- Home

- »

- Distribution & Utilities

- »

-

Natural Gas Generator Market Size, Industry Report, 2030GVR Report cover

![Natural Gas Generator Market Size, Share & Trends Report]()

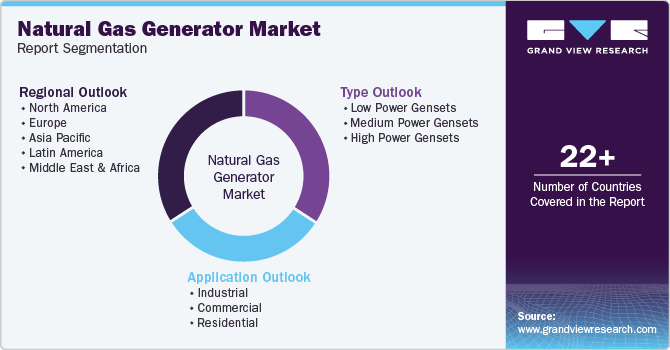

Natural Gas Generator Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Low Power Genset, Medium Power Genset), By Application (Industrial, Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-936-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Gas Generator Market Summary

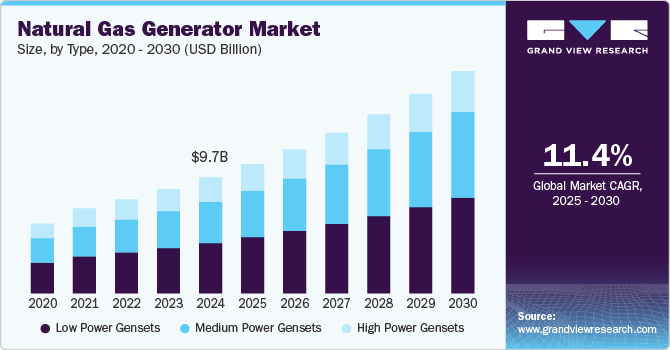

The global natural gas generator market size was estimated at USD 9,741.0 million in 2024 and is projected to reach USD 18,667.3 million by 2030, growing at a CAGR of 11.4% from 2025 to 2030. This growth can be attributed to the Increasing demand for reliable power supply amidst frequent outages, alongside stringent environmental regulations favoring cleaner energy sources, propelling market expansion.

Key Market Trends & Insights

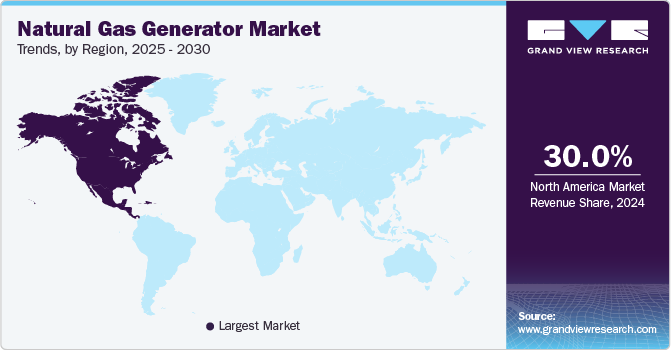

- In terms of region, North America was the largest revenue generating market in 2021.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2022 to 2030.

- In terms of segment, low power gensets accounted for a revenue of USD 3,107.2 million in 2021.

- Medium Power Gensets is the most lucrative power rating segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9,741.0 Million

- 2030 Projected Market Size: USD 18,667.3 Million

- CAGR (2025-2030): 11.4%

- North America: Largest market in 2021

In addition, the rising occurrence of power outages and power supply deficits globally, combined with regulations imposed on diesel gensets due to high levels of carbon emissions, is driving the global demand for natural gas generators. Furthermore, technological advancements enhancing efficiency and performance, combined with rising industrial and commercial activities, are crucial in meeting the escalating energy needs globally.

Natural gas generators convert natural gas into electricity and are increasingly significant in the global energy landscape. The surge in natural gas production is largely attributed to supportive policies that promote sustainable development and reduce greenhouse gas emissions, as natural gas is a cleaner-burning alternative to traditional fuels. In addition, growing industrial and commercial facilities, such as shopping malls, high rises, universities, restaurants, district heating and cooling plants, refineries, office buildings, and others in the U.S., are driving the demand for uninterrupted electricity supply to expand businesses and perform operations efficiently, which propels the demand for natural gas gensets.

