- Home

- »

- Advanced Interior Materials

- »

-

Die Cutting Machine Market Size, Industry Report, 2033GVR Report cover

![Die Cutting Machine Market Size, Share & Trends Report]()

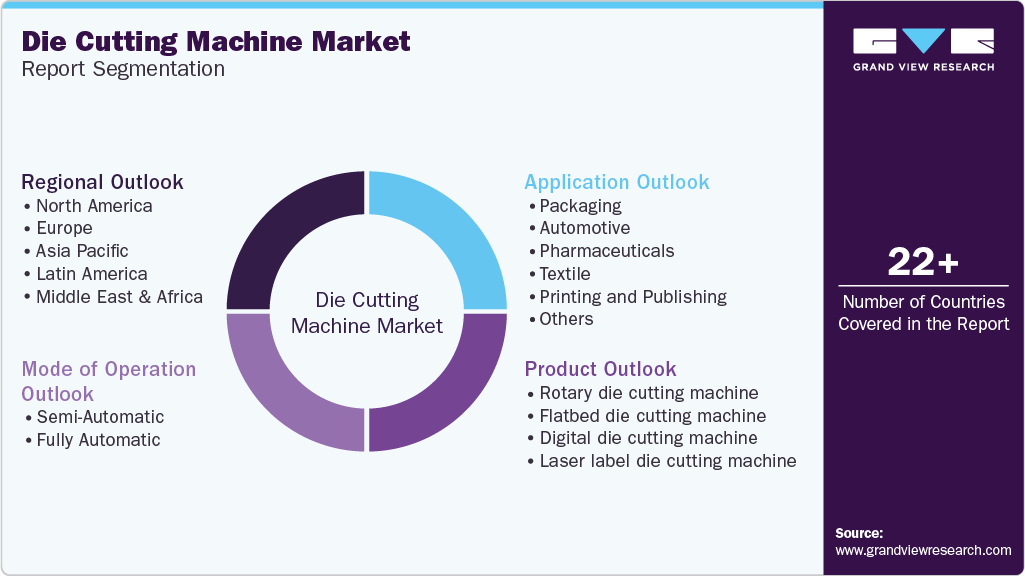

Die Cutting Machine Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Rotary Die-Cutting Machine, Flatbed Die-Cutting Machine, Digital Die-Cutting Machine), By Mode of Operation (Semi-Automatic, Fully Automatic), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-848-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Die Cutting Machine Market Summary

