food. The product is used as a preservative in cosmetics. The Brazilian Health Regulatory Agency (ANVISA) allows its usage in oral hygiene products at 0.1% concentration and 5% concentration in nail products as a hardening agent.

Key Companies & Market Share Insights

Companies are planning to accomplish digitization in the industrial and operational aspects of business, such as industrial automation and remote work enablement, to reduce operational costs and the need for additional workforce. Manufacturers are focusing on increasing their production capacities to meet market demands, thereby offering lucrative opportunities for the growth of the market.

A majority of these companies have integrated their business operations across the value chain to incur maximum profit at the lowest investment. The market for formaldehyde is characterized by the presence of a large number of multinationals and regional players that are engaged in constant research & development activities to formulate advanced products.

Key Formaldehyde Companies:

- Foremark Performance Chemicals

- Hexion

- Georgia-Pacific Chemicals

- Celanese Corporation

- BASF SE

- Capital Resin Corporation

- Evonik Industries AG

- DuPont

- Alfa Aesar

- Ashland

- Perstorp

- LRBG Chemicals Inc.

Recent Developments

-

In July 2022, Hexion Inc. announced that it had started employing bio-based methanol in formaldehyde production at its manufacturing facility in Baytown, Texas, to provide a more sustainable product

-

In May 2023, Foremark Performance Chemicals announced the completion of its acquisition of NexGen Chemical Technologies. The acquisition would allow Foremark to enable safe and sustainable natural gas production, thereby helping in the transition to clean energy

-

In May 2022, Bakelite Synthetics announced the acquisition of Georgia-Pacific Chemicals. Georgia-Pacific Chemicals contributes complementary resin and formaldehyde technologies, as well as end-use markets in building materials, industrial, transportation, chemical intermediates, and specialty resins

-

In December 2022, Johnson Matthey plc announced the expansion of the company’s manufacturing site in Perstorp, Sweden to address the rising demand for formaldehyde. The expansion is expected to increase the site’s capacity by around 50%

Formaldehyde Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.3 billion

Revenue forecast in 2030

USD 12.3 billion

Growth Rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Derivatives, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America (CSA); MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Belgium; Russia; China; Japan; India; South Korea; South East Asia; Argentina; Brazil; Saudi Arabia; South Africa

Key companies profiled

Foremark Performance Chemicals; Hexion; Georgia-Pacific Chemicals; Celanese Corporation; BASF SE; Capital Resin Corporation; Evonik Industries AG; DuPont; Alfa Aesar; Ashland; Perstorp; LRBG Chemicals Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Formaldehyde Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global formaldehyde market report based on derivatives, end-use, and region:

-

Derivatives Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Urea Formaldehyde (UF)

-

Phenol Formaldehyde (PF)

-

Melamine formaldehyde (MF)

-

Polyacetal Resins

-

Pentaerythritol

-

1,4 Butanediol

-

Methylenebis

-

Hexamethylenetetramine (HMTA)

-

Others

-

-

End-use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive

-

Furniture

-

Textile

-

Healthcare

-

Oil & Gas

-

Agriculture

-

Water Treatment

-

Cleaning Products

-

HVAC

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

South East Asia

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global formaldehyde market size was valued at USD 7.92 billion in 2022 and is expected to reach USD 8.3 billion in 2023

b. The global formaldehyde market size is projected to grow at a compound annual growth rate (CAGR) of 5.7% in terms of revenue from 2023 to 2030 to reach USD 12.3 billion by 2030.

b. The building & construction end-use segment dominated the formaldehyde market with a revenue share of over 30.0% in 2022. This is attributed to the growing utilization of formaldehyde in numerous construction materials, which helps improve the tensile strength and toughness of building materials.

b. Some of the prominent players in the formaldehyde market include Foremark Performance Chemicals, Hexion, Georgia-Pacific Chemicals, Celanese Corporation, BASF SE, Capital Resin Corporation, Evonik Industries AG, DuPont, Alfa Aesar, Ashland, Perstorp, and LRBG Chemicals Inc.

b. The growing inclusion of formaldehyde in several end-use industries such as building & construction, automotive, furniture, textile, healthcare, oil & gas, agriculture, water treatment, cleaning products, and others is estimated to trigger market growth in the near future.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.