- Home

- »

- Power Generation & Storage

- »

-

Diesel Generator Market Size, Share & Growth Report, 2030GVR Report cover

![Diesel Generator Market Size, Share & Trends Report]()

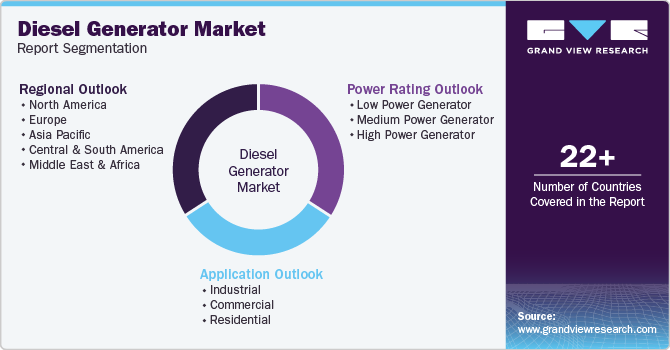

Diesel Generator Market Size, Share & Trends Analysis Report By Power Rating (Low Power, Medium Power, High Power), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-682-0

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 – 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Diesel Generator Market Size & Trends

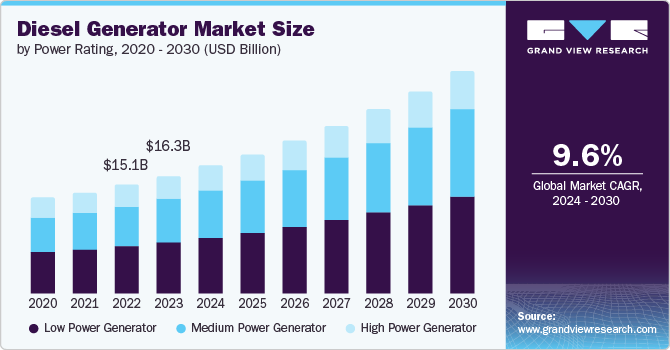

The global diesel generator market size was estimated at USD 16.36 billion in 2023 and is expected to grow at a CAGR of 9.6% from 2024 to 2030. Increasing energy demand globally far outstrips the supply. Factors, such as continuous population growth, infrastructure development, and rapid industrialization in emerging economies drive power demand. Diesel generators are favored for their numerous benefits, including low operating costs and superior fuel efficiency, making them particularly popular in developing areas, notably the Asia Pacific region. Despite these advantages, they also have several disadvantages, such as noise pollution and the emission of harmful gases. The World Nuclear Association has predicted that the electricity demand is likely to double from current levels. In addition, the U.S. Department of Energy forecasts that solar energy will become the most plentiful energy source available.

Significant growth in the economies of major developing nations, such as India and Brazil, is expected by 2050. India is expected to grow from being the third largest to the second largest economy in the world, only after China in terms of GDP at PPP (purchase power parity). Countries, such as Brazil, India, and South Africa, are already suffering due to a low power supply. Emerging economies are expected to account for 65% of the global economy. The U.S. market is anticipated to witness substantial growth owing to rising costs of power outages across several IT-enabled service firms and data centers and growing consumer awareness of the need for a reliable emergency power supply. In addition, the market is also driven by the rising vulnerability of grid power stations to disasters caused by changing weather conditions across the region.

Solution providers are mainly responsible for manufacturing, installing, maintaining, and repairing generator systems. Dealers or electrical contractors typically enter into supply and maintenance agreements with end-market consumers, which include commercial establishments, residential areas, and small businesses that use generators for emergency power backup. In addition, companies often appoint an in-house monitoring engineer to oversee the operation of numerous generators in industrial-scale settings. Stringent government regulations regarding reducing harmful carbon emissions are expected to boost the penetration of gas-based generators over diesel generators. This trend is anticipated to restrict the demand for diesel generators across all end-use sectors. However, low operating costs and low initial investment are among the key factors sustaining the current requirement for diesel generator sets.

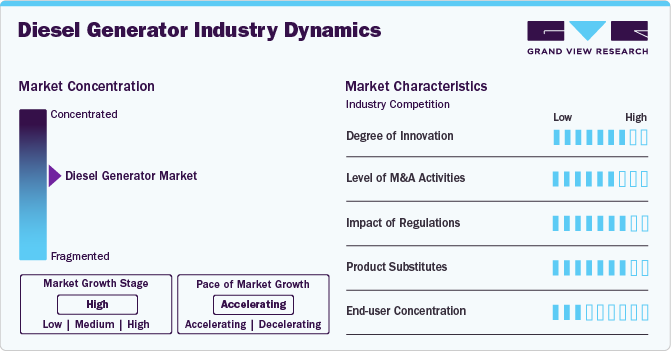

Market Concentration & Characteristics

The diesel generator market is slightly consolidated in nature with the presence of key industry players, such as AKSA Power Generation Company, Atlas Copco AB, Caterpillar, Cummins Inc., Doosan Portable Power, Generac Power System Inc., Honda India Power Products Ltd., and Kohler Co., which hold significant market shares. These companies often use aggressive marketing strategies, R&D initiatives, and M&As, to strengthen their market position and expand their product offerings.