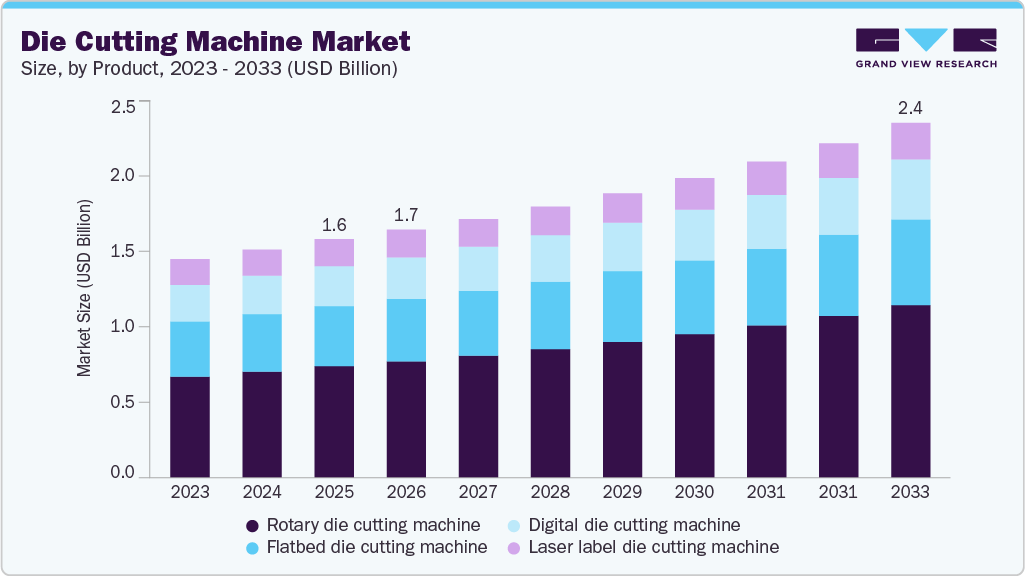

The global die cutting machine market size was estimated at USD 1,611.3 million in 2025 and is projected to reach USD 2,394.4 million by 2033, growing at a CAGR of 5.3% from 2026 to 2033. Rising demand for advanced packaging solutions across e-commerce, food & beverage, and consumer goods sectors is a major factor driving the die cutting machine market.

Key Market Trends & Insights

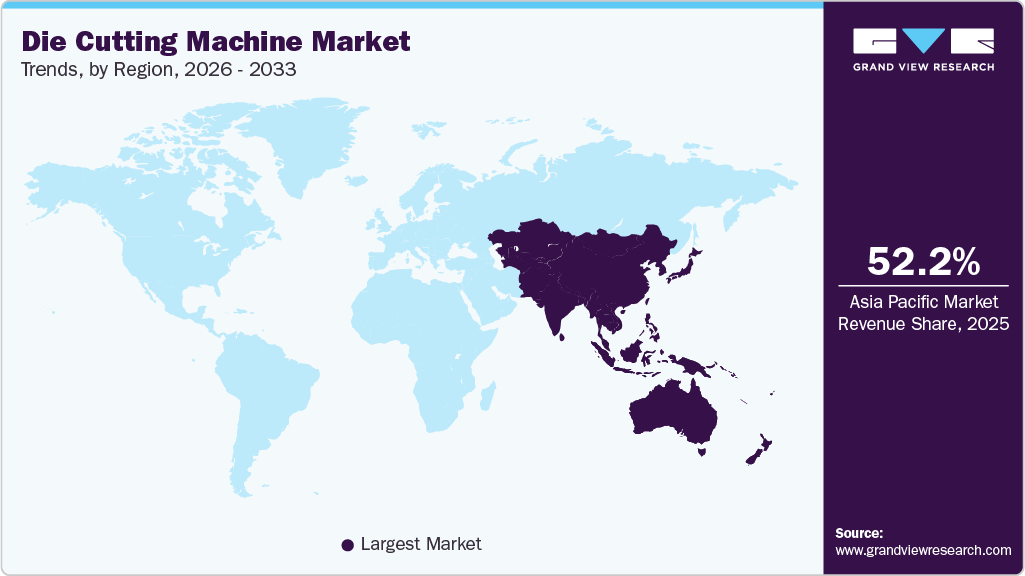

- Asia Pacific dominated the die cutting machine market with the largest revenue share of 52.2% in 2025.

- The die cutting machine market in the India is expected to grow at a substantial CAGR of 7.0% from 2026 to 2033.

- By product, the rotary die cutting machines led the market and accounted for 46.8% share in 2025.

- By mode of operation, fully automatic die cutting machine segment led the market in 2025 and accounted for 58.9% share.

