- Home

- »

- Medical Devices

- »

-

Dietary Supplements Contract Manufacturing Market Report, 2030GVR Report cover

![Dietary Supplements Contract Manufacturing Market Size, Share & Trends Report]()

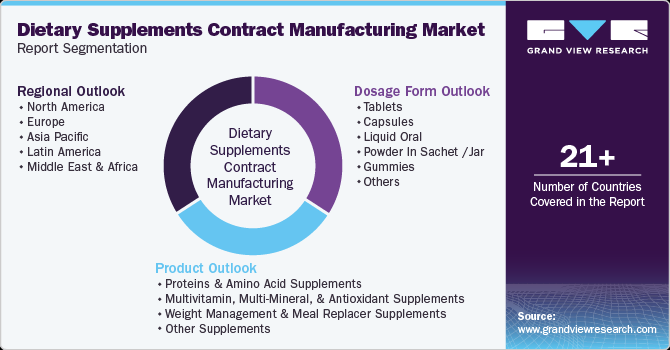

Dietary Supplements Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Proteins & Amino Acid, Multivitamin, Multi-Mineral, Antioxidant), By Dosage Form (Tablets, Capsules, Liquid Oral, Gummies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-257-2

- Number of Report Pages: 169

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dietary Supplements Contract Manufacturing Market Summary

The global dietary supplements contract manufacturing market size was estimated at USD 59.63 billion in 2024 and is projected to reach USD 121.2 billion by 2030, growing at a CAGR of 12.6% from 2025 to 2030. The market growth is due to the increasing demand for dietary supplements, the rising obese population, and a growing number of market players.

Key Market Trends & Insights

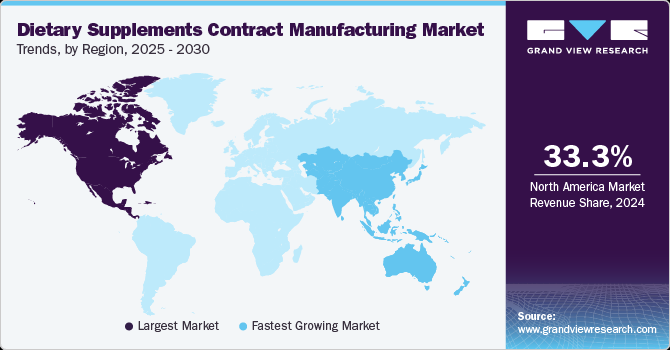

- North America dietary supplements contract manufacturing market dominated and accounted for 33.29% in the global market due to the well-established market.

- The U.S. dietary supplements contract manufacturing market held a dominant share in the North America dietary supplement contract manufacturing market.

- By product, the protein & amino acids supplements segment held the largest market share in the dietary supplement contract manufacturing industry in 2024.

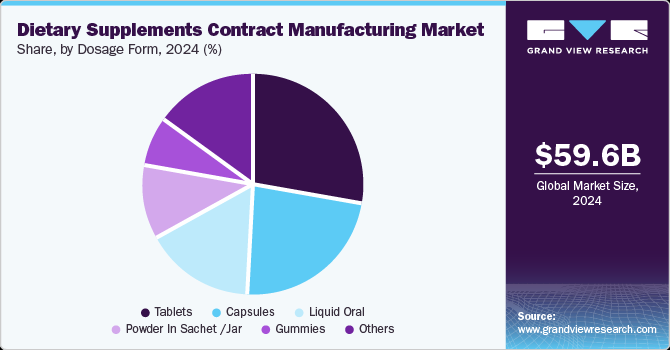

- By dosage form, the tablets segment held the largest market share in the dietary supplement contract manufacturing industry in 2024..

