- Home

- »

- Medical Devices

- »

-

Digital Dental X-ray Market Size, Share, Growth Report, 2030GVR Report cover

![Digital Dental X-ray Market Size, Share & Trends Report]()

Digital Dental X-ray Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Intraoral, Extraoral), By Application (Medical, Cosmetic Dentistry, Forensic), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-215-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Dental X-ray Market Size & Trends

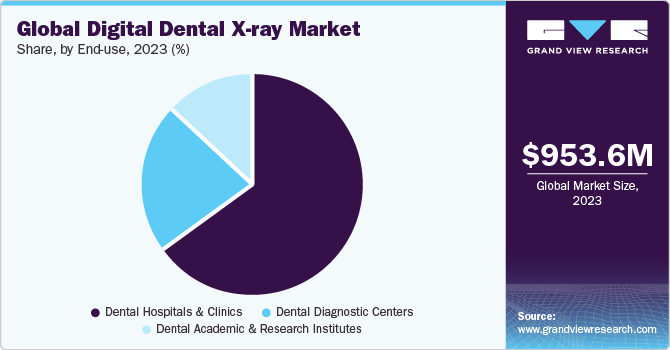

The global digital dental X-ray market size was estimated at USD 953.65 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2030. Digital dental X-rays are images of a patient’s teeth and surrounding structures that are utilized to assess oral health. The increase in preference of people for better aesthetic and oral care and the rise in burden of dental disorders has led to an increase in the frequency of digital dental X-ray procedures, which is in turn boosting the market growth. The digital X-ray system is advantageous because of its high speed and improved image resolution, as it can even capture low-contrast structures.

The adoption of digital sensors in digital x-ray systems enables easy storage of images on the software, which can be easily accessed and is a better alternative to films that require developing & safekeeping for future viewing. In addition, the films cannot be stored for a long time, as they deteriorate over time and cause environmental pollution as well. These digital sensors, most importantly, involve a lower risk of radiation exposure due to the use of flat panel detectors. Hence, due to the technical advantages, digital x-ray systems save additional labour costs.

According to the NCBI article published in November 2023, 13% of adults seek dental care for infections or toothaches within four-years. Alarmingly, 1 in 2600 individuals in the U.S. are hospitalized due to dental infections. The prevalence of untreated dental caries is noteworthy, affecting more than 20% of the population. At the same time, a significant three-quarters of individuals have undergone at least one dental restoration in their lifetime. Periodontal disease, impacting an estimated 35% of Americans aged 30 to 90, further emphasizes the widespread need for advanced dental technologies and equipment which drives the market growth.

There has been a rise in the number of dental visits in recent years. This can be attributed to the rising incidence of oral cavities and other dental problems in the last decade and increasing awareness about oral care & hygiene. Furthermore, changes in diet such as the consumption of fast foods & food with high sugar content have led to a rise in oral issues. According to the National Center for Health Statistics, around 65% of the population aged over 18 visited dental practices in the U.S. This, coupled with an increasing number of dental practices is anticipated to propel the market growth.

Market Concentration & Characteristics

The market has been experiencing many technological innovations, one such path-breaking innovation is the cone-beam Computed Tomography System (CBCT). CBCT has provisions for fast, accurate, and 3-D imaging of patients to examine dental disorders. This system has successfully surmounted the pitfalls of the conventional 2-D X-ray imaging aiding precision studies and effective diagnostics of dental diseases.

Digital dental X-ray players in market leverage strategies such as collaborations, partnerships, and acquisitions, to promote reach of their offerings and increase their product capabilities globally. For instance, in February 2022, Dentsply Sirona Inc. entered into a strategic collaboration with Google Cloud and introduced its medical grade 3D printing technology to boost its leadership in digital dentistry.

Regulations significantly impact the market by ensuring stringent compliance standards for product safety, quality, and documentation. While promoting patient welfare, these regulations also necessitate rigorous tracking, reporting, and adherence to good clinical practice (GCP).

