- Home

- »

- Digital Media

- »

-

Digital Content Creation Market Size And Share Report, 2030GVR Report cover

![Digital Content Creation Market Size, Share & Trends Report]()

Digital Content Creation Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Content Format, By Deployment, By Enterprise Size, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-034-4

- Number of Report Pages: 182

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Content Creation Market Summary

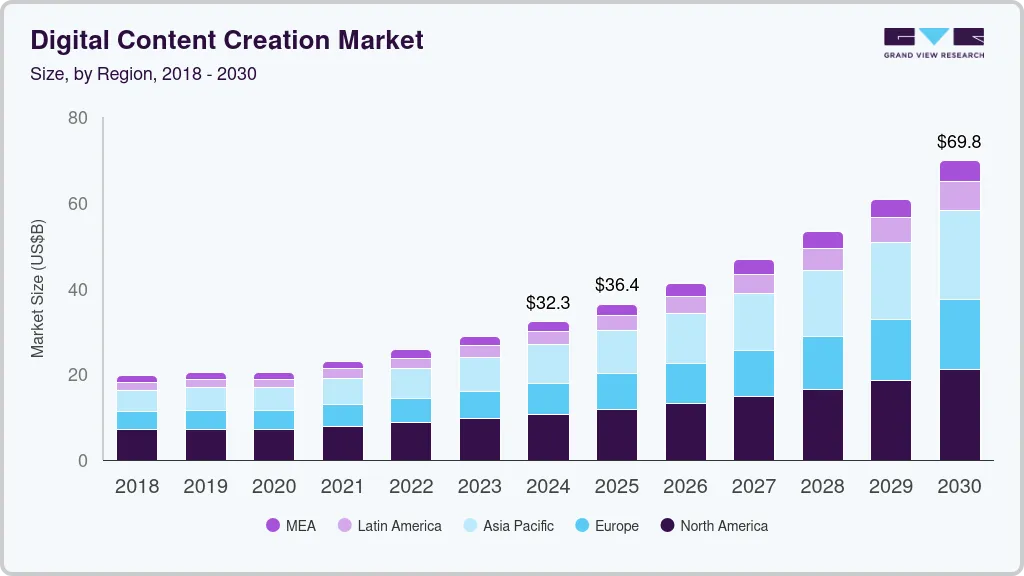

The global digital content creation market size was estimated at USD 32.28 billion in 2024 and is projected to reach USD 69.80 billion by 2030, growing at a CAGR of 13.9% from 2025 to 2030. Factors such as the growth in the adoption of AI, investment in IT, and increasing adoption of cloud computing are driving the demand for the market.

Key Market Trends & Insights

- The North America digital content creation market dominated the market with a share of 33.4% in 2024.

- The U.S. Digital Content Creation market held a dominant position in 2024.

- By component, the tools segment dominates the market, with a revenue share of 73.1% in 2024.

- By content format, the video segment dominates the market, with the highest revenue share in 2024.

- By deployment, the cloud segment dominates the market, with the highest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 32.28 Billion

- 2030 Projected Market Size: USD 69.80 Billion

- CAGR (2025-2030): 13.9%

- North America: Largest market in 2024

For instance, in 2021, according to Cybersecurity Ventures, approximately 200 zettabytes of data were stored globally in the same year, i.e. 50% of all data was stored in the cloud, compared to 2015 when only 25% of all data was stored in the cloud.

The digital content creation market includes creating content in various content format types such as textual, graphical, audio, and video and, furthermore publishing or promoting the content on online platforms. The key players in this market provide their services through their applications and software in a cloud or on-premises environment. For instance, Integra Software Services provides its cloud platform iRights which streamlines media rights acquisition, photo research, and text permissions workflows for publishers. Furthermore, the cloud-based design tool by Figma allows users to access design files from any device. The tool provides vector technology that focuses on layout and (UI) user interface design. Moreover, many designers prefer Figma for making wireframes, prototypes, and production-ready designs.