Natural disasters and severe weather conditions due to climate change have resulted in extended power outages, driving demand for backup power as a necessary amenity in commercial, residential, and industrial buildings. The abundance of natural gas in the U.S., combined with the well-developed infrastructure for transporting it within the country, has fueled the demand for generator sets in the U.S. Gas generator sets are becoming more popular than diesel generator sets due to the country's shale gas revolution, and this trend is expected to continue in the coming years.

Moreover, another crucial factor is the need for a consistent power supply amid rapid economic growth. As industrial sectors expand and populations grow, the reliance on uninterrupted power has intensified. The information and communication technology sector, particularly data centers, significantly contributes to this demand, necessitating dependable generators.

Type Insights

The low power genset dominated the global natural gas generator industry and accounted for the largest revenue share of 43.5% in 2024. Low power gensets are popular for residential and commercial power backup applications. Nowadays, people use various electrical appliances in their homes, such as geysers, water pumps, AC units, water purifiers, and others. These appliances require more power to function, as in the case of washing machines, which might consume 750 watts but need about 2500 watts to start. As a result, many households choose to have only an 80 KW generator set as a standby power source.

Medium power gensets are expected to grow at a CAGR of 12.9% over the forecast period, owing to the rising energy demands in the industrial and commercial sectors. As economies expand, there is a heightened need for dependable power systems to support operations, particularly in emerging markets. In addition, the shift towards cleaner fuel options has led many businesses to adopt natural gas generators for their efficiency and lower emissions than diesel alternatives. Furthermore, government initiatives promoting clean energy use are propelling investments in medium power gensets, making them a preferred choice for various applications requiring substantial power output.

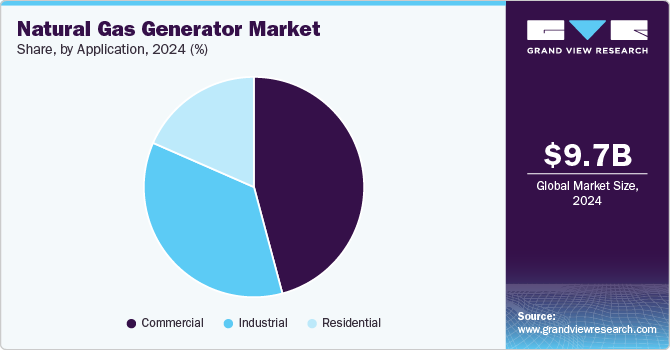

Application Insights

The commercial sector led the market with the highest revenue share of 45.8% in 2024, primarily driven by the increasing demand for reliable and clean energy solutions. Businesses are increasingly adopting natural gas generators to ensure uninterrupted power supply, especially in retail, healthcare, and telecommunications sectors. In addition, the shift towards environmentally friendly practices is prompting companies to choose natural gas over diesel, as it produces fewer emissions.

The industrial sector is expected to grow at a CAGR of 11.5%, owing to the need for consistent and efficient power supply to support various operations. As industries expand and modernize, reliable energy sources are essential for maintaining productivity and minimizing downtime. Furthermore, natural gas generators are favored for their ability to provide a cleaner alternative to traditional diesel generators, aligning with sustainability goals. Moreover, technological advancements and government initiatives promoting clean energy adoption are encouraging industries to invest in natural gas generators for their operational needs.

Regional Insights

The North America natural gas generator market dominated the global market and accounted for the largest revenue share of 30.0% in 2024. This growth can be attributed to the abundance of shale gas reserves and a robust infrastructure for natural gas transportation. In addition, the region's commitment to clean energy initiatives has led to increased adoption of natural gas generators, which are favored for their lower emissions compared to diesel. Furthermore, the presence of prominent gas genset OEMs and EPC players, large shale gas reserves, and developed infrastructure for the transportation of natural gas has emerged as the primary driving factors for the North America natural gas generator set market.

U.S. Natural Gas Generator Market Trends

The natural gas generator market in U.S. led the North American region and held the largest revenue share in 2024, primarily driven by significant investments in natural gas infrastructure and favorable government policies promoting cleaner energy sources. In addition, the shift from coal to natural gas for electricity generation is accelerating, supported by technological advancements that enhance efficiency. Furthermore, the increasing reliance on off-grid power systems during peak demand periods is driving businesses and consumers to adopt natural gas generators as a cost-effective solution for uninterrupted power supply.