The expansion of the existing digital dental X-ray product line with advanced sensors drives the market growth. For instance, in October 2023, PreXion, Inc. announced the launch of a new Evolve Sensor X-ray intraoral digital dental imaging sensor to expand its already available dental imaging system. Regional expansion involves establishing strategic distribution hubs and partnerships to efficiently navigate diverse regulatory landscapes.

Product Insights

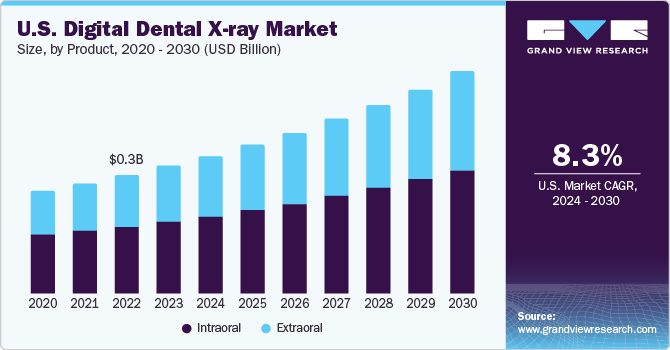

Based on product, the intraoral segment led the market with a largest revenue share of 56.9% in 2023. Intraoral digital dental X-ray equipment provides detailed images, allowing dentists to spot cavities and monitor the general health of teeth & jawbone. These are most widely used diagnostic methods in the field of dentistry. Intraoral imaging is utilized for an assortment of procedures, such as diagnosing caries & checking endodontic file location. The intraoral devices are expected to show high growth due to the exceptional spatial and contrast resolution offered by these devices.

The extraoral segment is projected to grow at a significant CAGR during the forecast period. Extraoral digital dental X-ray devices are used in examination of large lesions when the area of pathology is greater and cannot be captured using intraoral technique. Viewing impacted teeth, monitoring of growth & development of the jaws in relation to the teeth, and identifying potential problems between teeth & jaws as well as other bones of the face can be done with the help of extraoral radiology equipment.

Application Insights

In terms of application, the medical segment held the market with the largest revenue share of 66.9% in 2023. Digital dental radiography is essential for dentists in evaluating the severity of conditions such as cavities, tumours, and fractures, aiding in the assessment of tooth decay levels and identification of other oral issues like cysts or abscesses. In addition, they are useful in detecting impacted or missing teeth and assessing bone loss due to periodontal disease. Digital dental X-ray play a vital role in diagnosis and treatment of a majority of oral conditions.

The cosmetic dentistry segment is projected to grow at a fastest CAGR of 10.0% during the forecast period. Intraoral and extraoral radiographs are crucial in cosmetic dentistry as they are widely clicked before undertaking any dental procedure. Intraoral X-rays are required to analyse tooth roots, which is essential before undergoing any cosmetic procedure. Restorations with inlay or onlay are planned using radiographs, which help determine certain prerequisites, such as periodontal support, extent of decay, and tooth proximity to the nerve.

End-use Insights

Based on end-use, the dental hospitals & clinics segment led the market with the largest revenue share of 65.3% in 2023. This segment is driven by the availability of developed & latest infrastructure, rise in investments to develop sophisticated healthcare infrastructure, increase in the number of skilled professionals, and easy accessibility. Also, these are well-equipped with technologically advanced treatment setups, providing services for several oral diseases. In addition, dental hospitals & clinics lay greater emphasis on innovative modes of treatment and patient care, which is expected to lower costs and increase adoption of dental services across all sections of the society.

Moreover, some financial investment groups are also developing hospitals with dental specializations, providing general dental care and speciality treatment under one roof. Solo dental practices are increasing across the globe. Independent dental clinics are also growing owing to rising competition between care providers and demand for cost-effective treatments.

Regional Insights

North America dominated the market with a revenue share of 44.0% in 2023. The factors such as well-established reimbursement policies, strong medical infrastructure, the existence of key players, and advancement in preventive and restorative dental treatments drives market growth. Moreover, according to the American Dental Association, 85% of individuals in the U.S. truly value dental health and consider oral health a vital aspect of overall care. The combination of all these significant factors will make North America the most promising regional market over the forecast period.