Market Size & Forecast

- 2024 Market Size: USD 59.63 Billion

- 2030 Projected Market Size: USD 121.2 Billion

- CAGR (2025-2030): 12.6%

- North America: Largest market in 2024

In addition, increasing benefits associated with outsourcing manufacturing processes and expansion of service offerings by contract manufacturers, leading to the development of new dietary supplements, are driving market growth. As per the Council for Responsible Nutrition (CRN), in the U.S., more than 74% adult population consumes dietary supplements, of which 55% of adults are regular users of dietary supplements.

The global dietary supplements market continues to expand with increasing demand from emerging economies. Contract manufacturers offer international market expertise and support. Moreover, they assist dietary supplement companies with navigating international regulations, addressing cultural preferences, and adapting products to local markets. Contract manufacturers with a global presence and knowledge of diverse regulatory requirements provide a competitive advantage to dietary supplement companies looking to expand globally. For instance, in October 2023, Barentz announced an agreement with Ashland to distribute its pharmaceutical and nutraceutical portfolio products in Ireland, the UK, Denmark, Norway, Sweden, Finland, Iceland, Estonia, Latvia, and Lithuania. This agreement broadened the company’s operational capabilities in the market.

Opportunity Analysis

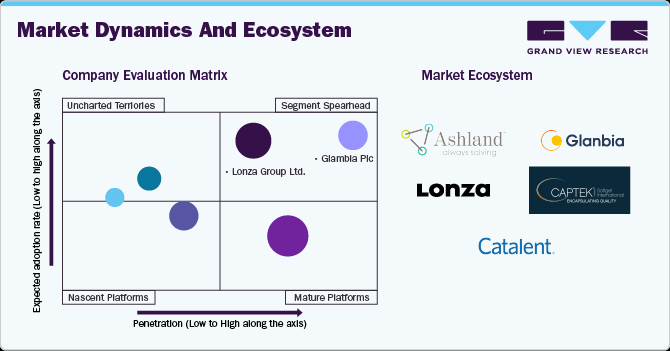

The market is growing due to rising consumer demand for health and wellness products, regulatory support, and increasing brand outsourcing. Companies like Lonza Group Ltd. and Catalent, Inc. are capitalizing on this trend by investing in innovative delivery formats (e.g., softgels, gummies) and sustainable ingredient sourcing. Lonza’s expertise in capsule technology and Catalent’s R&D capabilities give them a competitive edge in catering to evolving consumer preferences. As more brands seek cost-effective, high-quality production, contract manufacturers offering advanced formulations and compliance with global standards will experience sustained demand.

Technological Advancements

The market is evolving with technological advancements that enhance product quality and efficiency. Innovations in 3D printing for personalized supplements, nanoencapsulation for better nutrient absorption, and AI-driven formulation development are driving industry growth. Companies like Biotrex Nutraceuticals are integrating automated production lines and smart tracking systems to ensure precision and compliance, while Vantage Nutrition (ACG Group) is focusing on sustained-release capsule technology to improve bioavailability. These advancements are helping manufacturers meet increasing consumer demand for effective, science-backed supplements while maintaining cost efficiency and regulatory compliance.

Pricing Analysis

Pricing in the Dietary Supplement Contract Manufacturing Market is influenced by formulation complexity, ingredient sourcing, and manufacturing technology. Tablets and capsules are the most cost-effective, ranging from USD 0.03 to USD 0.10 per unit, while softgels and gummies are priced higher at USD 0.05 to USD 0.20 per unit due to advanced encapsulation and natural flavoring. Powders and liquid supplements vary widely, with costs depending on protein content, botanical extracts, and bioavailability enhancers. Regions like North America and Europe have higher manufacturing costs due to strict regulations, while Asia-Pacific offers more competitive pricing driven by cost-effective labor and ingredient availability.

Market Concentration & Characteristics

The dietary supplement contract manufacturing industry is driven by breakthroughs in delivery systems, ingredient stability, and formulation techniques. Companies are developing self-emulsifying drug delivery systems (SEDDS) for better absorption, precision fermentation for sustainable ingredient production, and smart coatings to improve nutrient release. Gummy and liquid formulations are evolving with sugar-free, plant-based alternatives, catering to health-conscious consumers. Automation and blockchain-based traceability are also enhancing quality control.