Component Insights

The tools segment dominates the market, with a revenue share of 73.1% in 2024. Owing to the growth in the usage of tools in digital advertising through smartphones. Moreover, the statistics by Zippia in 2022 stated that over 51% of consumers identified new products and services on their smartphones on search engines like Google. Furthermore, this makes the implementation of SEO tools crucial for marketers. Digital content creation tools aid in creating various content such as videos, podcasts, blogs, presentations, charts, official documents, infographics, voice commands, music, and several others. There is a wide range of tools provided by firms in this segment, such as Canva, Adobe applications, Figma, Google Podcasts, Apple Podcast, Netflix, and various other tools.

The services segment is accounted to hold the highest CAGR over the forecast period. Services include integration & deployment for integrating the new system with the existing system and deploying the software, maintenance & support for resolving customer queries and maintenance of the software, and training & consulting for training and acquainting employees with the new system. Furthermore, the services segment will witness the highest growth as the software and applications provided by the companies to the users require maintenance and servicing in regularly.

Content Format Insights

The video segment dominates the market, with the highest revenue share in 2024. The rise in video will continue to grow as more users feel comfortable watching video content; for instance, according to a survey by Google, 79% of the respondents in the U.S. said that they found comfort and solace in consuming video content, and it distracted their minds from stress during troubles times. The user-generated content is the most relatable among consumers. Furthermore, 92% of customers preferred it over traditional advertising as it is organic and reliable, according to pepper content. Moreover, several people who are not tech-savvy are also creating videos and posting it on TikTok and other video-sharing websites. Moreover, according to statistics by MarketingProfs, 81 percent of senior marketing experts from various companies and industries utilized online video content in their advertising campaigns.

The graphical segment is projected to register a significant CAGR over the forecast period. There are various software for displaying graphical content in the market, such as Power BI and Tableau, which help in giving better insights with the help of dashboards that consist of graphs, charts, tree maps, and various other visualization tools. This software enhances the productivity of the users with the help of visualization tools; for instance, Lenovo's analytics BI and visualization team developed an adaptable sales dashboard for the purpose of ad hoc analysis with the aid of visual analysis software Tableau. Moreover, the productivity of Lenovo increased by 95% across 28 countries. The e-commerce team of Lenovo analyzed customer engagement indicators to create a better online experience for the customers and improve the company's brand reputation and revenues.

Deployment Insights

The cloud segment dominates the market, with the highest revenue share in 2024. Cloud applications are expanding in the media industry along with the media industry itself. Large and small media and entertainment companies are taking advantage of the cloud's presence and changing their business models to provide their customers with seamless, quick, and digital content delivery. Moreover, users in today's environment need fast access to videos, movies, and related content in their comfort zones as they have become habitable to smooth and comfortable experiences. For instance, the cloud-based design tool by Figma allows users to access design files from any device. The tool provides vector technology that focuses on layout and (UI) user interface design.

The on-premises segment is projected to register a significant CAGR over the forecast period. In on-premises deployment includes applications through which the user can create digital content such as games, blogs, charts, presentations, and several others by downloading the application on their device. There are various companies providing on-premises applications to users, such as Microsoft, Canva, Adobe, and several others. The key players like Simplygon by Microsoft, an on-premises 3D game content optimization software that enables game development firms to set up automated procedures to generate LOD chains or processing steps for gaming characters.

Enterprise Size Insights

The large-size enterprises segment dominates the market, with the highest revenue share in 2024. The large enterprise segment includes enterprises with an employee strength of more than 500. The implementation of digital marketing tools and digital marketing in general will boost the growth of digital content creation in India. The value of the digital marketing job market is estimated to grow three times by 2025, according to a Goldman Sachs analysis. Flipkart researches and focuses on the appropriate set of keywords regularly to run display, search, and shop advertisements. To advertise to customers who, add items to their shopping carts, firms in large enterprises such as Flipkart employs third-party platforms like Google Ads to run advertisements and advertise itself on other websites.