U.S. Digital Dental X-ray Market Trends

The digital dental X-ray market in the U.S. held the largest revenue share in North America in 2023, owing to factors such as rise in number of dental hospitals and clinics and advanced diagnostic centers, equipped with state-of-the-art X-ray technology. The innovative landscape, coupled with a well-established regulatory framework, positions the U.S. as a leader in adopting and advancing digital dental X-ray technologies, contributing significantly to its dominance in the North American market.

Europe Digital Dental X-ray Market Trends

The Europe digital dental X-ray market was identified as a lucrative region in this industry. The market remained unaffected by the economic downturn in European countries mainly due to the presence of sophisticated healthcare infrastructure, high awareness among patients & dentists, the growing dental diseases among both adult & young population and rise in number of people visiting dentists.

The digital dental X-ray market in the Germany held the largest revenue share in 2023, due to the Germany's well-regulated reimbursement scheme plays a crucial role in driving market growth. Approximately 80.0% of the German population is covered by statutory health insurance policies, and the reimbursement system for medical devices is classified into inpatient and outpatient policies.

The UK digital dental X-ray market is expected to grow at the fastest CAGR over the forecast period, due to several compelling factors that have fuelled the demand for these medical devices across diverse dental care settings. The UK has a sizable healthcare system, creating a consistent demand for medical products and a receptive attitude toward innovative technologies.

The digital dental X-ray market in France is expected to grow at the fastest CAGR over the forecast period, due to the demand for digital dental X-ray market is on the rise, driven by several key factors, including the increasing geriatric population and the growing burden of dental diseases. According to the World Bank, the geriatric population in France has risen from 18% in 2012 to 20.8% in 2020. This demographic shift has contributed to a significant prevalence of dental diseases in the country.

Asia Pacific Digital Dental X-ray Market Trends

Asia Pacific digital dental x-ray market is anticipated to witness significant CAGR of 10.7% over the forecast period. This growth due to the presence of high growth opportunities to cater to the unmet needs of the target population, in this region. Moreover, growing number of dental diseases, as well as technological advancements in digital dental X-ray devices, also driving the growth in the market. The government in the developing countries like India, and China are taking extensive efforts to improve the healthcare infrastructure owing to which the adoption of innovative solutions for diagnostics and therapeutics increased.

The digital dental X-ray market in the Japan held the largest revenue share in 2023, due to favourable government initiatives, including increased awareness of dental diseases, and robust healthcare system, are contributing to the growth of the market. Age-related dental diseases such as dental caries and periodontal gum disease are quite prevalent in the country, providing key opportunities for market growth.

The China digital dental X-ray market is expected to grow at the fastest CAGR over the forecast period, owing to the strong support from government and substantial investments in R&D have played a pivotal role in advancing China's digital dental X-ray devices. Moreover, dental tourism has increased in China, as Americans travel to the country for treatment because of availability of advanced technology, high-quality services, and shorter waiting period for most procedures, as well as ample availability of trained personnel.

Middle East & Africa Digital Dental X-ray Market Trends

The digital dental X-ray market are expected to witness a high demand in the Middle East, which can be attributed to the rising focus on adoption of modern, sophisticated, and innovative equipment. Regional disease burden, increasing privatization of healthcare, and growing penetration of health insurance have led to a positive environment for the market in MEA countries. In addition, rise in government initiatives undertaken to improve healthcare infrastructure in South Africa and other African countries is expected to boost the demand for digital dental X-ray systems

The Saudi Arabia digital dental X-ray market is expected to grow at the fastest CAGR over the forecast period, due to presence of high-quality healthcare infrastructure with high accessibility to health facilities is likely to facilitate the market growth in the country. In 2022, Saudi Arabia spent an estimated USD 36.8 billion on healthcare & social development, accounting for 14.4% of its 2022 budget. The healthcare landscape in the country is expected to further advance as the government is trying to bring about reforms in the sector.

