- Home

- »

- Power Generation & Storage

- »

-

Diesel Generator Market Size, Share, Industry Report, 2033GVR Report cover

![Diesel Generator Market Size, Share & Trends Report]()

Diesel Generator Market (2026 - 2033) Size, Share & Trends Analysis Report By Power Rating (Low Power Generator, Medium Power Generator, High Power Generator), By Application (Industrial, Commercial, Residential), By Region, And Segment Forecasts

- Report ID: 978-1-68038-682-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Diesel Generator Market Summary

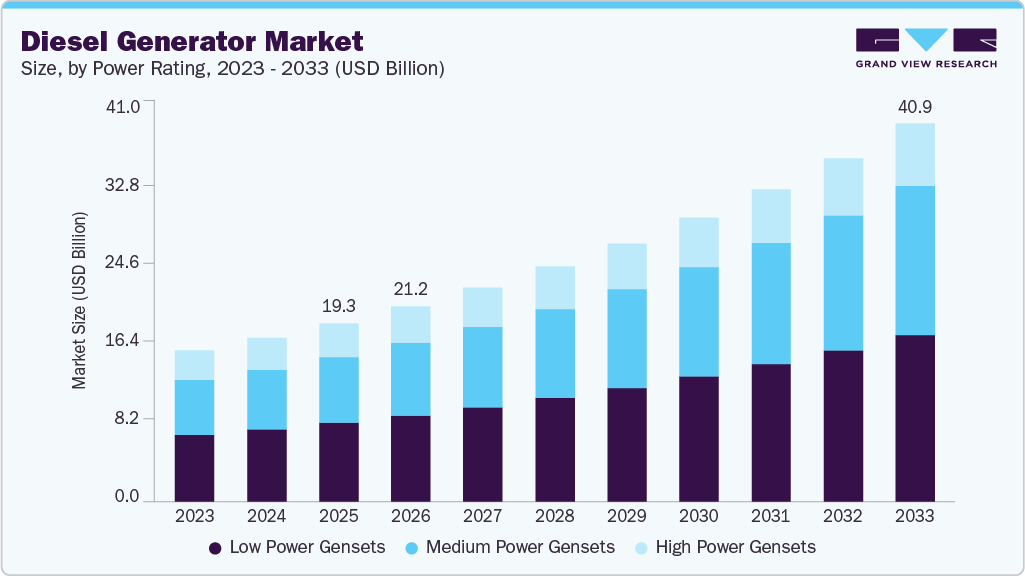

The global diesel generator market size was estimated at USD 19.33 billion in 2025 and is projected to reach USD 40.99 billion by 2033, growing at a CAGR of 9.9% from 2026 to 2033. A diesel generator operates by combusting diesel fuel within an internal combustion engine to produce mechanical energy, which subsequently drives an alternator to generate electricity.