Various product substitutes are available for diesel generators, including natural gas generators, solar power systems with battery storage, and grid power solutions in areas with reliable electricity infrastructure. Natural gas generators offer cleaner emissions than diesel and are preferred in regions with accessible natural gas supplies. Solar power systems are gaining popularity due to the falling costs of solar panels and battery storage, providing renewable energy solutions with lower operating costs over time. Diesel generators face competition as backup power solutions for locations with stable grid power. These substitutes are increasingly attractive due to environmental concerns, cost efficiencies, and advancements in renewable energy technologies, increasing competition for diesel-powered generators.

Regulations significantly impact the market by influencing emissions standards, operational restrictions, and market entry requirements. Stringent emissions regulations, such as limits on nitrogen oxides (NOx) and particulate matter, compel manufacturers to invest in cleaner technologies or face penalties, affecting production costs and product pricing. Operational restrictions, such as noise limits and zoning regulations, dictate where and how diesel generators can be used, impacting their market reach and application flexibility. Government incentives and subsidies for cleaner alternatives like renewable energy sources further shape market demand, influencing consumer preferences and investment decisions. Overall, regulatory dynamics are crucial in shaping the competitive landscape and driving innovation within the market.

Power Rating Insights

The power generator segment accounted for a significant market revenue share of 44.0% in 2023, owing to a broad application base in the commercial and residential sectors. Generators with a capacity below 80 kW are used as power backup solutions in residential homes to power devices such as water pumps, water purifiers, AC units, geysers, and others. Furthermore, the low cost of these generators is expected to play a crucial role in boosting product demand over the forecast years.

The high-power generator segment is expected to attain a significant growth rate over the forecast period owing to its rising demand in power, manufacturing, and marine industry, where there is a huge requirement for continuous power supply. High-power diesel generators are installed for power generation and distribution across off-grid remote areas, as it is not economically feasible to supply direct grid power to several remote places.

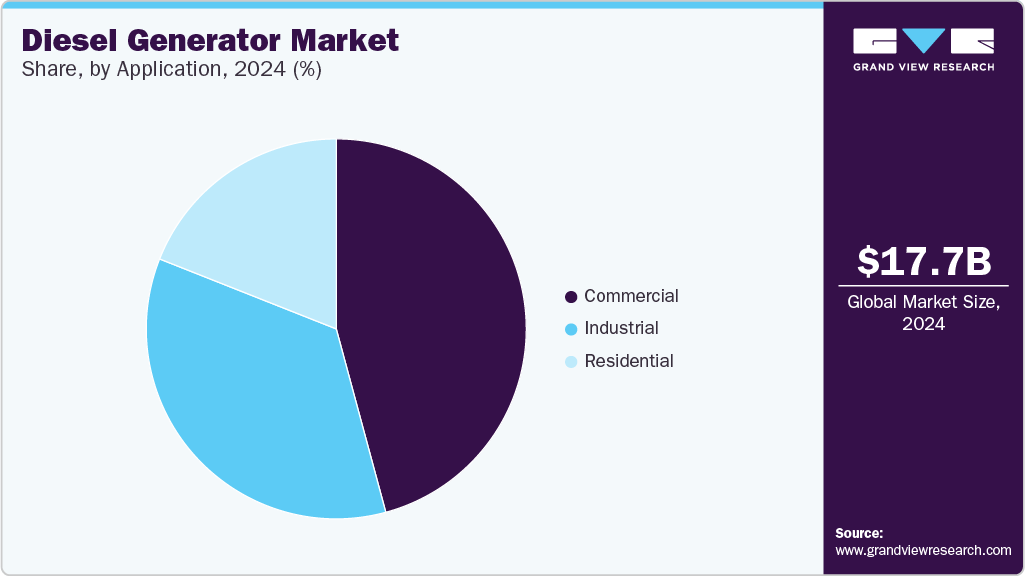

Application Insights

The commercial application segment occupied the largest revenue share in 2023 and is projected to grow substantially over the forecast period. The high growth rate can be attributed to the broad application scope, including several industries, such as data centers, government centers, educational institutions, healthcare, hospitality, telecom, and agriculture. Diesel generators are used as backups across commercial establishments in case of sudden power interruptions, such as electrical outages and voltage fluctuations, which add to financial losses if not tackled.