The dietary supplement contract manufacturing industry is witnessing partnerships, collaborations, mergers, and acquisitions as companies seek to expand their capabilities, geographic reach, and service offerings to stay competitive in the evolving landscape. The growing demand for dietary supplements in emerging markets due to rising disposable incomes, urbanization, and increasing health consciousness. Contract manufacturers are expanding their presence in these regions to capitalize on the numerous growth opportunities. For instance, in May 2023, Biofarma Group acquired US Pharma Lab, Inc.-a key CDMO specializing in nutraceuticals such as vitamins, minerals, probiotics, and premium dietary ingredients

The dietary supplement contract manufacturing industry is characterized by a complex interchange of evolving regulations, industry standards, and consumer demands. Regulatory authorities such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) are involved in monitoring and enforcement of quality control measures to ensure safety, efficacy, and accurate labeling of dietary supplements. Changes in regulations such as the implementation of the Dietary Supplement Health and Education Act (DSHEA) or updates to Current Good Manufacturing Practices (cGMP), can significantly impact contract manufacturers' operations and compliance requirements. In U.S., the Federal Trade Commission (FTC) regulates advertising & marketing claims, and the FDA oversees labeling claims.

The growing adoption of e-commerce platforms and Direct-To-Consumer (D2C) sales channels is transforming the marketing and sales landscape of dietary supplement products. This transformation is reshaping how contract manufacturers operate in the industry. Consumers are increasingly conscious of the ingredients used in dietary supplements, with a growing preference for natural and organic options. This shift in consumer preferences presents an opportunity for contract manufacturers to differentiate themselves by specializing in sourcing and incorporating high-quality natural and organic ingredients into product formulations. They can also ensure compliance with organic certifications and sustainability standards, helping dietary supplement companies meet the demands of environmentally conscious consumers.

The market is driven by increasing health awareness, regulatory shifts, and growing demand for functional nutrition. Asia-Pacific is emerging as a manufacturing hub due to lower production costs and a booming nutraceutical industry, attracting global brands for outsourcing. North America and Europe continue to expand through premium formulations and regulatory compliance, with companies investing in local production to reduce supply chain risks. Latin America and the Middle East & Africa are witnessing gradual growth as consumer demand for supplements rises, prompting manufacturers to establish localized facilities and strategic partnerships for market penetration.

Product Insights

The protein & amino acids supplements segment held the largest market share in the dietary supplement contract manufacturing industry in 2024. The awareness of the importance of maintaining a healthy lifestyle and physical fitness is growing. Consumers, including athletes, fitness enthusiasts, and health-conscious individuals, are seeking protein and amino acid supplements to support their fitness goals, muscle recovery, and overall well-being. The desire to optimize athletic performance and achieve the desired body composition is driving the demand for proteins and amino acid supplements. The demand for plant-based and vegan protein supplements is growing due to various factors, including ethical considerations, environmental concerns, and dietary preferences. For instance, plant-based proteins are gaining popularity as alternatives to animal-derived proteins. The growing number of protein & amino acids supplement brands is expected to fuel the adoption of contract manufacturing services for these products to save costs and increase efficiency. In September 2022, Tata Consumer Products (TCP) entered the nutritional supplements market with the launch of Tata GoFit-a plant protein powder containing ingredients such as peas and brown rice.