Key Market Trends & Insights

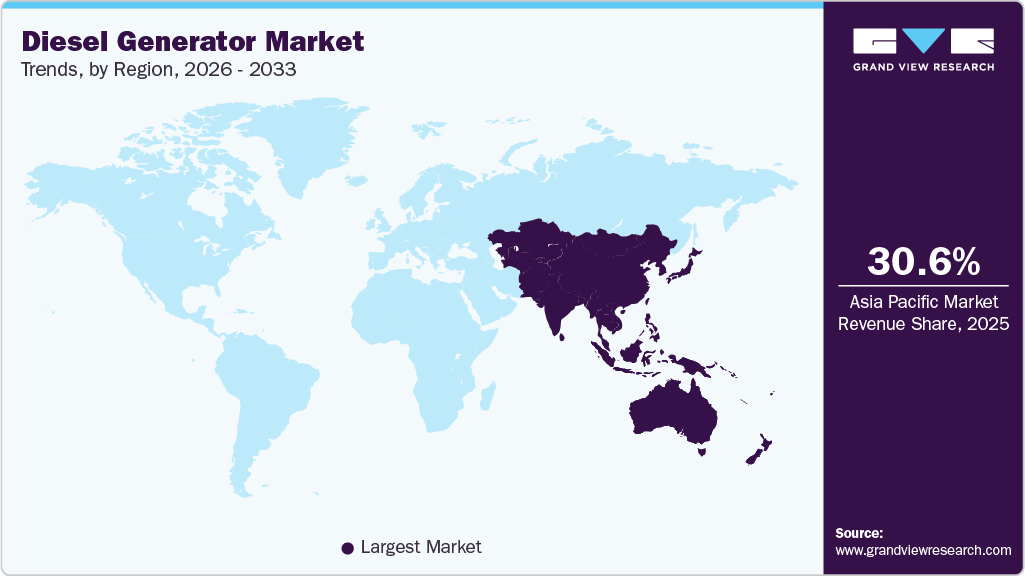

- The Asia Pacific diesel generator market held the largest global revenue share of 30.6% in 2025.

- The U.S. diesel generator industry is expected to grow significantly from 2026 to 2033.

- By power rating, the low power gensets segment held the highest share of 44.1% in 2025.

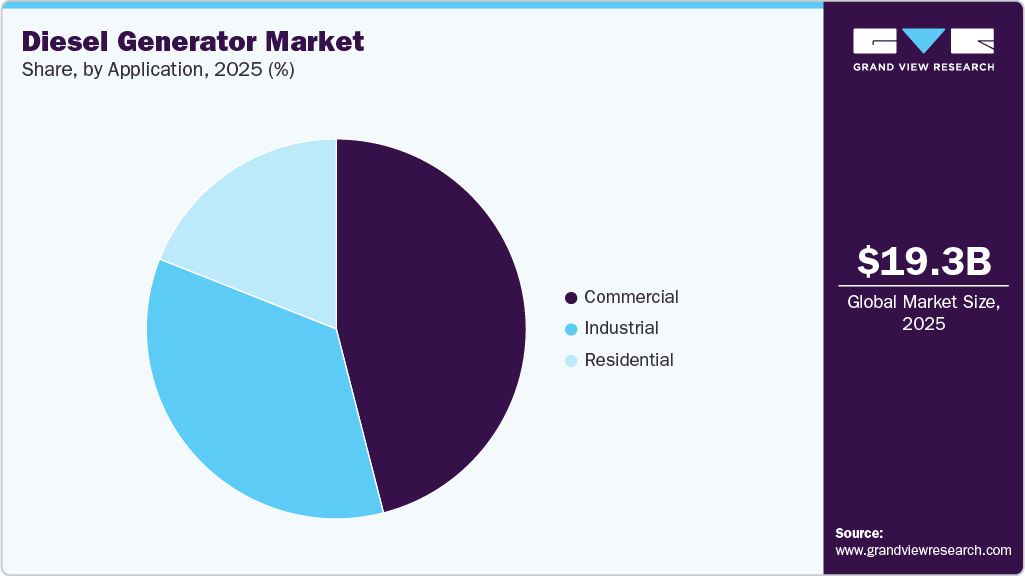

- By Application, the commercial segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 19.33 Billion

- 2033 Projected Market Size: USD 40.99 Billion

- CAGR (2026-2033): 9.9%

- Asia Pacific: Largest Market in 2025

Continued technological progress in power generation systems and increasing adoption of distributed energy solutions are major factors fostering market expansion.The rising demand for reliable backup power, particularly in regions with unstable grid networks, along with growing requirements across the industrial, commercial, and residential sectors, is also strengthening demand in the emergency power diesel generator industry.

Diesel generators remain extensively used for standby, prime, and continuous power applications, where medium- and high-capacity units are preferred due to their durability, operational flexibility, and cost-effectiveness. Their ability to deliver instant power during outages and support critical operations in sectors such as healthcare, manufacturing, data centers, and construction further reinforces market growth. The ongoing expansion of infrastructure projects in countries such as the U.S., Japan, India, and China, along with supportive government investments in industrial development and power reliability improvements, continues to drive the adoption of diesel generators globally.

Drivers, Opportunities & Restraints

The global diesel generator market continues to advance on the back of rising demand for reliable, flexible, and cost-effective power generation solutions across commercial, industrial, and residential sectors. In regions where grid instability persists or renewable integration remains uneven, diesel generators play a crucial role in ensuring an uninterrupted power supply. Their rapid start-up capability, high durability, and ability to operate under varying load conditions make them essential for backup and prime power applications. Continuous improvements in engine efficiency, fuel optimization, and emissions control technologies are further supporting the wider adoption of these technologies across data centers, healthcare facilities, construction sites, and remote industrial operations, thereby reinforcing the market’s importance in both standby and distributed power environments.