The industrial diesel generator segment accounted for the second-largest revenue share in 2023. The segment includes the manufacturing & construction, electric utilities, mining, transport & logistics, and oil & gas sectors. These sectors draw huge product demand due to their heavy power consumption operations. Favorable government policies for industrial development in developing economies, such as China, India, and Brazil, are among the key factors driving the segment growth. The residential segment is expected to witness significant growth over the forecast period owing to rising customer awareness, growing load demand on the primary grid, and increasing number of power failures. Moreover, diesel generators are a reliable secondary power source in households in case of grid failure or electrical outages.

Regional Insights

The diesel generator market in North America accounted for a share of 20.2% in 2023. The presence of prominent diesel generator OEMs and the growing demand for backup power are the primary factors driving the regional market growth.

U.S. Diesel Generator Market Trends

The U.S. diesel generator market held a share of 85.2% in 2023 and is projected to expand further in the coming years due to increased demand for backup power systems to ensure uninterrupted power supply to important facilities, such as data centers and hospitals, that require 24/7 electric supply. Growth in industrial and commercial facilities, such as shopping malls, high rises, universities, restaurants, office buildings, manufacturing facilities, and refineries, in the U.S., is driving market demand for continuous power supply for efficient business operations.

The diesel generator market in Canada is poised to grow at a significant rate over the forecast period. The commercial and industrial sectors generate the highest demand for backup power systems in the country. Numerous energy-intensive industrial activities are the key catalysts for the growing electricity demand from the industrial sector.

Europe Diesel Generator Market Trends

The Europe diesel generator market is anticipated to grow at a substantial pace during the forecast period. The rising population is a major factor influencing the power generation market in the region. In addition, the growing GDP of the region is projected to attract various end-use players looking to expand their consumer bases. The growing population provides a constant inflow of customers, which positively impacts a wide range of industries by creating more competition among the participants. Thus, increasing industrial facilities in Europe drive the market for diesel generators for backup power.

The diesel generator market in Germany is expected to progress at the fastest CAGR over the forecast period due to rising demand for backup power systems from expanding manufacturing and other industrial end users.

The UK diesel generator market held a significant revenue share in 2023. Factors, such as the growth of the manufacturing sector and a rise in the number of data centers across the UK, are expected to drive the demand for diesel generators in commercial and industrial facilities in the country. In addition, a rise in the number of commercial and office buildings across the country is another major factor anticipated to boost the demand for diesel generator sets.

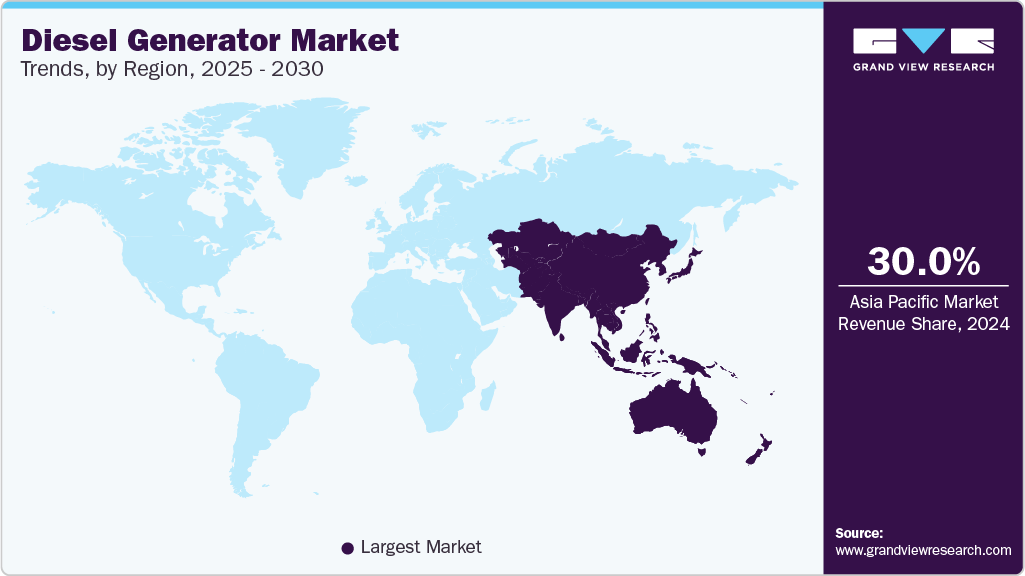

Asia Pacific Diesel Generator Market Trends

The diesel generator market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. The regional market growth is driven by the need for efficient backup power systems. Moreover, the high growth of the industrial sector in China, India, Japan, and South Korea has triggered the demand for industrial diesel generators in the region. The establishment of heavy equipment, oil & gas, and process companies in China owing to low labor and utility costs has been supporting market growth.