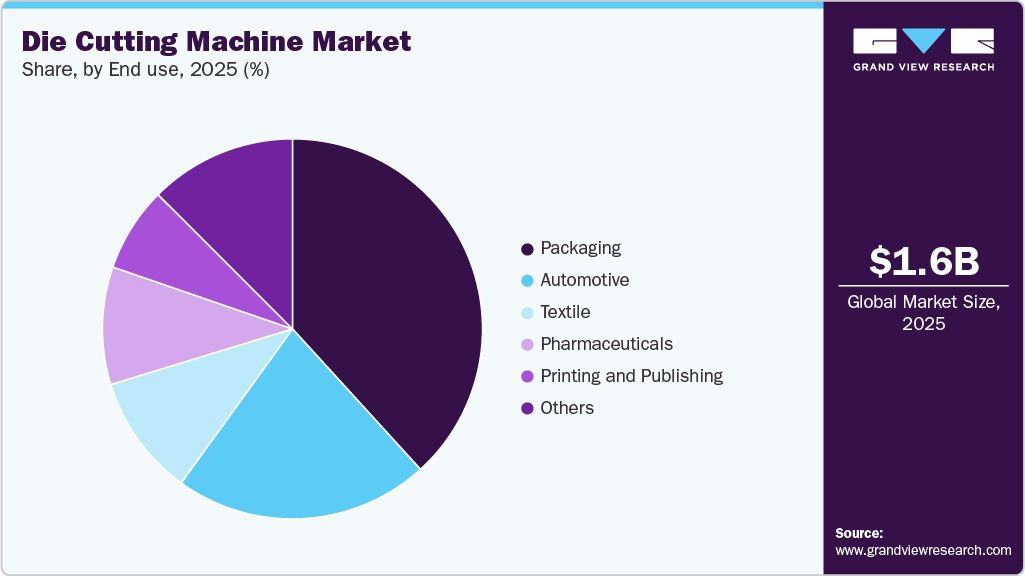

- By end use, pharmaceuticals segment is expected to grow at the fastest CAGR of 6.4% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 1,611.3 Million

- 2033 Projected Market Size: USD 2,394.4 Million

- CAGR (2026-2033): 5.3%

- Asia Pacific: Largest market in 2025

Manufacturers increasingly require high-speed and precise cutting systems to handle diverse packaging materials and customized designs. Growth in short-run production and personalized packaging is encouraging the adoption of digital and laser die cutting technologies.

Automation and Industry 4.0 integration are further accelerating market expansion as companies aim to improve productivity and reduce operational costs. Fully automatic die cutting machines with smart controls, real-time monitoring, and reduced downtime are gaining popularity in large-scale production environments. Increasing demand from automotive, pharmaceutical, and electronics industries for precision-cut components is also supporting growth. Continuous technological advancements, including improved accuracy and faster processing speeds, are enabling manufacturers meet strict quality standards and high-volume requirements.

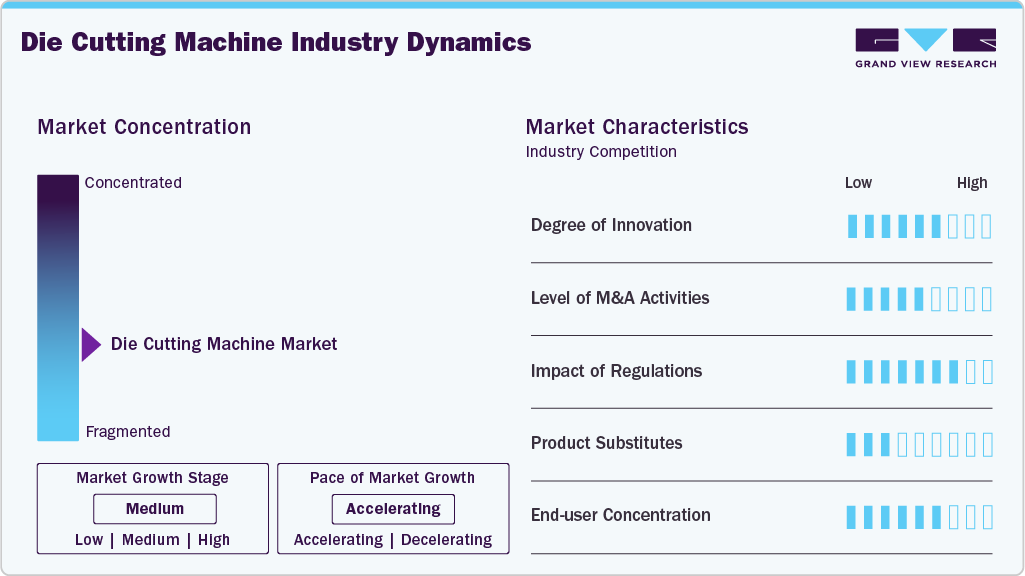

Market Concentration & Characteristics

The die cutting machine market shows a moderately fragmented structure, with several global leaders competing alongside regional manufacturers and specialized technology providers. Large companies dominate high-end automated and industrial-scale equipment, while smaller players focus on niche applications such as digital die cutting and customized converting solutions. Market competition is driven by innovation, pricing strategies, and after-sales service capabilities, creating diverse offerings across different price segments.