Emerging opportunities arise from the development of hybrid power systems that integrate diesel generators with battery storage and renewable energy sources, enabling improved fuel efficiency and reduced emissions. Advancements in digital monitoring, remote diagnostics, and predictive maintenance tools are enhancing performance reliability and reducing lifecycle costs, making diesel generator fleets easier to manage for end users. Growing electrification in developing economies, expansion of telecom infrastructure, and increasing demand for dependable onsite power in mining and oil & gas operations are also creating new avenues for deployment. However, the market continues to face constraints, including tightening emissions regulations, rising environmental concerns, and fluctuating diesel fuel prices. Additionally, the push toward cleaner energy sources and policy uncertainties in some regions present challenges to long-term market expansion.

Power Rating Insights

The low power gensets segment remained the dominant power rating category, accounting for over 44.1% of revenue in 2025, and is expected to retain strong momentum throughout the forecast period. Growing global electricity demand driven by rapid urbanization, residential expansion, and the increasing reliance on backup power solutions across small commercial and telecom operations continues to support the deployment of low-power diesel generators. Their ability to provide reliable, immediate-start power during outages, alongside rising adoption in remote and off-grid environments, further reinforces their market prominence. These units also generate substantial aftermarket requirements, contributing to the continued expansion of the diesel generator service and maintenance market as operators prioritize performance optimization and lifecycle cost reduction.

The medium power gensets segment is projected to register the fastest CAGR of 10.8% over the assessment period. Its balanced output capacity, operational durability, and ability to meet the demands of industrial, healthcare, data center, and infrastructure applications make it suitable for a wide range of critical power environments. The segment’s rising use in construction, mining, and large commercial operations also accelerates demand, supporting related growth opportunities in the diesel generator components market through increasing requirements for advanced control systems, filtration units, and fuel management technologies.

Application Insights

The commercial segment led the diesel generator market, accounting for approximately 46.1% of the total revenue in 2025. Rising electricity demand due to global urbanization, rapid expansion of commercial infrastructure, and growing reliance on uninterrupted power across sectors such as retail, hospitality, healthcare, education, and office complexes continues to support the adoption of diesel generators in commercial settings. Governments and businesses are increasingly prioritizing reliable backup power solutions to ensure operational continuity, a trend also reflected in the Europe market, where grid instability concerns and stringent uptime requirements remain key considerations. Although long-term demand remains positive, some market participants remain cautious due to tightening emissions regulations and uncertainties surrounding future sustainability standards.

The commercial segment is also projected to register the fastest CAGR of 10.5% over the forecast period. The expansion of activity in data centers, logistics hubs, large commercial buildings, and critical service facilities continues to drive the need for dependable backup and prime-power diesel generator solutions. Stricter power reliability requirements are encouraging commercial establishments to invest in high-performance diesel gensets capable of supporting sensitive equipment and essential services during outages. Increasing focus on hybrid power configurations and the operational flexibility offered by small and mid-sized diesel generators further strengthens adoption across a wide range of commercial environments.

Regional Insights

Asia Pacific held over 30.6% of the global diesel generator market revenue in 2025, driven by rapid industrialization, rising emergency power requirements, and widespread adoption of backup power solutions across China, India, and South Korea. The region also recorded the fastest CAGR of 11.9%, supported by strong commercial expansion, data center growth, and increasing demand for reliable power in urban and rural areas with inconsistent grid performance. Regional governments and private enterprises continue to prioritize dependable diesel generator systems to support infrastructure development, manufacturing activities, and the expansion of telecom networks. APAC’s robust engineering capabilities, combined with the presence of major generator manufacturers, further reinforce its critical role in shaping global diesel generator advancements.

North America Diesel Generator Market Trends

Large-scale infrastructure upgrades and increasing demand for reliable backup power across commercial, residential, and industrial sectors are key market growth drivers. The region continues to witness rising investments from data centers, healthcare facilities, telecom operators, and large commercial establishments requiring high-availability power systems. Supportive regulatory frameworks, a growing focus on disaster preparedness, and rising frequency of weather-related grid disturbances are further strengthening market demand. Additionally, ongoing industrial expansion and improvements in generator efficiency and emissions compliance continue to fuel adoption across North America.