The China Diesel Generator Market in China dominated the Asia Pacific region and is expected to retain its dominance over the forecast period as it is one of the fastest-growing economies in the sub-continental region owing to the rapidly growing manufacturing sector supported by favorable government norms. The telecom industry in the country has grown in the last couple of years and the trend is expected to continue in the coming years owing to the robust mobile network services and improving internet infrastructure.

The India diesel generator market is witnessing rapid growth, as it is one of the fastest-growing economies globally owing to the rising middle-class population, increasing disposable income levels, and business-friendly government reforms. The country’s generator sets market is inclined toward using diesel as a raw material, however, the diesel generator market has experienced challenges over the past few years due to stringent pollution regulations, and growing demand for gas generators.

Central & South America Diesel Generator Trends

The diesel generator market in Central & South America is expected to witness considerable growth. CSA heavily relies on oil for power generation. As a result, oil represents a significant portion of the energy mix in the region. However, growing concerns regarding carbon emissions from diesel generators and stringent regulatory frameworks to curb pollution are expected to restrain regional market growth. Similar to Europe, the CSA region is also focusing on power generation from clean resources.

Middle East & Africa Diesel Generator Trends

The MEA diesel generator market is witnessing steady growth. Growing construction and infrastructure developmental activities are driving the demand for backup power, thus propelling the demand for diesel generators. The power producers’ inability to meet the power demand, especially during extremely hot weather conditions, is considered as an opportunity for the MEA regional market.

Key Diesel Generator Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In May 2023, Cummins, a power generation equipment and engine manufacturer, launched a novel diesel generator set powered by their B45 engine, a 4.5-liter, four-cylinder diesel engine designed for power generation applications. This new generator set is expected to provide reliable power for a variety of industries, including construction, rental, and prime power

-

In August 2022, Caterpillar launched three standby diesel generators ranging from 20 to 30 kilowatts (KW) for the North American market. These diesel generator sets, powered by the Cat C2.2 engine, are designed for small industrial, telecommunications, and commercial applications. They meet U.S. EPA emergency emission standards and industry safety certifications and offer features like exceptional performance, compact size, readily available parts, and optional enclosures

Key Diesel Generator Companies:

The following are the leading companies in the diesel generator market. These companies collectively hold the largest market share and dictate industry trends.

- AKSA Power Generation Company

- Atlas Copco AB

- Caterpillar

- Cummins Inc.

- Doosan Portable Power

- Generac Power System Inc.

- Honda India Power Products Ltd.

- Kohler Co.

- Rolls-Royce Plc

- Wartsila Corporation

Diesel Generator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.74 billion

Revenue forecast in 2030

USD 30.75 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Power rating, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Russia; France; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

AKSA Power Generation Company; Atlas Copco AB; Caterpillar; Cummins Inc.; Doosan Portable Power; Generac Power System Inc.; Honda India Power Products Ltd.; Kohler Co.; Rolls-Royce Plc; Wartsila Corp.; Cooper Corp.; Powerica; Mitsubishi Heavy Industries, Ltd.; Ashok Leyland

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diesel Generator Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the diesel generator market report based on power rating, application, and region:

-

Power Rating Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Power Generator

-

Medium Power Generator

-

High Power Generator

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Russia

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global diesel generator market was estimated at USD 16.36 billion in 2023 and is projected to reach USD 17.74 billion in 2024.

b. The low power generator segment accounted for a significant market revenue share of 44.04% in 2023 owing to the wide application of low power generators in commercial and residential sectors.

b. The global diesel generator market is expected to witness a compound annual growth rate of 9.6% from 2024 to 2030 to reach USD 30.75 billion by 2030.

b. Some key players operating in the Diesel Generator Market include Atlas Copco AB, Caterpillar Inc, Cummins Inc., Generac Power System Inc, AKSA Power Generation, Doosan Skoda Power , Cooper Corp., Kohler Co., Mitsubishi Heavy Industries, Ltd., Honda India Power Products Ltd., Rolls-Royce plc, Wartsila , Powerica , FG Wilson Inc., Ashok Leyland,

b. Increasing demand for uninterrupted and reliable power supply from end-use segments such as manufacturing & construction, power generation, telecom, oil & gas, marine, residential, chemical, and healthcare applications is anticipated to propel the diesel generator market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."