The multivitamin, multi-mineral, and antioxidant supplements segment is anticipated to witness fastest CAGR during the forecast period. The increasing prevalence of dietary deficiencies due to inadequate nutrient intake or specific dietary restrictions is a key factor driving the market. There is a growing awareness among consumers about the importance of maintaining overall health and well-being.Multivitamins, multi-minerals, and antioxidants are seen as essential components of a balanced diet that can help bridge nutritional gaps. As a result, consumers are turning to supplements to fill potential nutrient gaps and support their health goals. Soigner Pharma is an Indian pharmaceutical as well as a third-party manufacturing company. Its lineup includes contract manufacturing services for multivitamins, multi-minerals, and antioxidant tablets. On the other hand, American Health Foundation, Inc. offers ready-to-brand private-label vitamin and supplement formulas in various delivery forms and dosages.

Dosage Form Insights

The tablets segment held the largest market share in the dietary supplement contract manufacturing industry in 2024. The demand for dietary supplements in tablet form has been increasing due to their convenience, ease of use, and long shelf life. Recent advancements in tablet technology have made it possible to produce tablets with improved disintegration, dissolution, and bioavailability. This has led to an increase in the popularity of tablets as a delivery system for dietary supplements. Tablets are a well-established delivery system for dietary supplements and are widely recognized by regulatory agencies such as the FDA. This makes it easier for contract manufacturers to comply with regulatory requirements and ensures that tablets are safe and effective for consumers. For instance, Gemini Pharmaceuticals is a U.S.-based dietary supplement manufacturer specializing in condition-specific formulations and line extensions for customers across the globe. It offers dosage forms such as tablets & capsules and applications ranging from cognitive health to ayurvedic formulations. The products of the company are FDA registered, routinely audited, cGMP certified, and inspected to 21 CFR Part 211 for dietary supplement manufacturing.

The gummies segment is expected to grow with the fastest CAGR during the forecast period. The market for gummies and chews is growing rapidly, driven by the increasing demand for dietary supplements in more palatable forms. Consumers are increasingly looking for dietary supplements that are not only effective but also enjoyable to consume. Gummies offer a fun and flavorful way to incorporate vitamins, minerals, and other nutrients into one’s daily routine. As a result, manufacturers are investing in expanding their gummy supplement offerings to cater to this growing demand. Contract manufacturers are responding to this trend by offering a wide range of customization options, including ingredient selection, dosage forms, and packaging, to meet individual/regional consumer preferences.

Regional Insights

North America dietary supplements contract manufacturing market dominated and accounted for 33.29% in the global market due to the well-established market, with numerous contract manufacturing companies offering services to brands and businesses. These companies have the necessary infrastructure, regulatory knowledge, and quality standards, to ensure the safety & efficient production of dietary supplement products. The dietary supplements contract manufacturing growth in the U.S. and Canada is a key factor contributing to market growth. In addition, the presence of a vast population across these countries with increased obesity levels & lifestyle-related diseases, increased disposable incomes, and shifting trends towards supplements, which offer numerous health benefits beyond basic nutrition, has fueled the market growth.

U.S. Dietary Supplements Contract Manufacturing Market Trends

The U.S. dietary supplements contract manufacturing market held a dominant share in the North America dietary supplement contract manufacturing market. Growing adoption of healthier products & lifestyle has led people to consume more Vitamins, Minerals, and Supplements (VMS) for a holistic approach to their well-being, which is expected to fuel market demand. Consumers are increasingly seeking natural and preventive approaches to maintain their health, which has led to a rise in demand for nutraceutical products. Similarly, growing innovations and launches of dietary supplements in the U.S. are anticipated to fuel the market growth. For instance, in July 2022, Sirio Pharma, a nutraceutical CDMO, acquired 80% of Best Formulations, a contract manufacturer of nutraceuticals & dietary supplements based in the U.S. The above-mentioned factors are expected to drive the market over the forecast period.

Europe Dietary Supplement Contract Manufacturing Market Trends

Europe's market is fueled by strict regulatory standards under EFSA, ensuring high-quality supplement production. The rising demand for vegan, organic, and allergen-free supplements is pushing manufacturers toward sustainable and plant-based formulations. Innovation in sustained-release capsules and bioavailability enhancers is gaining traction among premium brands.