U.S. Diesel Generator Market Trends

The U.S. diesel generator industry is experiencing robust growth, driven by increasing concerns over power reliability, expanding data center infrastructure, and rising demand across manufacturing, healthcare, and commercial buildings. Frequent grid disruptions, coupled with the nation’s growing digital economy, are accelerating investments in high-capacity standby and prime-power diesel generator systems. Federal and state-level initiatives to strengthen critical infrastructure resilience, along with strong demand from construction and oil & gas sectors, further support market expansion. The presence of established OEMs and advanced service networks positions the U.S. as one of the most influential markets globally.

Europe Diesel Generator Market Trends

The Europe diesel generator industry is supported by the region’s strong focus on grid resilience, energy security, and uninterrupted power for mission-critical environments. Data centers, hospitals, manufacturing facilities, and commercial buildings across Europe continue to invest in diesel generators to maintain operational continuity during outages or grid instability. The European Union’s sustainability commitments are also encouraging the adoption of lower-emission diesel technologies and hybrid generator systems. In addition, the presence of advanced OEMs and engineering expertise positions Europe as a key hub for technological innovation in diesel generator solutions.

Latin America Diesel Generator Market Trends

The region’s increasing focus on infrastructure development, industrial expansion, and modernization of aging power systems drives the Latin America market’s growth. Countries across the region are investing in reliable and flexible backup power solutions to support economic growth, improve grid stability, and mitigate frequent outages. Growing deployment of renewable energy sources, combined with the need for dependable standby power in mining, manufacturing, and commercial facilities, continues to stimulate market demand. Supportive government policies and rising private investment in power infrastructure are further encouraging the adoption of diesel generators across Latin America.

Middle East & Africa Diesel Generator Market Trends

The Middle East and Africa (MEA) diesel generator industry is witnessing growth, driven by rising electricity demand, rapid urbanization, and continued expansion of commercial, construction, and industrial activities. Diesel generators remain essential for meeting backup and prime-power needs across remote locations, oil & gas operations, and regions with inconsistent grid infrastructure. Government-led initiatives to strengthen energy security, expand critical infrastructure, and improve grid connectivity further propel market growth. The region’s large-scale development projects and sustained demand for emergency and standby power solutions support the continued deployment of advanced diesel generator technologies.

Key Diesel Generator Company Insights

Some of the key players operating in the global diesel generator market include Caterpillar, Cummins Inc., among others.

-

Caterpillar is one of the largest global manufacturers of diesel generator systems, serving applications across industrial, commercial, residential, and utility sectors. The company offers a wide portfolio of generator sets, ranging from low- to high-capacity units, designed for standby, prime, and continuous power applications. Caterpillar focuses on high-reliability engine technology, fuel-efficient performance, and advanced digital controls, supported by its global dealer network for service and maintenance. The company’s strategic initiatives include expanding its presence in data centers, infrastructure, oil & gas, and mining sectors while integrating hybrid power solutions, remote monitoring capabilities, and emissions-optimized engine designs to meet evolving regulatory standards and customer demands.

-

Cummins Inc. is a leading international provider of diesel generator sets, widely recognized for its robust engine technology and comprehensive power generation solutions. The company’s diesel gensets cater to diverse applications, including telecom, healthcare, commercial facilities, residential backup, and industrial operations. Cummins emphasizes high-performance engines, low operating costs, and advanced control systems that enhance reliability and load management. The company’s strategic roadmap includes investments in hybrid and microgrid-ready generator systems, digital fleet management tools, and emissions-compliant engine platforms. With a strong global distribution and service network, Cummins continues to strengthen its market presence across emerging and mature markets, supporting demand for dependable backup and prime power solutions.

Key Diesel Generator Companies:

The following are the leading companies in the diesel generator market. These companies collectively hold the largest market share and dictate industry trends.

- AKSA Power Generation Company

- Atlas Copco AB

- Caterpillar

- Cummins Inc.

- Doosan Portable Power

- Generac Power Systems Inc.

- Honda India Power Products Ltd.

- Kohler Co.