The die cutting machine market is characterized by steady technological innovation focused on automation, precision, and digital integration. Manufacturers are introducing smart control systems, faster changeover mechanisms, and laser-based cutting technologies to improve efficiency and flexibility. The shift toward short-run production and mass customization is accelerating the adoption of digital die cutting solutions. Continuous advancements in software connectivity and machine intelligence are improving productivity and reduce material waste.

Regulatory requirements influence machine design, particularly in packaging sectors such as pharmaceuticals, food, and medical products where safety and traceability are critical. Standards related to operator safety, environmental compliance, and energy efficiency encourage manufacturers to develop more secure and sustainable systems. Compliance with international quality certifications also drives the adoption of advanced automation and monitoring features. Regulations around recyclable materials and eco-friendly packaging further shape equipment capabilities and material handling.

Demand for die-cut machines is largely concentrated in packaging and printing industries, supported by growing e-commerce and consumer goods markets. Large packaging converters account for significant equipment investments due to high production volumes and automation needs. Automotive, pharmaceutical, and electronics sectors represent specialized but growing end user segments requiring precision cutting. The presence of both high-volume industrial buyers and small custom producers creates diverse demand patterns across the market.

Drivers, Opportunities & Restraints

Growing demand for innovative packaging solutions across e-commerce, food, and consumer goods industries is a major driver for the die cutting machine market. Manufacturers are investing in high-speed and automated systems to improve production efficiency and reduce labor dependency. Increasing adoption of digital printing is also creating demand for flexible die cutting technologies that support short runs and customization. Rising need for precision cutting in automotive, electronics, and medical packaging further supports market growth.

Expansion of sustainable packaging and recyclable materials is creating opportunities for advanced die cutting systems capable of handling diverse substrates. Integration of smart manufacturing, data analytics, and IoT-enabled monitoring allows companies to optimize operations and minimize downtime. Emerging markets with growing packaging and industrial manufacturing sectors offer significant growth potential for equipment suppliers. Development of laser and digital die cutting solutions is enabling new applications requiring high flexibility and rapid design changes.

High initial investment costs and maintenance expenses can limit adoption, particularly among small and medium-sized converters. Skilled labor requirements and complex machine setup may create operational challenges for some end users. Fluctuations in raw material demand and economic slowdowns can affect capital equipment spending in packaging and printing industries. Competition from alternative cutting technologies and price-sensitive markets may also impact profit margins for manufacturers.

Product Insights

Rotary die cutting machines led the market and accounted for 46.8% share in 2025, due to their high-speed performance and ability to handle continuous production processes efficiently. These systems are widely used in packaging and label manufacturing, where large volumes and consistent quality are essential. Their compatibility with roll-to-roll processing and automated production lines enhances productivity and reduces downtime. Strong demand from e-commerce packaging and FMCG sectors continues to support their leading market position.

Digital die cutting machine segment is anticipated to grow at a significant CAGR over the forecast period, driven by rising demand for short-run production and customized designs. These machines eliminate the need for physical dies, allowing faster setup and greater flexibility for changing production requirements. Growth in digital printing and on-demand manufacturing is encouraging adoption across printing, packaging, and promotional applications. Advancements in software integration and precision cutting technology are further accelerating market expansion.