UK dietary supplements contract manufacturing market is driven from a post-Brexit regulatory shift, allowing greater flexibility in innovation and formulation. A surge in e-commerce and direct-to-consumer brands is driving demand for contract manufacturing services. Personalized nutrition and DNA-based supplementation are emerging as key trends, encouraging companies to develop customized solutions.

Germany dietary supplements contract manufacturing market is projected to witness lucrative growth in the coming years. The country is a key hub for contract manufacturing in dietary supplements. The country's focus on scientific validation and high consumer trust in clinically tested supplements drive premium product demand. Herbal and botanical extracts, especially for stress relief and digestion, are seeing high adoption.

France dietary supplements contract manufacturing market is projected to witness considerable growth in the coming years. The growth is due to rising demand for anti-aging formulations. The strong influence of organic and natural product preferences is driving innovation in botanical-based supplements. Government support for sustainable manufacturing and eco-friendly packaging is pushing companies toward greener solutions.

Asia Pacific Dietary Supplement Contract Manufacturing Market Trends

Asia Pacific dietary supplements contract manufacturing market is expected to witness the fastest growth over the forecast period. This growth can be attributed to various factors, such as the growing demand for dietary supplement products from various countries, such as China, India, Japan, South Korea, & Australia, and the constantly improving need for contract manufacturing services to meet the production requirements. In addition, increasing awareness about health & wellness, growing intake of health supplements, changing lifestyles, and a growing aging population drive the demand for dietary supplement products. Consequently, this improves the need for contract manufacturing services to meet production requirements.

Japan dietary supplements contract manufacturing market is driven by an aging population seeking functional foods and nutraceuticals for longevity. The FOSHU (Foods for Specified Health Uses) regulatory framework supports innovation and consumer trust in high-quality supplements. Demand for fermented and traditional herbal formulations is increasing, aligning with Japan’s preference for natural health solutions. Companies are investing in precision fermentation and probiotic technology to enhance supplement efficacy.

India dietary supplements contract manufacturing market is driven by surging demand for nutraceuticals, increasing awareness of health and fitness, rising disposable incomes, and a growing obesity & aging population. Furthermore, adoption of nutraceuticals is growing at a steady pace in India, especially among the population focused on strengthening immunity. Numerous people are consuming herbal and nutraceutical dietary supplements as an alternative to conventional medicine. For instance, in February 2022, Amway India launched a range of nutrition supplements in convenient, appealing, and simplified formats, such as jelly strips and flavorful gummies, under the Nutrilite brand

China dietary supplements contract manufacturing market is a major country for dietary supplement contract manufacturing in the Asia Pacific. The country's growth is driven by the increasing prevalence of chronic diseases and lifestyle-related health issues, making consumers more conscious about their health. This has led to an increased emphasis on contract manufacturing for developing new, high-quality dietary supplement products that offer unique benefits in reducing the risk of diseases or health conditions.

Latin America Dietary Supplement Contract Manufacturing Market Trends

Latin America's market growth is driven by increasing middle-class affordability and health awareness. Demand for traditional herbal and plant-based supplements is strong, particularly in countries with a history of natural medicine. Contract manufacturers are expanding facilities to meet the rising demand for immune-boosting and weight management supplements.

Brazil dietary supplements contract manufacturing market is experiencing rapid growth due to a fitness-conscious population and demand for sports nutrition. The ANVISA regulatory framework is evolving, allowing for more supplement innovations and streamlined approvals. Increasing consumption of plant-based proteins and functional drinks is driving local contract manufacturers to expand their capabilities. Domestic production incentives are encouraging investment in advanced manufacturing technologies.