- Rolls-Royce plc (MTU)

- Wärtsilä Corporation

Recent Developments

-

In March 2025, Cummins Inc. announced the expansion of its diesel generator manufacturing facility in Pune, India, aimed at increasing production capacity for high-horsepower generator sets ranging from 500 kVA to 3,500 kVA. The upgraded plant incorporates advanced automation systems, precision machining technologies, and enhanced testing capabilities to support the growing demand from data centers, industrial operations, and large-scale commercial infrastructure projects.

Diesel Generator Market Report Scope

Report Attribute

Details

Market Definition

The diesel generator market size represents the total global revenue generated from diesel-powered generator systems across various power ratings, including sales of equipment, components, and associated services.

Market size value in 2026

USD 21.16 billion

Revenue forecast in 2033

USD 40.99 billion

Growth rate

CAGR of 9.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

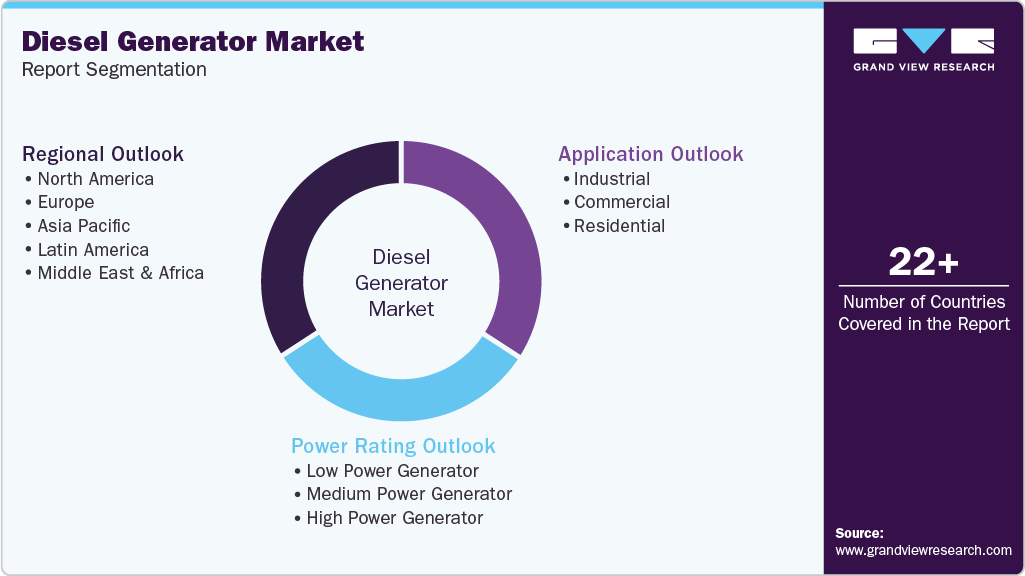

Power rating, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Caterpillar; Cummins Inc.; Generac Power Systems Inc.; Kohler Co.; Rolls-Royce plc (MTU); Wärtsilä Corporation; Atlas Copco AB; AKSA Power Generation Company; Doosan Portable Power; Honda India Power Products Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diesel Generator Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global diesel generator market report based on power rating, application, and region:

-

Power Rating Outlook (Revenue, USD Million, 2021 - 2033)

-

Low Power Generator

-

Medium Power Generator

-

High Power Generator

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global Diesel Generator market size was estimated at USD 19.33 billion in 2025 and is expected to reach USD 21.16 billion in 2026.

b. The global Diesel Generator market is expected to grow at a compound annual growth rate of 9.9% from 2026 to 2033 to reach USD 40.99 billion by 2033.

b. The global diesel generator market is expected to witness a compound annual growth rate of 9.7% from 2025 to 2030 to reach USD 30.75 billion by 2030.

b. Some of the key vendors operating in the global diesel generator market include Caterpillar, Cummins Inc., Generac Power Systems Inc., Kohler Co., Rolls-Royce plc (MTU), Wärtsilä Corporation, Atlas Copco AB, AKSA Power Generation Company, Doosan Portable Power, and Honda India Power Products Ltd., among others.

b. The key factors driving the diesel generator market include rising demand for reliable backup power across commercial, industrial, and residential sectors, particularly as growing renewable energy penetration increases the need for stable and immediate standby solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.