Mode of Operation Insights

Fully automatic die cutting machine segment led the market in 2025 and accounted for 58.9% share, due to their ability to deliver high productivity, consistent accuracy, and reduced manual intervention. These systems are widely adopted by large-scale packaging and printing manufacturers seeking faster production cycles and lower labor costs. Advanced automation features such as real-time monitoring and automated material handling improve operational efficiency. Increasing demand for high-volume manufacturing and standardized output continues to support their strong market share.

Semi-automatic die cutting machine segment is growing significantly as small and medium-sized businesses seek cost-effective solutions with flexible operation. These machines provide a balance between automation and manual control, making them suitable for customized or lower-volume production. Rising demand for short-run packaging and niche applications is encouraging adoption in regional markets. Lower investment requirements and easier maintenance compared to fully automated systems also contribute to their growing popularity.

End Use Insights

The packaging segment dominated the die cutting machine market and accounted for 38.2% share in 2025, due to rising demand for folding cartons, labels, corrugated boxes, and flexible packaging across e-commerce and consumer goods industries. High production volumes require efficient and precise die cutting solutions to maintain consistency and speed. Growth in branded and customized packaging designs further increases the need for advanced cutting technologies. Continuous expansion of food, beverage, and retail sectors also supports strong equipment demand.

The pharmaceutical segment is witnessing rapid growth driven by increasing demand for precise and compliant packaging solutions such as blister packs and medical labels. Strict regulatory requirements for safety, traceability, and product protection encourage adoption of high-precision die cutting machines. Expansion of global pharmaceutical production and rising healthcare needs are boosting investment in advanced packaging equipment. Automation and accuracy requirements in sterile packaging processes further accelerate growth in this segment.

Regional Insights

North America die cutting machine market is experiencing steady CAGR of 3.8% over the forecast period, driven by advanced manufacturing practices and early adoption of automated and digital die cutting technologies. High demand for innovative packaging, labeling, and short-run customized production supports equipment investments. The presence of established packaging and pharmaceutical industries encourages continuous modernization of machinery. Focus on sustainability and efficiency improvements is further driving market expansion.

U.S. Die Cutting Machine Market Trends

The U.S. dominates the North American die cutting machine market due to its advanced packaging, printing, and manufacturing industries. High demand for automated and high-speed equipment supports adoption across large-scale production facilities. Strong presence of e-commerce, consumer goods, and pharmaceutical sectors drives continuous investment in modern die cutting technologies. Ongoing innovation and integration of digital workflows further strengthen market leadership.

Die-cut machine market in Canada is experiencing steady growth driven by expanding packaging demand and modernization of printing and converting operations. Increasing focus on sustainable packaging and efficient production processes encourages adoption of advanced die cutting solutions. Small and medium-sized manufacturers are investing in flexible and semi-automatic systems to improve productivity. Growth in food packaging and healthcare industries also contributes to rising equipment demand.

Europe Die Cutting Machine Market Trends

Europe die cutting machine market is growing due to strong packaging standards, technological innovation, and strict environmental regulations promoting efficient production systems. Manufacturers are investing in advanced automation and energy-efficient equipment to meet sustainability targets. The region’s well-established printing and packaging sectors create consistent demand for high-precision die cutting solutions. Growth in luxury packaging and specialty printing applications also contributes to market development.

Die-cut machine market in Germany dominates the European die cutting machine market due to its strong industrial base, advanced machinery manufacturing, and well-established packaging sector. High adoption of automation and precision engineering supports demand for technologically advanced die cutting systems. The country’s focus on high-quality production and Industry 4.0 integration drives continuous equipment upgrades. Strong presence of automotive and consumer goods industries further contributes to steady market demand.

Italy die cutting machine market is witnessing notable growth driven by its expanding packaging, labeling, and printing industries. Increasing investment in flexible packaging and luxury carton production is encouraging adoption of modern die cutting machines. Small and medium-sized converters are upgrading equipment to improve efficiency and customization capabilities. Rising export-oriented manufacturing and innovation in design-focused packaging support continued market expansion.