The digital dental X-ray market in Kuwait is expected to grow at the fastest CAGR over the forecast period, due to the rising prevalence of dental disorders and growing demand for effective treatment. Kuwait has a high incidence of dental caries and there are no signs that it is declining. Most people suffer from periodontal disorders. To improve people's quality of life, oral health promotion needs to be strengthened and a clear strategy should be created & put into action.

Key Digital Dental X-ray Company Insights

Air Techniques, Inc; Midmark Corporation, and Cefla s.c. are some of the emerging market participants in the global market.

Key Digital Dental X-ray Companies:

The following are the leading companies in the digital dental x-ray market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona Inc.

- Envista Holdings Corporation.

- Planmeca Group.

- Vatech

- Acteon Group

- Air Techniques, Inc.

- Cefla s.c.

- J. Morita Corporation

- Midmark Corporation

- Fussen Technology

Recent Developments

-

In October 2023, Denti.AI has officially announced the significant achievement of securing FDA 510(k) clearance for Denti.AI Detect. This groundbreaking AI-powered imaging solution enhances disease detection capabilities in intra- and extraoral radiography, along with providing charting automation

-

In June 2023, LunaLite Dental, has unveiled its latest development in dental treatment, the LunaLite automated laser-based dental x-ray positioner. This LunaLite cutting-edge equipment is set to transform the x-ray process, providing improved efficiency and comfort for both dental professionals and patients

-

In February 2022, Overjet has successfully obtained a U.S. patent for its artificial intelligence (AI) technology, which is designed to measure anatomical structures and quantify disease on dental X-rays. This accomplishment reflects the recognition and protection of Overjet's innovative approach in the field of AI-driven dental imaging

Digital Dental X-ray Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.04 billion

Revenue forecast in 2030

USD 1.79 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Dentsply Sirona Inc.; Envista Holdings Corporation.; Planmeca Group.; Vatech; Acteon Group; Air Techniques, Inc.; Cefla s.c.; J. Morita Corporation; Midmark Corporation; Fussen Technology

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Dental X-ray Market Report Segmentation

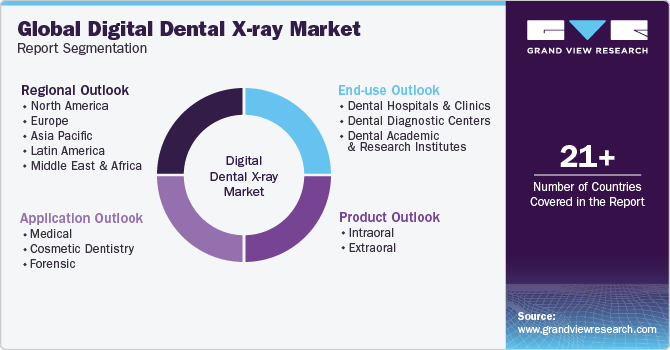

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital dental X-ray market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Intraoral

-

Extraoral

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Cosmetic Dentistry

-

Forensic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Hospitals & Clinics

-

Dental Diagnostic Centers

-

Dental Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital dental X-ray market size was estimated at USD 953.65 million in 2023 and is expected to reach USD 1.04 billion in 2024.

b. The global digital dental X-ray market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 1.79 billion by 2030.

b. North America dominated the digital dental X-ray market with a share of 44.0% in 2023. This is attributable to the well-established reimbursement policies, strong medical infrastructure, the existence of key players, and advancement in preventive and restorative dental treatments.

b. Some of the players operating in this market are Dentsply Sirona Inc.; Envista Holdings Corporation.; Planmeca Group.; Vatech; Acteon Group; Air Techniques, Inc.; Cefla s.c.; J. Morita Corporation; Midmark Corporation; and Fussen Technology.

b. Key factors that are driving the digital dental X-ray market growth include the rise in prevalence of dental disorders, surge in consumer demand for optimal dental treatments, and continuous technological advancements within the dental industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.