The small & medium-sized enterprises segment is projected to register a significant CAGR over the forecast period. Google Ads by Google LLC is contributing to the growth of digital content creation in the small and medium enterprises market. For instance, a jewelry store based in Kolkata Senco Gold, witnessed a 28% increase in its brand recognition in well-established areas like Kolkata with the help of Google’s advertising tool Google Ads.

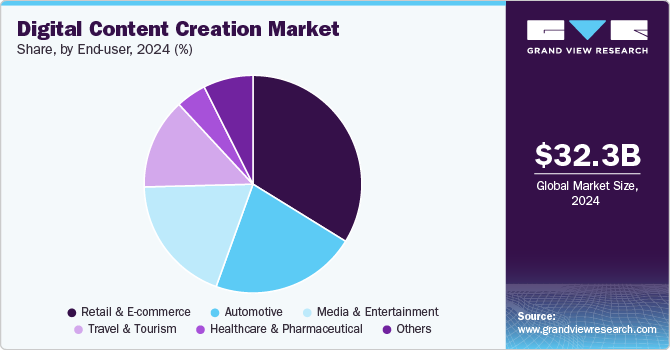

End-user Insights

The retail & E-commerce segment dominates the market, with the highest revenue share in 2024. Retail outlets are in various settings, including online, in-person sales, direct mail, and brick-and-mortar establishments such as supermarkets and shopping malls. Whereas e-commerce refers to business transactions primarily conducted electronically through the Internet. Moreover, Walmart Inc., a U.S.-based retail corporation, contributed to the growth of digital content creation in the retail sector. For instance, in September 2022, the firm expanded its retail media product reach by partnering with social media platforms such as TikTok, Snap, Roku, Firework, and TalkShopLive to create new off-site and video-based advertising capabilities. The company worked with its new partners to link the advertisers with its customers' key moments during their shopping trips on Walmart.com or another platform.

The media & entertainment segment is projected to register a significant CAGR over the forecast period. The media and entertainment industry comprise television, radio, film, and print. Moreover, this segment includes digital content such as movies, TV shows, radio shows, news, music, newspapers, magazines, books, and ebooks. Moreover, Podcasts have become a dominant form of audio delivery, allowing consumers to access content on-demand. This format caters to the growing preference for flexibility in media consumption, with audiences increasingly moving away from traditional radio formats23. The podcasting sector is expected to continue its growth trajectory as more creators and brands leverage this medium for storytelling and engagement.

Regional Insights

The North America digital content creation market dominated the market with a share of 33.4% in 2024. One of the reasons for North America being a leading market is its dominance in audio content. For instance, according to an article by Sound Chart in March 2022, the music industry was led by the Americans, and US market was the largest market globally for music. Moreover, it was reported that, approximately 70% of the songs on Spotify's Global Top-50 playlist were recorded by US-based artists as of March 2019.

U.S. Digital Content Creation Market Trends

The U.S. Digital Content Creation market held a dominant position in 2024. The proliferation of digital devices, such as smartphones, tablets, and smart TVs, has led to a surge in digital content consumption among individuals in the U.S. Consumers are actively scouting for diverse and engaging digital content across various platforms and channels, including social media, streaming services, and various websites. The growing popularity of social media and online communities has particularly revolutionized content distribution and audience engagement. Social media platforms have typically emerged as essential channels for content creators to connect with their target audience, build a loyal following, and increase visibility for their content.

Europe Digital Content Creation Market Trends

The initiatives being pursued within the European Union to foster a digital single market by harmonizing regulations, facilitating cross-border distribution, and promoting cultural diversity have created an environment conducive to content creation and related innovation, thereby encouraging content creators to explore new markets, collaborate across borders, and produce localized content that resonates with diverse audiences.

Asia Pacific Digital Content Creation Market Trends

The Asia Pacific Digital Content Creation market is anticipated to grow at a significant CAGR over 2025 to 2030. The proliferation of smartphones and the evolving mobile-first culture in Asia are playing a pivotal role in driving the growth of the digital content creation market in Asia Pacific. Mobile devices have become the primary means of accessing the internet and consuming content for a significantly larger population across the region. Hence, content creators are tailoring their content to be mobile-friendly and optimized for smaller screens to ensure a seamless user experience across various devices.