Asia Pacific Die Cutting Machine Market Trends

Asia Pacific led the die cutting machine market and accounted for 52.2% share in 2025, due to strong growth in packaging manufacturing, expanding industrialization, and increasing demand from e-commerce and consumer goods sectors. Countries such as China, Japan, and India have a large base of packaging converters and printing companies investing in automation. Cost-effective manufacturing capabilities and rising export-oriented production further support equipment adoption. Continuous expansion of electronics and automotive industries also drives demand for precision die cutting solutions.

Die-cutting machine market in China dominates the Asia Pacific die cutting machine market due to its large-scale packaging manufacturing sector and strong industrial production capabilities. High demand from e-commerce, consumer goods, and electronics industries drives continuous investment in automated die cutting solutions. The presence of numerous packaging converters and machinery manufacturers supports rapid technology adoption. Government initiatives promoting advanced manufacturing and export growth further strengthen market leadership.

India die cutting machine market is experiencing strong growth driven by expanding packaging demand, rising urban consumption, and rapid growth of the e-commerce sector. Increasing investments in flexible packaging, pharmaceuticals, and FMCG industries are encouraging adoption of modern die cutting machines. Small and medium enterprises are upgrading to automated systems to improve productivity and quality. Government support for domestic manufacturing and industrial development is also supporting market expansion.

Middle East & Africa Die Cutting Machine Market Trends

The Middle East and Africa region is emerging as a growing market due to expanding packaging industries and increasing industrial diversification. Demand for flexible packaging and labeling solutions is rising alongside growth in food processing and pharmaceutical sectors. Investments in manufacturing infrastructure and modernization of printing facilities are supporting equipment adoption. Increasing focus on local production and supply chain development further contributes to market growth.

Die-cutting machine market in South Africa dominates the Middle East & Africa die cutting machine market due to its relatively developed packaging and printing industries. Growing demand for food packaging, labels, and consumer goods supports adoption of modern die cutting technologies. The presence of established manufacturing infrastructure encourages investment in automated and efficient machinery. Increasing focus on local production and regional export opportunities further strengthens market growth.

Latin America Die Cutting Machine Market Trends

Latin America is witnessing gradual growth supported by increasing demand for packaged goods and expansion of local manufacturing industries. Rising investments in food and beverage packaging and retail distribution channels are encouraging adoption of modern die cutting machines. Companies are upgrading equipment to improve production efficiency and reduce waste. Economic development and growing urban populations continue to drive packaging demand across the region.

Die-cutting machine market in Brazil dominates the Latin America die cutting machine market due to its strong packaging and printing industries supported by a large consumer base. Rising demand for packaged food, beverages, and personal care products drives investment in efficient die cutting equipment. Expansion of retail and e-commerce sectors is encouraging manufacturers to adopt advanced production technologies. Continuous modernization of local manufacturing facilities further strengthens Brazil’s leading position in the region.

Key Die Cutting Machine Company Insights

Some of the key players operating in the market include Heidelberger Druckmaschinen AG, BOBST, and Koenig & Bauer AG.

-

Heidelberger Druckmaschinen AG focuses on integrated die cutting and post-press solutions designed to enhance productivity in packaging and commercial printing applications. Its systems emphasize automation, precise cutting accuracy, and seamless workflow integration with digital printing environments. The company develops equipment that supports fast job changeovers and efficient handling of folding cartons and labels. Strong software connectivity enables real-time monitoring and optimized production performance. Continuous innovation in packaging finishing technologies strengthens its position in high-value production segments.

-

BOBST specializes in advanced die cutting technologies for folding cartons, corrugated packaging, and label converting, offering both flatbed and rotary solutions. Its machines are designed for high-speed production, automation, and consistent quality output in demanding industrial environments. The company focuses on digitalization, smart factory integration, and modular machine designs to improve operational flexibility. Strong expertise in packaging production lines allows seamless integration between printing, die cutting, and finishing processes. Continuous development of sustainable and efficient converting technologies supports its leadership in the packaging sector.