Key Dietary Supplements Contract Manufacturing Company Insights

Some of the key players operating in the dietary supplement contract manufacturing market are leveraging advanced formulation technologies, sustainable ingredient sourcing, and automation to stay competitive. Companies like CAPTEK Softgel International, NutraScience Labs, and Lonza Group Ltd. are focusing on high-bioavailability delivery systems and personalized nutrition solutions to meet evolving consumer demands. For instance, in August 2024, Ashland Inc. announced the completion of its nutraceuticals business sale to Turnspire Capital Partners LLC. this strategic initiative will enhance contract manufacturing capabilities and drive innovation in custom formulations further strengthened North American production.

Key Dietary Supplements Contract Manufacturing Companies:

The following are the leading companies in the dietary supplements contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Ashland

- Glanbia plc

- Lonza Group Ltd.

- CAPTEK Softgel International Inc.

- Catalent, Inc

- Trividia Manufacturing Solutions, Inc.

- Biotrex Nutraceuticals

- Martinez Nieto.

- Menadiona

- NutraScience Labs

- Nutrivo LLC,

- Gemini Pharmaceuticals

- Biovencer Healthcare Pvt Ltd

- Rain Nutrience

- Vantage Nutrition (ACG group)

- LiquidCapsule

- DCC plc

- Nature’s Value

- MPI NutriPharma BV

- FAVEA Czech Republic (Favea)

- MediGrün Naturprodukte GmbH (MediGrun)

Recent Developments

-

In February 2024, Catalent Inc., a global provider of consumer health products and Novo Holdings announced a merger agreement. In the agreement, Novo Holdings will acquire Catalent for USD 16.5 billion.

-

In October 2023, Vitaquest International announced the acquisition of the Ashland powder processing facility. The Ashland company’s fluidized bed process technologies will enable particle & powder engineering for the food & beverage and dietary supplement business.

-

In January 2023, Activ'Inside, a French ingredient expert, planned to invest USD 13.24 million in a contract production facility between Beychac and Caillau, France. By investing in these facilities, the company plans to expedite its development by providing a 360-degree service, ranging from clinically validated ingredients to personalized dietary supplements.

Dietary Supplements Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 66.97 billion

Revenue forecast in 2030

USD 121.2 billion

Growth rate

CAGR of 12.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, dosage form, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Ashland; Glanbia plc; Lonza Group Ltd.; CAPTEK Softgel International, Inc.; Catalent, Inc.; Trividia Manufacturing Solutions, Inc.; Biotrex Nutraceuticals; Martinez Nieto S.A.; Menadiona; NutraScience Labs; Nutrivo LLC; Gemini Pharmaceuticals; Biovencer Healthcare Pvt Ltd.; Rain Nutrience; Vantage Nutrition (ACG group); LiquidCapsule, DCC PLC; Nature’s Value; MPI NutriPharma BV; FAVEA Czech Republic (Favea); MediGrün Naturprodukte GmbH (MediGrun)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dietary Supplements Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dietary supplements contract manufacturing market report based on product, dosage form, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Proteins and Amino Acid Supplements

-

Multivitamin, Multi-Mineral, and Antioxidant Supplements

-

Weight Management and Meal Replacer Supplements

-

Other Supplements

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Liquid Oral

-

Powder In Sachet /Jar

-

Gummies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dietary supplement contract manufacturing market size was estimated at USD 59.63 billion in 2024 and is expected to reach USD 66.97 billion in 2025.

b. The global dietary supplement contract manufacturing market is expected to grow at a compound annual growth rate of 12.6% from 2025 to 2030 to reach USD 121.2 billion by 2030.

b. North America dominated the dietary supplement contract manufacturing market with a share of 33.29% in 2024. This is attributable to the well-established market, with numerous contract manufacturing companies offering services to brands and businesses.

b. Some of the key players operating in the dietary supplement contract manufacturing market include Ashland, CAPTEK Softgel International Inc., Catalent, Inc., Trividia Manufacturing Solutions, Inc.

b. Key factors that are driving the market growth include increasing benefits associated with outsourcing manufacturing processes and expansion of service offerings by contract manufacturers, leading to the development of new dietary supplements,

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.