Key Digital Content Creation Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

-

Microsoft Corporation, known for developing BASIC interpreters for early personal computers, Microsoft has evolved into a dominant force in software, hardware, and cloud services. Its core products include the Windows operating system and the Microsoft 365 suite, which features productivity applications like Word, Excel, and PowerPoint. Microsoft plays a pivotal role through various platforms. Microsoft 365 not only enhances productivity but also facilitates collaboration among teams via tools like Teams and SharePoint, which are essential for seamless content creation and sharing. Azure supports content creators with scalable computing resources for hosting applications and deploying AI-driven solutions that enhance production capabilities.

-

Google LLC, a subsidiary of Alphabet Inc., is a prominent American multinational technology company headquartered in Mountain View, California. Founded in September 1998 by Larry Page and Sergey Brin while they were PhD students at Stanford University, Google has grown from a search engine into a comprehensive provider of internet-related services and products. Its offerings include advertising technologies, cloud computing, software, and hardware, making it one of the "Big Four" technology companies alongside Amazon, Apple, and Microsoft.

Key Digital Content Creation Companies:

The following are the leading companies in the digital content creation market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- Picsart

- Adobe Systems

- Corel Corporation

- Acrolinx

- Google LLC

- Integra Software Services

- MarketMuse, Inc.

- Quark Software Inc.

- Canva

Recent Developments

-

In April 2024, Axel Springer SE and Microsoft Corp. have announced a significant expansion of their partnership, focusing on advertising, AI, content, and cloud computing services. This collaboration aims to utilize their combined strengths to support independent journalism and enhance user experiences through innovative AI solutions and premium content distribution. Key initiatives include extending adtech collaborations to the U.S., developing AI-driven content experiences, enhancing offerings through Microsoft Start-MSN, and migrating SAP solutions to Microsoft Azure.

-

In October 2024, Adobe has introduced the Adobe Content Authenticity web app, a free tool that enables creators to attach Content Credentials to their digital work, which helps protect their content from misuse and ensures proper attribution. This initiative, developed in collaboration with the creative community since 2019, aims to enhance transparency in the digital ecosystem, addressing growing concerns over unauthorized use of content and AI-generated manipulations.

Digital Content Creation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.38 billion

Revenue forecast in 2030

USD 69.80 billion

Growth rate

CAGR of 13.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-user, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada, Mexico; U.K.; Germany; France; Italy; Spain; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Argentina; Chile; United Arab Emirates (UAE); Saudi Arabia; South Africa

Key companies profiled

Microsoft Corporation, Picsart, Adobe Systems, Corel Corporation, Acrolinx, Google LLC, Integra Software Services, MarketMuse, Inc., Quark Software Inc., Canva

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Digital Content Creation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital content creation market report based on component, content format, deployment, enterprise size, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Tools

-

Services

-

-

Content Format Outlook (Revenue, USD Million, 2017 - 2030)

-

Textual

-

Graphical

-

Video

-

Audio

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030

-

Large Size Enterprises

-

Small and Medium Sized Enterprises

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & E-commerce

-

Automotive

-

Healthcare & Pharmaceutical

-

Media & Entertainment

-

Travel & Tourism

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital content creation market size was projected at USD 32.28 billion in 2024 and witnessed a value of USD 36.38 billion in 2025.

b. The global digital content creation market is estimated to grow at a CAGR of 13.9% from 2025 to 2030 and reach USD 69.8 billion by 2030

b. North America dominated digital content creation with a share of 32.9% in 2023. This is attributable to the presence of prominent players in the market such as Google LLC, Amzon.com Inc., Microsoft Corporation Adobe, Integra Software Services, and several others.

b. Some key players operating in the digital content creation market are Microsoft Corporation, Picsart, Adobe Systems, Corel Corporation, Acrolinx, Google LLC, Integra Software Services, MarketMuse, Quark Software, and Canva

b. Key factors driving the market growth include the growing preference for cloud based digital content creation tools and growth in the adoption of AI

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.