Key Die Cutting Machine Companies:

The following key companies have been profiled for this study on the die cutting machine market.

- Heidelberger Druckmaschinen AG

- Komori Corporation

- Duplo International

- Yawa Printing Machinery Co., Ltd.

- Masterwork Machinery Co., Ltd.

- Hunkeler AG

- BOBST

- SANWA Co., Ltd.

- ASAHI MACHINERY Limited

- Delta ModTech

- Winkler+Dünnebier GmbH

- Sysco Machinery Co., Ltd.

- Berhalter AG

- DIMO TECH

- Koenig & Bauer AG

Recent Developments

-

In January 2026, Wanjie India plans to introduce a new flatbed die cutting machine at Pamex 2026 aimed at label and packaging applications. The system is designed for improved speed, flexibility, and efficient handling of short to medium production runs. Advanced features and configurable options support evolving production needs. The launch reflects increasing demand for modern die cutting solutions in India.

-

In April 2025, Koenig & Bauer partnered with Siemens to develop advanced automation and digital solutions for modern machinery production. The collaboration focuses on improving connectivity, flexibility, and operational efficiency. By combining expertise from both companies, the initiative supports smarter manufacturing systems. The partnership aims to enhance performance through integrated digital technologies.

-

In January 2025, BOBST introduced upgrades to its EXPERTCUT 106 PER die-cutter to improve production efficiency and machine performance. The enhancements focus on faster setup, better automation, and reduced material waste during operation. Improved energy efficiency and consistent cutting accuracy support higher productivity levels. These developments help packaging manufacturers streamline workflows and increase output.

Die Cutting Machine Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,673.3 million

Revenue forecast in 2033

USD 2,394.4 million

Growth rate

CAGR of 5.3% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of operation, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Heidelberger Druckmaschinen AG; Komori Corporation; Duplo International; Yawa Printing Machinery Co., Ltd.; Masterwork Machinery Co., Ltd.; Hunkeler AG; BOBST; SANWA Co., Ltd.; ASAHI MACHINERY Limited; Delta ModTech; Winkler+Dünnebier GmbH; Sysco Machinery Co., Ltd.; Berhalter AG; DIMO TECH; Koenig & Bauer AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Die Cutting Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global die cutting machine market report based on product,mode of operation, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Rotary die-cutting machine

-

Flatbed die-cutting machine

-

Digital die-cutting machine

-

Laser label die-cutting machine

-

-

Mode of Operation Outlook (Revenue, USD Million, 2021 - 2033)

-

Semi-Automatic

-

Fully Automatic

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Automotive

-

Pharmaceuticals

-

Textile

-

Printing & Publishing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global die cutting machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.3% from 2026 to 2033 to reach USD 2,394.4 million by 2033.

b. Asia Pacific led the die cutting machine market and accounted for 52.2% share in 2025, due to strong growth in packaging manufacturing, expanding industrialization, and increasing demand from e-commerce and consumer goods sectors. Countries such as China, Japan, and India have a large base of packaging converters and printing companies investing in automation.

b. Some of the key players operating in the global die cutting machine market include Heidelberger Druckmaschinen AG; Komori Corporation; Duplo International; Yawa Printing Machinery Co., Ltd.; Masterwork Machinery Co., Ltd.; Hunkeler AG; BOBST; SANWA Co., Ltd.; ASAHI MACHINERY Limited; Delta ModTech; Winkler+Dünnebier GmbH; Sysco Machinery Co., Ltd.; Berhalter AG; DIMO TECH; Koenig & Bauer AG.

b. The global die-cut machine market is driven by rising demand for advanced packaging solutions, increasing automation in manufacturing, and growth in e-commerce requiring high-speed and precise cutting systems. Expansion of digital printing, customization trends, and demand from automotive and pharmaceutical industries further support market growth

b. The global die cutting machine market size was estimated at USD 1,611.3 million in 2025 and is expected to be USD 1,673.3 million in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.