Asia Pacific Natural Gas Generator Market Trends

The APAC natural gas generator market is expected to grow at a CAGR of 14.0% over the forecast period, driven by the escalating demand for efficient backup power systems amid rapid industrialization. The high growth of the industrial sector in China, India, Japan, and South Korea has triggered the demand for industrial generator sets in the region.

The natural gas generator market in China dominated the Asia Pacific and accounted for the highest share in 2024, driven by the government's commitment to reducing carbon emissions, which has led to increased adoption of natural gas as a primary fuel source. Furthermore, the growing industrial sector requires reliable power solutions, driving demand for natural gas generators that provide efficient and environmentally friendly energy.

Europe Natural Gas Generator Market Trends

The Europe natural gas generator market is expected to grow significantly over the forecast period as countries seek to meet stringent environmental regulations and reduce greenhouse gas emissions. In addition, the transition from coal-fired power plants to natural gas facilities is a key trend supported by government initiatives promoting cleaner energy sources. Furthermore, the increasing frequency of extreme weather events has underscored the need for reliable backup power solutions, further boosting the demand for natural gas generators across various applications.

The growth of the natural gas generator market in Germany is expected to be driven by strong government policies promoting renewable energy and reducing carbon footprints. The country’s commitment to transitioning from coal and nuclear power has led to greater reliance on natural gas as a cleaner alternative. Furthermore, advancements in technology have improved the efficiency of natural gas generators, making them an attractive option for both commercial and industrial applications seeking sustainable energy solutions.

Key Natural Gas Generator Company Insights

Key players in the global natural gas generator industry include Kohler Co. Inc., MTU Onsite Energy, Cooper Corp., and others. These players adopt several strategies to improve their competitive edge. These include investing in research and development to innovate and improve generator efficiency, performance, and emissions reduction technologies. Furthermore, strategic partnerships and collaborations with other companies and stakeholders are common and aimed at expanding market reach and sharing expertise.

-

Caterpillar Inc. manufactures natural gas generators and provides various gas-fueled generator sets for various applications. The company operates in the power generation segment, focusing on solutions that deliver dependable and efficient energy. Caterpillar's product portfolio includes gas engines and generator sets designed for cogeneration power plants, with outputs ranging from 400 kW to 4,500 kW.

-

Kohler Co. Inc. specializes in manufacturing natural gas generators for commercial and residential markets. The company focuses on providing consistent backup and prime power solutions within the power systems segment. Its natural gas generators are engineered for efficiency and low emissions, making them an attractive choice for environmentally conscious consumers. The company's offerings include a variety of generator sizes and configurations.

Key Natural Gas Generator Companies:

The following are the leading companies in the natural gas generator market. These companies collectively hold the largest market share and dictate industry trends.

- Cummins Inc.

- Caterpillar Inc.

- Kohler Co. Inc.

- Mitsubishi Heavy Industries, Ltd

- MTU Onsite Energy

- Generac Power Systems, Inc.

- Cooper Corp.

- General Electric

- Yanmar Co., Ltd

- Mahindra Powerol

Recent Developments

-

In October, 2024, HIMOINSA launched its HGY Series of natural gas generators in Madrid, Spain, showcasing a new power solution for critical applications. Developed in collaboration with Yanmar Power Technology, these generators range from 1250kVA to 3500kVA and are designed for efficiency and low emissions. The HGY Series supports alternative fuels such as natural gas and hydrogen, aligning with sustainability goals. Equipped with advanced features for optimal performance, these generators are set to enhance HIMOINSA's global market presence in power generation.

-

In February 2023, Cummins Inc. announced the launch of its new 175 kW and 200 kW natural gas generator sets, designed to meet the growing demand for reliable and efficient power solutions in North America. These generator sets are engineered for performance and sustainability, offering lower emissions and reduced operating costs. The introduction of these natural gas generators reflects Cummins' commitment to providing innovative energy solutions that support various applications, from commercial to industrial sectors.

Natural Gas Generator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.87 billion

Revenue forecast in 2030

USD 18.67 billion

Growth rate

CAGR of 11.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Russia, China, India, Japan, South Korea, Brazil, Argentina, UAE Saudi Arabia

Key companies profiled

Cummins Inc.; Caterpillar Inc.; Kohler co. Inc.; Mitsubishi Heavy Industries, Ltd; MTU Onsite Energy; Generac Power Systems, Inc.; Cooper Corp.; General Electric; Yanmar Co., Ltd; Mahindra Powerol.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Gas Generator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global natural gas generator market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Power Gensets

-

Medium Power Gensets

-

High Power Gensets

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.